Reconciling bank accounts in QuickBooks Online is a crucial part of maintaining accurate financial records for your business.

But have you ever gone to reconcile your accounts and the numbers just don’t add up? That can be really frustrating, especially if you don’t know how to fix the problem. And it can be time-consuming as you try to figure out what the problem is so you can resolve it.

However, with a bit of patience and attention to detail, you can troubleshoot your bank reconciliations and get your accounts back on track.

In this post, you’ll learn why it is important to reconcile your accounts regularly, as well as 3 ways to identify the problem when things don’t reconcile, as well as how to fix them.

- Why it is important to reconcile accounts monthly

- 3 Steps to troubleshoot bank reconciliations issues

- In conclusion

Let’s get into it.

Key Takeaways

- Reconcile regularly – Match QuickBooks to your bank to catch errors, fraud, and stay on top of cash flow.

-

Check balances first – Wrong starting or ending balances are often the cause of reconciliation issues.

-

Review all transactions – Look closely at debits, fees, and missing entries to find discrepancies.

-

Use QBO tools – Audit logs and filters make it easier to pinpoint problem transactions.

-

Ask for help – QuickBooks Support can guide you if reconciliation issues persist.

Why It is Important to Reconcile Accounts Monthly

The main reason you want to reconcile your accounts is to make sure that what your books say and what your bank says matches.

The objective is to look for any discrepancies between your bank statement and the transactions recorded in QuickBooks Online. When you can troubleshoot your bank reconciliations and get things to match up properly, you get an accurate picture of what is going on. From this you can monitor your cash flow accurately, see when there are irregularities, and even identify if and when theft is going on.

There are several reasons why things might not match up exactly. These might include:

- Transactions that were recorded in QuickBooks but not on your bank statement, or vice versa

- Errors in the transactions recorded in QuickBooks Online, including incorrect dates, amounts, or descriptions

If you have been incorrectly charged, you want to dispute this amount in a timely manner to ensure your account balances are accurate.

3 Steps to Troubleshoot Bank Reconciliations Issues

Here are some steps you can follow to troubleshoot reconciliation issues in QuickBooks Online:

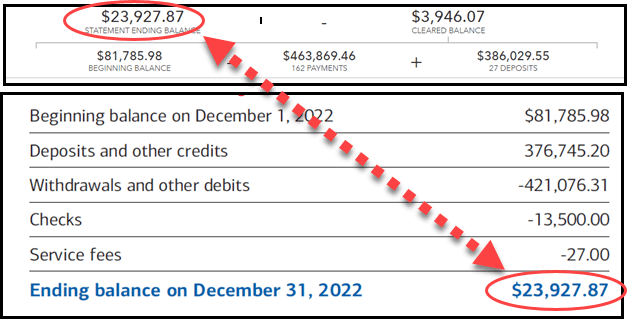

1. Check Your Beginning & Ending Balances

Occasionally an old transaction has been changed. In this case, my beginning balance matches, but if it did not match, I would need to find the discrepancy by following the troubleshooting process below.

When there are errors with your beginning balance, these are the steps you can take to fix them.

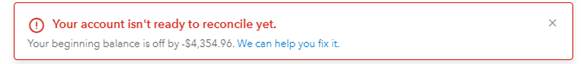

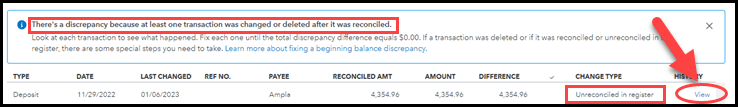

Occasionally when you attempt to reconcile an account you will see the following warning:

Clicking on the blue “We can help you fix it” will allow you to see reconciled transactions that were changed after the prior reconciliation was completed. In this case, it is a bank deposit that was accidentally unreconciled in the bank register. It shows this under the “Change Type” column.

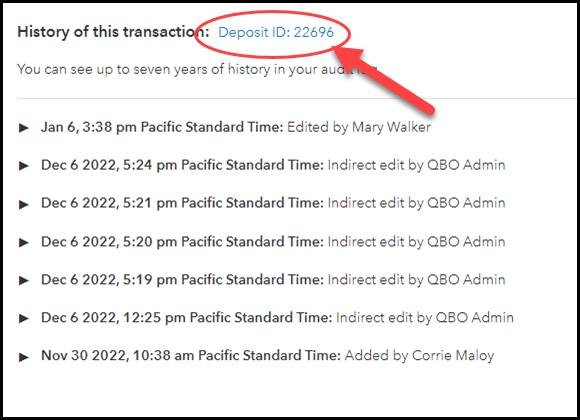

If I click on the blue “View” next to the transaction, I can see a full audit history for this transaction and who made the change.

