Dropshipping is a popular method for selling online because it eliminates the hassle of managing inventory or shipping products to your customers. However, it comes with its own set of challenges.

One common issue is when your supplier (the dropshipper) wants to charge you sales tax for orders shipped to states where they have nexus.

And they should!

If your dropshipper has nexus in the states they’re shipping to, they’re REQUIRED to charge sales tax unless they have a valid resale certificate from you on file.

So, the question becomes how to get a resale certificate.

In this article, we’ll talk about:

- What a resale certificate is

- How they work

- Steps to get a resale certificate

- How to get an out-of-state resale certificate

- Key points to keep in mind

- How to get a resale certificate in the states that don’t allow out-of-state certificates

- How to get help with your sales tax

Let’s get into it.

Key Takeaways

- Resale certificates let you buy products tax-free for resale.

- Rules vary by state, some accept out-of-state certificates, others don’t.

- You usually need a sales tax permit first.

- SST and MTC forms make multi-state use easier.

- Suppliers don’t have to accept your certificate, so communication matters.

- Keep valid documentation and renew as needed.

- Consult sales tax experts to stay compliant.

What is a Resale Certificate?

“A resale certificate is a signed document that indicates that the purchaser intends to resell the goods.” Sales Tax Institute

This lets you purchase products from your supplier tax-free, with the understanding that the items will be resold.

Some states have their own resale certificates. Others rely on multistate certificates.

We’ll cover both.

How Resale Certificates Work

As a buyer, it is your responsibility to obtain any resale certificates you need and present them to your supplier at the time of purchase.

Your supplier must collect and verify these certificates before waiving sales tax. They also need to keep the certificates on file for future transactions or in case of an audit.

Who Pays Sales Tax When a Resale Certificate is Provided?

When it comes to dropshipping, handling sales tax can become complex, and the question becomes “So, WHO pays the sales tax?”

Read here to dive into the sales tax implications of dropshipping, including who is responsible to pay in various situations.

Who Can Use a Resale Certificate?

You can only use a resale certificate when purchasing products that will be resold to an end consumer.

It is NOT intended to be used for products that will be used or consumed while conducting your business.

For example:

- When you can use a resale certificate: If you own an online boutique, you can buy clothing from your wholesale supplier using a valid certificate so you don’t have to pay sales tax on the purchase. The intention is that you will sell the clothing to your customers and collect the sales tax (if you have nexus in that state – more details on that here).

- When you can’t use one: However, if you need to buy a laptop to run your online boutique, you cannot use an exemption certificate to buy it because you’re intending to keep the equipment and not resell it.

Now, let’s define some terms that are commonly confused.

What is the Difference Between a Resale Certificate and an Exemption Certificate?

“Exemption certificate” refers to any type of document that allows for sales tax-exempt purchases based on the type of purchaser or transaction.

A resale certificate is a specific type of exemption certificate.

Sometimes the two terms are used interchangeably, but they aren’t exactly the same.

What is the Difference Between a Resale Certificate and a Sales Tax Permit?

This is an interesting question, and it’s important to know the difference because, while they are both connected to sales tax, they play very different roles.

A resale certificate allows you to purchase products tax-free when the intent is to resell them.

A sales tax permit, on the other hand, is a license issued by a state that authorizes your business to collect sales tax from customers and remit it to the state.

Note: You can get a resale certificate for most states without getting a sales tax permit, though that is not always the case. We’ll go into more detail on this in a moment.

