There is a new W-4 form in 2020 with a number of changes. Here is a 2020 W-4 form overview of what you need to know as an employer with some resources to help you. You can also view our video, which has more details on these changes.

2020 W-4 Form Overview

There are a number of changes with this form. The form can be downloaded direct from the IRS here. The 2020 form is broken down into 5 sections or steps:

- Personal information

- Multiple jobs or spouse work (this is new)

- Dependent information

- Deductions or withholdings

- Signatures

The big change to note is a move from a number of allowances to a calculated amount of tax to withhold. This may be intimidating to many people for whom the allowance method was easier to grasp. Be prepared for questions from your employees.

Key Things to Note

Here are the key takeaways from the 2020 W-4 form:

- Allowances are gone, calculated withholdings are in

- The 2020 W-4 must be used for new employees whose first payroll is in 2020

- Existing employees do not need to fill out a new 2020 W-4, but…

- Existing employees will need to use the 2020 W-4 form if they wish to change withholdings

Why the Changes

The official line from the IRS for the new W-4 is it “reduces the form’s complexity and increases the transparency and accuracy of the withholding system.” It has also been noted that this is a response to the 2017 Tax Cuts and Jobs Act. My take is that both points are true, but the calculation of withholdings is more complicated as most people used the number of people they supported in a household as a quick way to determine allowances.

Here is FAQs on the 2020 Form W-4 for those that want the details or can’t fall asleep.

Entering into Payroll Systems

With the 2020 W-4 form, you will need to enter the information into your payroll solution of choice. There are a lot of options out there, but here are details for the payroll solutions we work with:

Gusto

- Gusto will automatically transfer information from the W-4 if you send it out via Gusto. See this article, Access W-4 forms for employees for details.

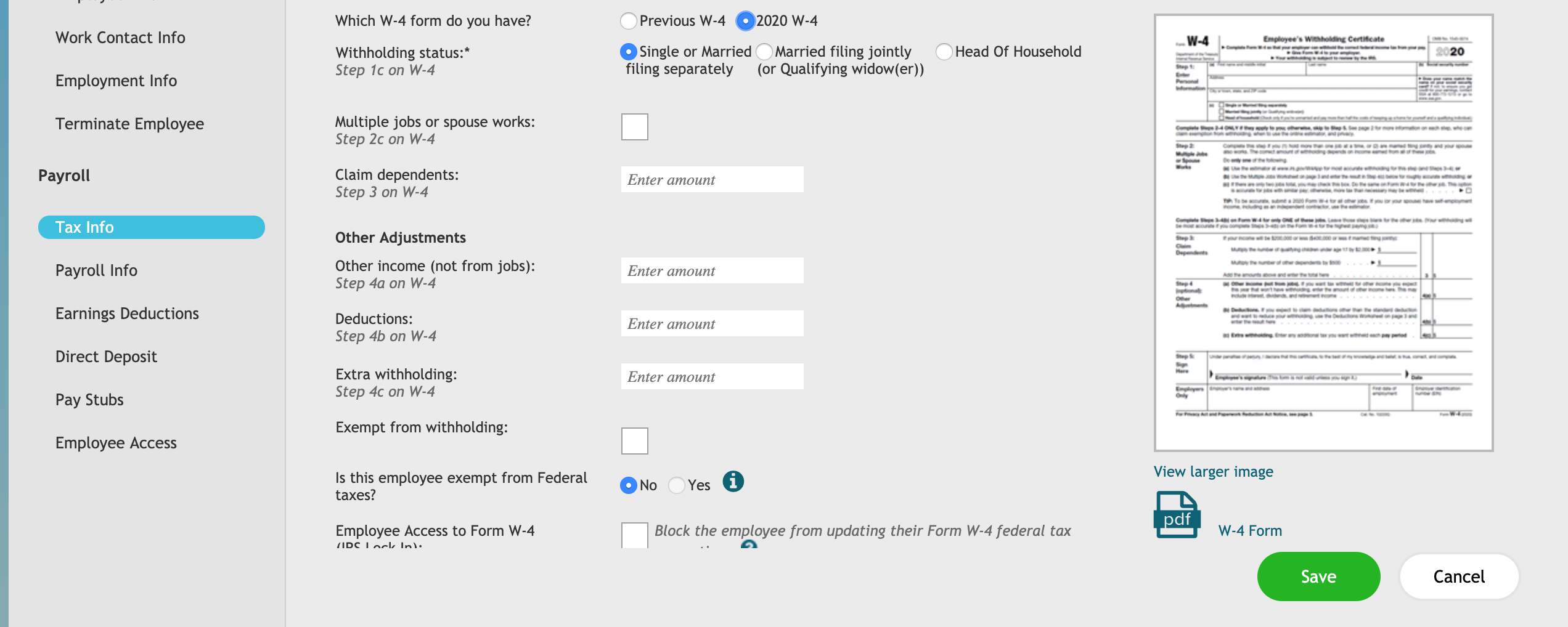

ADP Run

- For new employees, use the Add employee wizard under Employees and it will guide you through adding the appropriate information

- For existing employees, go to Employees > Tax Info and select Edit under the Federal Tax section. You will have an option to edit using the 2020 W-4 there

QuickBooks Payroll

- There are many Intuit QuickBooks payroll products. This article, What’s changing with the Federal W-4? covers the 2020 W-4 changes. Skip to the bottom for how to enter the new W-4 information into the respective QuickBooks product.

Note that many of these changes may not take effect until January 1.

Next Steps

Here’s what you need to do to get ready.

- Download the 2020 W-4 form

- Start using it for new employees and changes with existing employees

- Be ready to support employee questions on how to calculate withholdings (our YouTube video goes into more details that will help you support employee questions)

If this and other payroll challenges are overwhelming, LedgerGurus can help.