Estimated reading time: 16 minutes

You probably have lots of questions about the Employee Retention Credit, such as:

- “Should I apply for the Employee Retention Credit or not?”

- “Why am I being inundated with marketing on this?”

- “Who should I work with?”

After receiving a call from a customer on this topic, I wanted to cut through the noise and provide an objective perspective on this topic. My goal is to help business owners make decisions on this “free money”.

This article is a beast and the main points I want you to leave with are:

- What is the Employee Retention Credit?

- How the Employee Retention Credit is calculated

- How to determine eligibility (it can be complicated)

- Considerations in choosing a partner to help with this credit (who to work with)

If you choose to read this whole article – gold star for you! If you’d rather skip to the various sections, the points above are linked to them.

What is the Employee Retention Credit?

The Employee Retention Credit (ERC) is a tax credit that was created by the CARES Act in March 2020 to help businesses retain their employees during the COVID-19 pandemic. The ERC is a refundable tax credit that is available to eligible employers who experienced a significant decline in gross sales or were fully or partially suspended due to a government order related to COVID-19.

How is the Employee Retention Credit Calculated?

The ERC is calculated as a percentage of qualified wages paid to eligible employees.

For qualified wages paid between March 13, 2020, and December 31, 2020, the credit is equal to 50% of the qualified wages, up to a maximum credit of $5,000 per employee.

For qualified wages paid between January 1, 2021 and September 30, 2021, the credit is equal to 70% of the qualified wages, up to a maximum credit of $7,000 per employee per quarter and up to $21,000 for the entire year.

Combined, a business could be eligible for up to $26,000 per employee for the applicable time periods in 2020 and 2021. That’s a lot of money you can get back, and thus the rise of an industry dedicated to this credit.

Who is Eligible for the Employee Retention Credit?

This is a very important question to consider before pursuing the credit. Eligible employers can claim the Employee Retention Credit (ERC) if they meet one of two criteria:

- An employer experienced a significant decline in gross receipts due to COVID-19.

- The employer’s business was fully or partially suspended by a government order due to COVID-19.

Let’s dive deeper into each of these.

Significant Decline in Gross Receipts

If you’re like me, you’re wondering what gross receipts are. No, they are not moldy, food covered receipts from your business lunch. Gross receipts are a total of income from sales, interest, dividends, rents, royalties using your tax accounting method (cash or accrual). For an expanded description, refer to this FAQ answer from top 30 accounting firm, Cherry Bekaert. Simplifying this, it is essentially all the money you earned during a quarter.

Qualifications for 2020

A business must have experienced a gross receipts decline of 50 percent in the applicable quarter in 2020 versus the same quarter in 2019.

Let’s do a quick example:

- Your business made $500,000 in gross receipts in Q2 2019

- Your business made $200,000 in gross receipts in Q2 2020

- Your business had a 60% decline in gross receipts and is eligible for the ERC for Q2 2020

Qualifications for 2021

A business must have experienced a gross receipts decline of 20 percent in the applicable quarter in 2021 versus the same quarter in 2019. Note that the comparison again is for 2019.

Let’s do a quick example:

- Your business made $500,000 in gross receipts in Q2 2019.

- Your business made $350,000 in gross receipts in Q2 2021.

- Your business had a 30% decline in gross receipts and is eligible for the ERC for Q2 2021.

Is your mind starting to go numb? That’s why you’re getting all the calls.

Full or Partial Suspension Due to Government Orders Related to COVID-19

READ THIS! The biggest gray area of this tax credit is the eligibility provision around full or partial suspension. If you talk to 10 different experts, you will likely get 10 different answers.

Take a look at the guidance from the IRS Guidance on the Employee Retention Credit under Section 2301 of the Coronavirus Aid, Relief, and Economic Security Act Notice 2021-20 to see how this can be difficult to determine:

Supplier Impact from Government Orders (page 28):

“Question 12: If a governmental order causes the suppliers to a business to suspend their operations, is the business considered to have a suspension of operations due to a governmental order?

