If you’re running a 7- to 8-figure ecommerce business, states that are cracking down on sales tax enforcement should definitely be on your radar.

States are becoming increasingly aggressive in pursuing sales tax revenue, especially from ecommerce sellers, as they try to recoup losses from recent years.

Through partnerships with platforms like Amazon, multi-state collaborations, and dedicated audit task forces, states aren’t just getting aggressive anymore. They’re becoming sophisticated and coordinated.

Through partnerships with platforms like Amazon, multi-state collaborations, and dedicated audit task forces, states aren’t just getting aggressive anymore. They’re becoming sophisticated and coordinated.

And remember: it’s not the states’ responsibility to prove you’re in compliance—it’s yours.

But don’t worry!

We can help. Let’s dive into what states are doing and why it matters. We’ll show you how you can keep your business safe and compliant.

We’ll cover:

- The current state of sales tax enforcement

- Key enforcement tactics states are using

- How to protect your ecommerce business

- How LedgerGurus can help you navigate sales tax compliance

Let’s get into it.

Key Takeaways

Key Takeaways

- Sales tax enforcement is getting more aggressive and coordinated. States are leveraging partnerships, data sharing, and audit task forces to track down non-compliant sellers.

- Pre-audit surveys and shared data are major enforcement tools. States are requesting detailed sales data, from both registered and unregistered sellers, and collaborating across borders to identify potential violations.

- Compliance starts with understanding your nexus. Knowing where and when you trigger nexus is critical to staying ahead of audits and avoiding costly penalties.

- LedgerGurus can simplify your sales tax compliance. With services like nexus analysis, VDAs, and full-service sales tax management, we’ll help you navigate the complexity and protect your business.

The Current State of Sales Tax Enforcement

States are really ramping up their efforts to collect sales tax.

With tighter-than-ever budgets, they’re looking to ecommerce sales tax as an opportunity for revenue recovery, putting increasing pressure on online sellers.

Cross-Border Information Sharing

Here’s an example of what’s actually happening: Illinois, one of the most aggressive states about sales tax, is now requesting sales data for several other “great lakes region” states during their audit processes.

They’re not just looking at sales within their borders—they’re seeking information on behalf of their neighboring states.

NOTE: We recommend that you only share sales data for the state that sent the letter, but it COULD trigger the other states to come knocking. This is a good time for you to examine your overall compliance and determine if you need to get registered somewhere or potentially do a VDA.

This means if you’re not compliant in one state, you could be discovered through another state’s audit process.

The implications for multi-state sellers are serious.

For example, Washington and Minnesota, as well as other states, have taken the unprecedented step of sending letters to businesses that aren’t even registered in their states, asking for more information about their sales tax compliance.

States are examining your total U.S. sales data through these shared reports, making it easier than ever to identify sellers who should be collecting and remitting sales tax in their jurisdictions.

The Domino Effect

What makes this particularly challenging for high-revenue sellers is the domino effect.

If one state audits you and finds issues, neighboring states may decide to investigate you, too.

There’s no legal barrier preventing states from sharing your data, and they’re using this to their advantage to cast a wider enforcement net.

Here are some basic things you need to know about information sharing between states:

- States can share your sales information with other states. Streamlined Sales Tax (SST) states share sales info to facilitate tax collection on online purchases, but the specific details and limitations depend on the individual state laws and the agreements in place.

- While states can share sales data, they must generally comply with data privacy laws. Each state has its own laws regarding data sharing, so businesses need to check the rules of each state they operate in.

- States can get information from Amazon, which we cover in more depth later in this post.

