Cost optimization strategies are important for businesses in all stages (growth, maintenance, or survival). Cost optimization can become sloppy during growth phases, as costs attract less attention. But don’t forget that optimizing costs during growth leads to more profits. Growth is important, but profits are essential.

Here’s a quote our CEO heard from a friend that we love:

“Egos chase revenue, ballers chase profit”

During times of survival, businesses often turn to cost optimization. Where and how can they reduce costs? Doing so in the right way can make all the difference in surviving and later thriving. Let’s dive into some cost optimization strategies.

(Our blog article on Analyzing Business Cost Structures is a great prequel to this article)

In this article, we’ll cover:

- Understanding revenue producing costs

- Tier and adjust costs with sales ratios

- Protect/scale critical operating costs

- Prioritize non-critical costs

- Next steps

Let’s get into it.

Key Takeaways

- Revenue-Producing Costs

- Contribution Margin

- Break-Even Point

- Use Ratios for Cost Analysis

- Protect Critical Operating Costs

- Prioritize Non-Critical Costs

- Budgeting is Key

Understanding revenue producing costs

Some costs are essential to producing revenue. When looking at cost optimization, you’ll want to look at these revenue producing costs. These costs generally include the following:

- Cost of Goods Sold – direct costs of producing the product sold

- Customer Acquisition Costs – costs needed to acquire a customer (marketing expenses)

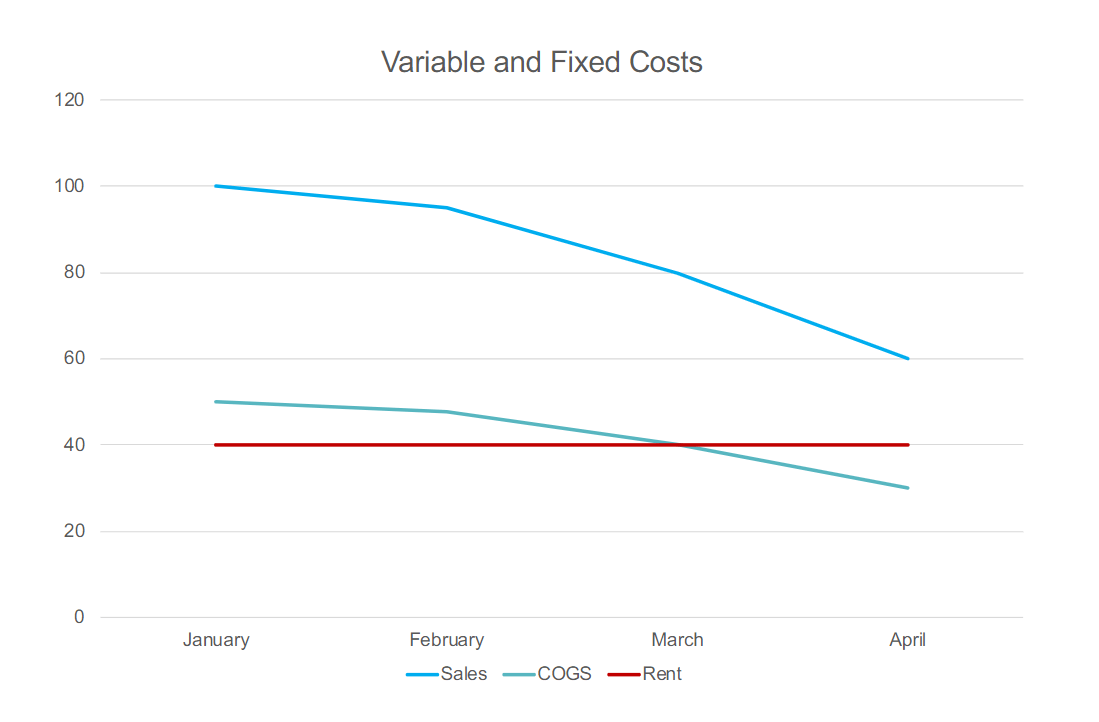

These costs are variable and generally move up and down with sales. Whereas fixed costs (overhead), are usually less essentially to producing revenue and remain constant as sales move up or down:

Contribution margin

Contribution margin

A key number to track is your contribution margin. This includes all variable costs that contribute to a sell of your product. Let’s say you sell shoes. Your variable costs could include the following:

- Shoe cost – $45

- Warehousing cost – $3

- Shipping cost – $2

- Customer acquisition cost – $10

- Total variable costs – $60

Let’s say the sale price is $100, which means you have a profit of $40/sale and a contribution margin of 40%. This should remain somewhat constant no matter how many sales you have.

