Estimated reading time: 12 minutes

Are you tired of unexpected costs eating into your profits? Understanding landed cost is essential for ecommerce businesses to manage expenses and make informed decisions. In this blog post, we’ll explore the components of landed cost, methods for calculating it, and strategies to reduce these costs, ultimately improving your bottom line. Let’s dive in!

Key Takeaways

- Understand landed cost to make informed decisions about pricing, sourcing and shipping.

- Calculate accurate costs with spreadsheets, software tools or manual calculations.

- Optimize supply chains, negotiate better rates and leverage technology for reduced landed costs.

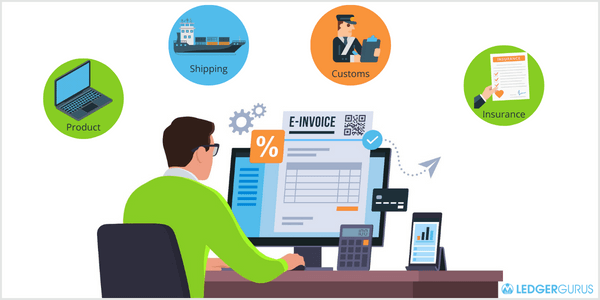

Defining Landed Cost: Key Components

The total cost of a product from its source to the buyer’s location is called “landed cost” and involves multiple factors. Such costs include:

- Pricing

- Shipping charges

- Any customs duty applicable

- Insurance coverage

- Overhead expenses incurred between these operations

Examining all these elements is necessary for managing spending and making informed business decisions. This is something we talk about a lot as an ecommerce accounting firm. When you are tracking your numbers accurately, you can do detailed expense tracking and profit margin analysis, which directly impacts your ability to make informed decisions.

By breaking down landed costs, businesses can meticulously track each expense involved in the procurement process. Also, since gross profit margin is the single most important metric in an ecommerce business, it’s super important to have what you need to calculate it correctly.

Gaining an understanding of each component will help you understand landed costs thoroughly. This includes analyzing price levels along with necessary taxes or fees like custom tariffs associated with transporting goods across borders. Exploring other possible overheads related to these costs also plays a part in assessing this information accurately.

To illustrate this, we’re going to follow a product shipment for a fictional company called Electra’s Electronics to see how the costs add up. The shipment will go from the supplier in China to the company’s warehouse in the US.

Product Cost

Product cost consists of elements such as raw materials, manufacturing fees, and labor costs. It is also commonly called buy costs or production costs.

For our fictitious company, Electra’s Electronics, product costs start to accrue when they order 100 units of an electronic gadget from a supplier in China. The gadgets have been manufactured and packaged, ready for the trip to the US. The gadgets cost $100 each, for a total of $10,000. That is the initial buy cost, which is the beginning of the total landed cost.

To lower this cost, you can streamline procedures while at the same time sourcing more affordable supplies. For example, optimizing production processes to reduce waste if you manufacture, finding suppliers that offer competitive prices for needed raw goods, or creating strong collaborations with vendors may help cut down product expenses drastically.

Electra’s Electronics could lower their costs by finding a supplier that sells the items for a lower price or by buying in greater numbers, so they get a discount.

Keeping track of and controlling product costs is very important because it affects your profit margins significantly. Being cognizant about how much your products actually cost will empower you to set appropriate pricing levels for them, manage a more successful supply chain operation efficiently from beginning to end – including efficient shipping strategies —and make decisions based on solid facts when considering sources for obtaining inventory items, among other things.

Shipping Costs

Shipping costs, also known as shipping expenses, are a crucial part of the final cost and will vary according to carriers, weight and distance. The transportation-related payments include handling fees and freight charges.

Electra’s Electronics’ shipping costs start when the products are shipped to the nearest shipping port in China. We’re going to say it costs about $500 to ship all 100 gadgets to the port. The shipment goes through customs (we’ll talk about the costs for that in a minute), and then is put on a boat to the US. The international shipping cost adds another $2000 in costs.

