Let’s talk about something that can significantly impact your financial health and organization – how many bank accounts your business should have.

Too often businesses do everything from a single account with a single bank, but there are better ways.

Think about it: mixing expenses, savings, and sales tax money in one account is like trying to keep track of your grocery, rent, and vacation funds all in one wallet. Sounds messy, right?

In this blog, we’re going to dive into the ideal number of bank accounts every business owner should consider having to streamline business finances and avoid confusion.

We’ll cover:

- Why you need more than one business bank account

- The 3 key bank accounts

- Why you need more than one bank

- Moving from 3 to many bank accounts for your business

- How to manage cash across accounts

- How to get help with your cash management and accounting

Let’s get started.

Key Takeaways

- Using just one business bank account creates unnecessary confusion and makes it harder to manage expenses, savings, and taxes.

- A minimum of three bank accounts is recommended: reserve savings, income checking, and payment checking.

- Having accounts in multiple banks increases security, ensures continuity, and maximizes FDIC insurance coverage.

- Segmenting funds by purpose (e.g., payroll, taxes, profits) improves financial clarity and control.

- The Profit First methodology offers a proven approach to managing cash effectively with dedicated accounts.

- LedgerGurus can help you set up and manage your accounts while you focus on growing your business.

Why Have Multiple Business Bank Accounts?

There are several reasons to have multiple bank accounts:

- Operational segmentation

- Cash optimization

- Security

- Levy protection

Operational Segmentation

There are natural divisions of cash movement in every business:

- Bills or accounts payable

- Payroll

- Accounts receivable or income from credit cards \ merchant accounts

- Taxes

Segmenting cash can be an easy way to control spending and account for the flow of funds.

Cash Optimization

Some cash needs to move in and out easily, some moves less frequently, and some needs to be protected. Different accounts can provide different levels of control and interest.

Also, in today’s high inflation environment, maximizing cash value needs to be a higher priority.

Security

It is remarkably easy to steal funds if someone knows the bank account, routing number, business name, and address. This can happen through fraudulent checks (it’s easy to order a checkbook online) or fraudulent ACH (electronic payments).

By having multiple bank accounts and a good cash management strategy, a small business owner can better protect against fraud.

Levy Protection

A government agency can put a lien or levy on a business account if taxes are determined to be owed. With an IRS levy, this can mean funds are frozen.

States can take similar moves. They will try to lock up all accounts, but there are some they know about already: the payroll or sales tax accounts. Having multiple accounts may buy some time while sorting out the issues.

You Should Have At Least Three Key Bank Accounts

With the reasons established, we now must answer the question: how many bank accounts should a business have?

