Picture this: you’re running an online store and selling into the vibrant state of Colorado. You’ve got a lot on your plate and you’re juggling multiple roles, from managing day-to-day operations to coming up with clever marketing strategies.

At the back of your mind, though, there’s always one nagging worry – dealing with Colorado’s ridiculously complicated sales and use tax system regulations.

Now, we know that dealing with the tax rates across all the jurisdictions in Colorado is frustrating and annoying, but it is also essential. So, what if we told you there’s a solution to make it easier?

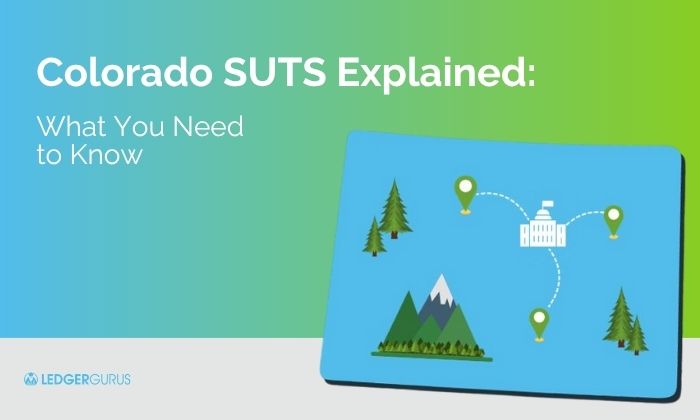

Enter Colorado SUTS, a platform designed to take some of the hassle out of handling the Colorado taxes for your business.

In this article, you’ll learn:

- Overview of Colorado’s sales tax system

- Important features

- How to navigate tax rates

- Benefits of the system

- Support and resources

- How to get help on all your sales tax needs

Let’s get into it.

Key Takeaways

-

Colorado’s sales tax system is complex, with many home rule cities.

-

SUTS simplifies filing and remittance for participating jurisdictions.

-

Provides GIS tax rate lookup for accurate customer-based calculations.

-

Includes taxability and exemption matrices for easier compliance.

-

Streamlines filings with uniform forms and a central remittance portal.

-

Colorado Department of Revenue offers support and resources for businesses using SUTS.

Overview of Colorado’s Sales Tax System

Colorado’s sales tax system is a mess.

To give you an overview of all the complexity involved, some of the special issues you need to know about are:

- State-collected jurisdictions

- Self-collected (home rule) jurisdictions

- Combined sales tax rates

- Special district taxes

- And some tax exemptions and variations, just to make things a bit spicy!

Below are some details on the first two: state-collected and self-collected jurisdictions.

State-Collected Jurisdictions

Colorado imposes a base sales tax rate, which is collected on most retail sales made within the state.

In state-controlled jurisdictions, the Colorado Department of Revenue collects that sales tax, along with any additional local taxes required by counties, cities, or special districts within those areas. It then distributes the local portion back to the respective local governments.

Self-Collected (Home Rule) Jurisdictions

Home ruled cities and towns have charters that give them the autonomy to make their own decisions about areas of local concern. Because each home rule jurisdiction can draft its own charter, there is a lot of variability in laws, policies, and structures from one municipality to another.

In the case of sales tax , these cities and towns have chosen to collect their own local sales tax, independently of the state.

This means that each self-collected jurisdiction can set its own sales tax rate and has its own tax laws and regulations, complicating things for online sellers.

Important Features of the Colorado SUTS

Because sales tax is such a convoluted mess, the Colorado Department of Revenue created the SUTS system as a single point of remittance to participating home rule jurisdictions for online sellers.

Think of it as your Swiss Army knife for sales and use tax. It has some key features that will make dealing with taxes in Colorado a lot easier than having to deal with each jurisdiction individually.

GIS Tax Rate Lookup Tool

The Geographic Information System (GIS) Tax Rate Lookup Tool helps you figure out the exact tax rate you should charge based on where your customers live. It provides details about counties, special taxation districts and local governments that require sales tax remittance.

No more head-scratching over which tax rate to use!

Taxability and Exemption Matrices

Colorado SUTS also gives you a cheat sheet (we mean, “taxability and exemption matrices”) to help you know what are taxable goods or services and what are not. It’s like have a sales tax guru in your corner.

The system’s matrices provides an all-encompassing list so you can efficiently calculate the applicable rates when needed.

In short, they help clarify not only each item’s taxable status, but compute accurate individual rates, too!

Tax Compliance Support into Home Rule Cities

Colorado sales tax becomes an especially big burden for online businesses operating into home rule jurisdictions. These places have their own rules, and can become quite a tax maze.

