Paying bills (or Accounts Payable) is a critical process for every business in order to keep the doors open. That’s because doing business means working with vendors, suppliers, or contractors, and all those people expect to be paid. Preferably in a timely manner!

This bill pay process is often referred to as Accounts Payable (AP), because AP is the account on the balance sheet where most of these liabilities live prior to payment.

AP represents all the goods and services you have received but not yet paid for. It is a reflection of the debt owed to vendors, contractors, and suppliers for things like inventory, maintenance services, contracted labor, and professional services.

This post explores the accounts payable process, what is it, how it works, ways it can benefit your organization, and an in-depth 3-step process to make sure you have all your bases covered. We also throw in some tips, warnings, and general accounting education.

How is AP Different From Other Expenses?

A business experiences two kinds of expenses.

- First, it has expenses paid for at the time of service or receipt of goods.

- Second, it has expenses from when services or goods are received, but not paid for until later.

An example of the first kind would be walking into store, picking up office supplies, and paying for them at check out. This is an example of a cash-based transaction where the expense is recognized at the time the payment is made.

It is a waste of your time and effort to handle these transactions as Accounts Payable. Don’t create bills for these and then pay them. It’s a total waste of your time. We recommend simply coding these expenses to the appropriate expense account as they hit your bank account and credit cards.

An example of the second kind would be buying inventory where your supplier gives you terms of 30 days before requiring payment. This is an example of an accrual transaction where the expense is recognized by your business at the time the value is received, rather than when you pay.

These expenses typically pass through Accounts Payable because there is a time lapse between the time the value is received and the time the bill is actually paid. This creates a liability called Accounts Payable. We DO recommend entering bills into your accounting system for these activities and managing payment against those bills.

What IS Accounts Payable?

Let’s get one thing straight really quick.

Accounts Payable represents money owed to other businesses. These businesses will send you invoices communicating the money you owe them.

What is Correct Accounts Payable Terminology?

One common confusion is the terminology used in this process.

- Invoices refer to money we expect to receive.

- Bills refer to money we expect to pay.

Why, then, do businesses say, “I need to pay my invoices?” Shouldn’t they say, “I need to pay my bills?” Is this the same thing?

In fact, it is not.

Businesses confuse this terminology because the documentation they receive from vendors says “Invoice” at the top because the vendor is sending them and they ARE invoices to the vendor. They represent money the vendor expect to receive. However, to your organization, they are bills because they represent money you have to PAY.

They are an INVOICE to the VENDOR but a BILL to YOU, a mirror relationship of the same thing.

I only bring this up because from this point forward we will refer to these as “bills” and we don’t want to confuse anyone.

Okay, done with the soap box. Moving on.

The Importance of Good Controls in Your AP Process

Business might handle AP in a variety of different ways, ranging from simple with poor controls, to more complex with good processes and, most importantly, good controls.

AP is one of the highest points of risk within your organization, so good controls are very important for protecting your assets. Our eCommerce Bookkeeping Checklist lays out weekly, monthly, and annual process that will help you create good controls in your AP process.

What’s the Accounts Payable Process?

Let’s say you need to order product from a vendor who lets you pay on terms of 30 days.

Not considering additional processes for controls, what would that process look like?

- You place a purchase order for the product with the vendor.

- The vendor sends you the product with a bill due in 30 days with payment information (ie. a routing number or an address to mail payment to)

- You record the bill in your books, increasing your Accounts Payable, and make note of the payment information.

- At some point, hopefully before the due date, you initiate payment to the vendor.

- You record this payment in your books against the bill you originally created to decrease your Accounts Payable appropriately.

How Does a Good Accounts Payable Process Make a Business Stronger?

There are many ways the AP process benefits your business’s accounting operations. Here are just a few of them.

1. Internal controls

A well designed AP process uses a system of checks and balances to make sure that everything is entered correctly and runs smoothly. This not only helps eliminate any mistakes and human error in the accounts payable process, but it also reduces fraud by preventing any single person from having total control of the business’s money.

2. Cash flow and Accurate Financials

Keeping track of the money you owe and who you owe it to gives you needed insight when managing your business’s finances. This helps you avoid errors, as well as strategize your spending and saving for the future. It also helps you settle your debts with ease.

This is one of the biggest reasons for tracking expenses on an accrual basis instead of cash. (This is one of the reasons why someone would move forward along the cash to accrual spectrum.) On a cash basis, you only have visibility into what you HAVE paid. You don’t know what you still owe and your balance sheet is artificially rosy and misleading. Using AP to track expenses incurred but not yet paid gives you a much more accurate picture of what you are dealing with.

3. Organization

The organization of the AP process allows for elevated debt management and structured historical records. Paying your bills and settling your debts on time is important not only for your business’s financial success, but also helps create positive relationships with your vendors. Using AP to record invoice and payment data creates a clear view of transactional history. This clear historical record, or audit trail, not only helps identify and resolve spending issues more efficiently, but it also can make audits run smoother.

Besides the basic process we outlined above, here are a couple other pieces to consider for this.

Who Handles Accounts Payable?

