The main difference between exempt vs. non-exempt employees is the ability to collect overtime. But knowing which category employees fit into can be confusing.

This law is regularly misunderstood by employers. Just because someone is on salary does not automatically make them exempt.

In this blog, we’ll help you answer these questions:

- What are the differences between exempt and non-exempt?

- How have the FLSA rules changed recently?

- What are the benefits of each classification?

- What are the consequences for misclassification?

- What are the next steps for employers?

Incidentally, another law that is regularly misunderstood is the one about W2 vs. 1099 employees. To learn about W2 vs 1099 employees, click here to read our blog article on the subject.

What Does Exempt vs. Non-Exempt Mean?

Let’s start with the basics.

Exempt employees are non-manual labor, “white collar” workers. They are considered exempt from overtime.

There are 3 qualifications, and ALL must be met to be considered exempt.

- Earn a salary

- Must be paid at least $35,568 annually or $684 per week

- Meet a duties test based on their job (more info on this below)

The Department of Labor (DOL) considers the following job categories exempt:

- Executive Employees

- Administrative Employees

- Learned Professionals

- Creative Professionals

- Computer-Related

- Outside Sales

- Highly Compensated Employees (HCEs)

Each of these has a duty test to determine eligibility. It should be noted, a job title alone does not determine exempt status.

These duty tests are the last piece of determining if someone is an exempt employee or not. For more information from the DOL, click here.

Executive

- Salary requirement

- Primary duty must be managing the business, or a department within the business

- Must regularly manage at least 2 full-time employees, or the equivalent in PT employees

- Must have authority to hire, fire, advance or promote other employees

- Ex. Department Manager

- For more info, click here

Administrative

- Salary requirement

- Primary duty must be managing business operations

- Work requires discretion and independent judgment in significant matters

- Ex. Marketing Specialist, HR Specialist, Auditor

- For more info, click here.

Learned Professional

- Salary requirement

- Primary duty must be work requiring advanced knowledge in a field of science or learning

- Work must be largely intellectual and requires discretion and judgment

- Knowledge must have come through a prolonged course of specialized intellectual instruction

- Ex. Doctor, Lawyer, CPA, Architect, Teacher

- For more info, click here.

Creative Professional

- Salary requirement

- Primary duty must be work requiring invention, imagination, originality, or talent in an artistic field.

- Ex. Actor, Musician, Illustrator, Novelist, Writers

- For more info, click here.

Computer-Related

- Salary requirement

- Primary duty must be systems analysis, design and development, testing, etc.

- Ex. Computer Programmer, Software Engineer

- For more info, click here

Outside Sales

- No salary requirement

- Primary duty must be making sales or obtaining orders or contracts

- Must regularly be engaged away from the employer’s place of business

- For more info, click here

Highly Compensated Employee

- Does office or non-manual work

- Is paid more than $106,432 a year

- Performs at least one of the duties of an exempt employee listed above

- For more info, click here

If an employee falls into one of the above categories and meets the duties test, they are considered exempt from overtime.

Non-exempt employees are everyone else. As a result of being non-exempt, these employees are eligible to collect overtime.

How Did the Rules Change for Exempt Vs. Non-Exempt?

A few of the FLSA rules recently changed.

Most significantly, the minimum salary requirement was increased to at least $684 per week or $35,568 a year. In addition, the HCE minimum salary increased to $107,432 a year.

Furthermore, employers can use nondiscretionary bonuses and incentive payments for up to 10% of the salary level.

What is a non-discretionary bonus?

A non-discretionary bonus is one that requires the employee to meet specific criteria in order to qualify for it.

Some examples of non-discretionary bonuses are:

- Hiring bonuses

- Attendance bonuses

- Bonuses for quality of work

- Bonuses for accuracy of work

- Longevity pay for retention bonuses

- Profitability bonuses

- Individual or group production bonuses

For example, I know of a company that has a bonus program in place where employees receive a bonus for arriving on time every day during a pay period. That bonus has qualifications that must be met in order to receive it. So, you’d better believe those employees move heaven and earth to get to work on time!

A discretionary bonus is one that is left up to the employer to decide when to give it and how much. For example, a Christmas bonus may be a discretionary bonus.

A few other changes involve revised special minimum salary details:

- $455/week – Puerto Rico, US Virgin Islands, Guam, and the Commonwealth of the Northern Mariana Islands

- $380/week – American Samoa

- $1043/week – “base rate” threshold for employees in the motion pictures industry

What Are the Benefits of Being Exempt or Non-Exempt?

