Estimated reading time: 9 minutes

The accounts payable process is critical for every business because doing business means working with vendors, suppliers, or contractors. All those people expect to be paid and preferably in a timely manner!

But a good accounts payable process is also crucial because AP is one of the highest points of risk within your organization. Fraud is easy if there aren’t good controls in place.

This article is about what those controls need to be and how to put them in place. It covers:

- What accounts payable (AP) is and isn’t

- How a good AP process makes a business less vulnerable to fraud

- 3 Steps to properly managing your Accounts Payable process

- Who should handle your AP

We also throw in some tips, warnings, and general accounting education.

What Accounts Payable Is and Isn’t

Accounts Payable refers to money a company owes to its vendors – they are outgoing funds. It is a liability on the balance sheet.

Accounts Receivable refers to money the company expects to receive from its customers – they are incoming funds. It is an asset on the balance sheet.

It is common to confuse some of the terminology used in these processes.

- Invoices refer to money we expect to receive.

- Bills refer to money we expect to pay.

Businesses often confuse this terminology because the documentation they receive from vendors says “Invoice” at the top because the vendor is sending them and they ARE invoices to the vendor. They represent money the vendor expects to receive.

However, to your organization, they are bills because they represent money you have to PAY.

They are an INVOICE to the VENDOR but a BILL to YOU, a mirror relationship of the same thing.

I only bring this up because from this point forward I will refer to these as “bills” and I don’t want to confuse anyone.

Okay, done with the soap box. Moving on.

The Basic Accounts Payable Process

Let’s say you need to order product from a vendor who lets you pay on terms of 30 days.

Not considering additional processes for controls, what would the basic process look like?

- You place a purchase order for the product with the vendor.

- The vendor sends you the product with a bill due in 30 days with payment information (ie. a routing number or an address to mail payment to)

- You record the bill in your books, increasing your accounts payable, and make note of the payment information.

- At some point, hopefully before the due date, you initiate payment to the vendor.

- You record this payment in your books against the bill you originally created to decrease your accounts payable appropriately.

This basic process is crucial for managing a purchase effectively and ensuring accurate invoice management.

Besides knowing what it is, it’s helpful to know how AP is different from other types of expenses in your business.

Accounts Payable vs Other Expenses: How Are They Different?

A business typically experiences two kinds of expenses.

- First, it has expenses paid for at the time of service or receipt of goods.

- Second, it has expenses from when services or goods are received, but not paid for until later.

An example of the first kind would be walking into store, picking up office supplies, and paying for them at check out. This is an example of a cash-based transaction where the expense is recognized at the time the payment is made.

It is a waste of your time to handle these transactions as accounts payable. Don’t create bills for them and then pay them.

We recommend simply coding these expenses to the appropriate expense account as they hit your bank account and credit cards.

An example of the second kind would be buying inventory where your supplier gives you terms of 30 days before requiring payment. This is an example of an accrual transaction where the expense is recognized by your business at the time the value is received, rather than when you pay.

These expenses typically pass through Accounts Payable because there is a time lapse between the time the value is received and the time the bill is actually paid. This creates a liability called Accounts Payable.

We DO recommend entering bills into your accounting system for these activities and managing payment against those bills.

How a Good Accounts Payable Process Make Your Ecommerce Business Less Vulnerable to Fraud

Businesses handle AP in a variety of ways, ranging from simple with poor controls, to more complex with good processes and, most importantly, good controls.

AP is one of the highest points of risk within your organization because fraud is easy if there aren’t good controls in place.

At LedgerGurus, we found that one our clients was unnecessarily paying hundreds of thousands of dollars to a vendor because there were not good controls in place to watch how money was being spent.

Adequate controls and checkpoints in the accounts payable cycle are essential to prevent unauthorized purchases and ensure efficiency.

Here are 3 benefits of a strong AP process:

1. Internal controls

Strong internal controls are essential to prevent fraud and ensure the integrity of the accounts payable process.

A well-designed AP process uses a system of checks and balances to make sure that everything is entered correctly and runs smoothly. Clear policies and procedures around invoice approval reduce unauthorized and unnecessary purchases and ensure timely payments, enhancing overall efficiency.

This not only helps eliminate any mistakes and human error in the accounts payable process, but it also reduces fraud by preventing any single person from having total control of the business’s money.

2. Cash flow and Accurate Financials

Keeping track of the money you owe and who you owe it to gives you needed insight when managing your business’s finances.

This helps you avoid errors, as well as strategize your spending and saving for the future. Making timely payments is crucial for maintaining good vendor relationships and can help you secure potential discounts from suppliers.

It also helps you settle your debts appropriately.

This is one of the biggest reasons for tracking expenses on an accrual basis instead of cash. (This is one of the reasons why someone would move forward along the cash to accrual spectrum.)

On a cash basis, you only have visibility into what you HAVE paid. You don’t know what you still owe and your balance sheet is artificially rosy and misleading.

Using AP to track expenses incurred but not yet paid gives you a much more accurate picture of what you are dealing with.

3. Organization

The organization of the AP process allows for elevated debt management and structured historical records. Paying your bills and settling your debts on time is important not only for your business’s financial success, but also helps create positive relationships with your vendors.

Reducing manual data entry in the AP process is crucial for improving accuracy and efficiency. Manual data entry is susceptible to human error and is time-consuming.

Implementing automation where possible streamlines the invoice capture process, creating a clear view of transactional history.

