Are you still using QuickBooks Desktop?

Many small- to medium-sized business owners have been using QuickBooks (QB) desktop software for decades. In 2001, QuickBooks came out with an online solution (QuickBooks Online), which gained significant traffic in more recent years. We still come across businesses stuck in the QuickBooks desktop era. Mind you, this is okay for certain businesses. But many businesses simply don’t understand the benefits of QuickBooks Online vs desktop and how it can help their business.

For most businesses in today’s world, moving to QuickBooks Online (QBO) can be a game changer. So, if you haven’t made the switch, now might be the time. In this post, we look at QuickBooks Online vs desktop and see if it makes sense for you to move to QBO (it probably does!).

QuickBooks Online

To be honest, when QuickBooks Online was first introduced, the product was “ahem” …bad. This is completely normal for first attempts in technology. When companies like Xero entered the market with superior products, QuickBooks knew the business world was moving in the direction of online accounting. They decided to get serious.

Starting in 2013, Intuit began putting 90% of their development resources toward creating QuickBooks Online into the product it is today – well-developed and robust – so you should get over the fact that QBO was really bad in the beginning! In fact, Intuit is abandoning its legacy desktop product in many ways by phasing it out and putting less effort into its development. With every passing year, QuickBooks Online becomes a more favorable product when compared against desktop.

Other online accounting solutions like Xero and NetSuite are also good solutions. This post is less about promoting or comparing online accounting solutions, but more about the benefits of moving your accounting online and if this move makes sense for your business. At this point in time, Xero and QBO are very compatible products with similar functionality and usability.

QuickBooks Online vs QuickBooks desktop

QuickBooks desktop

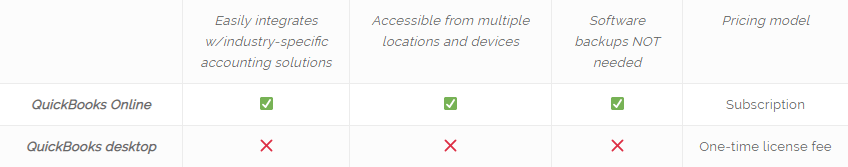

First, let’s take a look at what you get with QuickBooks desktop. This software is a very stand-alone product. By stand-alone, we mean two things:

- The functionality you get with the software you download, is mostly what you get. There are SOME tools you can integrate with desktop to increase functionality, but options are limited, and the integration is clunky and hard to use. Many of the latest, best apps often don’t even bother with a desktop integration.

- You can only use QuickBooks desktop on the computer that it is downloaded on or in an environment when a server is hosting the software. This severely limits its ease of access.

Basically, what you get in the QuickBooks desktop version you download is what you get, and you only get it in a limited access space. Therefore, the desktop version is built out with in-depth features in specific areas such as payroll, job costing, and inventory systems. While it is great to have all these features in one system, Intuit is no longer developing these features while apps that solve these same problems are constantly being developed. As apps continue being released that solved industry-specific problems and connect with online accounting solutions, the desktop version falls further behind in its functionality.

Another issue to consider is the risk of losing financial data on QuickBooks desktop if your computer goes down. Many desktop users have experienced this sinking feeling of losing many years of key financial data. With QuickBooks desktop, you need to be in the habit of regularly backing up your software.

QuickBooks Online

Unlike QuickBooks desktop, QuickBooks Online has been built with the purpose of being a hub that connects with other tools (apps). App creators build industry-specific accounting apps with the ability to connect to online accounting solutions like QBO. (Click here to read about when you should and should not integrate apps with QBO). This ecosystem of apps integrated with QBO creates an incredible accounting world of automation, efficiency, and up-to-date solutions.

Let me just give one example. Ecommerce sales tax is out of control. Sales tax laws for ecommerce businesses differ between states and are constantly changing. Solutions such as TaxJar are incredible products that automate the process of identifying in what states businesses owe sales tax, collecting sales tax in those states, and then remitting sales tax in those states. TaxJar and similar products connect with ecommerce sales channels and online accounting solutions (like QBO) to automate this entire process, including on the accounting end.

This is just one example of the hundreds – maybe thousands – of industry-specific tools that exist. Now there are sales tax automation tools that integrate with desktop software, but not all of them do. And those that do integrate, don’t do so seamlessly. You will find similar situations with other industry-specific tools.

Before this ecosystem of accounting solutions, business owners or in-house accountants were the ones solving issues like ecommerce sales tax. In most cases, this would cost businesses more time and/or money than the solutions that exist today. In addition, apps that sync with online accounting solutions provide automated, real-time information.

Finally, with QuickBooks Online, you won’t have to worry about backing up your software. You can rest assured that you’ll never deal with losing years of key financial data.

QuickBooks Online vs QuickBooks desktop: A final decision

By now you should more fully understand the main differences with QuickBooks Online vs QuickBooks. You probably already know if you need to make the switch or not, but if you still can’t decide, consider these three buckets questions:

- Functionality – Do you need/want the best industry-specific solutions? Are there issues you or your accountant are solving that can be automated with existing tools in the market? Does QuickBooks Online, with an app add-on, give you a better result than Desktop features? Do you struggle to regularly buck up your financial data on QuickBooks Desktop?

- Accessibility – Do you need/want access to you accounting anytime, anywhere? Do you have people in multiple locations that need to access QuickBooks easily, or does on-premise work for your needs?

- Pricing – Are you okay with a subscription model? Do the math to see how often you buy a new version of QuickBooks desktop, and compare that cost with the subscription version of QBO that you would like to use.

If you answered yes to any of the “functionality” or “accessibility” questions, and yes to the third question, it’s probably time you make a move and get with the times of online accounting. Moving to QBO (or a similar solution) will give many of you better knowledge of your business in better time. And timely knowledge is power that fuels important managerial and strategic decisions for your business.

Don’t hesitate to reach out if you have any additional questions related to this post. Learn about how an accountant can help with your QuickBooks Online, and best of luck in your decision to move to QBO.