One of the most important parts of running a business is cash flow management. Being the captain of an up and coming business is not for the faint of heart. While entrepreneurship can be one of the most rewarding “career” choices, it can also be the hardest. Everything, and yes we know, everything hangs in the balance of the captain’s leadership, wisdom, and drive.

Your “make or break” time comes in those early years when you need something more than smarts and a business “education” to survive. You need grit. You need marathon-esque perseverance. And you need to be a student to those who have captained a ship through rough waters.

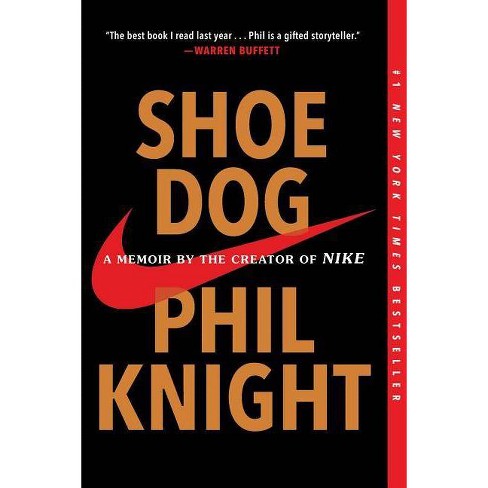

Enter now the book, Shoe Dog. It’s the story of Phil Knight, founder of Nike and entrepreneur extraordinaire. Shoe Dog follows the journey of this iconic company in the 1960s and 1970s–pre-Michael Jordan days–when it was still a little thing called Blue Ribbon Sports. In this memoir of a book, Phil shares the in’s and out’s of how he navigated growing a small business in record time. As a runner, Phil’s approach to business reflected the athlete’s spirit of pushing beyond self imposed limits, never quitting, and embodying the love of “the game,” rather than profit itself, as the reason to get up and do the grind.

Sound familiar? We don’t doubt it. So many of our clients start their businesses because they are Passionate (with a capital P) about their game and they want to generate income doing something they love.

But we know passion isn’t enough to always solve the numbers challenge. In a rapidly growing business, the scramble for cash flow is REAL. Especially in the online selling world. Buying goods (often in another part of the world), distributing them in markets or directly to consumers, and waiting for the sales to generate cash flow back into the pool all take time. Often, a significant amount of time. And meanwhile, as the captain you’re doing your very best to keep leaks out of the hull.

So what do you do to avoid dangerously treading water with your business cash flow management? Phil shares some great answers.

But first let’s see his list of challenges:

- Buying inventory (not too much or too little)

- Paying down lines of credit

- Making payroll and paying vendors

Pretty common, stuff right? Yeah, these are some of the top challenges for every small product-based business owner.

The big challenge Phil notes which we all know is TIMING. The clock starts when the product is purchased from the manufacturer and extends to delivery and distribution and finally to sales. And any online seller knows it can be a significant amount of time between the purchase order to the product’s sale. Like months… and months.

So according to Phil, here’s some things you can do:

- Presale your product through discounting to retailers (think along the lines of crowdfunding). This works especially well with high demand products.

- Explore financing options. Simple advice here, but the key is doing the research and finding the option(s) that will work best for your business. You might consider some conventional options like business credit cards, lines of credit, or long-term business loans. Or some more involved options such as engaging in venture financing or factoring out your invoices as a discount to other companies. Added to this advice would be to establish your business credit EARLY. Like before the cash flow pinch point hits.

- Lastly, and this is what we preach all the time, take it upon yourself to have a superb understanding of your finances, cash flow management, and general accounting best practices. Numbers are an integral part of playing the business game. If you want to win, you have to approach your financial education like Jordan approached his ball training. Like a PRO.

Solid advice, right? But we’ve only given you a taste of the book–the business practices side of it. The best parts, in our opinion, are the stories and anecdotes. And these nuggets are worth their weight in gold. We’ll share just one here… and then do yourself a favor. Read the book. JUST DO IT. Because remember, Phil Knight started out just like you… a small product-based business with an aim to go BIG… and well, we all know how that story ended!

“So that morning in 1962 I told myself: Let everyone else call your idea crazy . . . just keep going. Don’t stop. Don’t even think about stopping until you get there, and don’t give much thought to where “there” is. Whatever comes, just don’t stop.”

― Phil Knight, Shoe Dog

If you need help with your business cash flow management or ecommerce accounting, reach out to us here – https://ledgergurus.com/contact-us/