Key Methods of State Sales Tax Enforcement

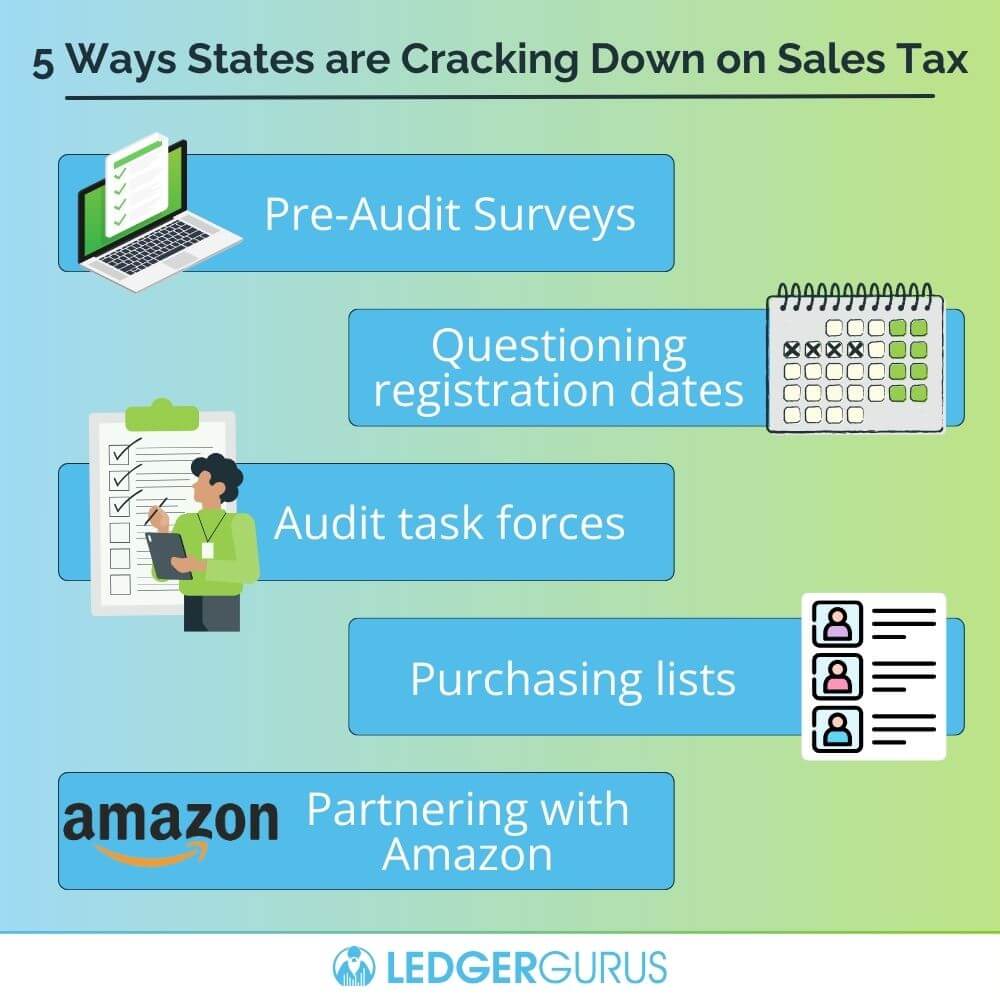

States are getting creative with how they’re enforcing sales tax compliance. Here are 5 methods they’re using:

States are getting creative with how they’re enforcing sales tax compliance. Here are 5 methods they’re using:

- Pre-audit surveys

- Questioning registration dates

- State task forces and resources

- Purchasing lists of online sellers

- Partnering with Amazon

Pre-Audit Surveys

More and more states are sending out pre-audit questionnaires or business activity surveys.

Even if you’re not registered in a state, you might receive one of these surveys requesting up to three years of your sales data. Here’s a list of states that are sending out the most letters lately:

- Arkansas

- Arizona

- Illinois

- Massachusetts

- Maine

- Michigan (Their letters seem to be probing for sales tax AND income tax.)

- New York

- Washington (They’ve been particularly active in sending out these surveys.)

- Wisconsin

What’s the Purpose of These Surveys?

These aren’t innocent information requests—they’re calculated moves.

States usually send them because they already suspect you owe them money. Here’s what they’re after:

- Sales history: Verifying whether your sales crossed their economic nexus thresholds.

- Business activities: Understanding how and where you operate in their jurisdiction.

- Shared data: Potentially using your information to alert other states.

Why Ignoring Them Isn’t an Option

Throwing the survey in the trash isn’t a good idea.

Non-response almost always triggers an automatic audit. By that point, states assume you’re hiding something, which increases the intensity of their investigation.

