On January 1, 2021, Illinois changed their sales tax filing requirements for remote sellers without a physical presence in the state. By the way, having inventory in an FBA warehouse does not count as having a physical presence in Illinois.

The reason why Illinois made these changes was to level the playing field for remote vs. in-state sellers. In-state sellers have already been collecting both the Use tax and the local rates. But remote sellers didn’t have to worry about the local tax responsibility. That is, until now.

In this article, we’ll cover:

- What rates should you be collecting as a remote seller vs. an in-state seller?

- What do you need to do to comply with the new Illinois sales tax law?

- Why are you getting all these registration certificates all the time?

- How to fill out the Illinois sales tax forms ST-1 & ST-2

- Other resources

Let’s get into it.

Key Takeaways

- Remote Sellers Now Fall Under the Retailers’ Occupation Tax (ROT)

- Filing Requirements Have Changed

- Why You Keep Getting Registration Certificates

- Use a Sales Tax Automation Tool

What Rates Should You Be Collecting as a Remote Seller vs. An In-state Seller?

Previously, remote sellers simply collected 6.25% sales tax and filed a Use Tax return. That is now changing as remote sellers are now required to pay the local tax rates, as well. If you fit the criteria, you must switch over to collecting Retailers’ Occupational Tax. This is a destination-based tax and is collected at both the state & local levels.

What Do You Need to Do to Comply with the New Illinois Sales Tax Law?

In order to comply with this law, you’ll need to do two things:

- Switch your account from a Use Tax acct to a Retailer’s Occupational Tax acct.

- Fill out an ST-1 form AND an ST-2 form when you file.

If you are an interstate business, you’ll also need Illinois Workers Compensation insurance and the correct filing requirements – though this is nothing new.

As Marc Shuman of Chicago-based law firm, Shuman Legal, says, “Illinois law requires employers to provide workers’ compensation insurance for almost everyone who is hired, injured, or whose employment is localized in Illinois. Sole proprietors, business partners, corporate officers, and members of limited liability companies may exempt themselves.”

Why Are You Getting All These Registration Certificates All the Time?

So, you may be wondering why you keep getting identical registration certificates in the mail all the time. Now’s a good time to break out our food truck analogy.

Imagine that you own a traveling food truck. Some days you park in a neighborhood parking lot to sell to the lunch crowd there.

Other days you go to a carnival in another town to sell your delicious food to the partygoers.

At each location, you’ve created a physical presence just by being there. You charge the local sales tax rate, as well as the state rate.

In Illinois’s eyes, they view remote sellers like this “food truck” that is traveling all over the state, selling its wares. Where it stops is the customer’s location, and it’s required to collect sales tax at that location’s rate.

So, what’s with all the registration certificates?

A brick-and-mortar store, by its definition, has a physical presence where it is located. By law, it is required to display its sales tax license.

With this food truck analogy, each stop on the food truck’s route / new ecommerce customer is a new location. Thus, the state’s system automatically sends out a new sales tax license for it.

So, the certificates may LOOK the same because the same location code is used, but they are all for different places. Don’t worry about keeping track of the differences, though. Thankfully their system is doing that.

Since each location generates a new license, and Illinois renews their licenses every year, it’s safe to assume you’ll just keep receiving new ones in the mail all the time. Just store them and don’t worry about it.

