If you’re an ecommerce seller with overdue sales tax in Massachusetts, now’s your chance to get back on track without having to pay penalties, potentially saving you a lot of money.

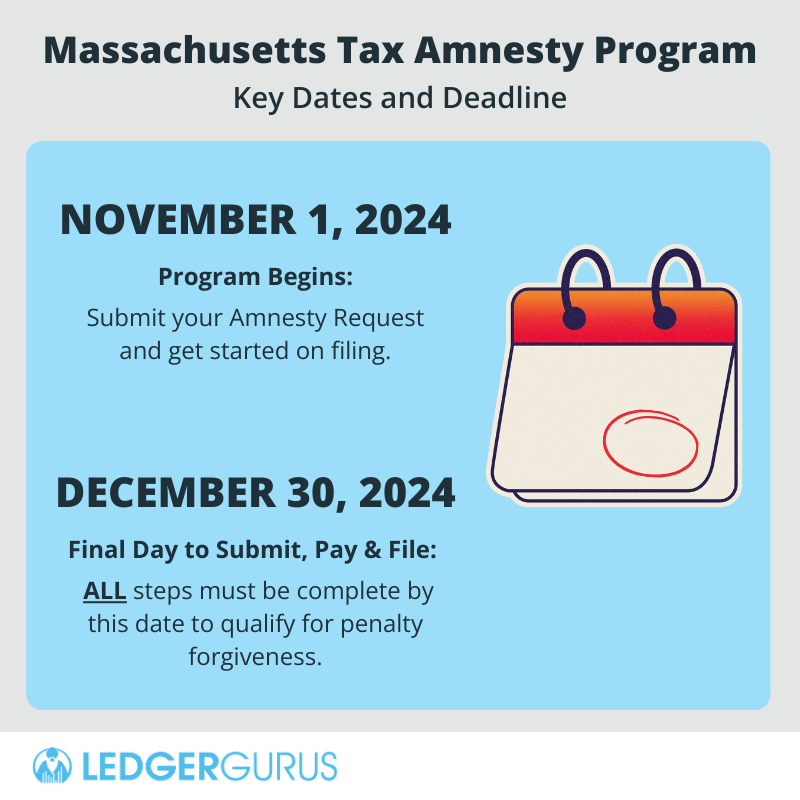

The Massachusetts Tax Amnesty Program, starts November 1st and runs through December 30th, 2024, and is a limited-time offer for businesses to clear up their tax issues.

If you’re reading this article, you’re probably already aware that getting caught up on sales tax is critical, and maybe you’ve even been looking for the right way to handle it.

This amnesty program makes the process easier and more affordable, so if there’s ever been a perfect time to sort out those taxes, it’s now.

Note: While this program is open to eligible taxpayers such as individuals, businesses, estates, and trusts, this article is specifically geared towards ecommerce sellers.

Here’s what this article covers:

- What the Massachusetts Tax Amnesty Program is

- Key benefits for ecommerce sellers

- Who is eligible

- Who is ineligible

- How to apply for the program

- Frequently asked questions

- How LedgerGurus can help you through this process

Let’s get into it.

Key Takeaways

- Limited-time opportunity to clear penalties

The Massachusetts Tax Amnesty Program offers a rare chance for ecommerce businesses to clear overdue sales tax penalties, but only if you act by December 30, 2024. - Eligibility and benefits you don’t want to miss

Eligible businesses—including those currently under audit—can take advantage of penalty waivers, making it easier and more affordable to get compliant and secure a fresh start. - Professional help can make the process easier

Handling the requirements, deadlines, and calculations on your own can be overwhelming. With professional support, you can save time, avoid errors, and stay focused on growing your business during the busy holiday season.

What is the Massachusetts Tax Amnesty Program?

The Massachusetts Tax Amnesty Program is a limited-time opportunity for businesses with overdue sales tax to catch up without the sting of penalties.

Running from November 1 to December 30, 2024, this program allows overdue taxpayers to pay back their owed sales tax and interest while waiving most or all of the penalties.

This kind of offer doesn’t come around often (the last time was 8 years ago), so it’s a big deal!

Massachusetts is essentially giving businesses a clean slate to settle outstanding sales tax obligations without the usual extra costs.

If you’ve been holding off on handling those overdue taxes, now is the perfect time to take advantage of this rare break.

“This is a great chance for businesses with sales tax exposure in Massachusetts to become compliant. I recommend taking advantage of the opportunity Massachusetts is providing,” said Amanda Lawrence, Accounting Supervisor in Sales Tax at LedgerGurus.

Key Benefits for eCommerce Sellers

1. Penalty forgiveness

One of the biggest perks of the Massachusetts Tax Amnesty Program is the chance to avoid or significantly reduce penalties on overdue sales tax.

For many businesses, penalties add up quickly and can make paying back taxes an even heavier burden.

