Estimated reading time: 7 mins

Preparing for Q4 sales is a year-round process for any business doing ecommerce. It involves multiple processes that are set and refined as the year progresses.

Done well, a business can harvest sales and profits during Q4.

Done poorly, it can be a drag that hurts a business as the New Year turns to sales slowdowns.

Read on to learn what you should be doing from January to December to maximize this peak season.

What this blog covers:

- Start with forecasting sales and marketing

- Then start your inventory planning

- The importance of a cash flow forecast and budget

- Developing a working capital strategy

- When to order your Q4 inventory

- Creating a pricing and discounting plan

- The need to refine plans along the way

- How to Handle BFCM and Q5

- A summary of what to do throughout the year

- How to get help executing your plan

Key Takeaways

- Start Early: Preparing for Q4 sales begins in Q1 with forecasting, budgeting, and planning for inventory to avoid last-minute chaos.

- Adjust Quarterly: Regularly refine your sales, inventory, and cash flow plans each quarter to stay aligned with actual performance and market trends.

- Leverage Q5: Don’t overlook the post-holiday period (Q5) for additional sales, as strategic planning can turn it into a profitable bonus.

If you want to watch the video instead, click here:

Start with Forecasting Sales (and Marketing)

I hate to break it to you, but planning for Q4 should begin in January.

It starts by developing a reasonable annual sales forecast.

This is best done in conjunction with a marketing and product release plan. Even better is when the finance and marketing/sales teams come together.

Ideally, the sales forecast is built by the sales and marketing teams, and is based on:

- New customer projections

- Existing customer lifetime value (LTV) and repeat customer purchase cadence

- Product launches

- Sales strategy

- Marketing campaigns

Finance teams do a poor job forecasting sales by themselves because a sales plan is heavily dependent on the product and marketing plans.

What the finance team can do is find issues in a marketing/sales plan, such as:

- Fixed Return on Ad Spend (ROAS) over time

- Oversimplified models

- Too aggressive or conservative growth

- Seasonal targets that don’t match historic patterns

Plans are never perfect, but when done collaboratively, they provide a guide for execution and make it easier to adjust when things don’t go according to plan… which they rarely do.

After all, to quote Dwight Eisenhower: “Plans are worthless, but planning is everything.”

To translate, plans will change, but the process of planning will get you where you want to go and help you know how to adjust along the journey.

The better the planning process, the better the ability to navigate realities that don’t go according to plan.

Next is Inventory Planning

A good sales plan should include projected units sold, which then becomes a forecast for inventory sold during the year.

Combine your sales projections with inventory in stock and you can develop an inventory ordering plan.

Here are some considerations to incorporate into your inventory plan:

- Manufacturing lead times

- Minimum order quantities

- Inbound shipping times

- Potential shipping disruptions

- Time of year

- Current events – in 2024 this includes Red Sea ship attacks, Panama Canal constraints, and air freight cost spikes from China

- Sales greater or less than the annual plan

- New product launch success or failure

If you are too aggressive in how much you order, you may tie up cash that doesn’t come back in sales fast enough.

If you are too conservative in how much you order, you may experience stock outs and lost sales.

There is no right answer, but you need to pick your approach and be prepared for the consequences.

For a resource on inventory planning, read Inventory Forecasting in Excel – A Template & Tutorial.

We also have a template to help you:

The Importance of a Cash Flow Forecast (and Budget)

The sales and marketing plans and an inventory plan are the foundational pieces of a cash flow plan.

It is much easier to build a cash flow plan if you also have a budget for other key areas like:

- Cost of goods sold

- Fulfillment

- Merchant fees

- Advertising and non-advertising costs

- Operating expenses (payroll, software, etc.)

With a cash flow forecast, you can then develop a working capital strategy.

Here is a ecommerce budget template to get you started.

Developing a Working Capital Strategy

With a sales and marketing forecast and inventory plan, the next question is how to fund inventory purchases.

