The state of California has an incredibly large and complicated sales and use tax system. Given that it has the fifth largest GDP in the world (approximately $3.9 trillion in 2023 and ranking close to nations like Japan and India), it’s no wonder it may feel like doing business with a foreign country when operating in California.

There are a lot of state sales tax laws and regulations to be compliant with in California. Your success is dependent on learning the factors that affect your sales tax compliance.

We’ll cover:

- How California sales tax works

- When ecommerce businesses have to collect sales tax in California

- How to register for a sales tax permit in California

- All about filing sales tax returns in California

- How to get help with your sales tax

Key Takeaways

-

California’s sales tax system is complex. California’s layered tax structure includes state, county, city, and district taxes, making compliance challenging. Knowing these details helps you stay compliant.

-

Determine if you have nexus in California. If you do, you’ll need to register for sales tax if you have physical or economic nexus in California—whether through a physical location, employees, or $500K in annual sales.

-

Know your products and customers: Confirm if your products are taxable or exempt. Also, collect exemption certificates from qualified customers to protect yourself in case of an audit.

-

Staying compliant is very important. Register before collecting sales tax, and remember to file returns on time. If this process feels overwhelming, LedgerGurus offers consultations and managed services to keep you compliant without the headache.

You can also watch our video on this topic here:

How California Sales Tax Works

To start with, California sales tax is divided into four levels:

- State

- County

- City

- Special district

The first three levels are combined into a single state sales tax rate of 7.25%.

Different California districts impose their own district sales tax rates, leading to a myriad of different rates across the state. They run from 0.1% to 1.00%, though some areas may have more than one district tax in effect (California Department of Tax and Fee Administration – CDTFA).

These local taxes combine with the state rate to form the overall sales tax rate.

In a best-case scenario for California online sales tax, you’ll find yourself collecting a straight 7.25%. However, that figure may run as high as 10.75% (CDTFA).

Origin-based vs. Destination-based Online Sales Tax

California has two types of sales tax rates: origin-based vs destination-based. This means that sales tax can be collected based on where the seller is located or where the buyer is located, and is determined by zip codes.

In California, sales tax is calculated based on origin, but it “is unique. It’s a modified origin state where state, county and city taxes are based on the origin, but district taxes are based on the destination (the buyer).” TaxJar

Please note that sales tax rates on online sales from out-of-state sellers are affected by the buyer’s location, since there is no California-based origin for these sales.

To make this aspect of the tax process easier on you, we highly recommend using sales tax software with your online business transactions. This ensures sales tax is being calculated accurately and your customers are charged correctly.

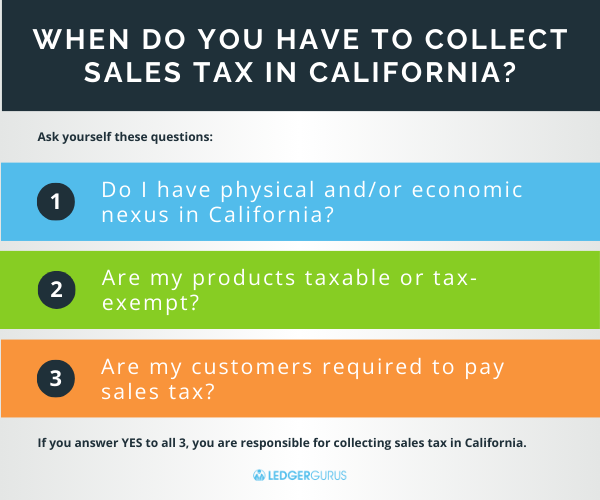

When Do eCommerce Businesses Have to Collect Sales Tax in California?

When determining if you are responsible for collecting and remitting California sales tax, ask yourself these questions:

- Do I have sales tax nexus in California?

- Are my products taxable or tax exempt?

- Are my customers required to pay sales tax?

If the answer to all three is yes, you are responsible for registering for a sales tax permit, collecting sales tax from your CA customers, filing returns and remitting it to the state.

Do You Have Sales Tax Nexus in California?

The term “nexus” has to do with what states you have a strong enough economic connection with to be required to collect and remit sales taxes, based on criteria such as physical presence, affiliate relationships, fulfillment programs, and economic nexus tax laws related to online sales.

There are different types of nexus, with the most common being physical and economic.

Physical Nexus

Physical nexus is pretty straightforward – it’s where you have a physical business presence in a state. However, there are nuances that many business owners may not be aware of.

Physical nexus goes beyond having office space or warehouses. It can also include places where remote employees work, equipment is leased or inventory is stored.

A good rule of thumb is to consider where you have PEOPLE and PROPERTY.

Economic Nexus

Economic nexus is tied to your sales activity. California, like all other states with sales tax, adopted the economic nexus ruling of South Dakota v. Wayfair in June 2018. The Wayfair ruling allows states to collect sales tax from online sales even when the business has no physical presence in that state.