By waiving these extra costs, the program helps ease that financial pressure, making it much more manageable to settle what you owe.

2. Resolution of unfiled returns and under-reported sales tax

If you’ve missed filing a few returns or under-reported your sales tax, this is your chance to catch up.

The program is a straightforward path to get compliant and take care of any unfiled or under-reported sales tax quickly and effectively.

3. A limited look-back period

There is a limited look-back period of 3 years that applies to non-filers who haven’t been previously contacted by the Massachusetts Department of Revenue (DOR).

This means that if you qualify (see the list of who is eligible below), you will only be required to file returns and pay sales tax and interest from returns due from January 1, 2022 through December 30, 2024.

4. A fresh start

Taking advantage of this amnesty program isn’t just about handling back taxes now—it’s also about setting yourself up for a smoother future.

By getting compliant now, you’ll reduce your risk of facing future audits and penalties, giving you peace of mind and more freedom to focus on growing your business.

In short, this amnesty is a solid investment in your business’s financial health.

Who is Eligible for the Tax Amnesty Program?

The Massachusetts Tax Amnesty Program is open to businesses with overdue sales tax issues who are ready to get things back on track.

Qualified sellers include:

- Ecommerce sellers with unfiled returns, under-reported sales tax, or existing tax liabilities

If you’re an ecommerce business that hasn’t filed sales tax returns, reported less sales tax than you should have, or has unpaid tax liabilities hanging over your head, this program is designed for you. - Sellers who have already registered or been contacted previously by the Massachusetts Department of Revenue (DOR)

This amnesty is available for businesses that the DOR has already reached out to about their sales tax obligations. This is a big deal because, usually, Voluntary Disclosure Agreements and other opportunities like this are off the table once you’ve registered or been contacted by the state. - Sellers currently under audit

Businesses undergoing an audit for recent tax periods are also eligible, allowing you to settle these obligations under the amnesty program’s favorable terms.

Who is Ineligible for the Massachusetts Tax Amnesty Program?

While the Massachusetts Tax Amnesty Program is an excellent opportunity for many, not everyone is eligible to participate. Here’s a list of who doesn’t qualify:

- Sellers who received prior amnesty relief in 2015 or 2016 for the same tax type and period

There is a 10-year moratorium in place, so if you took part in a similar amnesty program in 2015 or 2016 for the same tax issues, you won’t be able to participate this time around. - Sellers seeking a waiver of penalties for already paid assessments

If you’ve already paid your sales tax assessments but now want to get those penalties refunded or waived, this amnesty program doesn’t apply to you. - Sellers requesting a refund or credit for overpayments

This program is strictly for clearing unpaid tax obligations, not for those seeking refunds or credits on overpaid taxes. - Sellers under tax-related criminal investigation or prosecution

Those involved in a criminal tax investigation or prosecution are not eligible for amnesty. - Sellers in active bankruptcy

Businesses or individuals currently in bankruptcy proceedings are excluded from this program. - Sellers with false or fraudulent filings

If any prior returns, statements, or amnesty claims have been determined to be false or fraudulent, eligibility is lost for this amnesty opportunity.

If your situation falls outside these restrictions, this amnesty program could be your chance to resolve overdue sales tax issues and move forward with a clean slate.

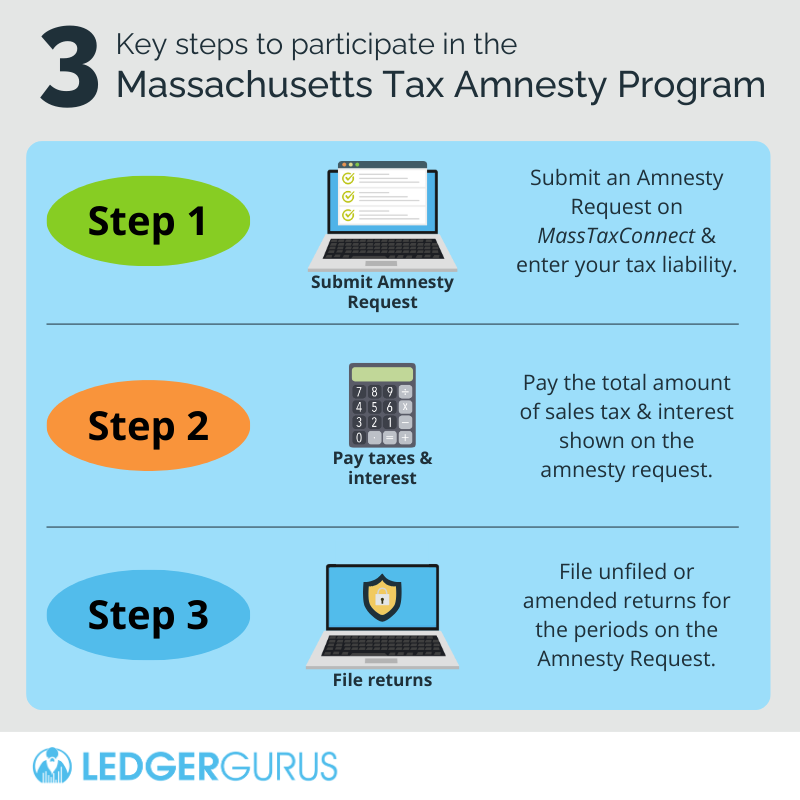

How to Participate in the Massachusetts Tax Amnesty Program

Getting started with the Massachusetts Tax Amnesty Program is straightforward.