How to Use These Surveys to Your Advantage

If you haven’t crossed the nexus threshold, these surveys can actually work in your favor:

- Prove your compliance: Providing accurate data shows you’re operating within the rules, which might prevent further action.

- Avoid audits: A well-documented response can stop the audit process before it even starts.

What to Do If You Receive One

- Don’t panic: These surveys aren’t always bad news—they can be an opportunity to clear up any misunderstandings.

- Get your records in order: Gather your sales data and ensure it’s accurate.

- Respond promptly: Ignoring these requests will only escalate the situation.

If you’re on a state’s radar, the best move is to show you’re organized and compliant. It’s much easier (and cheaper) to resolve issues early than to deal with a full-blown audit later.

For more information on these pre-audit surveys and how to handle them, read What Sales Tax Pre-Audit Questionnaires Mean for Your Ecommerce Business [+ How to Respond].

Questioning Registration Dates

One of the more subtle but aggressive tactics states are using to enforce sales tax is questioning registration dates.

States are examining when remote sellers registered for sales tax and comparing it to their sales activity to identify gaps in compliance. Many are specifically examining the period from when the Wayfair act was implemented in their state up to the seller’s registration date.

If there’s a mismatch—such as reaching a state’s economic nexus threshold before registering—states may demand back taxes, interest, and penalties.

Which States Are on the Hunt?

Some states are getting really aggressive with this:

- IL

- AZ

- WA

- UT (They’ve added a question on their registration form that asks for the last 3 years of sales.)

- South Dakota & North Dakota (They’re seriously nitpicking registration dates.)

- Wisconsin (They’re big on finding sellers who waited too long to register.)

- Maine (Small state, but big on catching late registrants.)

Common Mistakes Sellers Make

- Setting future start dates: Be careful with this. If you put in a future effective date, states may dig ask you to prove that your sales didn’t pass their threshold before that date. If you can’t they will expect you to cough up the back taxes.

- Sloppy records: Without good records, it’s hard to prove you stayed under the threshold. Have you considered all of your sales channels? Some states include MPF sales in the nexus threshold, and some do not. Have you considered the number of transactions? The states are moving away from transaction thresholds but they’re not completely eliminated yet. Are you looking at the shipping address and NOT the billing address?

- Missing the fine print: Every state has different thresholds, and it’s easy to get tripped up.

Our 10 Steps to Ensure Sales Tax Doesn’t Burn Down Your Business guide is an important resource here. Not only do we discuss the 10 steps you need to take to stay compliant, but we also keep an updated list of economic thresholds by state at the end.

How to Stay Out of Trouble

- Keep tabs on your sales: Use tools or systems to track your sales and monitor when you hit nexus in different states. We’ve written a comparison article here between several tools that we use with our clients and are familiar with.

- Register right away: It’s ideal to register as soon as you hit a state’s sales threshold, however, not every state requires you to do it with the very next transaction. At the end of our 10 Steps to Ensure Sales Tax Doesn’t Burn Down Your eCommerce Business guide, we have a chart with all the nexus thresholds by state, as well as registration requirements. This is a super valuable chart to have handy!

- Stay organized: Keep detailed records of your sales and registrations so you’re ready if a state asks questions.

- Do your homework: States change their rules all the time, so make sure you’re up to date.

The bottom line? Don’t wait for a state to find you first—it’s way more expensive that way. A little prep now can save you big headaches later.

State Audit Task Forces and Resources

States are forming dedicated audit task forces to zero in on remote sellers. These specialized teams are trained to spot compliance gaps and make sure every dollar of sales tax owed is collected. If you’re selling online, especially in states with large populations, you’re on their radar.

Why the Focus on Populous States?

States like Florida, California, and Texas are leading the charge. Why?

It’s simple math: more people means more sales, which means more potential sales tax revenue.

These states also have the resources to hire larger teams of auditors, giving them the manpower to dig deep into remote sellers’ activities.

What Does This Mean for You?

If your business is selling into these states, expect more scrutiny. These audit task forces don’t just target sellers registered in their states—they’re actively identifying businesses that may not even realize they’ve crossed nexus thresholds.

The takeaway?