Answer 12: An employer may be considered to have a full or partial suspension of operations due to a governmental order if, under the facts and circumstances, the business’s suppliers are unable to make deliveries of critical goods or materials due to a governmental order that causes the supplier to suspend its operations. If the facts and circumstances indicate that the business’s operations are fully or partially suspended as a result of the inability to obtain critical goods or materials from its suppliers because they were required to suspend operations, then the business would be considered an eligible employer for calendar quarters during which its operations are fully or partially suspended and may be eligible to receive the employee retention credit.

Example:

Employer A operates an auto parts manufacturing business. Employer A’s supplier of raw materials is required to fully suspend its operations due to a governmental order. Employer A is unable to procure these raw materials from an alternate supplier. As a consequence of the suspension of Employer A’s supplier, Employer A is not able to perform its operations for a period of time. Under these facts and circumstances, Employer A would be considered an eligible employer during this period because its operations have been suspended due to the governmental order that suspended operations of its supplier.”

TRANSLATION: If your suppliers couldn’t provide you with what was needed to do business, you would be considered impacted.

The Impact of Customers Staying Home Due to Government Orders (page 29):

“Question 13: If a governmental order causes the customers of a business to stay at home, or otherwise causes a reduction in demand for its products or services, and the business responds to the lack of demand by suspending some or all of its operations, is the business considered to have a suspension of operations due to a governmental order?

Answer 13: No. An employer that suspends some or all of its operations because its customers are subject to a government order requiring them to stay at home or otherwise causing a reduction in demand for its products or services is not considered to have a full or partial suspension of its operations due to a governmental order. If an employer’s operations are not suspended due to a governmental order but the employer experiences a reduction in demand, the employer may be considered an eligible employer if it experiences a significant decline in gross receipts.

Example:

Employer B, an automobile repair service business, is an essential business and is not required to close its locations or suspend its operations. Due to a governmental order that limits travel and requires members of the community to stay at home except for certain essential travel, such as going to the grocery store, Employer B’s business has declined significantly. Employer B suspends its operations due to the lack of demand. Employer B is not considered to have a full or partial suspension of operations due to a governmental order.”

TRANSLATION: Customers staying home due to government orders doesn’t determine a business to be impacted. Use the revenue reduction method to qualify.

The Transition of a Business to Work From Home (page 30):

“Question 15: If a governmental order requires an employer to close its workplace, but the employer is able to continue operations comparable to its operations prior to the closure by requiring employees to telework, is the employer considered to have a suspension of operations?

Answer 15: No. If an employer’s workplace is closed by a governmental order, but the employer is able to continue operations comparable to its operations prior to the closure, including by requiring its employees to telework, the employer’s operations are not considered to have been fully or partially suspended as a consequence of a governmental order. However, if the closure of the workplace causes the employer to suspend business operations for certain purposes, but not others, it may be considered to have a partial suspension of operations due to the governmental order.

Example 1:

Employer C, a software development company, maintains an office in a city where the mayor has ordered that only essential businesses may operate. Employer C’s business is not essential under the mayor’s order, and therefore Employer C is required to close its office. Prior to the governmental order, all employees at the company teleworked once or twice per week, and business meetings were held at various locations. Following the governmental order, the company ordered mandatory telework for all employees and limited client meetings to telephone or video conferences. Employer C’s business operations are not considered to be fully or partially suspended due to the governmental order because the employer is able to continue its business operations in a comparable manner.

Example 2:

Employer D operates a physical therapy facility in a city where the mayor has ordered that only essential businesses may operate. Employer D’s business is not considered essential under the mayor’s order, and therefore Employer D is required to close its workplace. Prior to the governmental order, none of Employer D’s employees provided services through telework and all appointments, administration, and other duties were carried out at Employer D’s workplace. Following the governmental order, Employer D moves to an online format and is able to serve some 32 clients remotely, but employees cannot access specific equipment or tools that they typically use in therapy and not all clients can be served remotely. Employer D’s business operations are considered to be partially suspended due to the governmental order because Employer D’s workplace, including access to physical therapy equipment, is central to its operations, and the business operations cannot continue in a comparable manner.

