Should I use accrual accounting or cash accounting for my business?

This is a very common question. You have a business, and you want to know how your business is doing. Oh, and once a year you need to file taxes. You may be struggling right now to decide whether to use cash accounting or accrual accounting. And you may also wonder how complicated it is to switch between cash and accrual accounting.

How to make this decision? And how can you know what is best for your business?

Defining Cash, Accrual and Most Common Users

For the sake of clarity, I’ll say “cash-basis accounting” to mean recording revenue when cash hits the bank account and expenses when cash leaves the bank account. I’ll say “accrual-basis accounting” to mean recording revenue and expenses according to GAAP accounting rules.

Who typically chooses to use strictly cash-basis accounting?

Most likely, brand-new companies that are trying to grow sales and just keep up with expenses. Or else, companies that have run very stably and predictably for years with little change in their structure or sales.

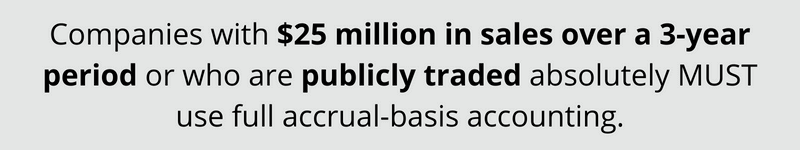

On the other end of the spectrum, who absolutely has to use GAAP accounting?

Companies that make $25 million in sales over a 3-year period or who are publicly traded absolutely must use full accrual-basis accounting.

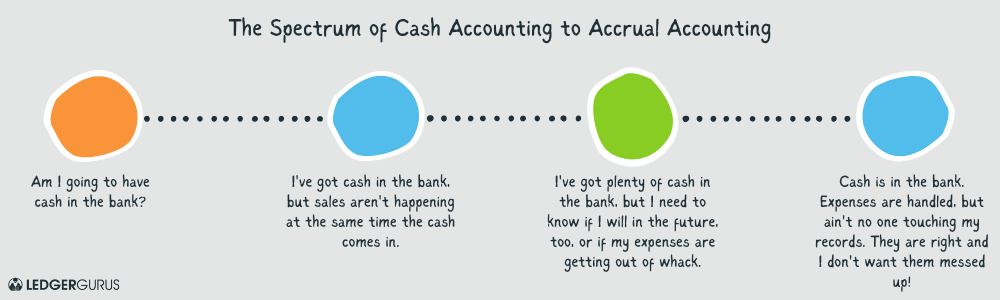

Cash to Accrual Is Actually A Spectrum

The reality for most companies, however, is that they use a combination of both cash and accrual. And most companies—including yours—will likely move along the spectrum from cash to accrual accounting as the company matures and grows.

So, that begs the questions:

- What does the spectrum between cash-basis and accrual-basis accounting look like?

- What pain points will push a company to incorporate more and more accrual processes?

- How will you know when your company needs to start using more accrual accounting principles?

Here’s a quick way to look at it.

And, to illustrate how a company can move through the spectrum, we’ll use a fictional company, “Bathtime Ducky Co,” as an example.

First Stop: Cash is King

Start-ups

Companies in start-up phase almost overwhelmingly choose to track their finances on a cash basis. They may have little revenue, or no revenue at all. Frankly, they’re mostly concerned with making sure they can keep enough cash in the bank to pay bills as they come along.

As such, the number that start-ups pay most attention to is their bank account balance. They are not usually ready to track financial data at a more complex level. Also, the IRS is perfectly satisfied with these companies filing their taxes on a cash basis. So, as long as the start-up company tracks how much it sells and spends each year, the company’s main needs are fully met by cash basis accounting.

Brand-new startup “Bathtime Ducky Co” launched its first few products in March of 20X1 on eCommerce platforms. The company hoped its product would gain popularity before the Christmas selling season, but soon found that their first months of sales just barely covered advertising costs. While Bathtime Ducky Co wanted to spend time each month reviewing their profit and loss statements, they instead had to focus all their time on increasing sales so that they could even survive until Christmas. So the owners settled on just keeping an eye on the bank account balance and sometimes even contributing personal funds to the company so they could stay afloat.

Mature companies with no seasonal variation

Other companies may find that they have been perfectly comfortable with a 100% cash model year after year. These companies, like “D’oh! Doughnuts” may find that they have very little seasonality. They get paid 100% cash up front for their product, and they pay cash 100% up front for their supplies and materials. Because very little changes week after week, they don’t have to plan for higher cash needs in some periods of the year.

