This blog is a summary of our first webinar, “Business Financial Health Check” in the series “6 Financial Actions for Business Survival During Economic Crisis”. You can view the recording of the webinar on-demand here, which goes into greater detail. If you’d like an expert to help you with your business financial health check, you can also schedule a time here with one of our gurus.

Our first step for businesses in economic crisis is to do a business financial health check. Our financial health check consists of the following:

Let’s get into it.

Key Takeaways

- Profitability = Sustainability – Long-term profitability is essential for business survival.

- Start with a Business Financial Health Check – Assess your current financial position before making decisions.

- Measure Sales Trends, Not Just Sales Volume – Compare year-over-year data for similar periods (7–30 days).

- Balance Sheet Health Matters – Ensure financial data is accurate and timely.

- Calculate Operating Runway – This tells you how many months you can survive before running out of cash.

- Cash is King – Monitor Operating Cash Flow Ratio: Net Cash Flow from Operations ÷ Current Liabilities

- Inventory Management is Critical

- High days in inventory can create cash bottlenecks.

- Optimize inventory turnover to maintain liquidity.

Business self-assessment

The first thing you need to do for business survival during economic crisis is to identify where you are at right now, financially. First, let’s remind ourselves that profitability = sustainability. During good economic times, it becomes easy to justify not operating profitably. You may be investing in growth and looking at the cash in your bank account. This is okay and good in certain circumstances! But any business that is not profitable long-term is not sustainable. Your cash may easily disappear over time if you are not operating profitably. (We are talking about bottom line, net profits).

When disruptions happen, such as an economic downturn, you may need to change your mindset significantly. Instead of focusing on investing, adjusting to a profitability mindset may need to happen.

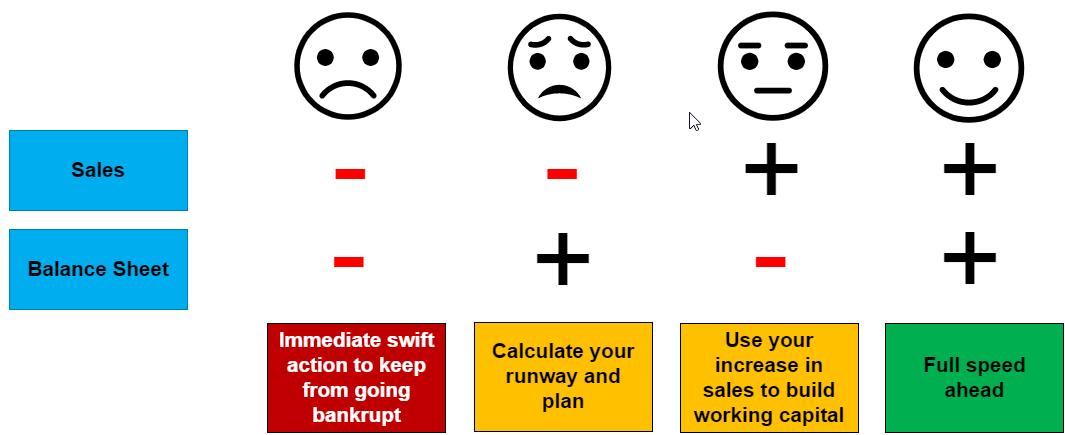

You should look at two factors when deciding what to do:

- Sales (are sales up or down since the economic downturn?)

- Balance sheet health (Your reserves. Inventory, bank account balances, accounts receivable, etc.)

Assess whether your sales on moving up or down. Then, do you feel comfortable with the reserves you show on your balance sheet? Our diagram below shows what action you should take when assessing your sales and balance sheet. But we will dive into each of these factors next.

Measuring Sales Trend

When looking at sales, you need to measure what matters. It’s not about the amount of sales, but the trend. Trends are what matter. When looking at your sales trend, we suggest looking at year-over-year for comparable periods. The time period you look at should be at least seven days and no more than 30 days. For example, you could compare March 10 – March 24, 2019 to March 10 – March 24, 2020. You will then be able to see your current sales trend.

When gathering your data, there are basically two ways to do so:

- Accounting system/CRM – this is typically for Invoice-based companies. Invoices are usually done through an accounting system or CRM. The pros are that it can be very accurate. The cons are that it depends on timely updates, which can be difficult for these types of companies.

- Sales system/payment processor – This is for businesses with a point of sale, such as retail. The pros are that data collected is fast and accurate. The cons are that you may need to look at multiple sales channels and payment processors to gather your data.

