If you run an e-commerce business and have very minimal physical presence in the states you are selling to, it’s very likely that you can get your sales tax compliance done for free, at least in 24 states, through the Streamlined Sales Tax (SST) program!

What is the Streamlined Sales Tax (SST) Program?

Streamlined Sales Tax program (SST) started more than 20 years ago, long before the Wayfair decision. It was established in March of 2000 after the US. Supreme Court ruling that a state may not require a seller to register and remit sales tax unless they have a physical presence in that state. That ruling was overturned by the South Dakota vs. Wayfair decision in 2018.

The SST’s mission is to modernize, simplify and unify all the things that makes sales tax difficult for businesses selling into multiple states with minimal physical presence.

So, now what?

A qualified business can contract with a Certified Service Provider (CSP) to register and file through the Streamlined Sales Tax program in 24 member states. The CSPs are compensated by states through a percentage of sales tax they remit on behalf of the qualified businesses. That means the businesses don’t pay CSPs anything for sales tax registration, calculation, and remittance.

What is a Qualified Business?

The original goal was to make sales tax simple enough that remote sellers would voluntarily comply in all the member states so the states can collect more tax revenue. Therefore, the definition for “qualified business” is more lenient than current-day “remote seller” in the sense that a certain degree of physical presence is allowed.

Physical presence is defined as:

- No fixed place of business in that state for more than 30 days

- Less than $50,000 of property in that state

- Less than $50,000 of payroll in that state

- Less than 25% of its total property or total payroll in that state

- Was not collecting sales or use tax in that streamlined state as a condition for the seller or an affiliate of the seller to qualify as a supplier of goods or services to that state.

Therefore, if you are a remote seller with absolutely no physical presence in any other states other than your home state, you are a qualified business and can utilize the SST program.

Who are the Certified Service Providers?

