Good financial statements are at the heart of any successful eCommerce business.

The goal of this post is to help you learn how reading & understanding your eCommerce financial statements can empower you to make better financial decisions for your business.

This is the first of a series of 4 posts that will deep-dive into financial statements, what they are, what they can tell you, and how to read & understand them. You can also view our YouTube video on this topic that goes into more depth and goes through the screenshots provided.

In this blog, you’ll learn:

- Accounting is the language of business

- Why don’t people utilize their financial statements?

- Why are financial statements so important?

- What are the basic financial statements?

- How to find your financial statements in QuickBooks online

- Going in depth with your Ecommerce financial statements

Let’s get into it.

Key Takeaways

- Accounting Is Essential for Business Success

- Financial Statements Answer Critical Business Questions

- Why Business Owners Avoid Financial Statements

- Financial Statements Show Past, Present, and Future

- The Three Core Financial Statements

- QuickBooks Online (QBO) Is Highly Recommended

- How to Access Financial Statements in QBO

- Learn to Read and Use Your Financial Statements

Accounting is the Language of Business

We at LedgerGurus specialize in this kind of thing, but we also understand that becoming an expert in financial statements is rarely the goal for an aspiring eCommerce business owner.

Usually the goals are to make money, change your life for the better, and maybe even change the world by bringing an amazing product to market.

That is all well and good, but there is another side of business, a side that often terrifies business owners… accounting.

Many business owners are dismissive or even terrified of their accounting and financial statements, so they may try to get away with not paying attention to them, but…

If you don’t pay attention to your financial statements, you may end up wondering where all the money has gone.

Accounting is the LANGUAGE of business. If you can speak “Accounting-eze,” you’re much more likely to be successful in your business.

But, you may ask, what if I just outsource my accounting?

That’s great, but as a business owner you still need to be able to read your financial statements. Outsourcing doesn’t get you off the hook here.

You see, because accounting is the language of business, all the questions you need answers for come back to accounting.

- The Christmas season is coming up. Do I need a loan to invest in more inventory?

- Can I afford to hire a warehouse manager? A new salesman? An accountant?

- How much should I spend on marketing? Am I getting a good return on my ad spend?

- How much should I spend to open a new warehouse?

Financial statements may be the single greatest tool business owners have to determine & ensure their success.

In other words, you MUST become financially literate if you’re going to run a successful business!

Why Don’t People Utilize Their Financial Statements?

- A Lack of Time

- A Lack of Know-How

- A Lack of Understanding

Business owners have a lot on their plates so digging into their accounting may not be a priority. They just don’t have time to do the work required to create good financials.

Often a simple lack of know-how is the culprit. Sometimes they’ve heard of QuickBooks or other accounting software but have no idea how to use them and don’t have the time to figure it out.

Other times, it’s a lack of understanding of why it’s important, why it should be a priority to them, and how it can empower them as a business owner.

Even so, eventually everything comes back to the Financial Statements and what they say, so now’s a great time to learn about them.

Why are Financial Statements So Important?

Financial statements tell the story of your business. They show:

- The Past (where you’ve been)

- The Present (where you’re at)

- The Future (the trends of where you’re going)

All of this is evident in good financials. Otherwise, you are flying completely blind, and that does NOT give a high degree of confidence.

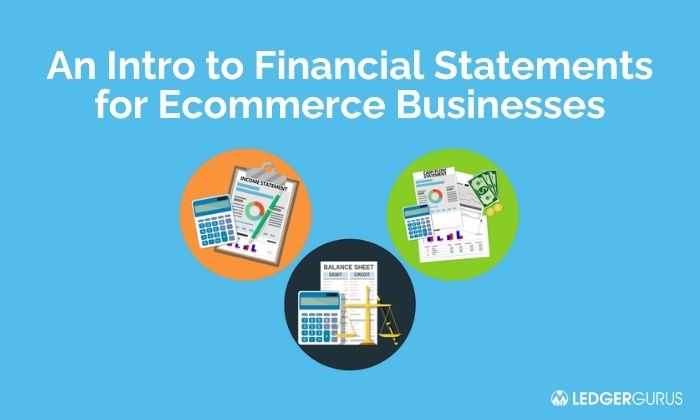

What are the Basic Financial Statements?