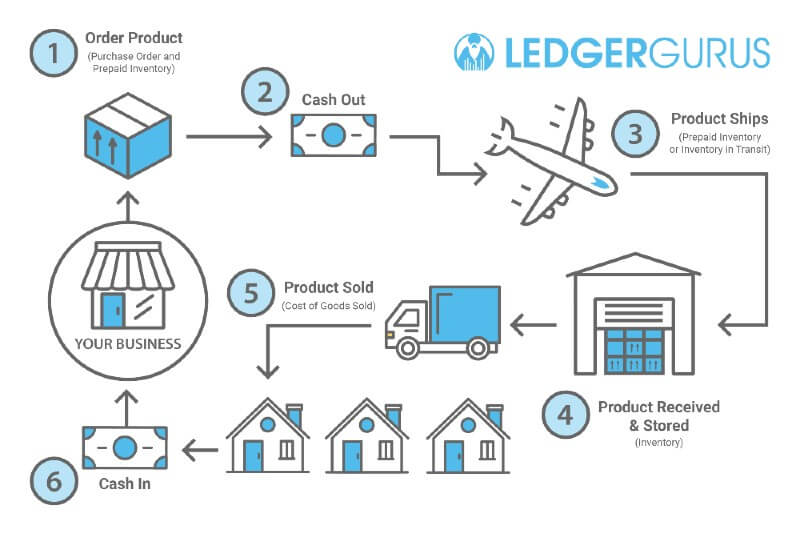

The challenge of consumer products business is their cash conversion cycle.

The cash conversion cycle is a critical metric for consumer product businesses as it measures the time between paying for inventory and receiving cash from customers.

Most brands will have a cash conversion cycle of multiple months.

With a long cash conversion cycle, a brand will need to fund inventory purchases by:

- Strong profitability and slow growth

- Capital from owners or investors

- Debt financing

Most brands don’t want to grow slowly, have difficulty raising capital from investors or putting more of their own money in, and therefore are left taking debt capital. For more on this topic, read Ecommerce Funding in 2024: What’s Available & How to Prepare For It.

The key from a Q4 planning perspective is:

- Establishing or adding lines of credit or loans

- Ensuring there is enough credit based on your cash flow forecast

When to Time Your Q4 Inventory Order

Inventory is ordered throughout the year, but the order for Q4 is usually the biggest.

Your inventory plan is the guide for when to order and this is typically in early to mid-summer, depending on the manufacturing source.

The most important adjustments for this order are determined by how sales have gone against plan:

- If sales are up, consider adjusting your sales plan and ordering more.

- If sales are down, reevaluate inventory on hand, adjust the sales plan, and right size the order.

This inventory order’s timing is determined by the manufacturing and shipping timing.

The quantity will change as actual sales deviate from the sales plan.

Tap into Debt, as Needed

You may have tapped into your debt already but will likely need to do so with the Q4 order.

If everything is lined up, this is a simple step. Use your debt and keep on growing.

Creating a Pricing and Discount Plan

Pricing and discounting is a dark art.

Q4 is one of the biggest selling times of year for consumer products, but it also comes with an expectation for discounts.

According to Salesforce via Digital Commerce 360, in 2023, the average discount was 27%.

From a financial standpoint, your discounting strategy should consider the following:

- A big enough discount to drive sales

- Not too big to eat into profits

Refining Plans Along the Way

Plans are living and should change as the year proceeds.

Each plan is linked to the other, so as the product and marketing plans change, so does the inventory plan, budget, and cash flow forecast.

Update them regularly at these recommended intervals:

- Cash flow forecast: weekly to monthly

- Marketing plan and sales forecast: monthly to quarterly

- Product plan: as needed

- Budget: monthly to quarterly (even semi-annually can work)

- Inventory plan: monthly to quarterly

If you aren’t adjusting with the reality of your execution, your plans are a grand work of fiction.

With regular adjustments, they become a critical component to steering your business.

BFCM and Beyond

Black Friday / Cyber Monday (BFCM) is mainly a marketing and sales activity.

From a financial standpoint, there isn’t much you can do to change the trajectory of this time.

Ideally, you are selling a lot, generating a load of cash, paying down debt, and seeing profits.

Don’t Forget Q5

There is a concept in ecommerce of Q5 (5th quarter) which is the period between Christmas and New Years.

This period is characterized by continued consumer shopping, often driven by self-gifting and post-holiday sale. (For more details, read What is Q5 and why does it matter?)

The sales and marketing team should drive this initiative starting in January, and everything else reflects it:

- Sales forecast

- Inventory plan

- Cash flow forecast

- Budget

- Pricing plan

Done well, Q5 can be a nice extra boost to sales and profits.