Depending on the structure of your business’s accounting system, there are many ways you can manage your accounts payable. You may have an in-house accounts payable department dedicated to AP. It may fall to the general bookkeeping and accounting department. Or you may decide to hire an accounting firm, like LedgerGurus, to help run your accounts payable process.

Here at LedgerGurus, we provide many accounting services to businesses including, but not limited to, accounts payable. We have a capable AP team with team members who work with businesses to take care of their accounts payable process. Our team members make sure that your business gets all its invoices entered accurately and paid on time. If you’re interested in learning more about our services, please let us know.

Whether you are handling it in-house or outsourcing it, the most important part is making sure your solution can:

- Keep accurate records

- Pay bills on time

- Manage good controls around the process

Steps to Manage the Accounts Payable Process

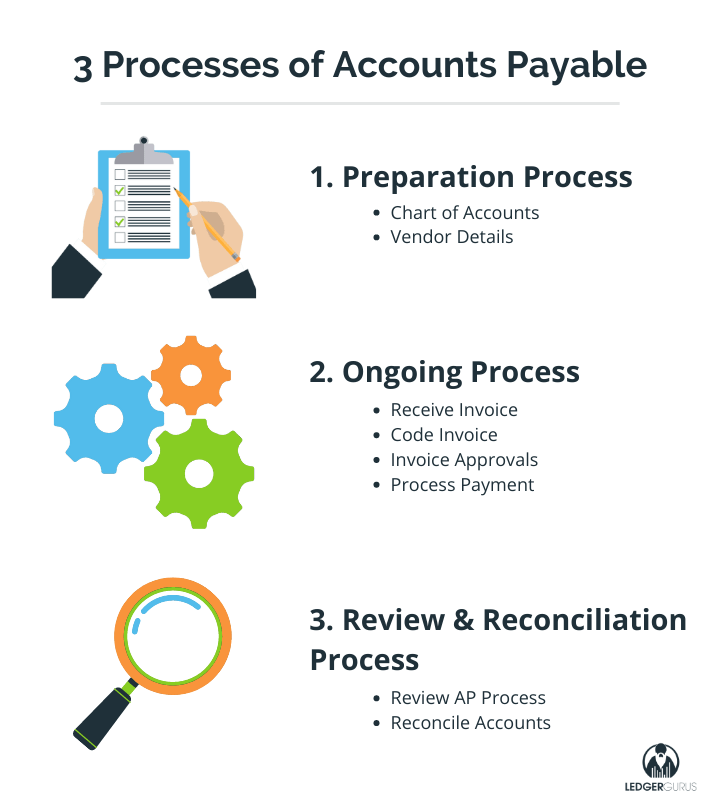

Step 1. Preparation Process

- Consider your chart of accounts: A chart of accounts is a structure used to organize and record your accounting transactions. When a bill is entered into Accounts Payable, there is always another side of that transaction, usually an expense account, identifying what the expense is for. We have a chart of accounts template you can follow, if you don’t already have one in place. We also have instructions on how to set it up in QuickBooks Online.

- Track important vendor details: To make paying your vendors easier, their information should be gathered and recorded. Once you have saved a vendor’s important contact information and payment information, it will make paying them in the future much faster and easier.

Step 2. Ongoing Process

- Receive invoice: After requesting or receiving product or services from a vendor, they will send you an invoice to request payment. This invoice will include any relevant information necessary to make a payment.

- Code invoice: Once you have the invoice, you can code the invoice and process it for payment. Coding an invoice includes entering the necessary payment information such as the amount due and the date it is due. It is also when you specify what account this transaction will be categorized under and assign approvers to double check the information.

- Invoice approvals: Once an invoice has been coded, any specified approvers can review the information to ensure it is entered correctly before payment is initiated.

- Process payment: After the accuracy of your invoice has been verified, payment can be initiated to the vendor.

Step 3. Review and Reconciliation Process

- Review the AP process: At the end of the ongoing process, you can now update your books to reflect the latest payment made to your vendors. This is also a perfect time to review your chart of accounts, vendor information, or any other relevant information and update it, if needed. AP aging reports can be very useful in helping you identify any vendors with balances that seem off.

- Reconcile Accounts: Regularly throughout the accounts payable process, usually monthly, you will want to reconcile your bank or credit card accounts to make sure that all payments have been entered, processed, and completed successfully. Remember any payments made pertaining to bills should be applied directly against those bills. Reconciling your accounts allows you to find any errors or problems that may have occurred during the AP process, duplicates that may have been entered, or payments that were never correctly applied. If you are using an external AP system like Bill, Veem or Rewardworks, you will also want to verify that their vendor balances match the individual vendor balances found in your accounting software AND that total AP balances match.

How Can the Accounts Payable Process Benefit You?

The accounts payable process can improve your business’s workflow in many ways. Some of these include streamlining the expense process, reducing errors, preventing fraud, and offering insight into how to optimize your spending efficiency. Whether implemented in-house or hired out to an outside accounting firm like LedgerGurus, using the AP process can give your business an extra boost to achieve simpler and more successful expense management.