Dropshipping is a great way to run an ecommerce business when you don’t want to own inventory or when you’d like to have someone else do the work of buying, tracking and shipping products to your customers.

However, sales tax can be a nasty surprise, especially when you don’t know what to expect or how to handle it.

This article will help you understand all the aspects of sales tax for dropshipping.

We’ll cover:

- How does dropshipping work?

- What is nexus and how does it affect dropshipping?

- How nexus affects sales tax obligations for dropshippers

- Who pays sales tax in drop shipping?

- How to get a resale certificate

- How to get help with your sales tax

Let’s get into it.

Key Takeaways

Key Takeaways

- Nexus is key for dropshippers. If you have a physical presence or meet a state’s economic threshold, you’re required to collect sales tax from customers in that state.

- Who pays sales tax depends on where the seller, supplier, and customer have nexus. Proper resale certificates can help avoid unnecessary sales tax costs.

- Get a resale certificate. To avoid paying sales tax on goods purchased from suppliers, apply for a resale certificate and share it with suppliers at checkout.

- Need Help? LedgerGurus offers consultations, training courses, and managed services to help dropshippers handle sales tax compliance accurately and easily.

How Does Dropshipping Work?

There are 3 parties involved in a typical dropshipping scenario:

- The customer

- The seller

- The supplier (a.k.a. dropshipper)

Note: For the purpose of this article, we will assume you are the seller.

The customer orders from you, the seller.

You don’t actually own the inventory, so you place an order with your dropshipper for your customer’s product.

Your dropshipper ships the product to your customer.

The customer only deals with you, the seller. They simply go to your website, place an order, pay for it, and their product shows up.

You deal with both the customer and your dropshipper.

When the customer places an order on your site, you then place an order with your dropshipper, who sends you an invoice and then ships the product to your customer.

There are essentially two transactions:

- Customer -> Seller

- Seller -> Drop shipper

So, where does sales tax come in and who pays it?

To figure that out, we first need to understand nexus.

What is Nexus and How Does it Affect Dropshipping?

In this context, nexus is when a business has a strong enough connection with a state to be required to collect and remit sales tax.

There are several ways to reach nexus, but in this article we’ll discuss the two main ones:

- Physical nexus

- Economic nexus

What is Physical Nexus?

To have physical nexus means that you have a physical presence in the state.

This could be because your business is located there or because you own product that is stored there (think Amazon FBA or a 3PL) or because you’ve got employees there.

The main factors of physical nexus are:

- People

- Property

So, if you’ve got either of those, you probably have physical nexus in the state and you need to register for a sales tax permit.

We say “probably” because different states have different rules regarding whether Amazon FBA is enough of a connection to be considered nexus.

What is Economic Nexus?

Economic nexus is a bit trickier.

Having economic nexus means you’ve sold enough products in a state for them to see you have a strong economic presence. In other words, you’ve passed their economic threshold, so they can require you to collect and remit sales tax.

The main factors in a state’s economic threshold are:

- # of Transactions AND/OR

- Amount of gross sales

The reason this gets tricky is because economic thresholds vary by state.

For instance, in New York, you reach it when you have $500K in gross sales there AND at least 100 transactions. You need both.

In Utah, you reach it when you have $100K in gross sales OR 200 transactions. Either one counts.

Whereas, in Oklahoma, you pass the threshold after you have $100K in gross sales. Plain and simple.

For a complete list of economic thresholds by state, as well as a list of the 10 steps online sellers must follow to be sales tax compliant, download our 10 Steps of Sales Tax guide.

How Nexus Affects Sales Tax Obligations for Dropshippers

As an online seller, you have nexus and need to collect sales tax wherever you have:

- Physical presence – people and/or property, starting with your home state

- Economic nexus – enough gross sales/transactions to pass a state’s threshold

Your dropshipper follows the same rules.

That means that they, too, are responsible for collecting sales tax wherever they have passed the economic threshold.

So, if your customer is in a state when your supplier has nexus, you will be charged sales tax because YOU are your supplier’s customer.

Pro tip: You may want to factor the cost of sales tax into your pricing, so it’s not coming out of your profits.

Who Pays Sales Tax in Dropshipping?

We get a lot of questions about this, and who pays sales tax in a dropshipping situation is different depending on who has nexus and where.

The two main questions we get are:

- Do I need to charge sales tax from my customers?

- Do I need to pay sales tax to my drop shipper?

Do I Need to Charge Sales Tax from My Customers?

This one is the easiest to answer.

If you have nexus in a state, you need to register for a sales tax permit and set up your channels to start collecting sales tax from your customers there.

This always brings up 2 BIG DON’Ts, though:

- Don’t register in a state until you have nexus. (You are NOT responsible to collect sales tax before you pass the threshold.)

