Estimated reading time: 11 minutes

What is this debate between cash vs accrual accounting for ecommerce inventory, and why is it such a big deal?

Everyone seems to talk about how complex inventory accounting is, and maybe you’re wondering why.

After all, it seems like it should be pretty straightforward, right? You know what you’ve ordered and how much it costs. So, you just record that as cost of goods sold, right?

Unfortunately, it’s not as simple as that.

In this article, we’ll explain:

- The difference between the cash vs accrual accounting methods

- What cash vs. accrual accounting looks like for inventory purchases

- How the accrual method impacts profitability

In short, we’ll explain what all this hubbub is all about!

The Difference Between Cash vs Accrual Accounting

There are two basic accounting methods: cash basis and accrual basis.

These are not just buzzwords in the accounting world; they are foundational approaches to accounting that can significantly impact how your business’s financial health is represented.

The main difference between the two methods is timing.

- When do you record revenue or expenses?

- In terms of inventory, when do you record the cost of inventory: when you buy it or when you sell it?

In general, if you record revenue or expenses when you pay or receive money, you are doing cash basis accounting.

If you wait to record it until you get a bill or sell an item, you are doing accrual basis accounting.

What is Cash Basis Accounting?

Cash basis accounting is akin to checking your wallet to gauge your business’s financial health. It’s straightforward and intuitive.

In inventory, this looks like accounting for items when you purchase them, rather than when they are sold to your customer.

Benefits of Cash Accounting

- Simplicity: It’s like keeping a personal checkbook. Revenue is recognized when cash is received, and expenses are recorded when paid. For very small businesses, this simplicity means less time and resources spent on detailed accounting.

- Immediate reflection of cash flow: It offers a clear, real-time picture of how much cash is actually on hand.

Downsides of Cash Accounting

- Short-term focus: It can paint a misleading picture of long-term profitability and financial health. Big expenses can skew your view for a particular month.

- Limited growth insights: For businesses with inventory or those offering credit to customers, cash accounting can obscure the real financial picture, making it harder to make informed strategic decisions.

What is Accrual Basis Accounting?

Accrual basis accounting is more like a detailed biography of your financial story, offering a comprehensive view of your business’s financial health.

In inventory, this looks like accounting for items as cost of goods sold (COGS) when they are sold to the customer, rather than when you purchase them.

Benefits of Accrual Basis Accounting

- Comprehensive financial picture: It records revenue and expenses when they are incurred, not just when cash changes hands. This approach offers a more accurate long-term view of a company’s financial situation.

- Better for strategic planning: Since it aligns revenue with the expenses incurred to generate that revenue, this method provides a more accurate picture of profitability, crucial for strategic planning.

Downsides of Accrual Accounting

- Complexity: It requires more accounting expertise and is more time-consuming, making it less suitable for very small businesses.

- Potential cash flow blind spots: Without careful cash flow management, a business could appear profitable on paper while facing cash shortages in reality.

Understanding these two methods is essential, as they not only influence how you track income and expenses but also shape critical business decisions.

What Cash Basis vs. Accrual Basis Look Like When Accounting for Inventory Purchases

One of the most challenging aspects of proper accounting for inventory and cost of goods sold is understanding the way it moves through the financial side of your business.

Money leaves your business when you pay for inventory, but it’s not typically expensed when it’s paid for the way it would be if you paid a gas bill or a marketing bill.

If it IS expensed right away, that’s cash basis accounting.

Inventory purchases represent a large expense that benefits your business for many months, maybe even years to come.

If you expense all that inventory right when you purchase it, it becomes very hard to understand whether your business is profitable or not.

It also skews your margins, both now and in the future.

What Cash Basis Accounting Looks Like on Your Books

Let’s say you’re starting a new business, so you purchase $80K of inventory to start with.

You can’t sell inventory you haven’t purchased (unless you’re drop-shipping), so this expense is necessary right away.

