It’s a question you may have asked yourself many times… Where’s the money going?

Understanding the in’s and out’s of where the money is going–the cash flow–is a common challenge among business owners. Why? Well simply put, most people just don’t get excited staring at numbers on a screen (except for the number nerds, like us) and often neglect evaluating their cash flow.

Looking at the financials of a business can feel confusing and downright overwhelming. How much cash will I have next month? Can I afford to invest in more inventory, a new warehouse manager, or additional marketing? Where’s the money really going?

As accounting experts (and self proclaimed number nerds), we know the power of being literate in the language of accounting. It’s a vitally important skill for business owners in making financially sound and profitable decisions.

A business owner who can foresee a cash dip in six months has a lot more financial options than one who realizes the truth two weeks out. Knowledge IS power. And we want to empower you to understand your eCommerce Cash Flow Statement.

So, let’s start with the basics. In this article you’ll learn:

- Cash flow 101

- Why use an ecommerce cash flow statement?

- Two main options for creating your ecommerce cash flow statement

- Benefits of a healthy cash flow

Let’s get into it.

Key Takeaways

Key Takeaways

- Cash Flow Defined – Cash flow is the net amount of cash moving in and out of a business over a specific period.

- Three Types of Cash Flow – Operating, Investing and Financing.

- The Cash Flow Cycle in Ecommerce

- Importance of the Cash Flow Statement

- Two Methods to Create a Cash Flow Statement

- Benefits of Healthy Cash Flow

- Financial Literacy is Power

Cash Flow 101

In its simplest terms, cash flow equates to the net amount of cash going in and out of your business during a specific time (e.g., year). There are three types of cash flow:

- Operating – cash flow as a result of your business activities (e.g., buying and selling product, overhead, payroll, marketing).

- Investing – cash flow as a result of buying and selling your business assets (e.g., a warehouse, machinery).

- Financing – cash flow that comes from partners, investors, or outside lenders (e.g., loans, equity contributions).

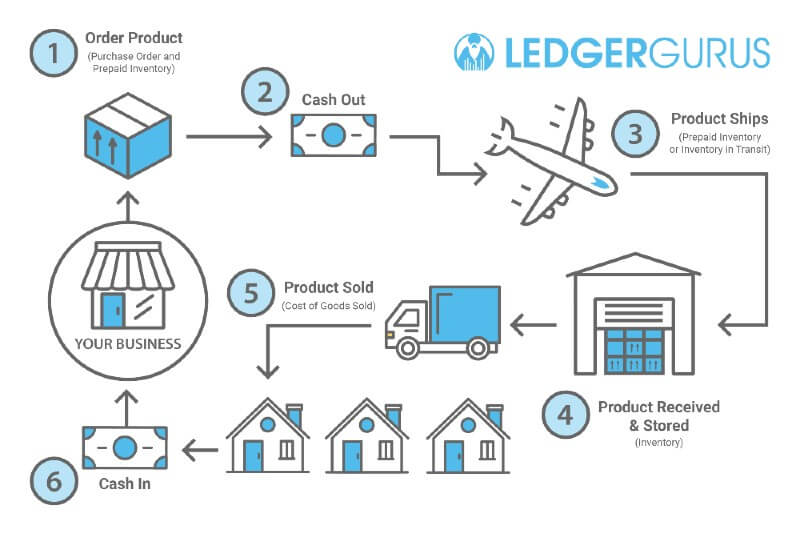

The movement of cash can be broken down into what’s called the cash flow cycle, which is one of the most important things an eCommerce business owner can learn to survive. This is what it looks like:

- Order and purchase product → CASH OUT

- Product shipped, received, and stored

- Product sold → CASH IN

We also have this handy visual which shows the cycle:

Knowing it can take months for this cycle to complete, it becomes really important to plan strategically for the anticipated cash dips and increases. This is where an eCommerce Cash Flow Statement can become your best friend.

The Cash Flow Statement is a financial statement built with information from both your Profit and Loss Statement and Balance Sheet. It essentially shows the movement of cash money within your business.

Why use an Ecommerce Cash Flow Statement?

Understanding the fluctuation of cash is essential to ensuring you can complete your cash flow cycle and stay profitable. Your statement gives you visibility into where the money is really coming and going. It gives you what we call operational integrity, which is making sure the operational activities of your business are cash positive (as opposed to cash negative) so you don’t have to rely on outside sources of cash to stay afloat.

Especially for eCommerce business owners, your Cash Flow Statement is a fundamental tool to knowing when to purchase new inventory. Just like Goldilocks, you don’t want too much or too little inventory. You want to hit the mark just right to save costs and maximize profit. And timing is key. For example, seeing the statement can help you determine when is the best time to reorder product for anticipated big sales seasons, like Christmas.

(On the topic of inventory specifically, be sure to check out our 10-minute video How to Calculate and Optimize Inventory Turnover where we explain the metrics of managing your inventory.)

Two Main Options for Creating Your Ecommerce Cash Flow Statement

In the accounting world, there are two main types of cash flow statements:

- Direct Method: This method looks at the cash that is brought in by sales and the cash that is paid out for expenses.

- Indirect Method: This method looks at net income first and then adds or subtracts all the cash impact from different operating activities (e.g., depreciation, accounts receivable, inventory, supplies, wages, taxes, etc.).

While the Direct Method is conceptually easier to understand, it can be more challenging to implement depending on how complex your systems are for tracking sales and expense data. For this reason, we recommend focusing on the Indirect Method as 1) this is the default structure used in QuickBooks and 2) it shows all the pieces for evaluating your net income which is another vital data point for making sound business decisions.

Benefits of a Healthy Cash Flow

If it’s still a little murky why you need to have an eCommerce Cash Flow Statement, let’s list a couple more reasons:

1. Healthy Cash Flow = Less Stress

Are you saying, “Well, duh!” Good! We know you know this, but it’s important to point out. Constant stress can kill a business! Negative cash flow can turn you into a business Sisyphus–ever rolling the stone uphill and yet never reaching the summit to profitability. In comparison, positive cash flow will feel like the stone is rolling downhill effortlessly. Here’s the deal, when you know where the money is coming and going, you are positioning yourself with the knowledge to make better, more profitable business decisions. Confidence and predictability are great counterweights to money stress.

2. Healthy Cash Flow = Increased Opportunities

When you’re looking to expand your business, you have to know your cash flow. Positive cash flow opens opportunities to invest in more inventory or infrastructure, engage in new partnerships, or ramp up your marketing. Perhaps you’ve kept these decisions on the backburner for a while because the cash simply is not there to expand? If that’s you, then take the Cash Flow Statement as your next step. Remember, this information will make you a better business owner and is one of the most powerful tools to leading a successful business!

Being a Number Nerd is Cool… and Profitable!

Hopefully, our breakdown of the cash flow basics has you thinking about your own cash flow position. Is it strong? Where can improvements be made? Are you operating from positive or negative cash flow?

Thinking about the big picture and seeing what’s really going on money-wise in your business is the first step to establishing a healthy cash flow and thriving business.

We know not everyone is a number nerd like us, but we also know there is untapped power in understanding your financial statements. Your numbers, at the end of the day, will make or break your business. And rather than dreading the work of getting number-savvy, we hope you can see now how your financial statements are your secret weapon to growing your business and taking it to the next level!

Want help getting your Ecommerce Cash Flow statement started? Reach out to us.