Estimated reading time: 9 minutes, 40 seconds

As an Amazon seller, are you wondering what your sales tax obligations are? LedgerGurus explains all you need to know. As accountants who primarily work with e-commerce businesses on platforms such as Amazon and Shopify, we have the experience you need to answer your sales tax questions.

Sales Tax Liabilities for Amazon Sellers

Is Amazon Collecting Sales Tax for Me?

This is the first most important question.

As an online retailer, you may be wondering if Amazon is collecting sales tax for you, the seller. Amazon is a marketplace facilitator, so, by law, it is required to calculate, report, and remit sales tax on behalf of sellers like yourself.

What is A Marketplace Facilitator?

This is just a nifty way of saying that Amazon is a marketplace that contracts with and sells other businesses’ goods. In these contractual relationships, the marketplace facilitator becomes responsible for calculating, collecting, and remitting sales tax for sales on the marketplace.

Marketplace Facilitator Laws by State

Most states require sales tax collection on the state level. They may also require collection on up to 3 other levels, and are listed on Amazon’s sales tax report:

- State

- County

- City

- Special district

Amazon automatically calculates the sales tax that is required for your state. So, the sales tax that a customer sees on their end will be one lump amount, but Amazon knows exactly how much is being collected for the various levels.

Amazon’s Monthly Filings

States with marketplace facilitator laws categorize Amazon (or other marketplaces, such as Etsy, eBay, Walmart, etc.) as one retailer, so anything sold under the Amazon umbrella must be accounted for. So, every month Amazon files a return that includes its own sales, as well as sellers’ sales to customers within the respective state. For example, your California sales will be included on Amazon’s monthly return filed with California.

Lumping all sales on a marketplace into a single, monthly return to each state makes it easier for sellers and for the state to process. (Phew! At least one piece of this is easier now.)

What Does This Mean for YOU?

Since Amazon files a return for the state each month, you do not have a calculation, collection, or remittance liability.

What You Should Do About Sales Tax for Amazon Sellers

While you may not have to calculate, collect, and remit sales tax as an Amazon seller, there are still action steps you should take.

Step 1 – Familiarize yourself with which states have marketplace facilitator tax laws.

Stay up to date with Marketplace Tax Collection on Amazon HERE. Note that things can change over time, so it’s important to revisit this information periodically. For your information, all 45 states with state sales tax laws also have marketplace facilitator laws in place, with Missouri being the last to come on board. This makes things SO much easier for marketplace-only sellers than they were before!

Two Scenarios in Which You May Have Reporting Liability

- To your HOME STATE

You are physically located in state XYZ, so you are required to register and have a sales tax permit for the state in which you live. (The exceptions are Alaska, Delaware, Montana, New Hampshire, and Oregon, which do not have state sales tax laws, though certain jurisdictions in Alaska DO have sales tax laws.)

As such, you will need to file returns in your home state. But you can file $0 returns because all the sales are through the Amazon marketplace, resulting in zero taxable sales for you.

- If you use Fulfillment By Amazon (FBA) warehousing

Some Amazon sellers question whether the use of an FBA warehouse in state XYZ translates to mean that you have a significant physical presence, or nexus, in that state. If you’re wondering if you have to file in all the states where your products are stored, the answer depends on which state.

About 50% of states declare that yes, having inventory in a third-party warehouse does create a physical presence, so you are required to register and file sales tax with the state.

The other half of the states do not require you to file because you don’t control where your inventory is stored before its sale.

Your Amazon reports can tell you where your inventory is housed. You can use that information to determine whether or not you have reporting liability.

Be aware that some states are actively pursuing FBA sellers on their income tax liability. Those states are:

- Pennsylvania

- Wisconsin

If you store inventory in FBA warehouses in either state, consult with your accountant to determine the best course of action regarding income tax.

Step 2 – Register for sales tax permits, as needed

Even if you sell through Amazon, you still need to have a sales tax permit in states where you have nexus.