Example 3:

Employer E, a scientific research company with facilities in a state in which the governor has ordered that only essential businesses may operate, conducts research in a laboratory setting and through the use of computer modeling. Employer E’s business is not essential under the governor’s order, and therefore Employer E is required to close its workplace. Prior to the governmental order, Employer E’s laboratory-based research operations could not be conducted remotely (other than certain related administrative tasks) and employees involved in laboratory-based research worked on-site. Employer E’s computer modeling research operations could be conducted remotely, and employees who engaged in this portion of the business often teleworked. Following the governmental order, the employees engaged in the laboratory-based research cannot perform their work while the facility is closed and are limited to performing administrative tasks during the closure. In contrast, all employees engaged in computer modeling research are directed to telework, and those business operations are able to continue in a comparable manner. Employer E’s business operations are considered to be partially suspended due to the governmental order 33 because Employer E’s laboratory-based research business operations cannot continue in a comparable manner.”

TRANSLATION: Moving to a remote work model when an office is shut down may or may not qualify.

These are just a few examples. As you can see, it can be complex to determine if your business was impacted. Determining if your business qualifies can result in a lot of money for you and those helping you. Let the marketing begin!

Why is There So Much Employee Retention Credit Marketing?

If you’re a business owner like me, you’re being inundated with outreach for the ERC. Daily emails, phone calls, and a myriad of advertisements. It’s coming from EVERYWHERE!

If you do the math, you can see there is a lot of money at stake and lots of businesses that want a piece of that enormous credit.

We have seen reputable tax credit companies charge 30% of the credit up front to calculate and file for the credit. And the refund can take months to receive! With the amount that is being charged, there is a lot of cash available for marketing. The key is to work with the right company. Now, how to decide who to work with.

Who Should I Work with to Receive the Employee Retention Credit?

This question should be considered thoroughly. There are number of “ERC Mills” that have sprung up to get their piece of the ERC pie. Many of these pop-up ERC businesses are the ones who are calling you daily, emailing you continuously, and marketing on every form of media known to man.

Calculating the credit and filing the forms is relatively easy and the fees are high. This is why so many companies are chasing this credit.

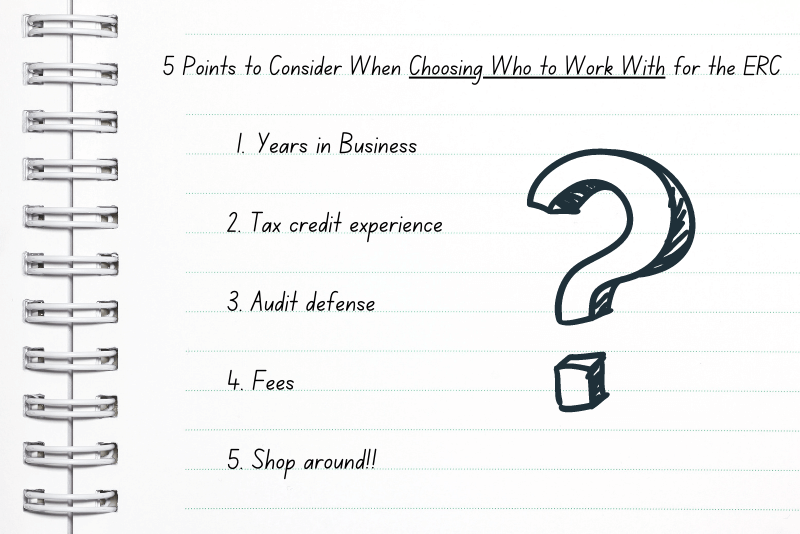

Here are five points to consider when selecting someone to help you with the credit:

1. Years in Business

If the business trying to help you with an ERC started in 2020 or 2021 – CAUTION! Another caution is a business who is only doing the ERC. Many of these businesses are simply doing a money grab. And they will be gone as soon as the fees they can collect are done.

It’s not to say that someone who just opened a business can’t help, but vet their credentials.

2. Tax Credit Experience

Does the company you are looking to work with have other tax credit experience? Many companies with experience with the Research and Development tax credit have spun up an ERC practice. These people usually are well-qualified to help with the ERC.

Accountants, especially those with payroll experience, can be solid partners in applying for the ERC.

