Texas franchise tax sounds like it has to do with running a franchise, like McDonalds or Little Caesar’s, when in reality it means something completely different.

It’s the way that some states structure their business tax laws.

So, what is franchise tax? What’s the difference between franchise tax and sales tax? Who has to pay it? How do you file? And how much do you have to pay?

In this post, we’ll explore answers to all these questions and show you exactly what you need to do, as well as how to get help if you need it.

We’ll cover:

- What is Texas franchise tax?

- What is the difference between franchise tax and sales tax?

- Who pays Texas franchise tax and who doesn’t?

- How to calculate your Texas franchise tax

- How to file your annual franchise tax report

- How to get help with your sales and franchise tax

Key Takeaways

-

Franchise tax is a tax on your gross revenue, not your profit, and it applies to anyone doing business or meeting economic thresholds in Texas.

-

Sales tax and franchise tax are totally different, one is paid by customers and the other by your business for the privilege of operating in Texas.

-

If your revenue is over $2.47M, you must file, even if you don’t owe tax, and the form you use depends on how much your business earns.

-

Marketplace sellers aren’t off the hook, because marketplace facilitator laws cover sales tax, not franchise tax. You still have to file if you meet the threshold.

What is Texas Franchise Tax?

What is Texas Franchise Tax?

The Texas Comptroller [TX state tax department] says, “The Texas franchise tax is a privilege tax imposed on each taxable entity formed or organized in Texas or doing business in Texas.”

So, what does that mean in plain English?

Imagine you have a lemonade stand in Texas.

The state says, “Hey, if you want to set up your stand here, you need to share a small piece of your lemonade earnings with us.” That piece is called the Texas franchise tax.

What is the Difference Between Franchise Tax and Sales Tax?

It’s important to note that franchise tax is NOT the same as sales tax.

- Sales tax is paid by the end consumer.

- Franchise tax is paid by businesses.

In fact, franchise tax is similar to a corporate income tax, though it is not a tax on your profit (like an income tax); it’s a tax on your top line sales.

Let’s break this down with our lemonade stand example again.

Franchise Tax: Think of franchise tax as a tax for doing business in Texas. Texas says, “Thanks for setting up shop here! Please pay this tax to keep running your lemonade stand in our backyard.”

Sales Tax: Now, let’s say every time someone buys a cup of lemonade from you, you add a little extra charge on top of the price. This extra bit is the sales tax. It’s not really part of the lemonade price; it’s something extra that goes to the state or city.

So, in a nutshell:

- Franchise tax is a tax on your gross sales for the privilege of doing business in Texas.

- Sales tax is a tax that is added to the purchase price and is collected on behalf of the state from your customers.

Who Pays Texas Franchise Tax?

Before we get into the meat of this article, we need to talk about a really important concept that impacts everything else. That is nexus.

To have nexus means that you have a strong enough economic connection with a state that you become liable to pay taxes there.

Because this concept is so important to understand, we’ve made a lot of content about it. Check out this blog to learn more: Complete Guide to Sales Tax Nexus for eCommerce Sellers.

You can also download our “10 Steps of Sales Tax” guide. It contains the 10 steps you need to follow to be sure you’re doing your sales tax right, from determining nexus to remitting sales tax and tracking it properly in your books.

There is also a state-by-state list of economic thresholds in the appendix at the end.

Now, back to who pays Texas franchise tax.

The short answer is that everyone who has nexus in Texas has to file & pay Texas franchise tax, and this includes marketplace sellers.

The longer answer is that all businesses that conduct business in TX or have passed the economic nexus threshold ($500K) have to file if they meet certain revenue requirements.

Understanding the 3 Thresholds for Who Pays

The next thing to know is that not everyone will file franchise tax in the same way. There are different thresholds that determine what you’ll pay or what form you’ll file.

Threshold 1 (no longer used) – Up until January 1, 2024, if your sales in the entire country were less than a certain amount, you filed the No Tax Due Information Report. However, that is no longer necessary.

For reports due after 1/1/24, if your annualized total revenue as listed on your federal tax return is less than or equal to $2.47M, you do NOT have to file the No Tax Due Information Report or pay Texas franchise tax.

However, you do need to file Form 05-102, Public Information Report or Form 05-167, Ownership Information Report.