In California, the economic nexus threshold is $500k in sales for the current or previous calendar year. This applies to all sales, so it even includes transactions like resales.

And remember, it includes ALL the sales from ALL of your sales channels. So, if you’re selling on Amazon and Shopify, even though Amazon is taking care of the sales tax there, you’re still responsible for filing California sales tax on your Shopify channel if you’ve passed the threshold in California.

We go into great detail about physical and economic nexus in our free guide 10 Steps to Ensure Sales Tax Doesn’t Burn Down Your eCommerce Business.

Are Your Products Taxable or Tax-Exempt?

If your business meets the definition of nexus, the next step will be to determine which products are taxable and which are exempt from sales tax.

You’ll want to do this exercise before sitting down and registering with the state. There is information you need to gather for the vendors of your taxable products in order to register, so it’s best to identify first which products apply.

Common tax-exempt products in California:

- Most non-prepared food items

- Medical supplies

- Prescription medicines

One resource to help you determine the tax status of your products is this list of tax exemptions compiled by the CDTFA – CA’s tax regulatory agency. This government document is a lengthy read, but it covers all of the nuances of what is exempt or not.

This list also covers the tax exemption status when doing business with non-profit organizations and government entities.

Note: If your product(s) are tax exempt, you don’t need to worry about any forms because it’s already in the state’s legislation.

Are Services Taxable in California?

According to SalesTaxHandbook.com: “California does not generally collect sales taxes on services. However, services which are ‘inseparable from the sale of a physical product’ (such as setup of a purchased machine) and fabrication/assembly services (services which create tangible personal property) are considered taxable.”

For more information, read this article about the basics of exemptions or you can watch our video: Do You Qualify for a Sales Tax Exemption?

Are Your Customers Required to Pay Sales Tax?

The last question to consider is whether your customers are required to pay sales tax or not.

Examples of exempt customers are:

- Government agencies

- Some non-profit organizations

- Schools

- Merchants buying goods for resale

It is vital to obtain a valid exemption certificate from your customers BEFORE agreeing to exempt the transaction from sales tax.

This is because, if you are audited, you MUST be able to provide a valid exemption certificate for every tax exempt transaction, or you will be held responsible for the uncollected sales tax.

How to Register Your Business for a Sales Tax Permit in California

Registering for a sales tax permit in California requires more detailed information than in other states. The things you’ll want to have handy include:

- A photocopy of your driver’s license (for U.S. citizens) or a photocopy of your passport (for non-citizens)

- Information for your vendors, including their business name, location and phone number

- All the basic information for your business and owners

Registration is managed on the CDTFA’s website: cdfa.ca.gov. Follow these steps for registering on the site:

- Scroll to the bottom of the page and look for the “Registration” menu

- “Register for a Permit, License or Account”

- “Register a New Business Activity”

- Follow the prompts from that point on.

After the state has processed your registration, they will send you a security code to set-up your account, so you can remit online sales taxes.

One really important point we need to stress is DO NOT start collecting sales tax until you have registered. Doing so is considered fraud and can land you in serious legal trouble.

That said, after you’ve registered, you’ll want to swiftly get your channels set up to collect sales taxes from customers.

Note: In the appendix of our 10 Steps of Sales Tax Compliance guide, we’ve got information for each state on how quickly you must register and start collecting after you have nexus. It also has lots of details and tips and tricks for ensuring your business is tax compliant.

All About Filing Sales Tax Returns in California

Once you’re registered for a permit and started collecting sales tax, it’s time to file your California sales tax returns online.

When Sales Tax Is Due

Be sure to remit your taxes ON TIME. Typically, sales tax is due on the 24th of the month following the sales activity.

So, for sales in the month of March, you must remit sales taxes by April 24th.

Please note, though, that sales tax accounts have different payment schedules assigned when businesses first receive their sales tax permit, which can be monthly, quarterly, or annually, with specific due dates for each period.

How to File a Return

Filing a return is a two step process:

- Submit the required sales data (filing the return).

- Remit the money you’ve collected to CDTFA.

You can fill out the paper forms (State, Local, and District Sales and Use Tax Return) to do this, but filing online is much easier through the California Tax Payers’ Portal is easier.

Watch our video How to File Sales Tax Online here.

What You Need to Know about California Sales Tax for Online Sellers (in a nutshell)

If you only remember a few things from our tips, let it be:

- Pay attention to nexus.

- Know if your products are taxable or tax exempt.

- Get exemption certificates from anyone who asks for a tax exemption.

How to Get Help with Your Sales Tax

If your business is still small enough that you want to handle sales tax yourself, we offer consultations where you can ask our sales tax experts questions about your specific situation.

We also have a super-informative sales tax masterclass created specifically for online sellers. We break sales tax down into manageable pieces and show you what you need to pay attention to.

And if your business has grown to the size or complexity where you’re ready to get professional assistance with sales tax, we’d love to work with you! Our sales tax team works with it all day, every day for our clients, and we’re happy to do yours, too.