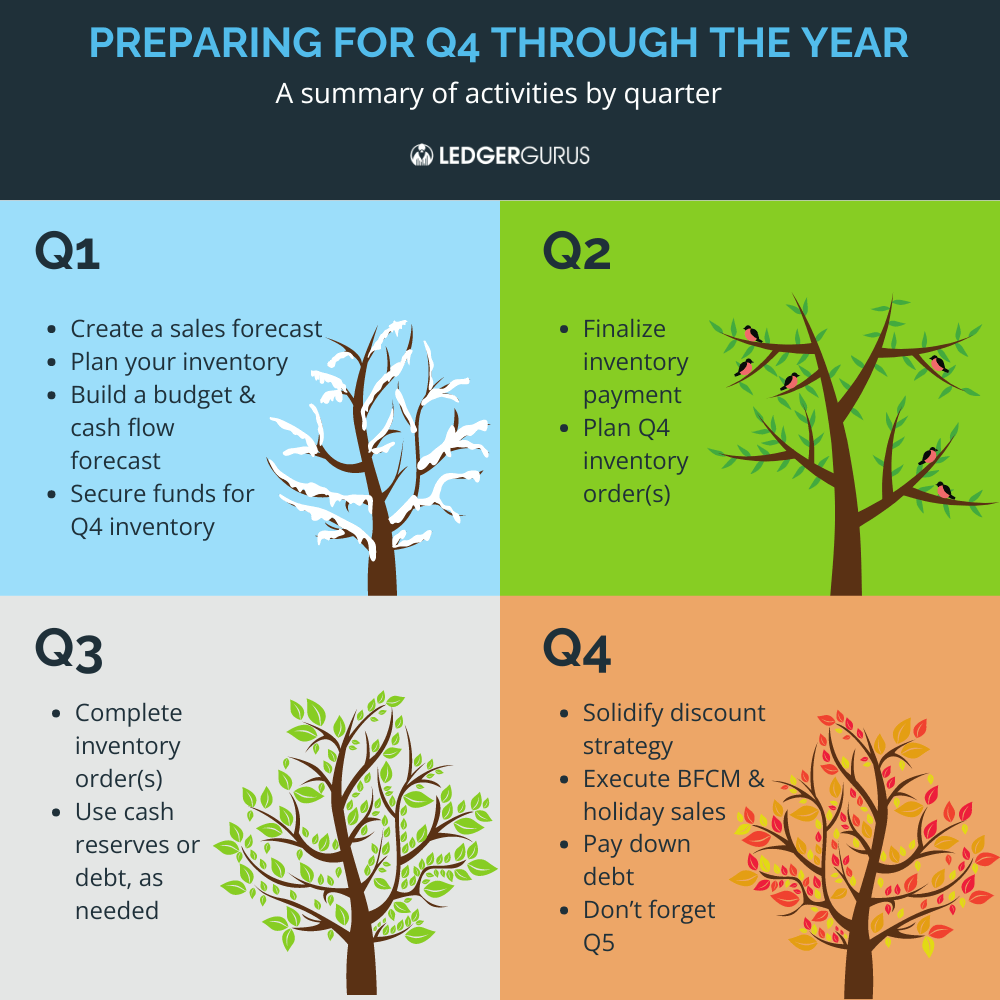

Summarizing What To Do Throughout the Year

Here is a summary of activities by quarter:

Quarter 1

- Develop a sales forecast

- Build an inventory plan

- Build a budget and cash flow forecast

- Figure out how to pay for the Q4 inventory orders

Quarter 2

- Solidify how you will pay for inventory

- Start making the Q4 inventory order(s)

Quarter 3

- Complete inventory order(s)

- Tap into your cash reserves or debt, as needed

Quarter 4

- Solidify your discounting strategy

- Execute your BFCM and holiday sales

- Pay down debt

- Don’t forget Q5

Rest and Repeat

If you’ve executed a good year and Q4, celebrate the New Year, then take a nice break and/or vacation. Once you’re done, return to start and begin again.

If you’re reading this and it isn’t January, it’s not too late.

Start somewhere, and get into a good planning cycle for the next year.

Becoming great at planning takes repetition, so start now and get better over time.

How to Get Help Executing on This Plan

Properly executing on this plan requires understanding some important concepts: forecasting, budgeting, and cash flow planning.

For these plans to be based on fact and not pipe dreams, they have to come from solid accounting.

When your numbers are solid, they become a foundation for everything else.

So, if you need help with your forecasting, budgeting, and cash flow planning, reach out to us.

We have a team of experts who can help you get accurate accounting and understand what it means, so you can make better decisions and propel your business to success.