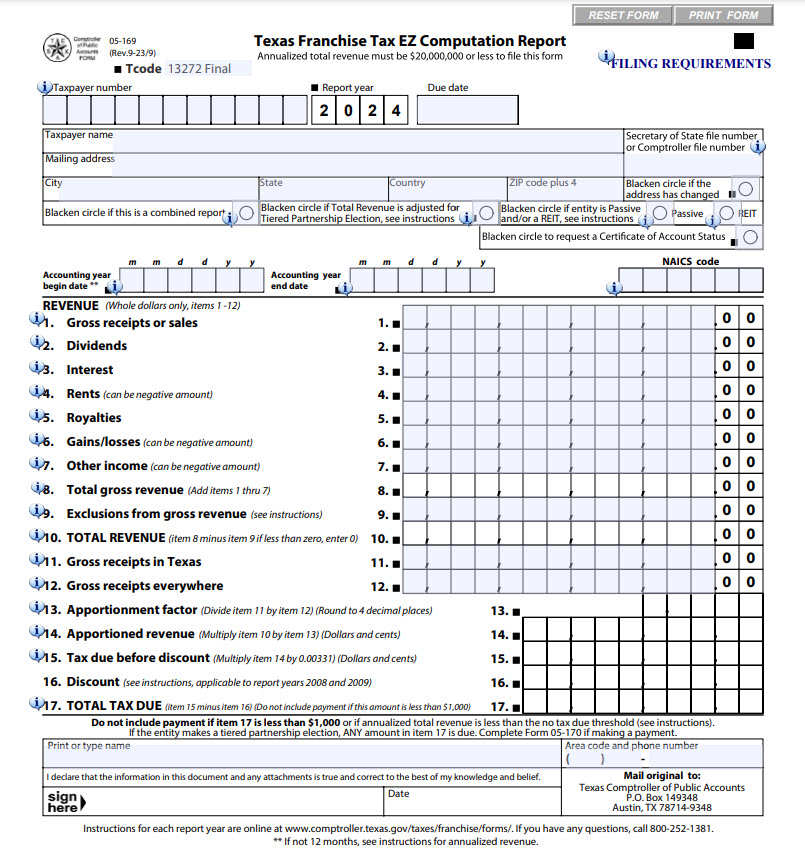

Threshold 2 – If your annualized total revenue is between $2.47-$20M, you’ll file the EZ Computation Report.