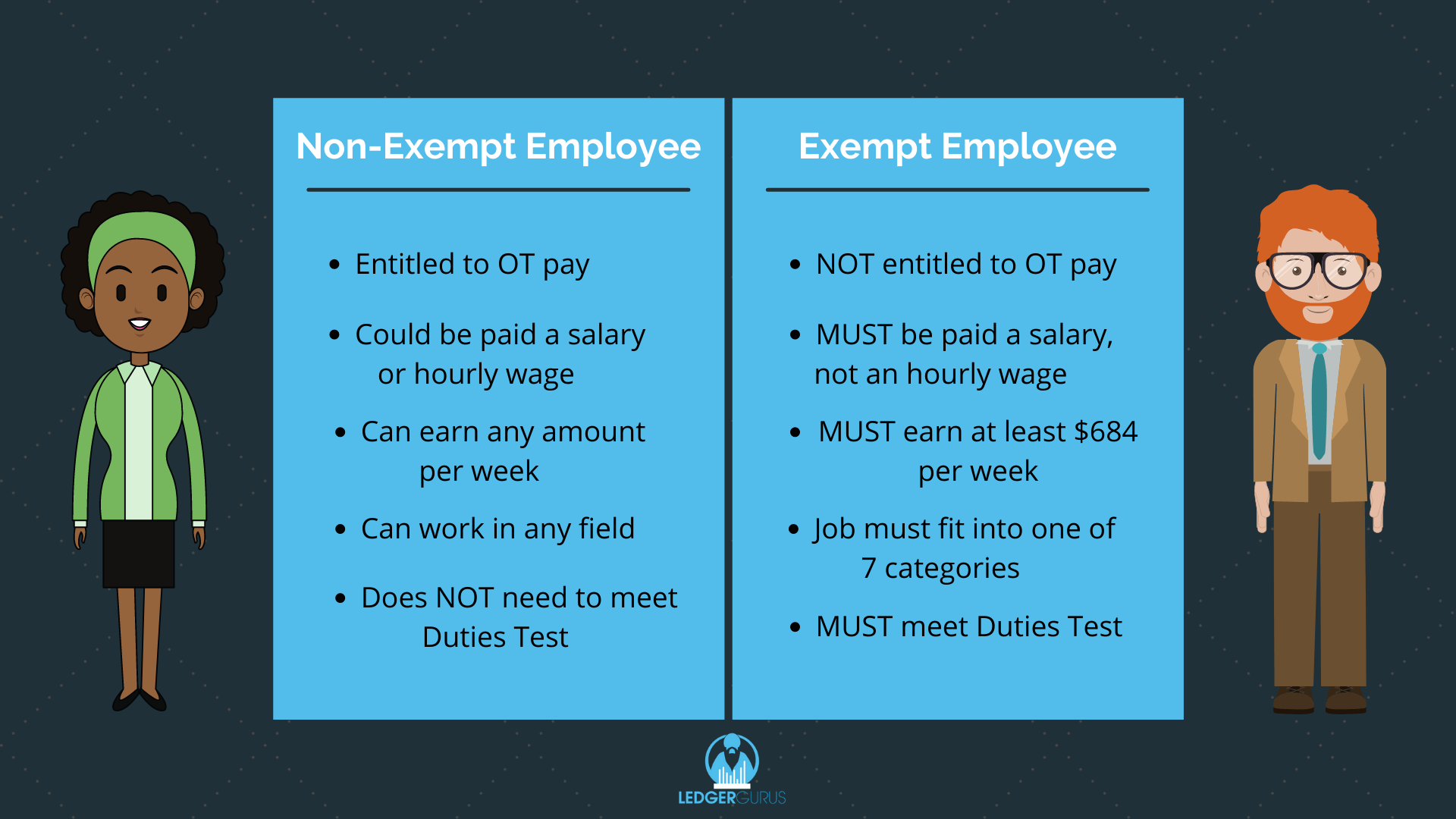

The easiest way to explain this is with a handy chart comparing the differences:

One benefit of being an exempt employee is that wages rarely fluctuate due to OT pay or having to take an hour or two off for a doctor appointment.

Exempt employees tend to be higher paid than non-exempt employees. In addition, they tend to have more control over their working hours. They can also determine which tasks to focus on and how much time to give them. Finally, their hours may fluctuate with intense periods and slow periods. But their pay doesn’t fluctuate accordingly.

The benefit of being a non-exempt employee is that a person can potentially increase their pay through working overtime. Another potential benefit is that they rarely have the kind of responsibility that a salaried worker would have.

Overtime Obligations

Non-exempt employees must be paid at least 1.5 regular pay for hours worked over 40 in a work week.

The employer can determine the work week (Mon-Sun, Thurs-Wed, etc.), but it must remain constant.

Misclassification Consequences

The most common reason for misclassifying is simply misunderstanding the law. Employers often mistake workers as exempt because they are salaried.

But, as you read above, there is a whole lot more to being exempt than just taking a salary. Exempt employees must also perform a certain high level of duties.

To be honest, some sources say that only 10-20% of the workforce qualifies as exempt.

Obviously, as an employer, it is your responsibility to make sure that you are classifying your employees correctly.

If you classify a non-exempt employee as exempt and you don’t pay them OT pay, then admittedly you’re not being fair to that employee. You could be at risk for lawsuits, resulting in paying back wages and OT. You’d also be responsible for any penalties, fees, and interest.

It is a bad idea to play this game. It’s better to learn how to classify your employees correctly.

Next Steps for Employers

So, what can you do to classify your employees correctly?

In the list below, here are some next steps:

- Review all exempt employees to see that they meet the new limits.

- For employees under the limits, either:

- Give them a raise OR

- Reclassify them and pay them OT.

If you need a more detailed list of next steps, try this:

- Read over the regulations and write clear job descriptions for each job classification in your company.

- After doing this, you should be able to accurately judge whether an employee is exempt or non-exempt.

- Make sure you’re not making improper deductions in the salary of otherwise exempt employees. This will turn them into non-exempt workers.

- Finally, seek professional advice if you need help reclassifying any employees.

To summarize, make sure you are classifying employees correctly. If you need help understanding the accounting required behind all this, be sure to contact us.