This clear historical record, or audit trail, not only helps identify and resolve spending issues more efficiently, but it also can make audits run smoother.

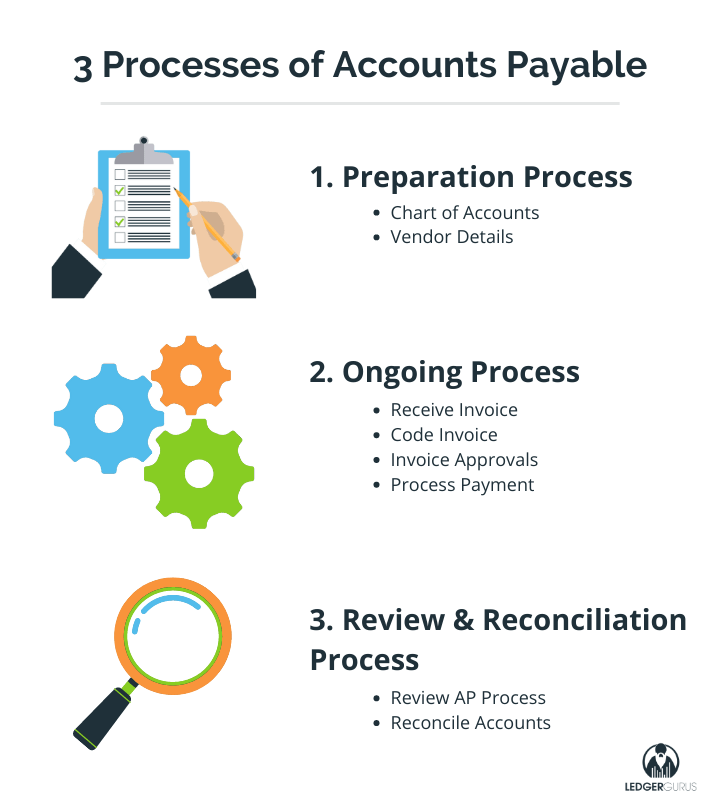

3 Steps to Properly Manage Your Accounts Payable Process

Step 1. Preparation Process

- Consider your chart of accounts: A chart of accounts is a structure used to organize and record your accounting transactions. When a bill is entered into Accounts Payable, there is always another side of that transaction, usually an expense account, identifying what the expense is for. We have a chart of accounts template you can follow, if you don’t already have one in place. We also have instructions on how to set it up in QuickBooks Online.

- Track important vendor details: To make paying your vendors easier, their information should be gathered and recorded. Once you have saved a vendor’s important contact information and payment information, it will make paying them in the future much faster and easier. Centralizing invoice payments is crucial for gaining a clear overview of company expenditures and preventing fraud. By handling all company spend from one place and using automation software, you can streamline invoice payments for your AP team.

Step 2. Ongoing Process

- Receive invoice: After requesting or receiving product or services from a vendor, they will send you an invoice to request payment. This invoice will include any relevant information necessary to make a payment.

- Code invoice: Once you have the invoice, you can code it and process it for payment. Coding an invoice includes entering the necessary payment information such as the amount due and the date it is due. It is also when you specify what account this transaction will be categorized under and assign approvers to double check the information.

- Invoice approval: Once an invoice has been coded, any specified approvers can review the information to ensure it is entered correctly before payment is initiated. Clear policies and procedures around invoice approval reduce unauthorized and unnecessary purchases and make timely payments, ensuring efficiency.

- Process payment: After the accuracy of your invoice has been verified, payment can be initiated to the vendor.

Step 3. Review and Reconciliation Process

- Review the AP process: At the end of the ongoing process, you can now update your books to reflect the latest payment made to your vendors. This is also a perfect time to review your chart of accounts, vendor information, or any other relevant information and update it, if needed. Additionally, reviewing the entire accounts payable cycle for accuracy and efficiency is crucial. AP aging reports can be very useful in helping you identify any vendors with balances that seem off.

- Reconcile Accounts: Regularly throughout the accounts payable process, usually monthly, you will want to reconcile your bank or credit card accounts to make sure that all payments have been entered, processed, and completed successfully. Remember any payments made pertaining to bills should be applied directly against those bills. Reconciling your accounts allows you to find any errors or problems that may have occurred during the AP process, duplicates that may have been entered, or payments that were never correctly applied. If you are using an external AP system like Bill, Veem or Reward.works, you will also want to verify that their vendor balances match the individual vendor balances found in your accounting software AND that total AP balances match.

The accounts payable process can improve your business’s workflow in many ways, including:

- Streamlining the expense process

- Reducing errors

- Preventing fraud

- Offering insight into how to optimize your spending efficiency

If you need help with this, our eCommerce Bookkeeping Checklist lays out weekly, monthly, and annual processes that will help you create and maintain good controls in your AP process.

Who Should Handle Your Accounts Payable Process

Depending on the structure of your business’s accounting system, there are many ways you can manage your accounts payable.

- You may have an in-house accounts payable department dedicated to AP.

- It may fall to the general bookkeeping and accounting department.

- Or you may decide to hire an accounting firm, like LedgerGurus, to help run your accounts payable process.

Here at LedgerGurus, we provide accounting services to ecommerce businesses, including accounts payable. We have a capable AP team with team members who work with businesses to take care of their accounts payable process.

Our team members can make sure that your business gets all its invoices entered accurately and paid on time. If you need ecommerce accounting, we can help. Click here to learn more.