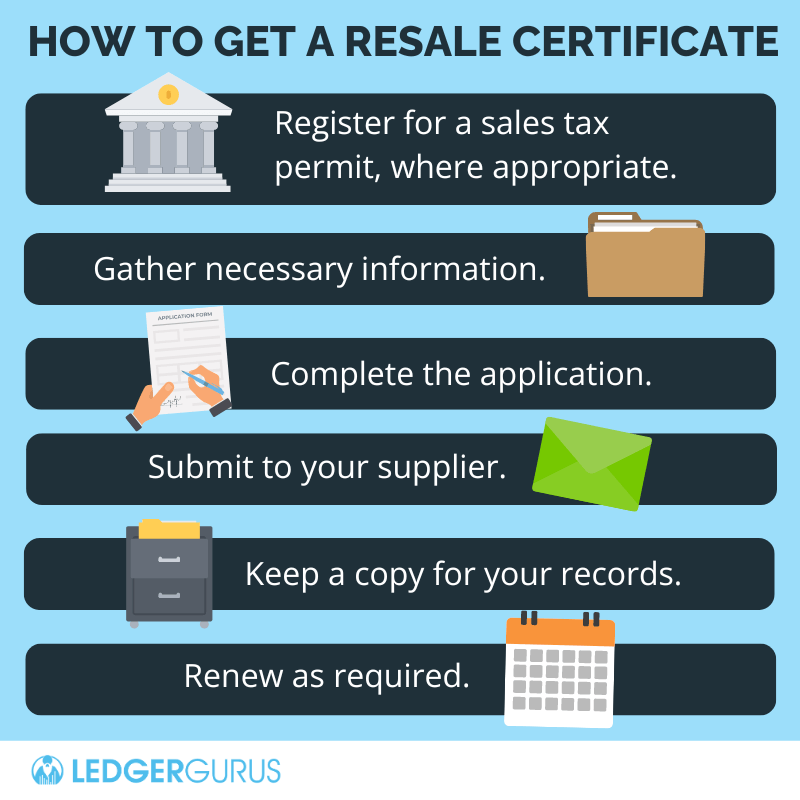

The Steps for How to Get a Resale Certificate

Getting a resale certificate is definitely worth the effort because of the potential cost savings of not having to pay sales tax out of your own profits.

But there are a few hoops you have to jump through.

Here is the general process:

And now with a few more details:

- Register for a sales tax permit, where appropriate: If you haven’t already, register your business for a sales tax permit in the state where you operate, as well as any other states where you have nexus (again, read this if you have questions about nexus). This allows your business to collect and remit sales tax.

- Gather necessary information: You’ll need to provide specific details, such as your business name, address, sales tax permit number, and a description of the products you intend to resell. (A more complete list is just below this section.)

- Complete the application: Fill out the resale certificate application, either online or via a paper form, depending on the state’s process.

- Submit the application: Submit the completed form to your supplier.

- Keep a copy for your records: Once your application is approved, make sure to keep a copy for your records. You’ll need this in case of an audit or for future transactions with suppliers.

- Renew as required: Some states require periodic renewal of resale certificates, so be sure to stay on top of expiration dates and renew your certificate as needed.

What Do You Need to Get a Resale Certificate?

There are certain things that most states require in order for a resale certificate to be valid. They are:

- Your name and address, as the purchaser

- The name and address of your supplier

- Your sales tax registration number, in the states where you have nexus

- Description of the product purchased for resale

- The reason for the exemption

- Statement affirming that the product will be used for resale

- The date and your signature and title

(from Sales Tax Institute)