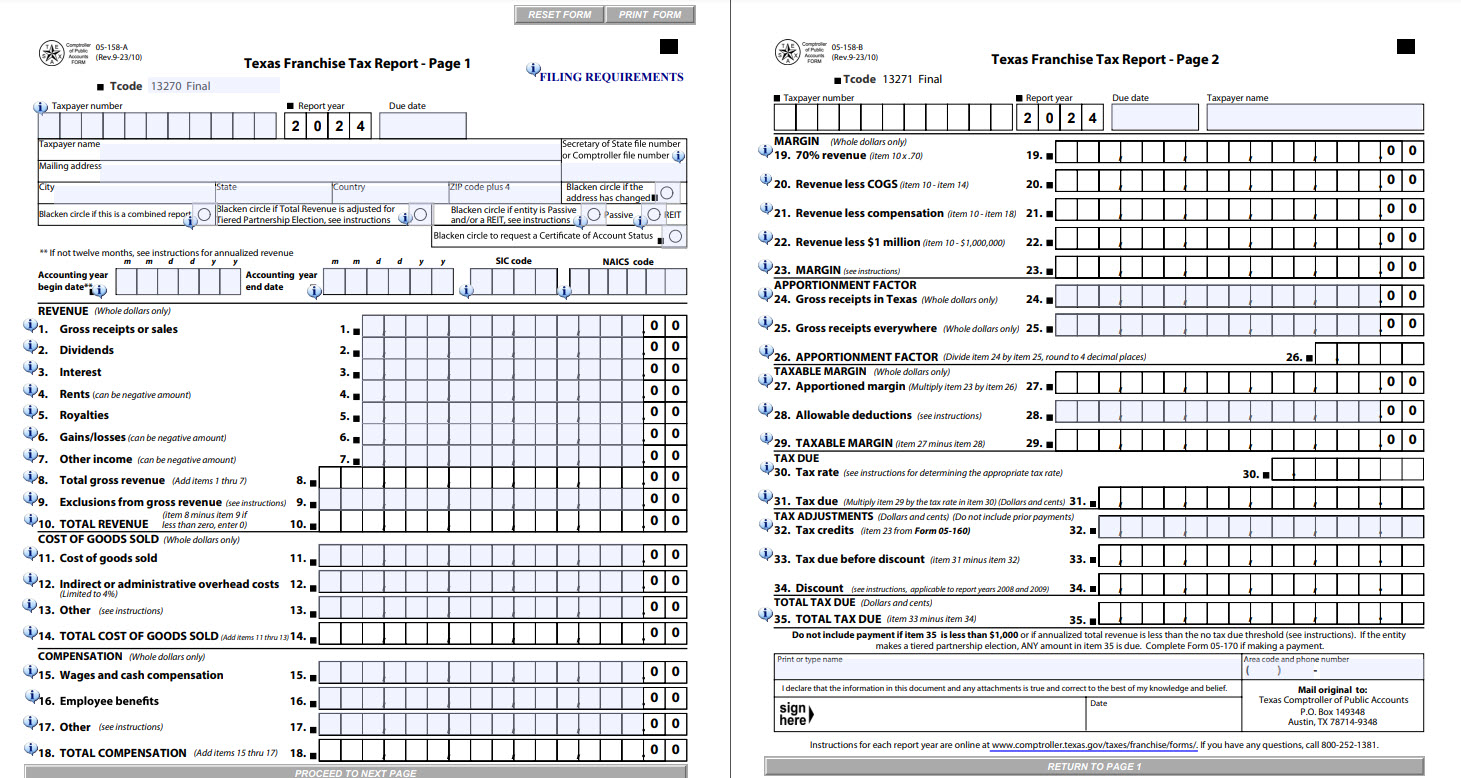

Threshold 3 – If your annualized total revenue is over $20M, you’ll file the Long Form Report.

The main difference between the EZ Form & Long Form are the different deductions you can take.

How Texas Franchise Tax Applies to eCommerce Sellers

One thing that is important to point out here is how Texas franchise tax applies to ecommerce sellers, whether selling on marketplaces or not.

Because of marketplace facilitator laws, sellers on marketplaces are no longer responsible for collecting and remitting sales tax in states that have marketplace facilitator laws in place.

Note: all states with economic threshold laws also have marketplace facilitator laws at this time. For more detail about which states have economic nexus thresholds laws, click here.

However, that does NOT include franchise tax. No matter what channels you sell on, if you fall within thresholds 2 or 3, you are responsible to file and pay Texas franchise tax.

How to Calculate Your Texas Franchise Tax

The Texas franchise tax is a bit like a math puzzle. There are a few ways to solve this puzzle, but we’ll talk about the most common way.

Step 1: Find your total revenue

First, you figure out how much money your business made from sales.

Step 2: Subtract your costs (deductions)

Texas knows you have to spend money to make money, so you can subtract some of these costs.

Step 3: Choose your margin

After subtracting your costs, you get something called your margin. You can choose from a few different paths (or formulas) to figure out this margin in the way that is best for you.

Step 4: Multiply by the tax rate

Once you have your margin, Texas asks you to take a small percentage of that (0.375% is the franchise tax rate for most businesses), and pay that.

Texas Franchise Tax Due Dates

The due date is usually May 15th for the filing & payment deadline and November 15th for the extension deadline. If the 15th falls on a weekend, the due date is the next business day.

If you need to file an extension, this is the link.

Remember, the extension is an extension to file, NOT an extension to pay. You still have to pay by the original deadline.

For more information, go to the Texas Comptroller webfile website.

Click here for extension forms.

How to File Your Annual Franchise Tax Report in Texas

Filing Texas franchise tax isn’t difficult, but it is a bit of a process, so we’ll walk you through it.

Getting a Texas Franchise Tax Account Set Up

First, go to www.comptroller.texas.gov.

When you register for a sales tax account, the state automatically creates a franchise account. You don’t need to apply for both.