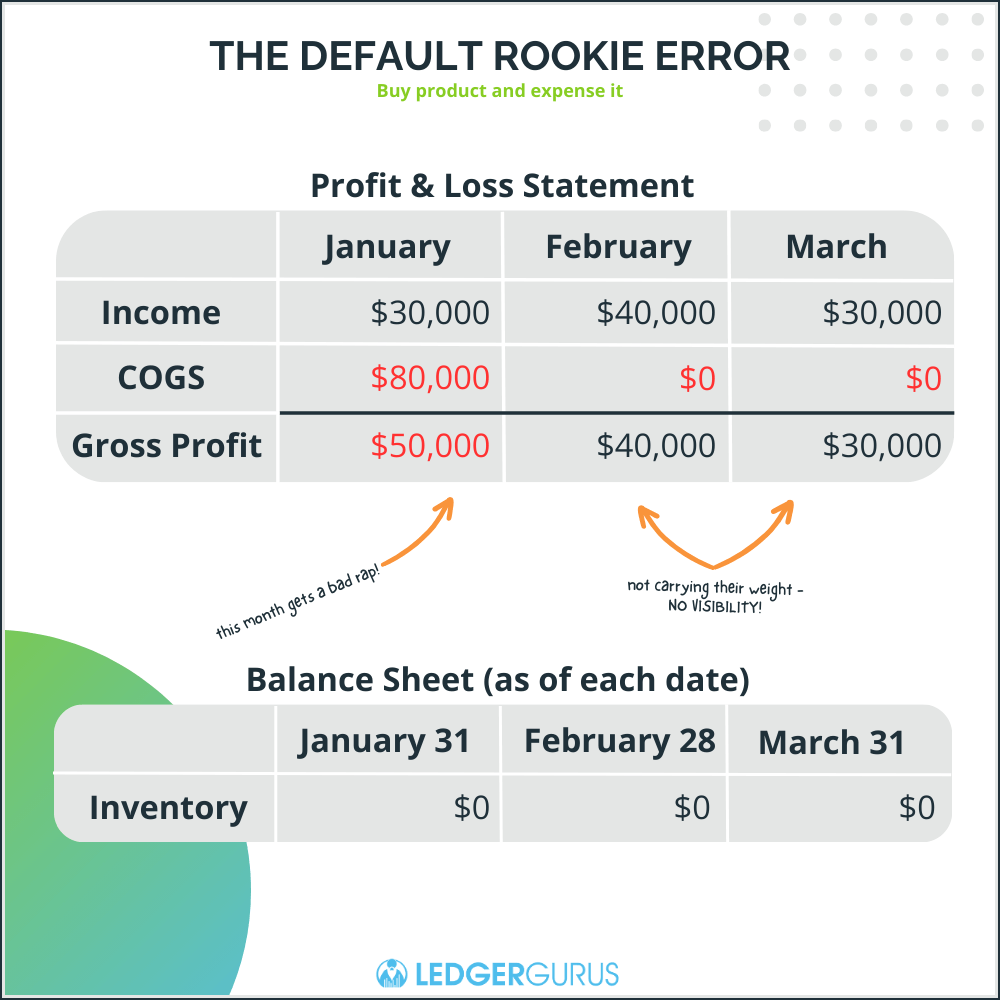

If the full $80K hits your books as an expense in the month the cash draw hits your account, you will show both a huge loss in that month AND artificial profits in the months that follow.

It would look like this….

You would show a huge loss on your profit and loss (income statement) in January when the expense hits, as well as gains in February and March, but with no product costs at all. Also, you wouldn’t show any value for your inventory as an asset on your balance sheet.

This is not an accurate picture. That’s why we call this the “default rookie error.”

The problem is that in the coming months when you am trying to figure out if you can afford new employees, new marketing expenses, or new warehouses, you will be making decisions based on inaccurate margins.

What Accrual Basis Accounting Looks Like on Your Books

Sometimes we wish we could personally explain this to every new, inexperienced business owner:

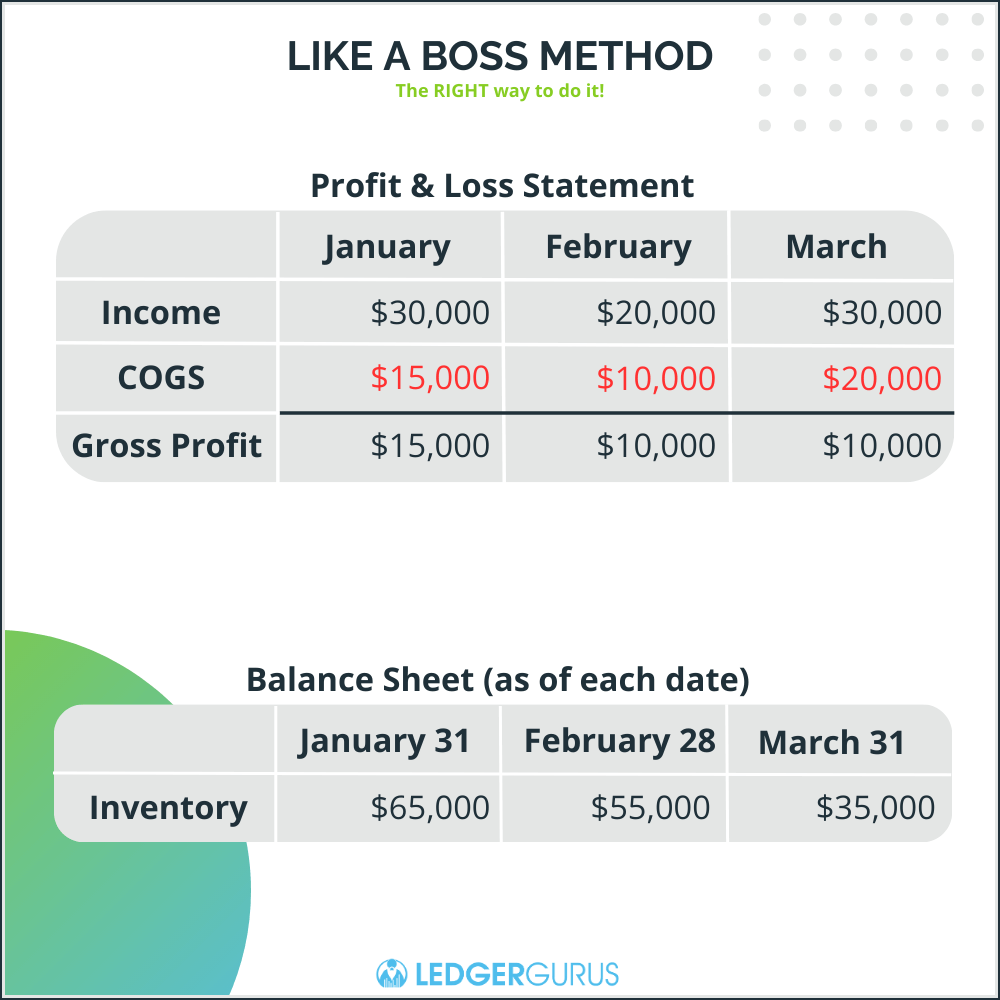

The way it would impact your profit and loss statement when it is expensed correctly over time would look like this:

We call this the “like a boss” method because it shows you know how to handle inventory accounting correctly.

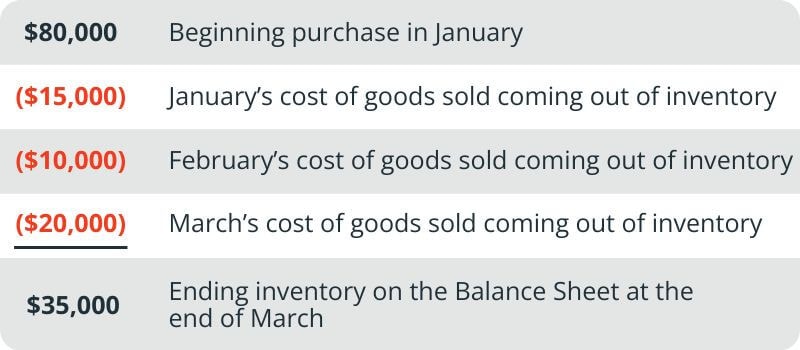

You can see that at the end of March, you would still have an inventory asset on the books of $35,000. This is because:

You can see that you also show nice, consistent gross profit margins of 50% each month. This allows you to plan the rest of your expenses from an informed place of knowing your accurate costs.

Using the accrual method of inventory accounting allows you to accurately see how much you have left as an inventory asset at the end of the month. And, it gives you accurate margins to plan around.

How the Accrual Accounting Method Impacts Profitability

This section is for business owners who are more seasoned pros. Since you understand the way that inventory should move through your books, you can also appreciate the impact that inventory can have on profits.

The larger your inventory ending balance, the lower your costs of goods sold number and the higher your profits.

Higher profits also means more taxable income.

This may not be the result you are after, or maybe it is.

Are you trying to maximize profits because you are trying to sell, or trying to minimize profits to reduce your taxable income?

We are certainly not suggesting you cook your books, but you can consider these priorities when deciding how to handle inventory decisions.

Choose a Costing Methods

One of the ways this is true is when deciding on a costing method for your inventory. The options you have available include:

- FIFO

- LIFO

- Average weighted cost

Which costing method you choose will have huge impacts on your reflected profitability.

For more information, read 3 Inventory Costing Methods | Pros, Cons, and How to Choose One for Your eCommerce Business.

Handle End Count Adjustments

Another area where your choices affect profitability is in how you choose to handle end count adjustments.

End count adjustments, essential in inventory management, involve correcting discrepancies between recorded inventory levels and actual physical counts at the end of a financial period. These adjustments are crucial for accurate financial reporting. They affect the calculation of the cost of goods sold (COGS) and, consequently, the gross profit of a business.