Here’s a step-by-step guide to help you make the most of this opportunity:

Step 1: Request amnesty and enter your tax liability

To begin, you’ll need to submit an amnesty request on MassTaxConnect, the DOR’s online portal. The request will be slightly different, depending on your situation.

Also, while you can only submit one amnesty request per account type, it can be for multiple periods.

If you have an existing tax liability, you’ll receive an Amnesty Eligibility Letter from the Massachusetts Department of Revenue (DOR), which includes instructions and a unique Amnesty Letter ID for your application. The ID will verify your amnesty request, as well as your tax liability.

If you underreported your tax liability, you’ll need to submit an amnesty request for the amount that you underreported. Make sure you indicate that it is for an Amended Return. Enter the amount of your tax liability based on the amended return calculation.

If you are a non-filer or a first-time filer, submit the request and indicate that it is for a New Tax Liability. Enter the amount of your tax liability based on the return calculation.

Note: If you have not previously been contacted by the DOR, you may be eligible for a 3-year, limited look-back period. This means that you’ll only be responsible for the last 3 years of sales tax, i.e. looking back 3 years.

If you are already under audit, contact your assigned auditor at the DOR to discuss amnesty. You’ll need to submit a request for either an Amended Return or a New Tax Liability and enter the amount based on the audit calculation.

Step 2: Pay the total amount of tax and interest shown on the amnesty request

To ensure that your penalties are waived, you must pay your outstanding sales tax and interest IN FULL by December 30, 2024.

Full payment ensures your application is complete and qualifies you for the amnesty benefits.

Step 3: File outstanding returns

Finally, make sure any unfiled or amended returns for past-due periods are completed and filed.

Submit your returns either electronically through MassTaxConnect or by mailing them to the DOR. Filing these returns is ESSENTIAL to qualify for the penalty waivers under the amnesty program.

NOTE: Make absolutely sure that you have complete all three steps by December 30, 2024 to qualify for the waived penalties.

Keep in mind that missing the deadline or paying less than the full amount will forfeit your eligibility for penalty forgiveness.

FAQs for eCommerce Sellers

What filing periods does the program cover?

The Massachusetts Tax Amnesty Program covers all filing periods with returns due on or before December 31, 2024.

There’s no limit on how far back you can go to report or pay back taxes.

What penalties will be waived?

The DOR will waive most penalties on back taxes owed by qualifying businesses.

Back taxes and interest will NOT be waived.

Who qualifies for the limited look-back period?

The 3-year, limited look-back period applies to non-filers who haven’t been previously contacted by the DOR.

This means that if you qualify, you will only be required to file returns and pay sales tax and interest from returns due from January 1, 2022 through December 20, 2024.

Can amnesty still help me if I’ve been contacted by the DOR previously?

Yes! Even if you don’t qualify for the limited look-back period, you are still eligible for a penalty waiver on all tax periods under review if you file the required returns and pay the sales tax and interest due by December 30, 2024.

Can I apply for the program if I’m already under audit?

Yes! Contact your assigned auditor to discuss amnesty and sales tax and interest amounts due. Make sure you’ve done all the necessary steps, including paying in full by December 30, 2024.

Penalties will be waived for any tax periods listed in the failure-to-file notice or audit if you pay the sales tax and interest with an amnesty return during the amnesty period.

What happens if I miss the deadline?

You will miss out on this opportunity.

Also, if you haven’t completed each of the steps by the deadline – submit, pay, and file – you will still be responsible for all of the penalties, as well as the back taxes and interest.

How LedgerGurus Can Help You Through This Process

Navigating the Massachusetts Tax Amnesty Program can feel overwhelming, especially with deadlines, paperwork, and calculating what you owe.

And all of this during the holidays, the busiest season of the year for ecommerce.

That’s where we come in!

Our team of professionals can handle the entire process for you—submitting your Amnesty Request, calculating your tax and interest owed, and submitting all necessary paperwork to the state. We can also get you registered, so you’re all set up for moving forward, too.

Getting professional help ensures accuracy, saves you time, and reduces the risk of costly errors. Let us take the stress off your plate so you can focus on running your business while we handle the details.

Reach out today to get started—don’t let this valuable opportunity slip by!