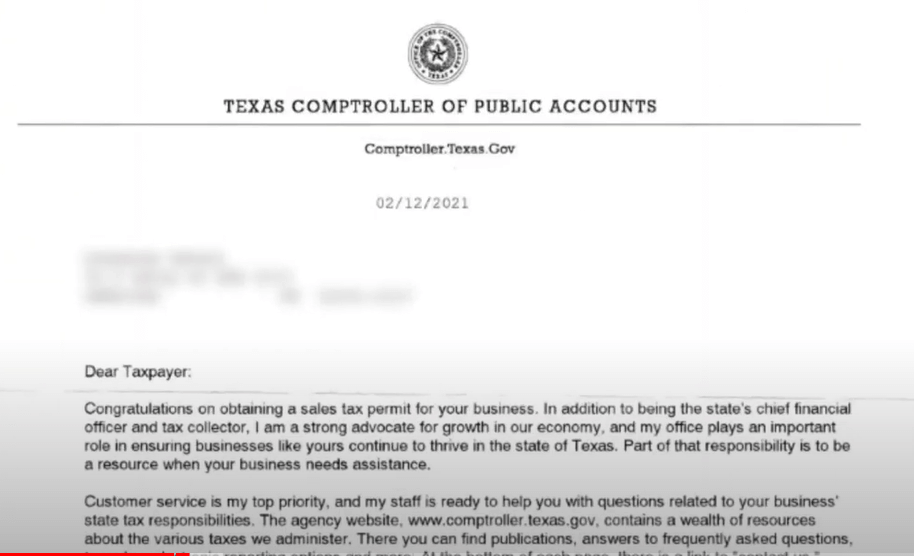

You should have received your webfile number in a letter when you registered for your sales tax permit. (It takes 2-3 weeks after registering to receive the letter.)

The letter looks like this:

At the bottom of the letter, it’ll have your sales tax webfile number.

You can extrapolate your franchise tax webfile number from your sales tax webfile number. You do that by changing the last digit of your sales tax number to one more and changing the R to an X.

Ex: Sales tax webfile number: RT590914 -> Franchise tax webfile number: XT590915

How to Fill Out the EZ Computation Report

We go into detail for this process in our video called How to File TX Franchise Tax | Complete DIY Walk-Through, including screenshares, so you can see exactly what this all looks like.

You can fill this form out electronically, but we’ll show you the downloadable PDF so we can walk you through the parts.

The top part is pretty self-explanatory. You’ll need:

- Your taxpayer number

- Contact information

- Your accounting year begin and end dates

- NAICS code (usually 454110 for online sellers)

For the revenue section, it’s a good idea to click the info icon on each line to make sure you know what to put there.

Lines 1-7 need to match your federal income tax return exactly. This is why you really can’t file your Texas franchise tax report until you’ve filed your federal income tax return and why the deadline is a month after the income tax deadline.

See how it should match up with forms based on your entity:

- Corporation – must match Form 1120, line 1C.

- S-Corp – must match Form 1120S, line 1C.

- For an LLC taxed as a sole proprietorship, it must match (Form 1040) Schedule C, line 3.

- Partnership – must match Form 1065, line 1C.

What each line is:

- 8 – Add up lines 1-7.

- 9 – This is your bad debt expense.

- 10 – Line 8 minus line 9. This is why you don’t want to just multiply your gross receipts in Texas by the Texas franchise tax rate.

- 11 – Pull the gross receipts for Texas from your sales channel.

- 12 – Definitely check the info icon for more info on this one if you’re confused.

- 13 – Divide line 11 by line 12.

- 14 – Multiply line 10 by line 13.

- 15-17 – Just do the math and then sign at the bottom.

How to Fill Out the Long Form Report

Everything is pretty much the same as the EZ Form, but it’s on two pages and you go into a bit more detail. Lines 10 – 23 allow you to take more deductions.

Then you’ll use those numbers to get your apportionment factors and the taxable margin. Finally, you’ll calculate the total tax due in Texas.

Again, if you get confused, make sure to click on the info icon at the beginning of each line.

How LedgerGurus Services Can Help

Bear in mind that state franchise tax requirements can and do change periodically. This is why working with a professional is helpful.

If you’re ready to turn dealing with sales tax and franchise tax over to the someone else, consider letting LedgerGurus take care of it. We have an entire team that specializes in managing and filing sales tax and franchise tax for our ecommerce clients.

So, why choose us?

- Easy Tax Handling: Think of us as your guide through the confusing world of sales and franchise taxes. We’ll help you avoid mistakes and make sure you’re not paying more than you need to.

- Save Money: With our help, you won’t waste money on unnecessary taxes or penalties for missing deadlines.

- Focus on Your Business: Leave the sales tax worries to us, so you can concentrate on growing your business and keeping your customers happy.

Ready to Get Started? If taxes are giving you a headache, it’s time to bring in some help. We’re here to make the whole tax thing a lot easier, especially if you’re dealing with sales tax and Texas franchise tax.

Get in touch with us, and let’s chat about how we can help your business with taxes. Whether you’re selling products or services online, we’re here to make sure that taxes are one less thing for you to worry about.