When I say the words “Shopify bookkeeping”, what kind of feelings do those words ignite in your tired soul? If there are feelings of anger, sadness, even despair, then you have come to the right place. There are weird and wonderful humans like the good people here at LedgerGurus. Humans who enjoy this crazy stuff. They have taken the time to understand the in’s and out’s of Shopify bookkeeping. Passing along this knowledge will better help you and your company. By deepening your grasp of this process, you will have more accurate numbers. It will also help you shed light on certain areas that you might have been getting wrong. And this is important because making informed decisions is key to your company’s success.

Shopify is an excellent resource for ecommerce businesses. But what is going on behind the scenes? How does your bookkeeper keep track of the transactions within your sales channels and payment processors? What are some of the best practices in the industry when it comes to Shopify bookkeeping? These are some of the tough questions we are more than equipped to tackle.

Oh the Bookkeeping We Will Do

Bookkeeping uses two accounts, credits and debits, to keep track of the financial activity of your company behind the scenes. A debit is an entry made on the left side of an account. It either increases asset and expense accounts, or decreases equity, debt or revenue accounts. A credit is an entry made on the right side of an account. It either increases equity, debt and revenue accounts, or decreases asset or expense accounts. Debiting or crediting accounts is the way we adjust our balances on a company’s financial statements. (For more info on Debits and Credits click here). Financial statements can include income statements, balance sheets and cash flow statements. (for more info on basic accounting/bookkeeping click here).