But thanks to Colorado SUTS, there is now one place to deal with all of that. As of late 2023, 66 “Home Rule” cities have agreed to be a part of this program, including big ones like Colorado Springs and Boulder.

SUTS streamlines the tax remittance process by providing:

- Accurate address-based tax rate calculations (like mentioned before)

- A uniform filing form for those 66 cities

- An automated remittance portal, while the Colorado Department of Revenue offers support and resources for businesses using the system.

This solution has helped address the complex problems caused by all the varying rates in the state.

With its user base rapidly expanding thanks to these benefits, this one-stop portal looks set to stick around into the future with everyone benefiting from its simplified approach to collecting taxes without complication or confusion.

Participating Jurisdictions

The Home Rule cities of Colorado have been granted autonomy to form and implement their own laws.

Online sellers that sell into most of these cities can utilize the SUTS system to help them determine the correct taxing jurisdictions, as well as collect tax at accurate rates specified by those particular areas.

Note: As of late 2023, 6 “home rule” cities have still not elected to participate in SUTS. That means that you’ll have to remit sales tax to them directly. For an example of what this could look like for a business, watch this video: Colorado SUTS Explained for Online Sellers.

Navigating Tax Rates with SUTS

Accurate Address-Based Calculations

Colorado SUTS uses something called “destination sourcing”, which uses the customer’s exact shipping address or delivery location to calculate tax rates appropriately.

So, if you’re selling to folks in different cities with different tax rates, no worries – SUTS has your back.

Handling Differing Tax Rates

The SUTS system doesn’t stop at calculating taxes. It can even handle items with different tax rates in the same city.

Imagine you’re selling both widgets and gadgets in Wheat Ridge. Colorado SUTS can help you sort out the correct tax rate for each item. Pretty handy, right?

Benefits of the CO SUTS

In short, the SUTS is all about simplifying your life as a business owner. Essentially, it’s a one-stop shop for most of your CO tax needs.

- It gives you a standard form to file taxes for all those Home Rule cities. No more drowning in paperwork or confusion.

- It provides a remittance portal that takes the headache out of filing sales tax returns.

- The portal calculates everything for you and ensures that all necessary requirements are met when dealing with various taxing jurisdictions regarding the sales tax revenue you’ve collected.

Now you can focus on running your business, knowing your taxes are in good hands.

Support and Resources from Colorado Department of Revenue

The Colorado Department of Revenue makes sure businesses don’t have to grapple with the SUTS system on their own. They offer plenty of helpful resources and assistance so that companies are able to use it effectively.

The official SUTS website is your go-to source for useful links, tax rate lookup tools, and even instructional videos. You can also get in touch with them through their contact page or give them a call.

How to Get Help with ALL Your Sales Tax Needs

Understanding how SUTS can help you is one thing, but if you’re an ecommerce business owner juggling multiple roles, there’s a solid chance that you are sick of dealing with sales tax in general.

Especially if you’re selling into any of the home rule cities that have not chosen to participate in SUTS. You’ll still have to remit to each of them individually, on top of your Colorado state sales tax return and the SUTS returns.

And Colorado isn’t the only highly complicated state for sales tax remittance.

If the monthly headache of figuring out where you have nexus, registering in new states, making sure your channel is set up to collect sales tax properly, and then going through all the hassle of remitting it to the states is driving you nuts, consider us. These are things we do here at LedgerGurus all the time.

We have an entire team that specializes in US sales tax, and we’d be happy to handle it for you.

Frequently Asked Questions

What is Colorado sales tax payable?

The Colorado sales tax payable is currently 2.9%. This rate applies to both the state sales tax and the use tax.

Does Colorado have tangible personal property tax?

Colorado enforces a sales tax on the retail sale of physical products, but does not impose it for services, with some specific exceptions that are included in law.

What city has the highest sales tax in Colorado?

Winter Park in Colorado has the highest rate of sales tax. The amount is applicable to any goods and services bought or sold within city limits.

What led to the creation of Colorado’s Sales & Use Tax System (SUTS)?

In Colorado, the establishment of the Simplified Use Tax System (SUTS) was inspired by a need to make their complex sales and use tax process easier. This decision had an increased level of importance as it takes into consideration certain home rule jurisdictions where particular taxes are concerned.

What support and resources are available for businesses using SUTS?

The Colorado Department of Revenue provides assistance and tools for businesses registered with the SUTS system, including an online hub featuring tutorials, a contact page to connect directly to their team, plus phone support.