Inaccurate adjustments can lead to either overstated or understated profits, impacting business valuation, creditworthiness, and tax liabilities. Moreover, they provide insights into inventory turnover and operational efficiency, making them a vital tool for informed business decision-making and maintaining financial integrity.

What is the Inventory Penalty?

We often get asked about what our clients call the “inventory penalty” when they are expensing right away. They say their tax accountants are coming back and increasing their taxable income because of inventory, which costs them more in taxes.

What is happening here?

When a company expenses all their inventory right away, their COGS expense is too high. When their tax accountant makes adjustments at the end of the year to account for ending inventory that is still owned by the company, it decreases their COGS expense, which increases their taxable income.

This is valid and correct, even if it frustrating.

Often when inventory is counted at the end of the year, it requires an inventory adjustment to true it all up to the ending count. You can make this adjustment by tying the count to the balance sheet and adjusting the remaining SKU values. Or you can make that adjustment by flushing out the balance sheet difference through cost of goods sold.

(Choosing between these options assumes you don’t have any responsibility to follow Generally Accepted Accounting Principles (GAAP) for an outside party.)

One method will optimize for profits and the other option will optimize for the lowest tax liability.

Moving from Cash to Accrual Accounting for Inventory and COGS

Transitioning from cash to accrual accounting for inventory and Cost of Goods Sold (COGS) is a significant shift that can greatly enhance financial clarity for businesses. Such a transition can be complex and often happens over time, but it is essential for businesses seeking a more accurate and insightful financial reporting system.

For more information on how a company typically moves from cash to accrual accounting, and for some tips on how to do it, read Should I Use Cash or Accrual Accounting for My Business?

How We Can Help You

As you can see, accrual accounting is something you really need to consider for your ecommerce business. There are pros and cons to both cash accounting and accrual accounting, but accrual will give you better numbers that you can count on to help you make better decisions for your business.

If you need help with your inventory accounting, let us know. We’re happy to help! We’ve helped many, many ecommerce companies get accurate numbers that they can trust, so they can reliably build their businesses with solid, data-driven decisions. We can help you do the same.

Click here to schedule a call.

Frequently Asked Questions

Can I use cash basis if I have inventory?

Generally, it is not a good idea for inventory-based businesses to use cash basis accounting. While cash basis might seem simpler, especially for tiny operations with minimal inventory, it often distorts the financial picture.

Think of it as trying to assess your business health without considering the true journey of your inventory costs – it just doesn’t add up!

What is accrual accounting for inventory?

Accrual accounting for inventory involves recording purchases and sales of inventory as they occur, regardless of when cash transactions happen. This method matches revenues generated from the sale of goods with the costs of those goods, providing a more accurate picture of financial health.

For example, when inventory is purchased, it’s recorded as an asset immediately, and when it’s sold, the cost of goods sold is recorded, along with the revenue.

Why is accrual accounting considered more accurate for inventory?

Accrual accounting offers a more accurate reflection of a company’s financial status by aligning revenue with the related expenses. In inventory management, this means recognizing the cost of goods sold at the same time as the revenue from those goods.

This method allows for better tracking of profit margins on inventory and provides a clearer picture of financial performance over specific periods.

Is accrual accounting for inventory required by Generally Accepted Accounting Principles (GAAP)?

Yes, GAAP requires businesses to use accrual accounting for financial reporting. This isn’t just fancy bookkeeping; it’s about painting an accurate, transparent picture of your economic activities.

Think of it as the gold standard for comparing financial health across the board to accurately reflect a company’s economic activities, particularly for inventory.

How does accrual accounting impact tax reporting?

While accrual accounting provides a clearer picture of financial health for internal management, it can also impact tax reporting.

Under accrual accounting, inventory costs and sales are reported in the period they occur, which might differ from when cash is received or paid.

This difference can affect the timing of tax liabilities, potentially leading to differences in taxable income calculations.

Can small businesses benefit from accrual accounting?

Small businesses can benefit significantly from accrual accounting for inventory. This method offers a more accurate picture of profitability and financial health, which is crucial for informed decision-making.

Sure, it demands more detailed bookkeeping, but the rewards – crystal clear insights for growth and strategy – are absolutely worth it.

What software solutions support accrual accounting?

In the world of accrual accounting for inventory, technology is your ally. From basic accounting software to sophisticated inventory systems, these digital tools are the secret sauce to automate transaction recording, manage inventory levels, and churn out real-time financial reports. It’s like having a financial wizard at your fingertips, simplifying complex management and keeping your books spot-on.