If you’re selling into high-population states, make sure you’re compliant before an audit team comes knocking. Proactivity is key to avoiding penalties and back taxes, the yucky consequences of sales tax enforcement.

Purchasing Lists of Online Sellers

Some states, like Utah and Connecticut, are taking a direct approach by buying lists of online sellers from third-party data providers. These lists help them identify businesses that may have economic nexus but aren’t registered or paying sales tax.

Partnering with Amazon

Since Wayfair v South Dakota in June 2018, states have the right to require online sellers to pay sales tax when they have nexus in their states.

One of the ways some states are doing this is by going straight to Amazon. Legally, Amazon must give them their lists of online sellers, and when they started holding inventory in those states.

States check those lists carefully to see which sellers have not been filing sales tax. Then they send those pre-audit questionnaires to those sellers asking for more information.

Like we said before, ignoring these is a bad idea because it’s a red flag that you’re not compliant and almost a guarantee of being audited.

How to Protect Your Ecommerce Business from State Sales Tax Enforcement Pitfalls

Protecting your ecommerce business starts with being proactive about sales tax compliance.

Monitor your sales and activities regularly to know exactly when and where you’ve triggered nexus.

Use tools or work with professionals (like LedgerGurus) to track your sales data across platforms like Amazon, Shopify, and eBay to avoid falling behind on your obligations. Staying informed about ever-changing state laws is equally important—what worked last year may not apply today.

It’s also crucial to maintain detailed, organized records of your sales, registrations, and filings. These records will be your first line of defense if a state questions your compliance.

If you’re unsure about where you stand, consider doing your own audit of your current processes and data or even doing a voluntary disclosure agreement (VDA).

Taking these steps now can save you from costly state audits, back taxes, and penalties down the road—keeping your business focused on growth instead of red tape.

For a really good (and recently updated with all the latest information) checklist of what to pay attention to, download our End of Year Sales Tax Checklist. It covers:

- Recent changes in Shopify tax engine options

- Voluntary disclosure agreements

- Reviewing your nexus footprint

- Checking sales tax rates and the taxability of your products

- Management of use tax

- Exemption certificates

- CO & MN retail delivery fees

- What states require sales tax license renewal and how often

- Recent transaction threshold changes

- Changes in the taxation of digital goods

Don’t be caught by surprise. Download the checklist and make sure you’re covered in each of the areas.

Let LedgerGurus Take the Sales Tax Burden Off Your Shoulders

Sales tax compliance shouldn’t feel like an impossible puzzle, but for many ecommerce businesses, it does. Trying to keep up with all the pieces of sales tax enforcement – nexus rules, registration requirements, and ever-changing state laws can be overwhelming—and mistakes are costly.

That’s where LedgerGurus comes in.

We specialize in helping ecommerce sellers like you tackle the toughest sales tax challenges. Here’s how we can make a difference:

- Nexus analysis: Unsure where you need to register? We can analyze your sales, inventory, and activities to pinpoint exactly where you have obligations.

- Registrations: Whether you need to register in one state or 30, we handle the paperwork and requirements for you. From completing applications to providing state-specific documentation, we ensure your registrations are accurate and timely, saving you from delays and unnecessary headaches.

- Backfilings: Fallen behind on sales tax filings? We’ll help you catch up. Our team works to file past-due returns accurately and efficiently, reducing penalties and getting your business back in compliance.

- Amended returns: Made a mistake on a previously filed return? No problem. We can correct errors, whether they involve reporting issues, miscalculations, or missing data. Proper amendments protect your business and ensure accurate tax records.

- Audit support: Sales tax audits are stressful, but they don’t have to be. If you’re facing an audit, we’ll stand by your side, handling communication with auditors, providing documentation, and ensuring your business’s interests are protected every step of the way.

- Voluntary Disclosure Agreements (VDAs): If you’re behind on compliance, we’ll negotiate with states on your behalf to reduce penalties and back taxes.

- Comprehensive sales tax services: From registrations to filings and ongoing compliance, we handle it all so you can focus on growing your business.

Sales tax doesn’t have to keep you up at night. Let us handle the complexity while you stay confident and compliant.

Ready to take the stress off your plate?

Reach out to LedgerGurus today and get back to running your business with peace of mind!