Determining if you were impacted by a reduction of revenue is fairly easy and many businesses can assist. Making a defensible and accurate assessment if your business was fully or partially suspended by a government order due to COVID-19 is a critical decision that you shouldn’t leave up to businesses that will disappear as soon as they are paid.

3. Audit Defense

If the IRS decides your ERC has issues, will your partner back you up? This is known as audit defense wherein they will work with the IRS to defend your tax credit. If someone is charging 30% of the credit, they should include audit defense.

Key to audit defense is that they are around years from now when IRS audits may occur. Many of the ERC mills will disappear, so buyer beware.

Audit defense should involve some thorough documentation, especially if your qualifications are based on full or partial suspension by a government order.

A best practice is getting an audit defense clause in a contract.

4. Fees

As noted earlier, we are seeing many businesses, reputable and otherwise, charging 30% of the tax credit as a fee. Some of these fees are being charged at the time of the tax credit application. If these fees feel egregious, we tend to agree. That said, they appear to be commonplace. For this fee, audit defense is a must. Paying 30% of the credit upon filing for and before receiving the credit feels unreasonable.

5. Shop Around

There are so many options, so talk to multiple parties. Talk to tax credit-specialized businesses, CPAs, and heaven-forbid the ERC mills. Don’t just go with the first person that hits you up.

There will be a lot of debate on whether your business was fully or partially suspended by a government order. Beware the partner who provides a quick yes. The right answer is that it will take some research. Each city / state had different orders. Impacts on your suppliers and business will take some understanding. Anything less is suspect.

How do You Claim the Employee Retention Credit?

The ERC is claimed on the employer’s quarterly federal tax return (Form 941) and can be used to offset the employer’s share of Social Security taxes. If the credit exceeds the amount of Social Security taxes owed, the excess can be refunded to the employer. This is relatively easy for anyone comfortable with IRS forms.

Getting the payment can take months.

What is the Deadline for Filing for the Employee Retention Credit?

The deadline to file amended payroll tax returns is April 15, 2024 for the 2020 tax year and April 15, 2025 for 2021.

We’re going to be getting calls and emails for years!

An Objective Perspective

LedgerGurus and I are not tax credit experts. What we are is an accounting firm with a specialization in ecommerce. There are CPAs, MBAs, and lots of other smart people on our team.

We have done Employee Retention Credits for our customers that qualify based on revenue reduction. We manage their accounting and can easily defend that point.

But, we do not support the ERC for business suspension as there is a lot of judgment here. We defer to experts who have more experience in tax credits.

Employee Retention Credit Resources

The ERC is a beast, so verify with other sources. This article doesn’t cover every nuance of the ERC, so be sure to work with an expert who has a comprehensive understanding.

Here are some resources from other businesses we deem reputable:

- IRS Employee Retention Credit webpage

- IRS Employee Retention Credit – 2020 vs 2021 Comparison Chart

- Cherry Bekaert 2023 Most Frequently Asked Questions about the Employee Retention Credit (ERC) published in January 2023

- Gusto’s Understanding the Employee Retention Credit for 2020 and for 2021 published in November 2021

- Lendio’s What is the Employee Retention Tax Credit (ERTC)?

- US Chamber of Commerce How to Claim the Employee Retention Tax Credit published in March 2023

Conclusion

The Employee Retention Credit is complicated, worth lots of money, and is a magnet to anyone who wants to make a quick dollar. We write this article for our customers, community, and anyone who wants some help in how to vet anyone who is trying to help them get the credit. Choose a partner wisely because a bad decision may result in a credit that must be returned with penalties.

Stay Connected

We work very hard to stay up with current events, both general business and ecommerce-specific. Our goal is to help our customers and the ecommerce community have the information they need to make good decisions. Every week we put out a newsletter with the top 3 things affecting businesses from a financial perspective. If you’d like to get that newsletter, sign up below.

If you’re interested in other articles we’ve written on significant issues affecting business, you can also read:

- Maximizing the FDIC Insurance Limit for Small Businesses

- How Many Bank Accounts Should a Business Have?

- Tradeshift Go Review: How to Supercharge Your American Express Business Credit Card