- Don’t collect sales tax until you have registered. (It’s actually illegal to do that!)

For more information, read our Complete Guide to Sales Tax Nexus for eCommerce Sellers.

Do I Need to Pay Sales Tax to My Suppliers?

This is a bit trickier and changes depending on where you and your dropshipper have nexus.

Typically in state to state transactions, sales tax is determined by the customer’s location.

Since you are placing an order with them, you are your dropshipper’s customer.

But please note that you will still be charged sales tax according to your customer’s location.

So unless you are exempt from paying sales tax (we’ll talk more about this later), your dropshipper is required to collect sales tax from you. It’s the law.

There are ways to get around it, but that is the simplest answer.

Examples of Sales Tax in Different Drop Shipping Scenarios

Again, whoever pays sales tax in a dropshipping transaction depends on where the parties involved have nexus.

So, let’s look at several scenarios to see how that works.

Scenario #1

Let’s say that you sell t-shirts and are located in Kansas. You have registered for a permit in Kansas but you are a pretty new seller, and you don’t have nexus anywhere else.

Your supplier is located in California, and is fairly new themselves and doesn’t have sales tax nexus in very many states either.

A customer in Utah orders a t-shirt from your site. You don’t have nexus in Utah, so you don’t charge them sales tax.

Your supplier also doesn’t have nexus in Utah, so they don’t charge you sales tax.

That was easy!

Scenario #2

You have another supplier, located in South Carolina, that has been in business for a long time and has nexus in almost every state.

The same customer orders another t-shirt. You still don’t have nexus in Utah, so you do not charge them sales tax.

However, your supplier DOES have nexus there, so they are required to charge you sales tax.

But you have provided them with a valid resale certificate (click here to see how), so you do not need to pay it.

Scenario #3

You’ve now been in business for a while and you have enough sales in Utah that you have passed the economic threshold ($100K in gross sales OR 200 transactions). You have registered for a permit and set up your website to collect there.

This customer likes your store a lot and has ordered another t-shirt. You now charge them sales tax on this order.

Your supplier in South Carolina is still required to charge you sales tax, but you have given them your sales tax permit number and are exempt from paying it.

How to Get a Sales Tax Exemption Certificate, or Resale Certificate

As you can see, getting a sales tax exemption is helpful when you’re dropshipping so you don’t have to pay sales tax on the invoice your supplier is sending you.

This is how it works:

- As a purchaser, you apply for a resale certificate and provide it to your supplier at checkout.

- Your supplier is required to collect these certificates and make sure they are valid before allowing the sales tax to be exempted. It is in the supplier’s best interest to do this because of their sales tax obligations. If they are audited and the certificates they have on file are found to be fraudulent, they are responsible for coughing up the money out of their own pocket.

This is why dropshipping suppliers are often such sticklers about resale certificates, and some may not accept them at all.

What is the Difference Between a Sales Tax Exemption Certificate and a Resale Certificate?

“A resale certificate is a document that allows a business to make tax exempt purchases based on the assumption the goods will be resold and the sales tax will be paid by the end consumer.” (Avalara)

“A sales tax exemption certificate is a document that allows tax-exempt purchases based on the status or circumstances of the purchaser.” (Avalara)

They’re pretty similar definitions, so we’ll use the terms interchangeably.

Can You Use the Same Resale Certificate in Every State?

No. Like everything else with sales tax, each state has its own rules, and it’s important to know what kind of certificate you need for your products.

There are no universally accepted resale certificates, but there are two kinds of multistate resale certificates:

- Streamlined Sales Tax (SST) Certificate of Exemption

- Multistate Tax Commission (MTC( Uniform Sales & Use Tax Resale Certificate

These two forms cover all but 10 of the states that have sales tax.

In order to get sales tax exemption certificates in those 10 states, you have to apply for a sales tax permit and use that to get the exemption. Until that happens, you just have to pay the sales tax on invoices into these states from your dropshipper.

They are:

- Alabama*

- California

- Florida

- Hawaii

- Illinois*

- Louisiana

- Maryland

- Massachusetts

- Washington

- Washington DC

*You can use your home-state issued reseller certificate for these states, just not the SST or MTC forms.

We have a video here that explains how to fill out the SST and MTC forms, including what forms of ID you can use, but it really is pretty straightforward when you follow the instructions.