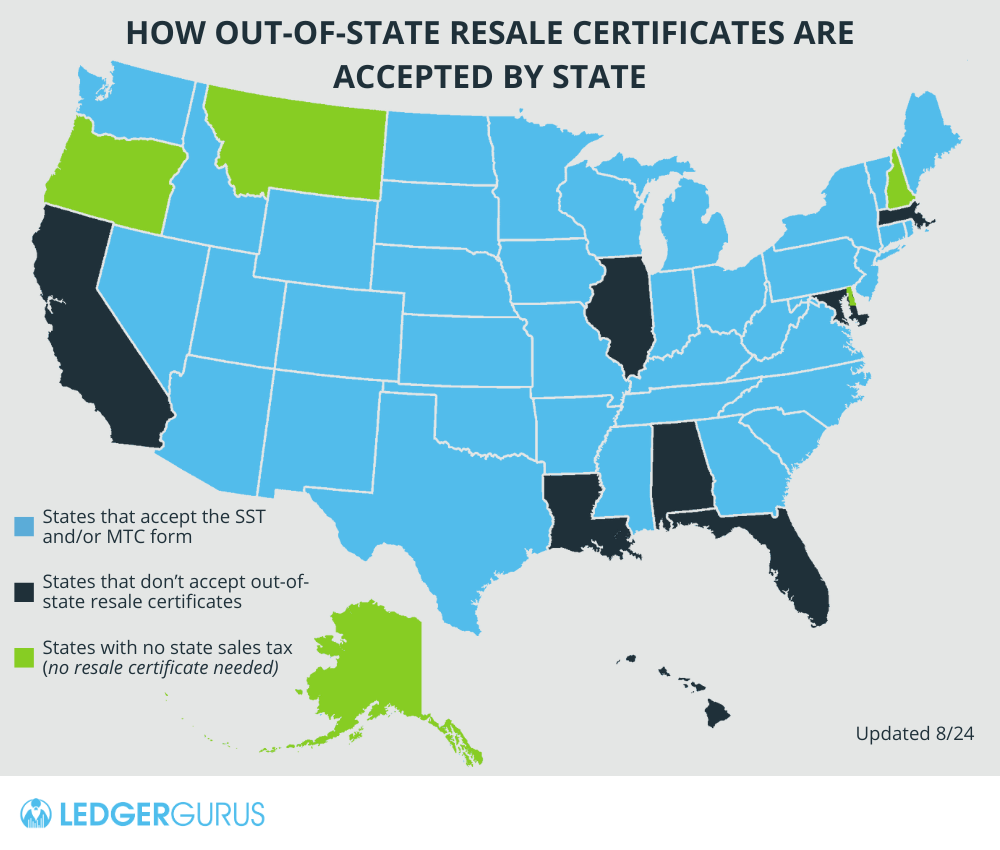

Can You Use the Same Resale Certificate in Every State?

No, you can’t use the same resale certificate in every state.

Each state has its own rules, and while most states accept out-of-state resale certificates, others require you to have one specific to that state.

It’s important to check the requirements for each state where you do business to ensure you’re using the correct resale certificate.

How to Get an Out-of-State Resale Certificate

The Streamlined Sales Tax Governing Board and Multistate Tax Commission make all this a lot easier by simplifying the process of getting and using resale certificates across multiple states.

Both of them provide a form that multiple states have agreed to accept as an exemption certificate.

Between them, they cover about 35 states. Yay!

And, the best part is that you DON’T have to register for sales tax permits individually in each of those states in order to use the forms.

What is the SST Form and How to Use It

The Streamlined Sales Tax (SST) form is a one-size-fits-all form that can be used as a resale certificate for any of the member states.

This significantly cuts down on paperwork, especially since all of them can be covered on the one form.

It is also very flexible to use.

Depending on your circumstances, you can use your sales tax permit number, your FEIN, or even your driver’s license number.

Click here for a complete list of all the states in the SST group.

What is the MTC Form and How to Use It

Look on the MTC form for whatever states you can’t find on the SST form.

The Multistate Tax Commission (MTC) Uniform Sales & Use Tax Exemption/Resale Certificate works similarly to the SST form.

It, too, makes it way easier to handle tax-exempt purchases without needing a different certificate for each state.

Click here for more information about the MTC form.

For help on how to fill out both the SST and MTC forms, watch our video tutorial.

Which States Do Not Accept Out-of-State Resale Certificates?

Some states do not accept out-of-state resale certificates at all, meaning you’ll need to obtain a resale certificate specific to those states if you’re doing business there. These states include:

- Alabama

- California

- Florida

- Hawaii

- Illinois

- Louisiana

- Maryland

- Massachusetts

- Washington DC

We have included information about how to get a resale certificate in each state at the bottom of this article.

Key Points to Keep in Mind about Resale Certificates

There are some key points that you, as a dropshipper, need to keep in mind about your resale certificates:

- Make sure they are valid: Ensure your resale certificate is valid and accepted in the state where you’re making the purchase.

- Use them properly: Only use a resale certificate for purchases you intend to resell. Using it for personal or non-resale items can lead to penalties.

- Keep documentation: Always keep a copy of every resale certificate you issue or receive. This is crucial in case of an audit.

- Watch the expiration dates: Some resale certificates have expiration dates. Keep track of them and renew them as needed.

- Keep state-specific rules in mind: Remember that each state has its own rules. Some states accept out-of-state certificates, while others require a state-specific one.