NOTE – If you sell through a non-marketplace channel, you’ll have to add all your sales from all your channels to accurately determine nexus. For more information, read Sales Tax Nexus – What Online Sellers Need to Know.

We have LOTS of resources to help you with that, but the easiest place to start is our 10 Steps of Sales Tax guide.

By the way, doing a complete nexus analysis is one of the services we can provide our clients. If you’d rather do it yourself, we give complete instructions for it in our premium sales tax course. It’s the same method we use for our clients.

Amazon FBA Inventory and Sales Tax Nexus

As you can tell, nexus is definitely a crucial topic for online sellers to get super clear on. This is probably one of the areas we get the most questions about on our YouTube channel. It can seem straightforward and that you’ve got it, and then it can get complicated again. That’s because states have different laws. What creates nexus in one state may not be the same in another state.

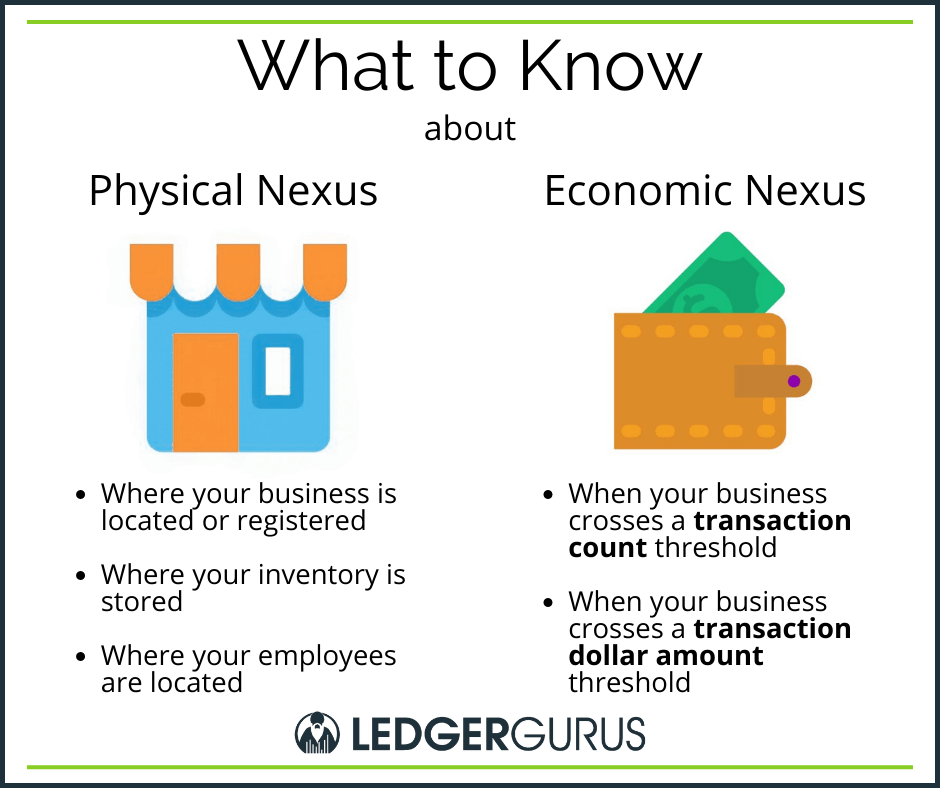

There are several ways to create nexus that apply for ecommerce businesses:

- Economic nexus – You may have nexus in a state where you have a significant number of sales (in terms of revenue and/or number of transactions). See the appendix in our 10 Steps sales guide to see what those thresholds are in each state.

- Physical nexus – You will have nexus in states where you have a physical presence. This commonly includes office buildings, where employees and salespersons live, and where inventory is housed. (Think PEOPLE and PROPERTY.)

Like we said earlier, it’s important to note that you may have nexus in locations where your inventory is stored.

For FBA sellers, this means you can have sales tax nexus in states where Amazon houses your inventory. Therefore, you are required to register for a sales tax permit and file $0 returns for sales in those states (if the product is taxable.) Many FBA sellers forget to consider their inventory location(s) when determining sales tax nexus.