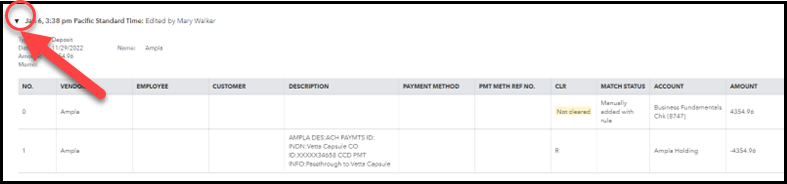

If I click on the blue transaction title “Deposit ID: 22696,” I can view the bank transaction. By clicking on the black arrow on the left side, I can open the audit log to see changes made.

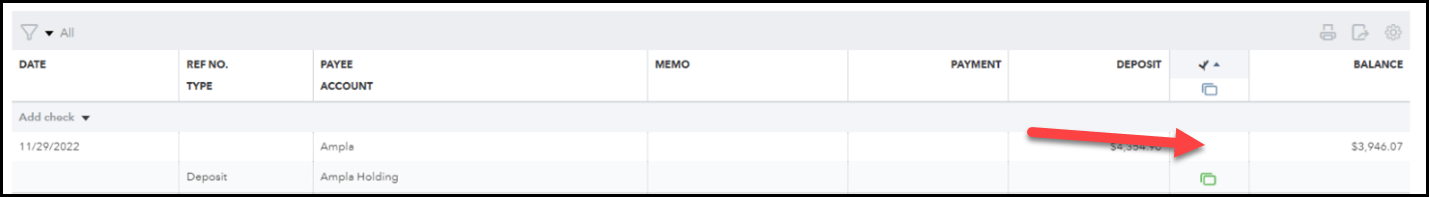

To correct the fact that this transaction was accidentally unreconciled and to mark it as reconciled, go to the Chart of Accounts and view this bank register.

When looking for an unreconciled transaction it is helpful to sort transactions by status using this box in the upper right-hand corner:

I want to click on the arrow until it shows a check mark and arrow facing up. This will move all unreconciled transactions to the top. Transactions listed with a green “C” have cleared the bank and matched banking activity since it was last reconciled.

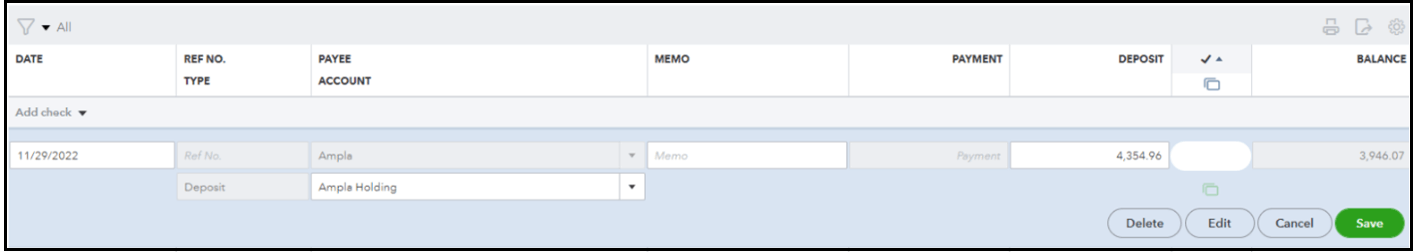

After locating the correct transaction, click on the empty space used to denote reconciliation status. This will open the transaction for editing and look like this:

Click the box twice until it has a “R” and click “Save.”