Contribution Margin = Sale Price – Variable Costs

In times of survival, it’s important to maintain your contribution margin and hold steady or lower fixed costs. Fixed costs are usually easier to adjust and reduce.

Break-even point

After understanding variable and fixed costs, a company should calculate and know their break-even point. This calculation will tell you how many products you need to sell in order to cover your fixed costs:

Break-even Point (# of units needed to sell) = Fixed Costs / Contribution Margin

Let’s say your break-even point is 50 units. If you are selling less than this number, you’ll need to reduce fixed costs or increase the number of units sold. Adjusting contribution margins is more difficult but can be done over time.

Tier and adjust costs with sales ratios

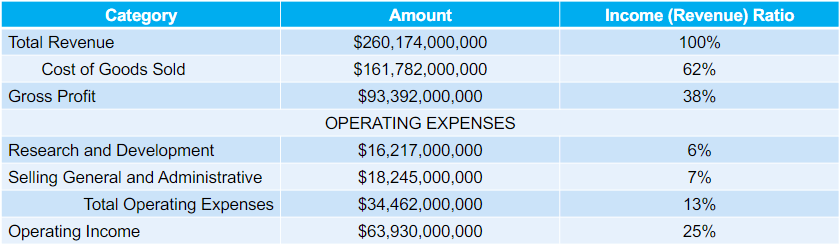

Another way to analyze and look at cost optimization is through income or revenue ratios. Using ratios helps you cut through the noise and not get hung-up on numbers. This method looks at every expense category as a percentage of income. Here’s an example from Apple’s 2019 fiscal year:

Key ratios to track or COGS and gross profit. Then your operating ratio and net income ratio (not shown in the example above).

Key ratios to track or COGS and gross profit. Then your operating ratio and net income ratio (not shown in the example above).

It’s important to categorize and organize expenses in a way that is easy to look at these ratios and create accountability. At LedgerGurus, we divide our expenses into categories, and in addition, functions or departments.

What is a good ratio for each expense category? It depend on the following:

- Industry – every industry has its own standards

- Company size – ratios differ between small, medium, and large companies

- Stage – good ratios differ when you are in growth, maintenance, or survival phases

When setting your ratio goals, we suggest looking at the following:

- Historical performance

- Industry best practices

- Company’s targets

Protect/scale critical operating costs

When looking at cost optimization, looking at your mission-critical costs is important. Basically, what costs do you need to keep your business running? You need to protect sales and other critical costs:

- People – key roles and high performers

- Tools – gsuite/office 365, truck for a plumber.

- Facilities – office, warehouse

Remember to think outside the box. Explore alternatives:

- People – pay cuts versus layoffs. Hiring an assistant versus adding a role (empower a high performer)

- Tools – equivalent alternatives, annual versus monthly subscriptions, used versus new

- Facilities – rent vs. own, sub-leasing

Prioritize non-critical costs

Once you have identified critical costs, you should have a list of non-critical costs. Then you can prioritize these costs. For example, ranking all your software. If you have identified a ratio goal for software, then you can reduce, eliminate, or downgrade the software at the bottom of the prioritization ranking, until you hit your ratio goal.

Your ratio goals can then turn into your budget (the nasty b-word). Remember that every highly successful company operates against a budget. Small businesses don’t like to budget. Instead, they budget off bank balances, which can turn bad real fast.

Next steps

To bring it all together, you should approach cost optimization in the following way:

Budget (with ratios) -> control -> measure -> adjust

We do this at LedgerGurus. It takes time to get into this cadence. But you will find greater success in being a baller (chasing profits). If you need help with this, let us know.