And remember that you need to collect and remit for all sales in those states on other sales channels. This may be a scary thought, but keep reading. We have LOTS of resources for you at the bottom of this article. LOTS!

How to Find Where Amazon is Holding Your Inventory

To find out where Amazon is holding your inventory, you will want to find the “Inventory Event Detail” report in Seller Central. This link will take you directly there, after logging in. As of this blog, you can also follow these steps after signing into Seller Central:

- Reports

- Fulfillment

- Inventory Event Detail

- Download the report for easier navigation. Choose a date range as far back as you would like to consider.

- Once downloaded, find the column titled “fulfillment-center-id.”

- Click the drop-down on the filter for this column. These are all the warehouse locations in which your inventory is stored.

- The first 3 letters of each “id” are associated with an airport. For example, “PHX3” would be a warehouse close to Phoenix, AZ. You would therefore have a nexus in Arizona. Find a complete list of warehouse ids and locations here.

Sales tax tools, such as TaxJar or Avalara, will also help identify where you have nexus due to FBA.

To Sum It All Up Regarding Sales Tax for Amazon Sellers

If you’re selling exclusively on Amazon, Amazon is taking care of your sales tax in all states that require sales tax. Amazon is in charge of calculating and collecting sales tax from your customers on your behalf. Your liability for sales tax with Amazon (or other marketplaces) is ZERO.

You might need to file a zero-dollar return in your home state, and you may consider registering in the states where your inventory is stored, especially if that state has income tax liability. Regardless of income tax liability in FBA states, your sales tax exposure is still ZERO.

Next Steps

Sales tax can be really complicated. That’s why we’ve created so many resources to make the process easier to understand for you. Those resources fall in several categories: DIY (with guidance), Do It WITH You, Do It FOR You.

Do It Yourself

– If your business is still fairly small (less than $1 in annual revenue), it’s unlikely that you have nexus in very many states. It is still doable for you to do it yourself, though you probably have lots of questions. To help you, we have:

- Sales tax consultations – 1-hour consultations with one of our sales tax experts in which you can ask all your questions. They can answer questions, guide you through confusing processes, talk you through registrations or filing returns, and almost anything else you can throw at them.

- Blogs – We’ve written a plethora of articles on all the aspects of sales tax.

- YouTube videos – We’ve also made A LOT of videos with tutorials and screen shares.

Do It WITH You

If you’re getting big enough that you have nexus in several states, or if you are still small but you want one place to learn the entire process from start to finish, so you know exactly what to expect, you may want to check out our sales tax courses. We’ve got 3 options:

- The Uncomplicated Truth about Sales Tax masterclass – a free 45-minute masterclass with downloads that will show you what to expect from the entire sales tax process from beginning to end. We answer many of the most commonly asked questions, and give you 3 Big Don’ts for what NOT to do when you’re setting up your sales tax.

- Sales Tax Roadmap for Online Sellers – This basic course is designed for online sellers who have nexus in 1-5 states and want to own the sales tax process themselves. It shows several simple ways to determine nexus without having to do a deep dive into all your sales data. It also shows how to register for sales tax permits and handle resales certificates, and walks through the remittance process. Lastly, it shows how to choose a sales tax tool that is right for your business.

- Sales Tax Roadmap – Premium Edition – This course is designed for online sellers who have nexus in 5-7 states, who aren’t yet ready to outsource their sales tax, OR for accountants who want to build a sales tax practice. It includes a detailed, in-depth nexus analysis (the exact same process we use with our clients). It also includes all the registration, channel setup, remittance, and sales tax tool information from the smaller course. It also includes a project management section for how to handle filings across multiple states.

Do It FOR You

If you’re just ready for someone else to take care of all this headache and mess for you, we are happy to do that, too. We have services for small companies with nexus in only a few states up to large companies with complex filings in every state. Let us take care of it, so you can focus on what you do best – running your business. Because we’ve never met a business owner yet who was stoked about doing their sales tax! Nope, not one!