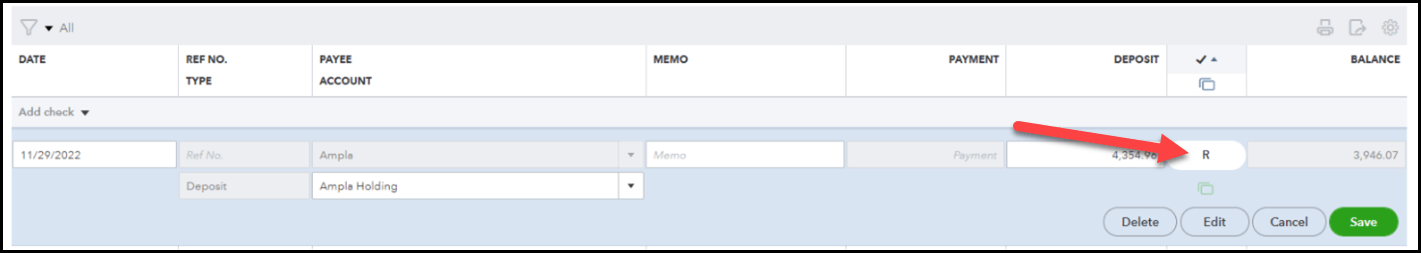

This transaction now looks like this in the register:

![]()

If you have multiple changes affecting your beginning balance, you will address each one using the same method. If a transaction was accidentally marked as reconciled, you will locate the transaction and change the box from “R” to blank and save.

2. Verify That Your Ending Balance and Date are Entered Correctly in QBO (Matching the Bank Statement)

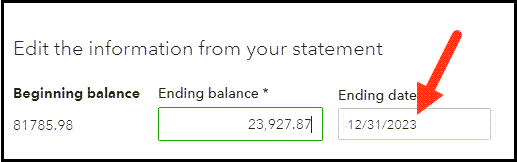

In this case the ending date was entered incorrectly as 2023, instead of 2022.

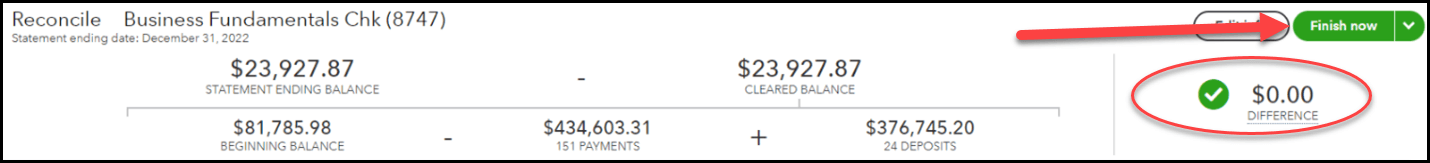

After correcting the closing date, QBO is only including cleared transactions that occurred during this time frame using Cleared Date. Now withdrawals and deposits match and you can click “Finish Now.”

3. Review Each Transaction

So far, we’ve tried to avoid reviewing every single transaction because it can be so time-consuming, but sometimes we NEED to dig in deeper to find the discrepancy.

If you are unable to clearly see what is going on, it may be that QBO is missing transactions. Start with the types of transactions that do not match the bank statement (usually debits) and look into it further.

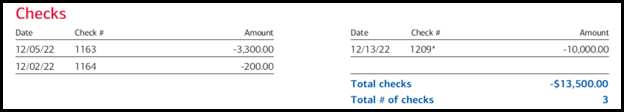

Step 1: If you are missing withdrawals (also called debits), review checks paid out to ensure they were entered in QBO.

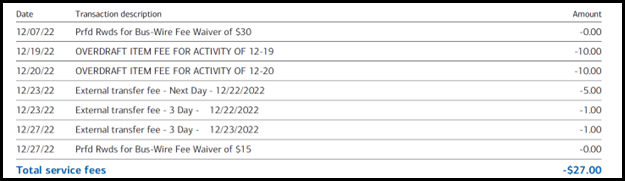

Step 2: Check to see if service fees have been recorded:

Step 3: Search your bank statement for the amount of the difference using “Ctrl + F” or looking through each transaction.

Step 4: If you still have discrepancies after reviewing your account activity and checking for errors, it’s possible that you might have missed recording some transactions. Look for any transactions that are recorded on your bank statement but not in QuickBooks Online. This is usually an incorrect amount, or unrecorded transactions.

You may need to reconcile each transaction individually. This can be time-consuming, but it can help you identify any specific transactions that are causing issues. I prefer to start at the first transaction on the statement and check off corresponding activity in QBO.

4. If You Still Can’t Solve the Problem

If you’re unable to resolve the reconciliation issues on your own, don’t hesitate to reach out to QuickBooks Support for assistance. They can help you troubleshoot the issue and get your accounts back on track.

In Conclusion

By following these steps, you can effectively troubleshoot bank reconciliations issues in QuickBooks Online and get your accounts back on track. Remember to be patient and pay close attention to detail, as this will help you identify and resolve any issues quickly and efficiently.