Meals and entertainment deductions are one of those gray areas that can leave business owners scratching their heads. What’s fully deductible, what’s partially deductible, and what’s off the table completely? It all depends on the purpose of the expense and who benefits from it.

The IRS has clarified some of the rules in recent years, including changes from the Tax Cuts and Jobs Act (TCJA) and temporary adjustments during the pandemic. These updates might mean you need to rethink how you handle business meals and entertainment to ensure you’re staying compliant and maximizing your deductions.

The IRS has clarified some of the rules in recent years, including changes from the Tax Cuts and Jobs Act (TCJA) and temporary adjustments during the pandemic. These updates might mean you need to rethink how you handle business meals and entertainment to ensure you’re staying compliant and maximizing your deductions.

In this blog, we’ll break down what’s deductible, what’s not, and how to navigate the current tax rules.

- 2025 Meals and entertainment deductions

- What is considered a tax-deductible expense?

- What expenses are NOT deductible?

- What entertainment expenses ARE deductible?

- Criteria for meals and entertainment deductions

- How LedgerGurus can help

Let’s get started.

Key Takeaways

Key Takeaways

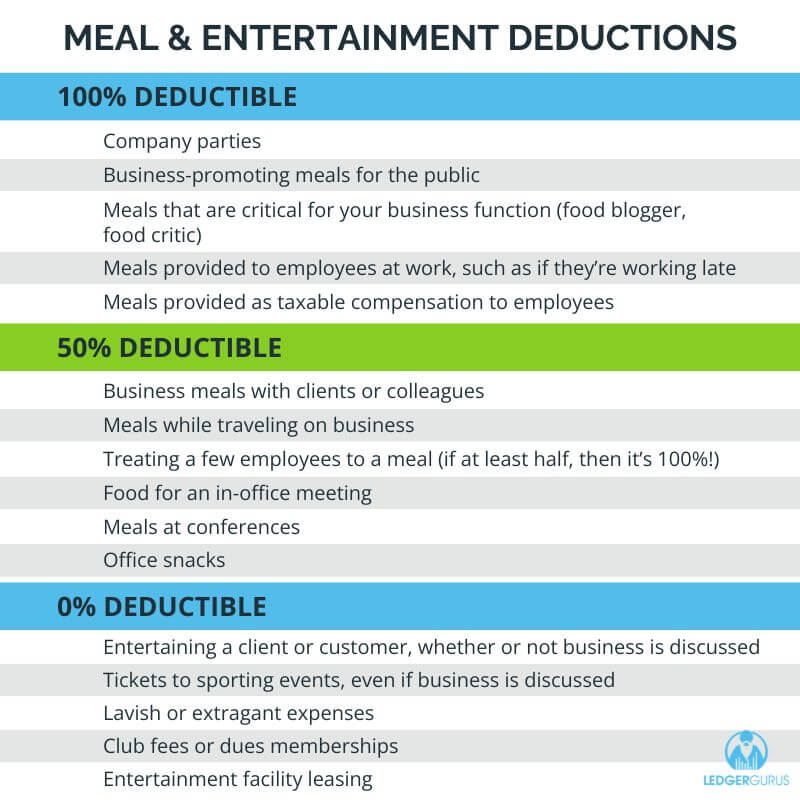

- 100% Deductible Expenses: Includes holiday parties, open house meals, and certain business-critical meals.

- 50% Deductible Expenses: Includes client meals, business travel meals, and food for in-office meetings.

- Non-Deductible Expenses: Includes entertainment (e.g., sporting events) and club memberships.

- Rules to Remember: Meals must be ordinary, necessary, and properly documented, with the business purpose and attendees clearly noted.

- Pro Tip: Food expenses at an event can still be deductible if billed separately from the entertainment costs.

2025 Meals and Entertainment Deductions

Deductions all comes down to what is the purpose of the meal/event and who is benefitting from it.

In the past, it was commonplace to use wining, dining AND entertaining as a way to woo clients. This was a great deal because you could write-off the box seats or the golf game, etc.