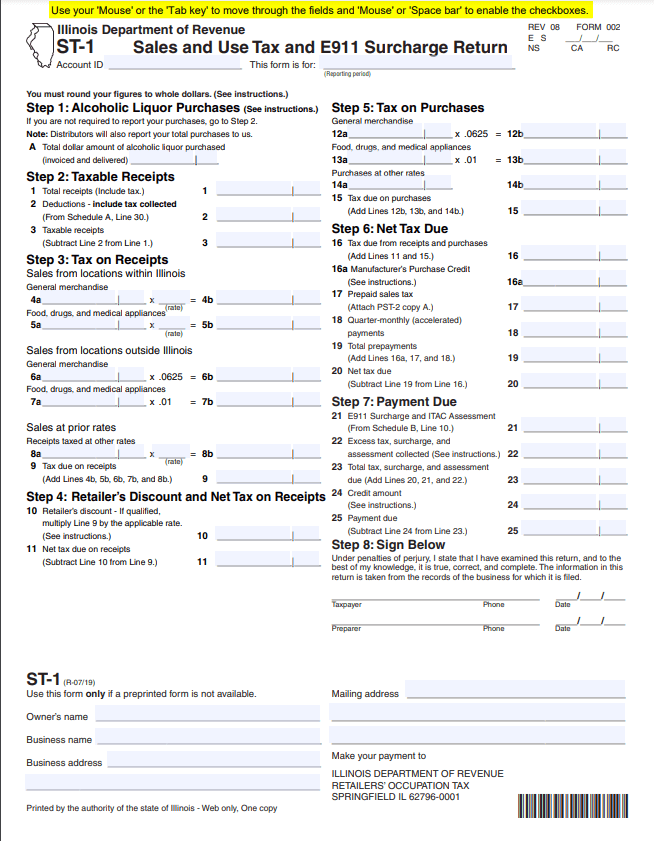

How to Fill Out the Illinois Sales Tax Forms ST-1 & ST-2

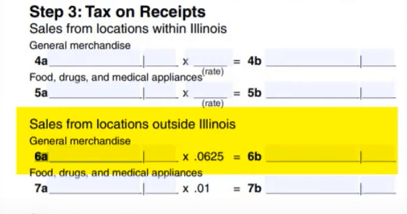

Before the changes on January 1, 2021, everything for remote sellers was reported on Line 6a. You’d put your sales in, and it would automatically multiply them by 6.25% and add it to Line 6b.

Line 6a would match Line 1, and there really wasn’t much more information you had to add to the form. Then it would calculate net tax due in Step 6, and you’d be set. Remit it and you were done.

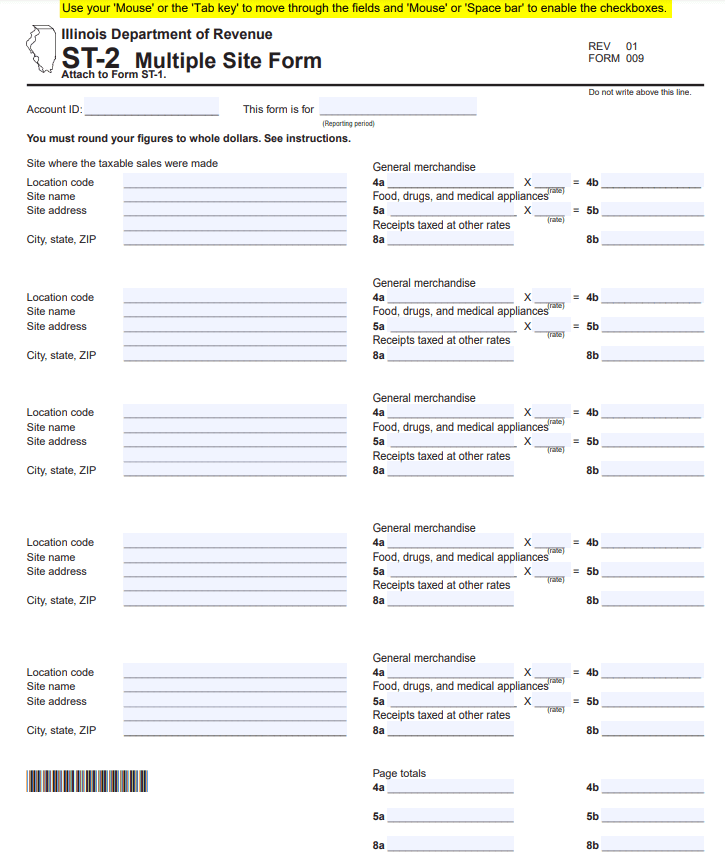

Unfortunately, that is no longer the case. Now you have to fill out Form ST-2, too.

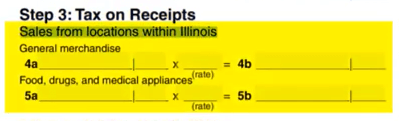

You now need to report every location (customer address), how much the transaction was, along with the specific rate associated with it. It’ll autofill the total amount of sales tax owed. And yes, this is customer by customer. The info will feed back into the corresponding line numbers on Form ST-1. It’ll fill out this part now.

By the way, it’s for this reason that we recommend using a sales tax tool for Illinois. It’s so you’re not having to do all this by hand.

Other Resources

This may feel completely overwhelming, and we don’t blame you. But we’re not hanging you out to dry on your own. We have several resources that you may find helpful.

If you’re just starting out with sales tax and aren’t sure what you’re doing yet, we recommend downloading our “10 Steps of Sales Tax” PDF and watching our free “The Uncomplicated Truth about Sales Tax” masterclass.

Next, we have created a sales tax course that is meant to walk ecommerce sellers or their accountants through the entire process of doing sales tax. Sales tax is messy and complicated, but it IS doable. To learn more about the course, click here.

If you’re ready to just hand this whole mess over to experts who do this every day, let us know. We are happy to take this off your plate, so you can focus on other aspects of your business.

If you’d like to watch the video this article was based from, click here.

To learn more about sales tax for ecommerce businesses, click here for all our sales tax articles and here for our YouTube playlist.