Here are the three basic financial statements and what they contain:

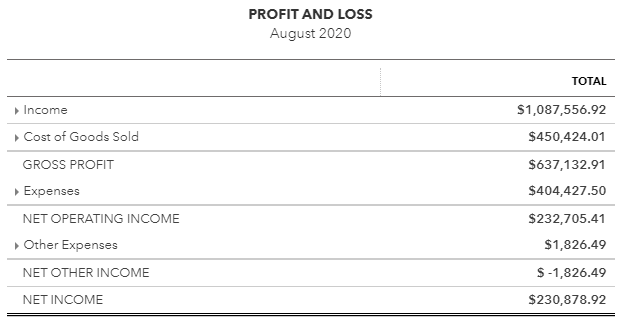

- Profit & Loss Statement

- Income & Expenses

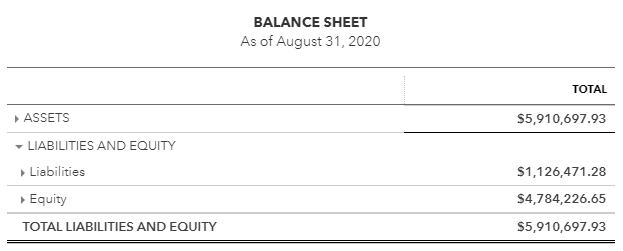

- Balance Sheet

- Assets, liabilities, equity

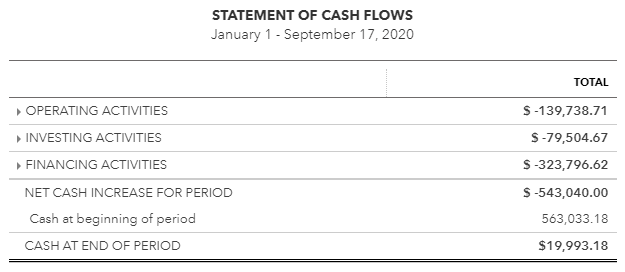

- Cash Flow Statement

- Where it all comes together

The Profit & Loss Statement (also called the Income Statement or P&L) shows what you’ve made, how much you’ve spent, and what you have left at the end of the day.

It is especially valuable for seeing why you’re succeeding or why you’re failing at your business.

This is an example of a basic Profit & Loss Statement. Each of these categories has a lot more detail in it, but we’ll go into that in another post. This goes for all 3 examples.

The Balance Sheet shows you where you stand as a business, what your equity is and how much your business is worth.

It also shows you how likely you are to go out of business, run out of cash, or go bankrupt.

The Cash Flow Statement is where it all comes together. It has aspects of both the Profit & Loss and the Balance Sheet on it. It can be the most useful of the three but can also be the hardest to read. As a result, it is often the most under-utilized.

Quick Plug for QuickBooks Online

You may have noticed that we at LedgerGurus are always talking about QuickBooks Online (or QBO). There are several good reasons for why we recommend it as a great way to track your accounting.

- It is extremely stable and well-supported by the company and other vendors.

- Many accounting apps integrate well with it.

- There are LOTS of resources to learn how to use it well – YouTube videos, blogs, etc.

We highly recommend QBO instead of the desktop version because since your business is online, your accounting software should be, too. You’ll find that your workflow with your apps will work better with it than with the desktop version, too.

Another reason to use it – When you use an accounting tool like QuickBooks Online instead of relying on a spreadsheet, your Financial Statements are a natural byproduct of your everyday accounting activities.

Let me say that again…. When you use an accounting tool like QBO for your everyday accounting activities, your Financial Statements are magically (i.e. automatically) created!!

How to Find Your Financial Statements in QuickBooks Online

From your Dashboard in QuickBooks Online, click on Reports -> Reports on the left side of the page.

(If your screen doesn’t look like the one in the video below, click on the 3 little lines in the top left corner to show this menu.)

On the Reports page, you’ll see lots of different reports to choose from. All of these are automatically created from your everyday accounting activities. For easy access, save the reports you want to use regularly by clicking on the star. This will move them into your favorites list at the top of the page.

Going in Depth with Your eCommerce Financial Statements

In our other blogs, we dive into each of the three reports. We:

- Go into detail about each report

- Learn the structure of parts and pieces

- Learn how to interpret your reports

- See what kind of questions they answer

- Learn how to read the trends in your business

Our goal with all this is that you become comfortable with your ecommerce financial statements. We hope you will gain a high degree of confidence to dive into your financial information and see what they can tell you.

We encourage you to be committed to becoming fluent in accounting, the language of business. This will empower you to be a much more successful business owner.

Here are some additional articles we’ve written on eCommerce Financial Statements:

If you’d like some indication of whether your financial statements are set up correctly and whether you’re in good hands with your current accountant or if you’re doing a good job for yourself, you can download our PDF “5 Signs of Bookkeeping Trouble for eCommerce Businesses”.

If you’re approaching $1M in sales and you are struggling with your eCommerce accounting needs, this is where we can really help you. Reach out and we’ll have a discussion of what it can look like for us to support you in your needs and help you achieve the next level of success.