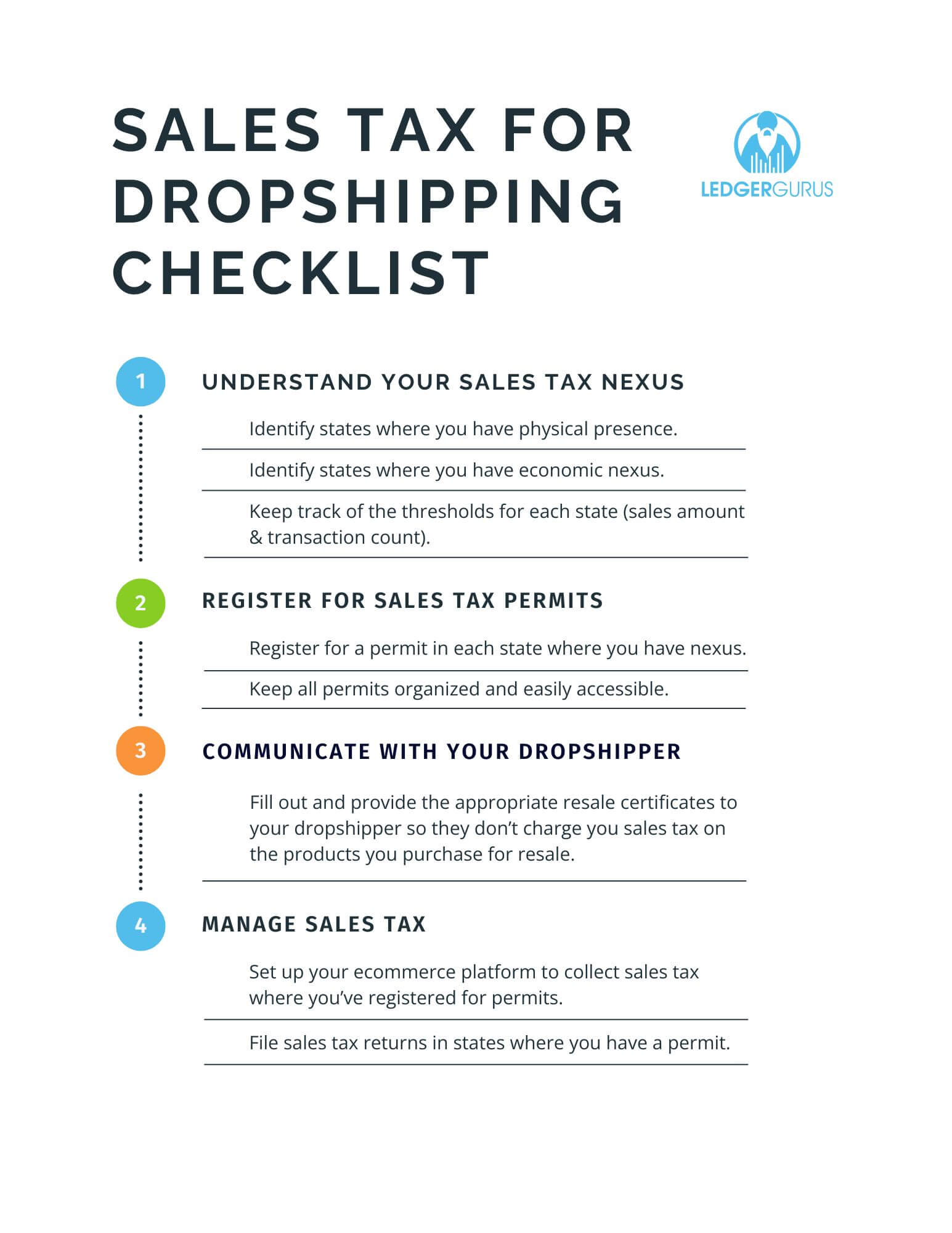

Here’s a checklist to make sure you remember all the pieces.

How to Get Help with Your Sales Tax

Sales tax is an often confusing and frustrating topic because the laws are constantly changing.

If you’re tired of trying to figure it out on your own, we have several options for you:

Do It Yourself with Guidance: If you have a bunch of questions that you need answered specifically for your situation, a consultation with one of our sales tax experts may be your best choice. We can answer questions, walk through processes with you, and even help you fill out forms correctly.

We also have a free sales tax masterclass you can watch to get the big picture of sales tax and understand better what is expected of you.

Managed for You: If you’d rather just have someone take the whole thing off your plate so you can focus on growing your business, consider LedgerGurus. We have a whole team of sale tax experts who do this stuff every day. We will be happy to handle it for you. Click here to get in touch with us. We are happy to help!

FAQs

Do I need a tax ID to dropship?

No. That is the value of using the SST and MTC forms. Here is a video that goes through how to get a resale certificate and what kind of IDs you can use on them.

Do dropshippers need to collect sales tax?

Yep, unless you have a valid exemption certificate on file with your supplier or unless you have not reached the threshold.