But recently, the IRS clarified a few things on the Tax Cuts and Jobs Act (TCJA) of 2018 regarding meals and entertainment deductions. One of the biggest changes is that deductions are no longer allowed for entertainment expenses, except for certain employee events.

In 2021, Congress passed a temporary tax incentive called the “Consolidated Appropriations Act” or CAA. As part of that, the 50% deduction for business meals was increased to 100% through the end of 2022. But the deduction was temporary, intended to boost the restaurant industry during COVID, and the rules have gone back to a 50% deduction for most business meals.

What is Considered a Tax-Deductible Expense?

There is still plenty of room for fun with deductions. You just have to be careful about what you’re doing so you can take them. Here’s a quick overview:

100% Deductible

Here are some examples of 100% deductible meals and entertainment expenses:

- The company holiday party or summer picnic (You can still have tax-deductible fun with your employees!)

- Business-promoting meals provided to the public, such as an open house.

- Meals provided as taxable compensation to employees (included on a W-2)

- Business meals that a critical part of your business function (ex. if you’re a food critic or food blogger)

- Meals provided to an employee at work, such as if they’re working late

- Meals provided as taxable compensation to employees or independent contractors, and included on the W2

- Meals sold to a client or a customer

50% Deductible

Here are some examples of 50% deductible meals and entertainment expenses:

- Business meals with clients or colleagues

- Meals while traveling on business

- Treating a few employees to a meal (Note – if it’s at least half of all employees, it’s 100% deductible!)

- Food for an in-office meeting

- Meals at conferences

- Office snacks

What Expenses are NOT Deductible?

- Entertaining a client or customer, whether or not business is discussed

- Tickets to sporting events, even if business is discussed

- Lavish or extravagant expenses

- Club fees or membership dues

- Entertainment facility leasing

This may change a few things about how you do business. Instead of doing business in a box at an NBA game, you may be better off to wine and dine your clients and customers because it’ll be 50% deductible instead of 0% deductible. OR the food at the entertainment can be deductible IF it is billed separately from the entertainment itself.

Make sure that you are reviewing meals and entertainment expenses to be sure you are properly applying the deductions.

What Entertainment Expenses ARE Deductible?

Some employee entertainment costs can still be deducted:

- Employee holiday party expenses

- Expenses for employee award or incentive trips

- Entertainment that is included in employees’ wages, and are reflected on their W2s (though there are some exceptions for highly compensated employees)

Criteria for Meals and Entertainment Deductions

In order to deduct business meals, you must be self-employed or operating a business. Employees on W2s no longer qualify for business meals deductions.

The meal expense must be ordinary and necessary in carrying on your business, meaning it cannot be lavish or extravagant.

You, as the business owner, or your employee must be present with at least one other party present (ex. a client or colleague). This does not apply while you or your employees are traveling for business or conferences.

What Are the IRS Requirements for Meal Receipts?

You must keep a proper record of the meal:

- The amount (delivery fees, taxes, and tips can be included)

- The time and place of the meal

- The business purpose of the expense, and

- The business relationship between the taxpayer and the individuals being fed.

If you’d like to review the law yourself, you can find it here.

How LedgerGurus Can Help

If you are an ecommerce business owner, you’re aware of how different ecommerce accounting is to regular accounting. LedgerGurus does not do tax preparation, but we ARE an ecommerce-specialized accounting firm. Our team of ecommerce experts can certainly get your financials in order so you’re ready to hand it over to your tax accountant.

Click here to learn more about our services. If you’d like to stay up-to-date with the latest ecommerce news, subscribe to our newsletter (the signup is in the sidebar ->).

If you’d like to stay up-to-date with the latest ecommerce news, subscribe to our newsletter (the signup is in the sidebar ->).

Every week we pull together the most important news for ecommerce and business finance. The goal is to help you stay informed so you can be aware of things as they happen and adjust things in your business as necessary.