Once it gets to the US and racks up another round of customs fees (we’ll get back to this), it’s put on a truck and sent to the company’s 3PL warehouse. This adds another $1000 to shipping costs. After the product is sold, it’s time to ship it to the final customer, adding another round of shipping costs. We’ll say it costs $10 per unit. We’ll add all this together in a minute and show you how to break it down into landed cost per unit.

Shipping costs can be reduced by negotiating better terms with delivery companies or seeking partnerships with 3PL providers (third-party logistics). Such collaborations usually prove more affordable since these firms have close relationships established with various shipping lines allowing them to offer discounted rates while they take care of every aspect of the shipping to customers process so you’re free to manage other parts of your business.

Customs Fees

The fees associated with international shipping, such as tariffs and taxes, can have a major impact on the total landed costs for your products.

Electra’s Electronics was hit with some hefty customs fees on both sides of the ocean. The origin country’s port charged $1000, and the destination country’s port added another $3000 in customs fees.

To reduce customs fees and stay ahead of competition in this area, it is important to keep up with changes to regulations about harbor charges and other related expenses. An effective strategy when importing from multiple countries could be partnering with an experienced 3PL provider offering fulfillment centers located strategically around the world, resulting in fewer transportation distances, hence reduced cost impacts like duties or levies. By finding ways to minimize all kinds of customs fees, you not only save money but also retain that much-needed competitive edge in the market.

Insurance Costs

When calculating landed costs, insurance is an essential component of the equation. Shipping insurance covers goods during transportation and may depend on a variety of aspects such as type or value, method of shipping utilized, etc.

Electra’s Electronics wisely purchased shipping insurance for their order. It came to $300.

Knowing how to compare various types like self-insurance policies versus cargo coverage enables companies to reduce their associated expenses.

By evaluating different alternatives for insuring your shipments wisely and selecting the right one that meets your needs can protect goods in transit while simultaneously achieving cost savings. Avoiding potential losses caused by damaged or lost items when being delivered from point A to point B reliably helps you remain profitable long term!

We have a great video about how to calculate COGS accurately to create a product cost formula.

Calculating Landed Cost: Methods and Best Practices

When it comes to calculating landed cost, there are a variety of methods available. These include using spreadsheets, software tools or manual calculations, each with its own benefits and drawbacks.

Using Spreadsheets

When it comes to calculating landed costs, spreadsheets can be an effective tool. They can also take time and have the potential for errors. To get optimal results from spreadsheet calculations, you should clarify components of cost, obtain precise data, and employ formulas accurately. Examine the validity of information provided regularly and update your spreadsheet frequently in order to make certain expenses are calculated correctly.

If you’re managing your inventory with Excel or Google Sheets, we have a free Inventory and COGS template. Besides sections for quantity reconciliation, COGS computation, and physical inventory valuation, it has a product cost catalog section where you can input all of your landed costs to come up with a cost per item.

When businesses expand and become more complicated, though, these sheet-based tools might not suffice anymore. In such situations specialized inventory management software will give better precision, while saving time spent on computations to arrive at your landed cost numbers.

Software Tools

Inventory management systems help businesses compute landed costs, increasing accuracy while at the same time saving time. Finale Inventory, Cin7 Core, and Katana are a few examples of leading inventory management software solutions.

It is essential that you assess features, ease of use and integration with existing systems when determining which tool will best suit your business needs. This way better decisions about sourcing material may be made, along with more confidence in shipping & pricing matters.

For more information, read The Top 10 Benefits of an Inventory Management Software.

Landed Cost Formula and Calculation Example

As we’ve said, to calculate an item’s total cost, the landed cost formula is composed of various components such as product costs, shipping fees, customs charges, insurance payments and overhead expenses.

All these are taken into account to give a more complete picture regarding its pricing – enabling better judgment when it comes to picking sources for supply or setting up prices accordingly. This landed cost equation enables companies to get an accurate estimate on their ultimate price so that they can make informed choices about sourcing and associated arrangements.

Calculation Example

To illustrate this, let’s gather up all those costs that Electra’s Electronics incurred.