- Be aware of supplier requirements: Some suppliers might have strict policies about accepting resale certificates, so it’s important to understand their requirements.

Are Sellers Required to Accept Resale Certificates?

No, suppliers are not required to accept resale certificates. Remember, they’re on the line for the sales tax if they are audited and cannot produce valid exemption certificates for all of the tax-exempt sales they’ve made.

If they are not accepting your valid resale certificate, there are a couple of reasons:

- They think you need in-state resale certificates for every state where they have nexus. But that is not necessarily true because most states actually accept out-of-state resale certificates or registration numbers (see the SST and MTC form information above).

- Sometimes, the issue is with your supplier’s systems—they just can’t handle the complexity. Some suppliers will only work with you if you have resale certificates for every state where they have nexus. Their systems might not be set up to charge sales tax selectively by state for different clients, so they make it easier on themselves by asking resellers to get certificates in all those states.

What to Do if Your Supplier Won’t Accept Your Resale Certificate

If your supplier won’t accept your certificate, here are a few steps you can take:

- Clarify the requirements: First, start by asking your supplier why they are not accepting your resale certificate. It might be due to specific state regulations or just how they run things.

- Provide additional documentation: If possible, provide additional documentation or proof of your tax-exempt status that might satisfy their requirements.

- Negotiate terms: Try negotiating with them. Explain your situation and see if there’s a way to work together, perhaps by agreeing to other terms that allow them to process your orders without charging sales tax.

- Consider using a different supplier: If the supplier is firm on their policy and it becomes a significant issue, you might need to explore other suppliers who are more flexible with accepting resale certificates.

- Consult a tax professional: If the situation is particularly complex or if you do business in multiple states, it may be worth consulting a sales tax professional to explore other options and ensure you remain compliant.

How to Get Resale Certificates in the 10 States that Don’t Accept Out-Of-State Certificates

Alabama

Alabama requires registration in the state to get a resale certificate, unless you are dropshipping. If you are, complete the Alabama Application for Certificate of Exemption (Form ST-EX-A1) to get a resale certificate.

For more information and details, see What guidance is there for vendors drop-shipping into Alabama and remote sellers?

California

California requires registration with the state to get a resale certificate. Once you’ve registered, fill out the California General Resale Certificate (CDTFA-230).

Florida

Florida requires registration with the state to get a resale certificate. Once you’ve registered, you’ll receive your own resale certificate annually.

You can log into your account at Florida Department of Revenue to print a copy of your resale certificate (scroll down to “Sales & Use Tax”).

Hawaii

Hawaii requires registration with the state to get a resale certificate. Once you’ve registered, fill out the Form G-17.

Illinois

Illinois requires registration with the state to get a resale certificate. Once you’ve registered, fill out the Illinois Certificate of Resale (CRT-61).

For more information, read this from the Illinois Department of Revenue.

Louisiana

Louisiana requires registration with the state to get a resale certificate. Once you’ve registered, you can download it from the state’s online portal.

For some of the rules around resale certificates, read Louisiana Revenue Information Bulletin No. 09-015 6/23/2009.

Maryland

Maryland requires registration with the state to get a resale certificate. Once you’ve registered, complete the online form available here and then add your information. You can then save or print it. Please note that any purchases under $200 are typically not allowed to be tax-free.

For more information, read Purchases for Resale.

Massachusetts

Massachusetts requires registration with the state to get a resale certificate. Once you’ve registered, fill out the Massachusetts Sales Tax ST-4.

Washington DC

Washington DC requires registration with the district to get a resale certificate. Once you’ve registered, request the District of Columbia Sales & Use Tax Certificate of Resale (OTR-368) directly from your account.

How to Get Help with Your Sales Tax

If navigating the world of resale certificates and sales tax has you feeling overwhelmed, you’re not alone.

Our sales tax experts are here to help you every step of the way.

Maybe you need personalized advice about your specific situation. Our sales tax experts can meet with you in a one-on-one consultation to answer all your questions and get you pointed in the right direction.

Or maybe you prefer to hand over the entire process to professionals. We’ve got you covered there, too. Our team of sales tax experts can help you avoid the stress and potential pitfalls. Reach out to explore our services.

We can help you stay compliant and focused on what you do best: growing your business.