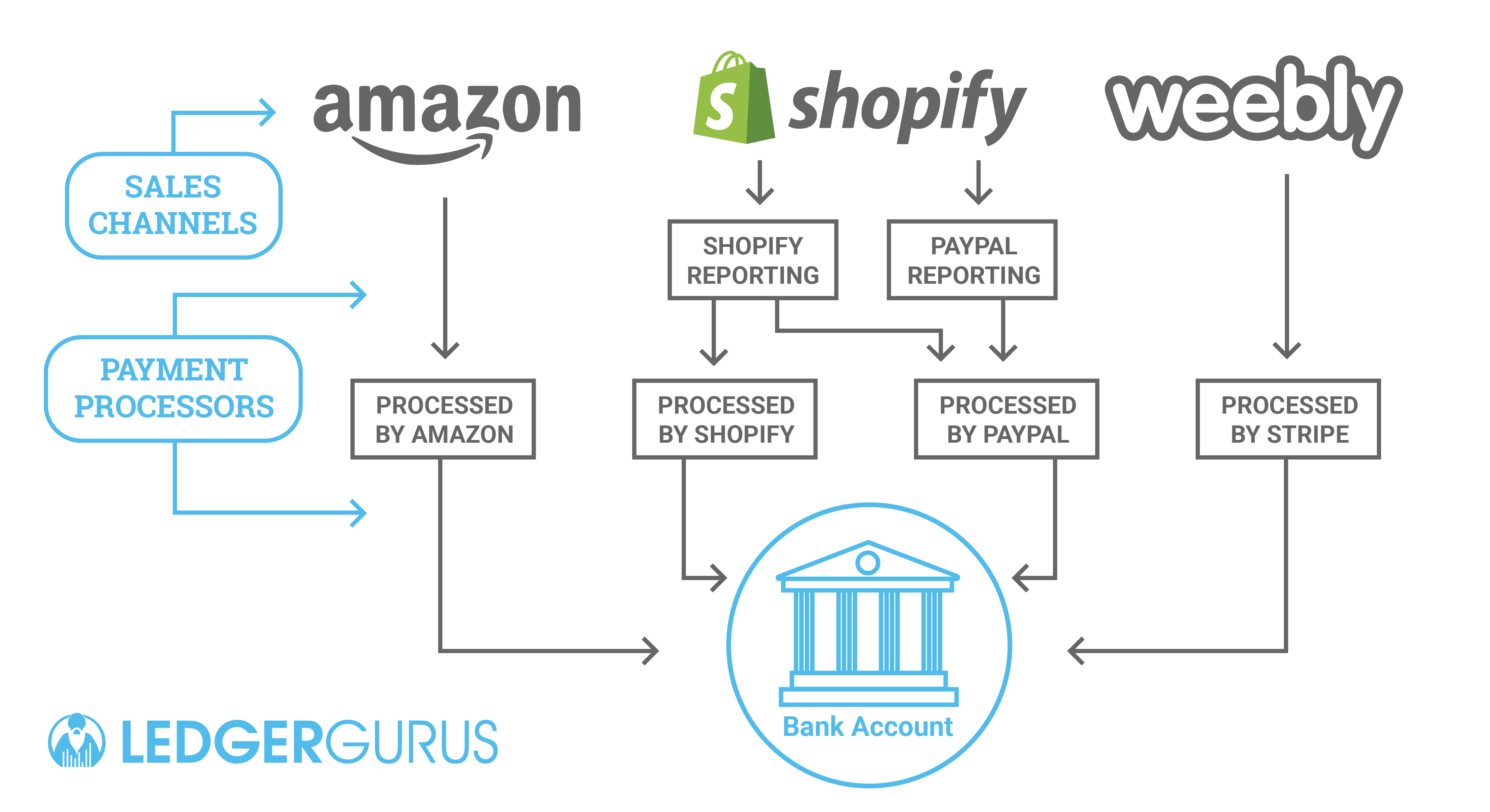

Using charts or mapping out processes is a helpful way to be able to see the relationship between platforms, channels, payment processors and your bank accounts.

Oh the Charts We Will Make

The chart at the top of this blog starts off by showing channel level activities (such as gross sales, discounts, shipping income and any tax liability). This is what the customer sees at the time of checkout. You can run reports on a channel that show info at that level. The deposits going into your bank account will not match the numbers in your reports. That is because there is a lot more that happens before anything hits your account.

Payment processors are also mapped out in this chart. In marketplaces like Amazon, eBay, or Etsy, it’s common that they use their own payment processor. In other words, there is only one step from the sales channel to the payment processor through to the checking account.

However, on Shopify, WooCommerce, BigCommerce, or when someone is using their own website, they have the option of including many payment processors. Their customers can choose from all these options at check out. It’s at the Shopify level that we see the gross sales, discounts, shipping income and tax liabilities. All that data must be split up according to which payment processors were used. In the example chart above, it shows how a company could have two payment processors through Shopify that it processes through before anything hits the bank account.

Oh the Entries We Will Book

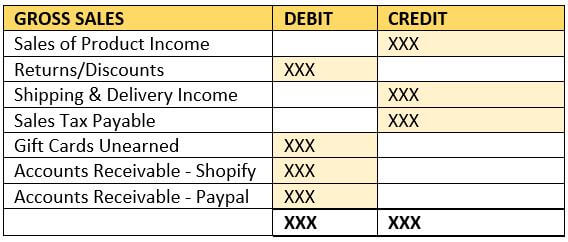

Next, our team at LedgerGurus uses ecommerce best practices to record these processes, as shown in the chart, by making several journal entries.

Channels/Platform Sales Journal Entry

We make the following journal entries when we are recording things like total sales, returns and discounts, shipping and delivery income and sales tax payable. We divide all their sales into which payment processor was used and create a receivable account for that. So, each payment processor has a receivable account linked with it. Therefore, we breakout total sales according to where we expect to see those deposits.

Payment Processor-Level Journal Entry

The next journal entries capture the payment processor-level activity. We will focus on Shopify sales and PayPal sales. At the payment processor level, we record the merchant account fees, returns and discounts, as well as charge backs or uncategorized expenses. We include returns, because if somebody returns something, it returns against their original payment method. The holding account represents whatever Shopify is holding on a company’s behalf. When we actually receive sales, we reverse the holding account.

Oh the Differences We Can Track

The last step is an important one. You need to make sure that your numbers are not off by too much. When we compare the amount of our receivables from payment processors, to the amount listed in the channel level journal entry, it will never match perfectly. This difference is because of the timing of the transactions.

Our LedgerGurus team uses a process to reconcile the payment processors every single month. We compare what we expected to see deposited with what we saw deposited. It is important to track these differences. If the differences are small, then it doesn’t usually require any further action. If the differences are too large, then that is an issue that should be looked into. Tracking these differences can help a company keep more accurate numbers. If there is a difference that is too large, then it makes it possible to correct the issues that led to that difference.

Shopify Bookkeeping

Whether or not Shopify bookkeeping piques your interest, we can help you to correctly track, chart and record your channel activity. Don’t just assume that the numbers you see are correct. This will help you make better and more informed decisions for your business. And the success of a company depends on all of those key decisions that create a foundation for growth.

For more information on how LedgerGurus can help you with your Shopify Bookkeeping click here.