Balance Sheet Health

A lot of business owners think about their accounting for tax purposes. But your financial data can be a powerful tool for decision-making if it is accurate at timely. Before looking at your balance sheet health, you’ll want to make sure the data is up-to-date and accurate. This is why quality accounting is so important, especially for business survival decisions during economic crisis.

You will want to look at two areas on your balance sheet:

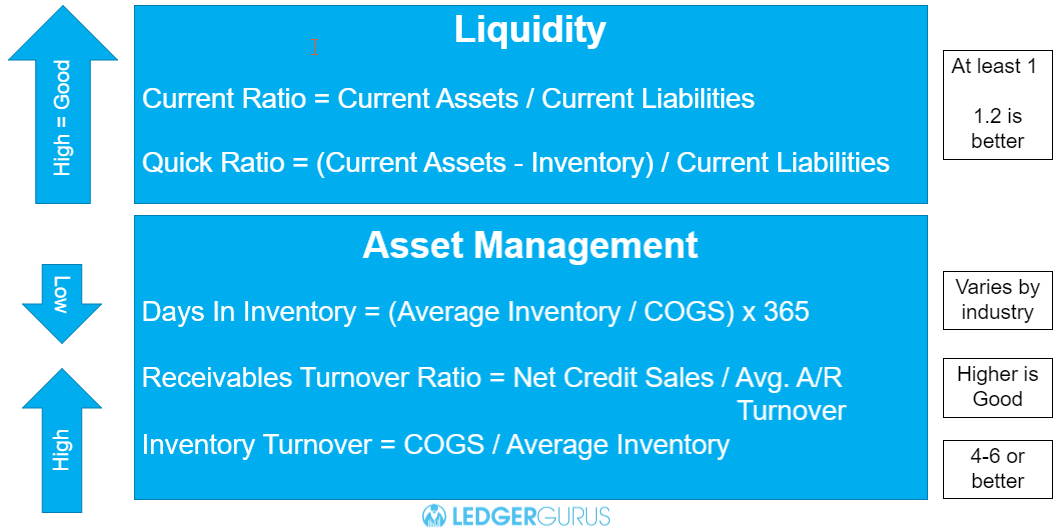

- Liquidity

- Asset management

Liquidity

Liquidity is basically how likely you are to go bankrupt. Can you convert assets to cash quickly? View the table below for Quick Ratio and Current Ratio formulas.

Asset management

How well are you managing and converting your assets into something of worth? View the table below for Days In Inventory, Receivables Turnover Ratio, and Inventory Turnover Ratios. You can see what you want each of these numbers to be.

Once you calculate these important ratios, you can Google if your ratios are poor, average, or good in general and for your industry. This will help you determine your balance sheet health.

Operating Runway

Operating Runway

The next thing you want to assess is how long you can survive on your reserves and current expenses. This is call operating runway. It will also tell you how much time you have left to make necessary adjustments before looking at bankruptcy. You’ll want to take this step if your sales are declining, but you have poor balance sheet health. It will help determine what to do next.

Here is the calculation for operating runway:

Working Capital (Current Assets – Current Liabilities)/Monthly Net Income or Loss

If you have a net less, the number you’ll see from this calculation will tell you how many months you have before running out of money, if everything stays consistent. This can happen fast if you are not careful!

So, how can you extend your runway? You have two options:

- Increase your cash reserves

- Cut expenses

If you need help increasing cash reserves, we have provided a resource relevant to the time of writing this blog (during the COVID-19 economic downturn). You can find different grants, loans, etc on our web page here.

When cutting expenses, you can look at fixed COGS that you have power to reduce. You can also look at your overhead expenses.

Cash Availability

Cash is king. Cash availability becomes an issue when you have sales coming in but can’t fulfill because of a lack of cash. For example, a product company getting orders but not having the inventory or cash to purchase new inventory. You want to be able to free this bottleneck.

The measurement here is Operating Cash Flow Ratio:

Operating Cash Flow Ratio = Net Cash Flow From Operations/Current Liabilities

You want this ratio to be at least 1. 1 would mean you have enough cash to support current operations, but you would struggle to support growth. The higher, the better.

Common cash flow issues include the following:

- Slow Accounts Receivable collections

- Long inventory purchase cycle

- High days in inventory (this isn’t an issue for selling, but can be an issue for covering operating expenses)

- Paying bills too quickly

- Excessive debt payments

Next Steps

Everything we have covered about business survival during economic crisis is dependent on good accounting. You NEED good accounting to make these decisions. If you have a lot of catch-up to do, start with the last month.

We will have subsequent blogs and webinars about next steps to decrease expenses, optimizing sales costs, increasing cash flow, and identifying new revenue opportunities.

If you need help, don’t hesitate to reach out.