Whether you are ready to exit your eCommerce business soon or not, this is good stuff to pay attention to.

This blog is a brief summary of our recent webinar, “Preparing Early for an eCommerce Business Exit – What to Do Now.”

In this webinar, we covered 4 specific topics that will help you improve your current business performance now and maximize your exit later.

- Is your ownership aligned on your exit plan?

- Do you have the correct legal and organizational structures in place?

- Do you have reliable financials?

- Are you tracking and optimizing key financial and business performance indicators?

Why Should You Care About this Right Now?

Maybe you are wondering why we’re talking about an exit plan when you’re still in the throes of building your business.

Fair question.

It’s kind of like when you go to sell a house.

Many people move into a new house and have lots of ideas for things they want to change & update. But then they get comfortable and/or busy and never get around to it, even though these projects will make their home more comfortable and enjoyable to live in now, along with increasing the market value.

Instead, they wait until just before they put their house on the market to work as hard as they can to whip it into shape.

If they’re lucky (& if there’s not too much work to do), after it’s beautiful and ready to sell, they often wonder why they didn’t do it sooner so they could enjoy it, too.

OR…

They run out of time to finish all the things they want/need to do and end up taking a lower price on the house because it wasn’t in tip-top condition.

They waited too long and let too many things slide and so it cost too much time & money to fix it all, let alone make it highly desirable to the highest bidders.

Does this sound familiar?

Let’s Apply This to Your eCommerce Business

Strategically planning & preparing for an exit from their eCommerce business is something a lot of owners fail to do.

Bu the consequence of this failure to act is that the business may not be in good shape or may not be ready to sell when the owner is ready to exit.

On the other hand, most successful entrepreneurs are thinking about their exit strategy from the very beginning.

Knowing you plan to hand over the reins and get the best return on your investment of time, money, and effort means it’s a good idea to structure things now so that you can go through the process as smoothly and easily as possible when you are ready. It makes it easier to see the big picture and put a plan in place to improve business practices now and maximize its value for your exit.

If you follow the advice in this webinar, you can enjoy of the benefits of a solid business now AND have it in tip-top condition and worth its max value when you’re ready to exit later.

Here is more detail on 4 of the most important areas to pay attention to now to prepare for an exit.

Is Your Ownership Aligned on Your eCommerce Business Exit Plan?

Anyone in your business that has ownership and/or is involved in executive team decisions should be aligned on an exit plan.

This is KEY to moving your business into a position for an exit and to gaining the trust of potential buyers.

It is a very good idea to agree early on about the following:

- A timeline of when to exit

- Goals & vision for the company before & after an exit

- A timeline of ownership involvement post-exit

- Clearly defined equity ownership & decision-making structures

Do You Have the Correct Legal & Organizational Structures in Place?

A strong legal & organizational structure gains the confidence of buyers and reduces potential deal-breaker scenarios.

Are you considering the following and their implications?

- Contracts w/ employees & vendors

- Protections in place for intellectual property, products, team, etc.

- Clearly defined roles for team members

- Goals & alignment

Do You Have Reliable Financials?

Clean & reliable financials are the starting point when it comes to valuation when you are ready to exit your business.

For eCommerce businesses, there are several accounting aspects that are unique to eCommerce and can drastically impact your valuation if they are misunderstood.

This is due to the fact that eCommerce accounting is so different from any other kind of accounting.

Here’s a specific checklist of questions to ask yourself:

- Are you accurately recording sales from your sales channels, instead of recording deposits in your bank account as “Sales”?

- Does your balance sheet have an inventory balance that changes frequently?

- Is your gross profit margin fairly stable from month-to-month and year-to-year?

- Is your sales tax recorded on your balance sheet as a liability, instead of an expense on your P&L?

If you answered “no” or you’re unsure of the answer to any of these questions, you can download “5 Signs of Bookkeeping Trouble in an eCommerce Business.”

Are You Tracking & Optimizing Key Financial & Business Performance Indicators?

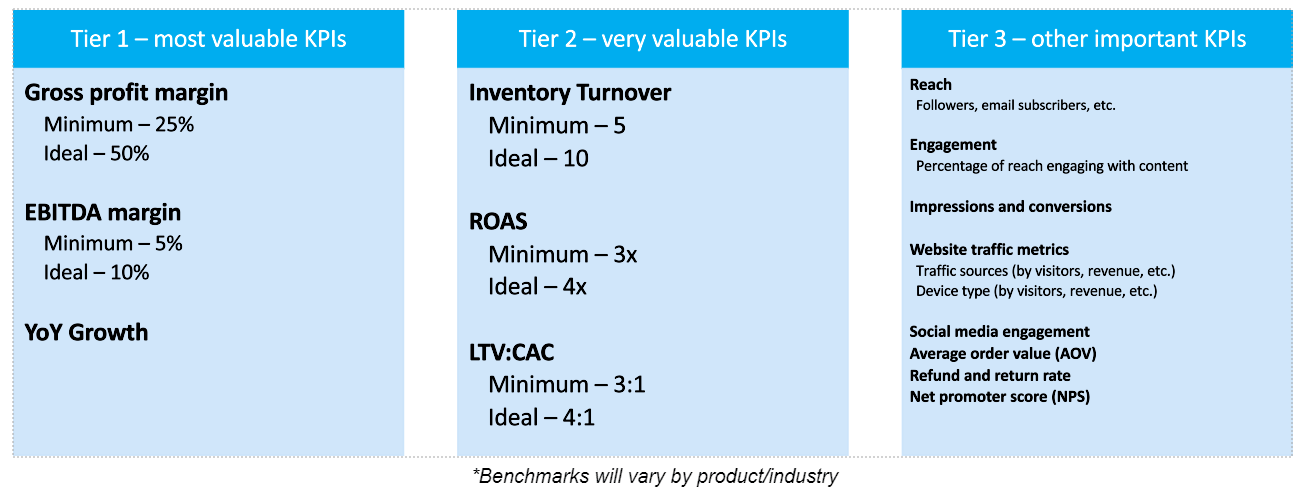

When it comes to the sale of your business, there are certain Key Performance Indicators (KPIs) that every buyer will want to see.

Here we have them categorized into tiers of which are most important. The benchmarks will differ by category & industry, and there may be some not on this list that are also important to your business.

You should identify which ones are most important for the success & sale of your business, and start tracking them. From there, you can optimize them to make your business as strong and successful as possible.

These are some of the most important topics to pay attention when you’re preparing to exit your eCommerce business.

If you need some help getting your financials ready for an exit, be sure to let us know.