- Product costs: $10,000 for 100 units ($100 each)

- Shipping costs:

- Shipping to the port: $500

- International shipping: $2000

- Shipping to the warehouse: $1000

- Customs fees, tariffs, and taxes:

- Origin country: $1000

- Destination country: $3000

- Insurance costs: $300

If you add all of that together, you get $17,800. Divide that by 100 (the number of units) to get $178 per unit in landed costs.

Now Electra’s Electronics knows what their actual landed costs are. This will assist them significantly when making decisions such as pricing or supply chain logistics, allowing for higher profits all around.

Strategies for Reducing Landed Costs

Reducing the expense of landed costs is a must for staying profitable and viable in business. To bring down your total cost, you should optimize your supply chain, negotiate advantageous deals with vendors and use technology to its full potential.

We will look into these approaches shortly.

Supply Chain Optimization

Optimizing your entire supply chain can bring down costs and increase efficiency. This includes improving cooperation with suppliers to reach better pricing, streamlining processes for cost-efficiency, as well as finding inexpensive transportation and storage solutions.

By establishing a good relationship between yourself and the supplier, you could attain discounts which would in turn lead to savings across the whole supply chain.

Negotiating Better Rates

Cost savings can be achieved by negotiating with carriers, suppliers and other service providers for more favorable prices. By building strong relationships based on things such as the length of contract and amount being purchased, it is possible to secure better rates that result in lower landed costs.

It’s important to research your options, comprehend where both parties stand when entering negotiations and remain open-minded, so you stay competitive while continuing business success long term.

Leveraging Technology

By leveraging technology, companies can enhance the accuracy of their landed cost calculations. This helps pinpoint areas where costs may be cut down for greater efficiency while eliminating manual errors that lead to less profitability.

Inventory management systems, visibility platforms, shipping optimization solutions, these all come in handy when trying to reduce expenses related to landed costs. By applying technology appropriately, you are able to make well-informed decisions regarding operations, thus improving your business’s financial standing in the long run.

Summary

It is only possible to make wise decisions for an ecommerce business by understanding landed cost and its components. Strategies like optimizing supply chain, bargaining better deals, and utilizing technology can help reduce these costs significantly. This will give a competitive edge in the market while boosting profitability.

Frequently Asked Questions

How do I calculate landed cost?

To figure out the total landed cost per unit, simply add together product costs, shipping rates, any applicable customs fees and duties imposed on imports or exports. Risk insurance premiums as well as overhead expenses. As an example, $20 (product) + $2 (shipping per item)+$.40(duties)+$10.40(insurance)+$2 processing fee=$34.80 would be your final calculation of a single unit’s Landed Cost.

Who pays for landed cost?

The total cost for a shipment to be delivered right up to the customer’s doorstep is covered by the retailer. This price, known as landed cost, consists of all components.

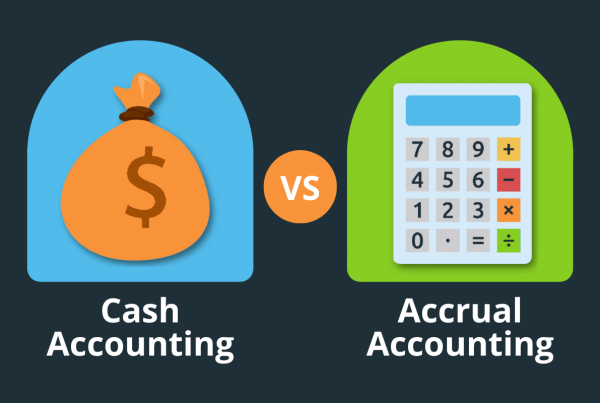

What is the difference between standard cost and landed cost?

Standard cost includes the cost of materials, labor, and overhead, but does not account for freight and other expenses incurred with landing the product.

In contrast, landed cost takes into account these additional costs to give a total cost of a product or shipment when it arrives at the buyer’s doorstep.

Does landed cost include cogs?

The landed cost includes all direct costs necessary for the manufacture or purchase of a product, as well as extra shipping and inventory storage fees. COGS is thus included in this overall expense calculation.

What are the key components of landed cost?

In order to determine the total cost, all aspects of landed costs need to be factored in. This includes product costs, shipping expenses, customs duties and charges insurance expenditures as well as overhead charges.