Also, because they always collect cash up front, they always know how much they have on hand to buy doughnut ingredients and pay their other expenses. During periods of inflation they may see that prices of ingredients, costs of labor, and costs of rent are rising, and they may have to therefore raise the prices on their doughnuts. But otherwise, very little changes month to month.

Next Stop: Timing Differences for Revenue and COGS

Now, what happens to a company that has uneven sales throughout the year due to seasonality? Or when the company pays for supplies in one month, though their products or supplies get used for several months?

While stable, unchanging companies like D’oh! Doughnuts may have their needs filled by cash basis, companies that are growing or maturing may decide it’s time to start moving away from purely cash. Some of the following could be pain points that cash accounting doesn’t help with:

- Companies sell on eCommerce platforms and want to show gross revenue, not just revenue net of fees.

- Companies who preorder and pay for new products, to receive the product several months later

- Customers who receive product and then don’t pay for several weeks.

- Inventory orders that come in all that once, though the inventory is sold for several months afterwards

Companies experiencing these pain points may start choosing to record their revenue on an accrual basis, and then simultaneously or afterwards, their COGS, even if they record everything else on cash basis. Companies will begin feeling that cash-basis accounting isn’t showing them the full picture of their sales, and so the most natural first step of better accounting is recording their sales on an accrual basis.

Bathtime Ducky Co’s Revenue Challenges

So, if Bathtime Ducky Co gets to 20X2 and has increased its sales enough to break even, then it may decide to start recording gross sales and gross expenses for ecommerce. The company may also start selling wholesale, which means needing to collect cash payments from clients who get credit and payment terms.

Recording revenue on an accrual basis will help Bathtime Ducky Co have a better feel for the periods when their sales are actually happening, regardless of when the cash payments are coming in. In 20X3, they may start tracking their COGS on an accrual basis too, so they can have a more accurate picture of how much their sales are actually costing to produce, regardless of when the cash for inventory exits the company bank account.

Further Along: Uneven Administrative Expenses

After a company begins tracking revenue and COGS on an accrual basis, the company may struggle to track its profitability accurately. This would most likely be due to administrative expenses still being recorded on a cash basis. Annual software renewals or other prepaid expense amounts may get paid out in large amounts one month, and then have no comparable expense for several more months.

Getting financial information that is comparable from one month to the next will be very difficult in this case. From a cash-planning perspective, management will have difficulty deciding what its monthly sales targets are. This is especially true since management doesn’t know how much its monthly company expenses will end up being.

The company’s next move, then, will be to move further along the spectrum from cash to accrual by recording prepaid expense and accrued expenses. This entails recording expenses in the period they’re being enjoyed, regardless of whether they are paid for upfront or afterward.

Bathtime Ducky’s Software Challenges

Bathtime Ducky Co manages to continue growing its business in 20X4. Management team feels that its revenue and COGS are being recorded in the proper period, and wants to record its software subscription expenses on a monthly basis to spread them over the length of the subscription, rather than recording a cash amount once an item is delivered.

Home Stretch: Full GAAP Compliance

Once a company is recording revenue, COGS, and most (or all) administrative expenses on an accrual basis, the company may find that it has investors or debtholders who now want financial statements, and who also make the company promise to comply fully with GAAP.

At that point, in order to fulfil these requirements from external lenders or equity partners, the company may find that it has finally arrived at the need for full and complete GAAP. It will move to implement any GAAP training or processes that weren’t yet being maintained, and may also need to hire an accounting firm for a review or audit of its financial statements. Similarly, the company may find it has reached the thresholds we reviewed originally: Companies who makes $25 million in sales over a 3-year period or who are publicly traded absolutely must use full accrual-basis accounting.

Bathtime Ducky Co on the Stock Exchange

If after rapid growth and expansion, Bathtime Ducky Co finds itself preparing for an initial public offering of stock, it will have likely worked to quickly prepare for GAAP accounting in its fullness and will then focus on improving the presentation of the financial statements to be at the level that is needed.

Summary

To recap, then, most companies do not use strictly cash accounting or strictly accrual accounting, but actually fall on a sliding scale from cash toward accrual. Those movements along the spectrum will usually be triggered by the company’s need for more accurate information or more rigorous reporting standards.

For a complete list of best practices for ecommerce accounting, along with what phases to pay attention to them in, download our Essential eCommerce Bookkeeping Checklist.

If you are interested in full-service accounting services, let us know. We’re happy to help!