- Avalara

- TaxCloud

- Sovos

- Accurate Tax

- Taxify (a sub product of Sovos) ***

- Exactor (a subsidiary of Intuit) ***

***certified by SST but are not currently offering free services

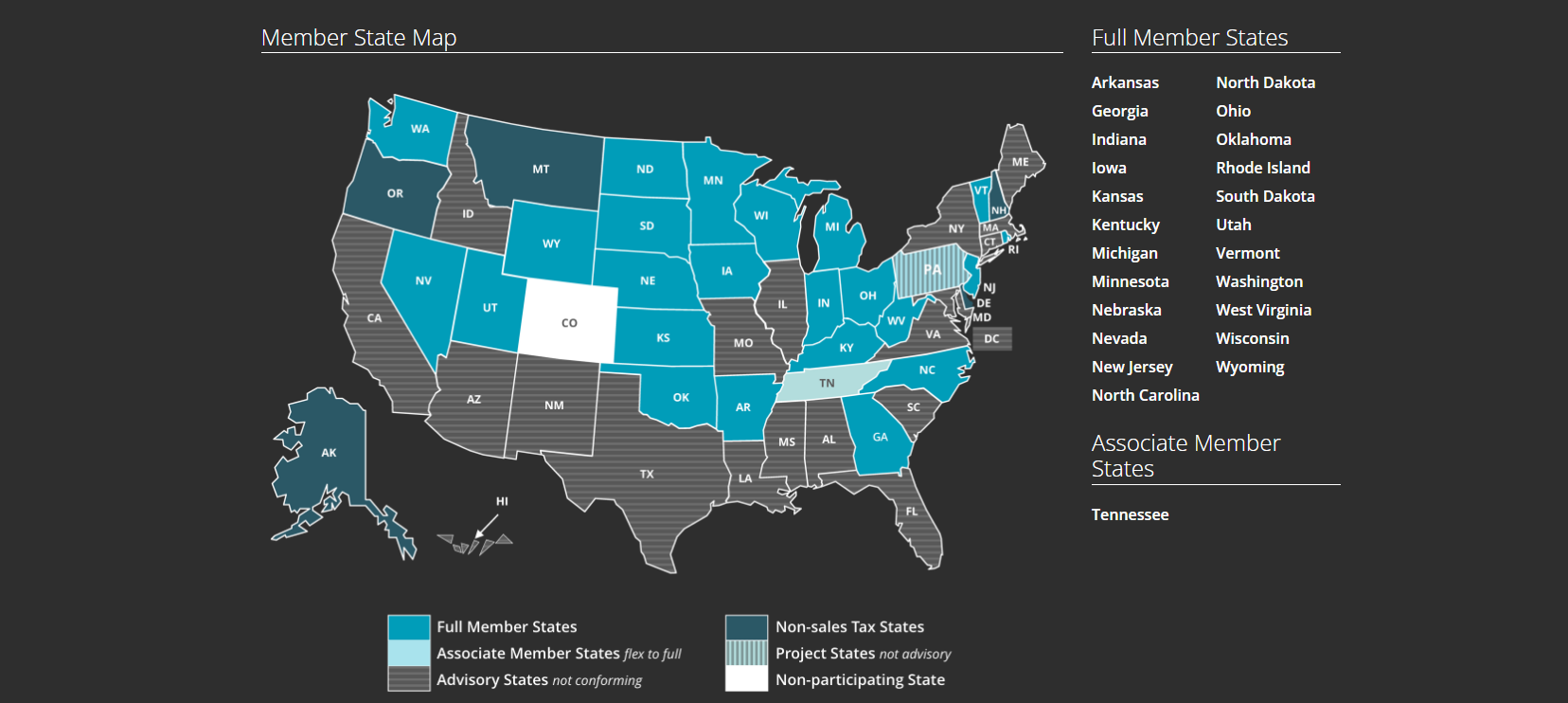

Who are the Member States?

When SST started, 24 member states got together and established:

- A central registration and filing portal

- A unified definition of products

- Simplified exemption certificate

- A Simplified administrative process for tax rates and boundaries

Please see below for a picture of the current member states.

If you are selling remotely into any of these 24 states, you can use the SST program and do one registration for all 24 states (or whichever states you choose to comply in). This “pick and choose” option was effective a couple years ago. Previously if you registered through SST, you had to register with all 24 states.

You’ll also have only one form to file in all 24 states. You will have the same definition of what a certain product is in all 24 states. And, these 24 states will need to follow the same administrative process when it comes to exemption certificates, etc. It’s almost like, for sales tax purposes, these 24 states are like 1 state.

For example, say you are a remote seller based in California. You are selling to all the states and want to collect in all the states. You can register for 24 states on SST and then register for the rest on their own websites. Now you’ll have to do 22 registrations for the 45 states that have sales tax, instead of 45 registrations.

What Services Can Qualified Businesses Get for Free?

If you are a qualified business and you want to participate in the SST program, reach out to one of the certified service providers. They can provide the below services for FREE:

- Set up and integrate its certified system with your system to calculate tax due at the point of sale or online checkout.

- Prepare & file returns and remit taxes collected to all the member states

- Registrations in all the member states

- Audit defense

For a more comprehensive list please refer to https://www.streamlinedsalestax.org/certified-service-providers/freeservices.

What About the States That Are NOT Part of the SST Program?

Unfortunately, you won’t get free services for sales tax compliance (calculation, registration and filing) in non-member states. If you have nexus in a non-member state, you will need to go to that state’s website, create an account, register and then file through that website’s online portal either manually or via a software.

What are the Pros and Cons of the Streamlined Sales Tax Program?

The biggest advantage of the SST program definitely is that it’s free for businesses to become sales tax compliant in 24 states.

However, there are some drawbacks of the program, as well, that I want to share.

First and foremost, it doesn’t cover all the states, especially the big states like California, New York and Texas. Businesses still have to register and file in these other states, having to pay accountants or a software company.

Second, the SST filing doesn’t include taxes other than sales tax and doesn’t cover home ruled cities. For example, Washington’s B&O tax is not covered by the SST filing, nor does Denver’s return (if you have physical presence in Denver and has an obligation to register and file in Denver).

Third, the requirements are strict when it comes to exemptions and tax calculated by the CSPs. Every exemption taken (other than product being nontaxable) needs to have an exemption certificate validating the transaction being exempt. Otherwise the CSP will calculate tax and the business will need to pay out of pocket. CSPs are required to remit taxes that they calculate, even if it’s not what businesses collected sometimes. This happens when the CSP’s tax rate database doesn’t match the sales tax engine used at point of checkout.

For a video version of everything you need to know about the Streamlined Sales Tax program, check our YouTube video.

What if I Still Have Other Questions?

Feel free to reach out to us or directly to SST if you have any additional questions.

To learn more about sales tax for ecommerce businesses, click here for all our sales tax blogs and here for our YouTube playlist.