Let’s talk about candy. We all know what candy is when we see it. It’s hard to debate whether something is candy or not when you walk down the grocery store’s aisle.

But it’s a completely different story to define candy when it comes to sales tax.

Why?

Because, depending on what kind of candy it is, it can be taxed at full rate, reduced rate or not taxed at all!

Why Are Certain Items Taxed Differently?

Let’s take a step back and talk about tax policies and why there are tax exemptions on certain items.

Tax policies are used to encourage or discourage behaviors, for example, sin tax for cigarettes and alcohol. Another unpopular sin tax is tax on sugar, and that’s why soda and candy are often taxable.

But another key function of tax policy is to create social equality. Thus comes a reduced tax rate or 0% tax rate for food. Food, especially raw food, is essential and necessary for human life. Therefore, a good number of states decided not to impose tax on such a commodity. Like prescribed medication, we simply can’t live without them.

So, food is tax free in certain states.

Is Candy Taxable?

As mentioned above, candy is usually taxable because policy makers want to discourage the consumption of sugar. But here’s the interesting part. A lot of states explicitly say candy is not food, therefore subject to tax, but if the candy has flour as an ingredient, then it’s not candy anymore.

Mind blowing, right?!?

Here’s an example:

Minnesota specifically tax exempts food and food ingredients. Food and food ingredients are defined as “substances, whether in liquid, concentrated, solid, frozen, dried, or dehydrated form, that are sold for ingestion or chewing by humans and are consumed for their taste or nutritional value.” Candy is excluded from Minnesota’s exemption for food and food ingredients and is subject to tax.

However, preparations containing flour are specifically excluded from Minnesota’s definition of candy. A Minnesota regulation notes that preparations containing flour include white, whole wheat, rice, corn, or brown flour, as long as the label lists “flour” as one of the ingredients. Candy with flour is therefore considered to be “food and food ingredients” by Minnesota and is exempt from tax.

So, if you buy a Twix bar in Minnesota, you don’t pay sales tax, versus if you buy a Snickers bar, you have to pay sales tax.

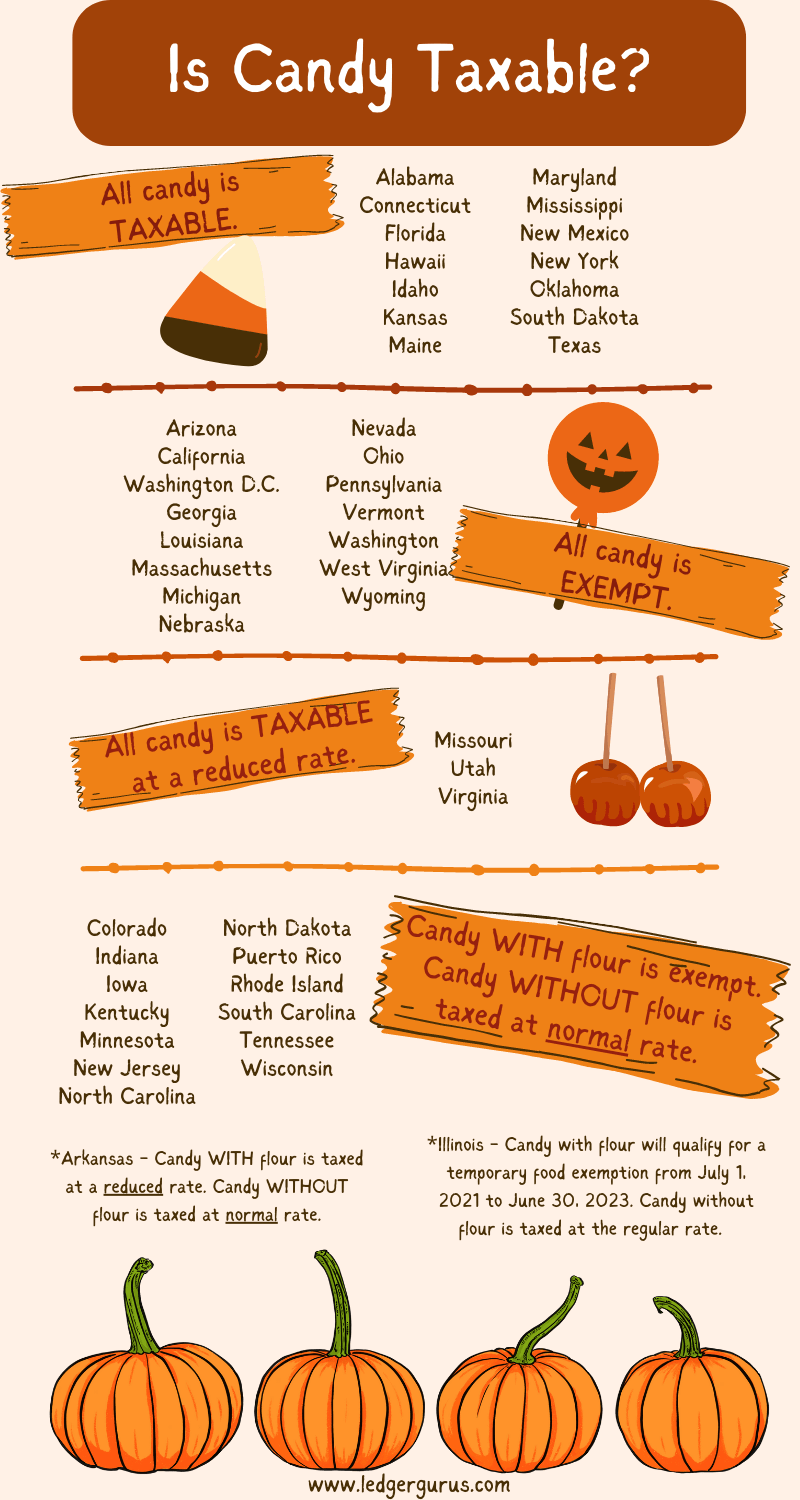

And Minnesota is not alone. Here’s a list of all the states’ treatment of candy in case next time you are at the grocery store you want to be more informed of exactly what items you are paying sales tax for.

Observations on Candy’s Taxability

We have two more interesting observations about candy’s taxability.

First, taxability is not the same for all the Streamlined Sales Tax states. The 24 SST states may agree on the definition of candy versus food, but they made their own decision on how to tax candy and food.

Second, if the candy is in spray, squeeze and/or powdered form, they are almost always exempt because taxable candy items must be in the form of bars, drops or pieces. If this doesn’t confuse you even more, I don’t know what will!

Do You Need Help with Sales Tax?

Figuring out the taxability of your products is a key step in becoming sales tax compliant and we are here to help.

Option 1: If you have questions and would like to meet with one of our sales tax experts, schedule a sales tax consultation.

Option 2: If you’d like to learn to become a sales tax hero, check out our sales tax courses.

Option 3: If you’re ready to turn your sales tax over to the experts and are interested in our sales tax services, be sure to contact us.