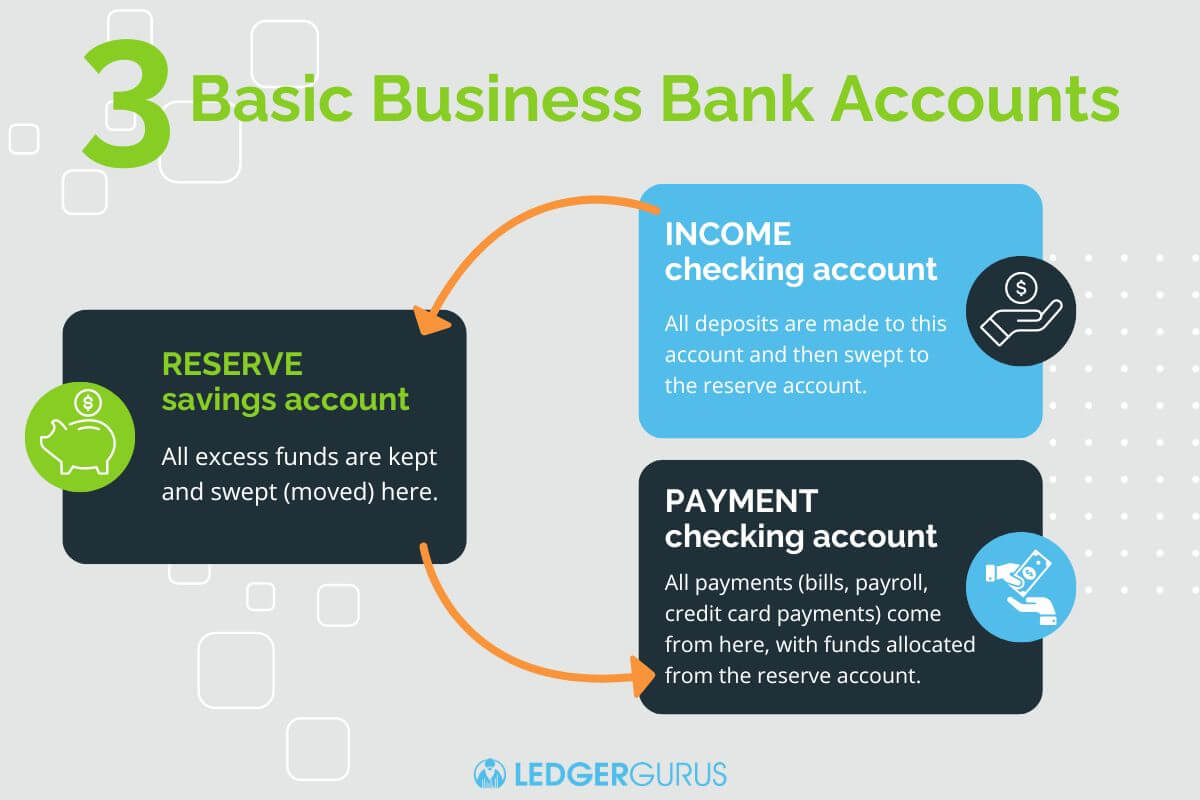

Let’s start with a basic strategy where a business has three separate accounts:

- Reserve savings account – All excess funds are kept and swept (moved) here. The account number should never be given out to protect the funds.

- Income checking account – All deposits are made to this account and then swept to the reserve account.

- Payment checking account – All payments (bills, payroll, credit card payments) come from here, with funds allocated from the reserve account.

You Should Have Accounts in Multiple Banks

In addition to having multiple bank accounts, a business should consider having multiple banks. Having multiple business checking accounts at more than one business bank can be valuable for a few reasons:

- FDIC insurance

- Business continuity

- Interest maximization

Exploring some of the best business online banking solutions is a wise move to ensure the safety of your funds. These platforms provide added security features like two-factor authentication and robust fraud detection systems.

FDIC Insurance

There are several ways to protect deposits above the $250,000 FDIC insured limit. One of those ways is by simply distributing funds across multiple banks. This will allow you to maximize the FDIC insurance limit.

Business Continuity

Banks occasionally fail, as we learned in 2023. Even if deposits are FDIC insured, a bank failure can make access to and movement of funds difficult. By using multiple banks, one bank’s issues don’t paralyze a business.

Interest Maximization

For reserve accounts, it is best to get the maximum interest on those funds. Find banks with high yield savings accounts and put reserves there.

At minimum, accounts in two banks is ideal. More than two is likely unnecessary until a business gets larger.

Moving From Three to Many Bank Accounts

As a business grows, it can make sense to break out the three accounts into multiple accounts. This can be for different reasons, but here are some approaches to consider:

- Payroll checking account – Break out payroll separately from payments and fund it around payrolls. Any issues with payroll taxes become isolated.

- Tax reserve savings account – It’s a good idea to have a tax reserve account. This can be a fixed amount of sales tax and\or calculated amount of income tax based on profits.

One can go much further depending on the type of business and purpose of funds. Splitting accounts across banks should consider the benefits of banks. Savings funds should be in banks with the best interest. Having payroll checking in a separate bank can be a good firewall should any issues arise.

Profit First Bank Accounts

We would be remiss not to discuss the popular book Profit First by Mike Michalowicz and his methodology around cash management and bank accounts. It’s a good approach to financial management, and here is a very quick summary on bank accounts within Profit First:

- Income checking account – All deposits are made here, then allocated to the subsequent accounts.

- Profit checking account – This is a percentage of income using the Profit First methodology.

- Owner’s Compensation checking account – This is a dedicated amount for payroll or distributions, depending on business type.

- Tax checking account – This is a calculated amount to cover taxes when they are due.

- OPEX (operating expenses) checking account – This is what is left over to run the business.

Profit First also recommends moving funds from the Profit checking and Tax checking accounts to corresponding savings accounts until those are paid out.

There is so much more to Profit First than these 5-7 accounts, so go check out the book for yourself. It’s a great read for owners of businesses of any size.

Multiple Bank Accounts for an eCommerce Business

LedgerGurus is specialized in ecommerce accounting, so we recommend some best practices to consider when it comes to bank accounts. Considerations include:

- Sales tax – Every ecommerce business is dealing with sales tax, and it could make sense to sweep collected sales tax to a checking and/or savings account until it is time to pay the different government agencies.

- Income – Revenue for ecommerce comes from merchant services like PayPal, Stripe, numerous payment processors and online platforms like Shopify, Amazon, etc. It could make sense to have dedicated accounts by channel as a business gets large.

An ecommerce business bank account structure could look something like this:

- Revenue checking account – Sweep funds to the general reserve savings account and sales tax savings account.

- Sales tax savings account – This is a calculated amount that can be accounted for from sales reports.

- Sales tax checking account – Funds from the sales tax savings account are moved here when it’s time to pay the appropriate agency.

- General reserve savings account – This can be an account from which funds are moved into different special purpose accounts. If a business is profitable, this account may get large and should maximize interest and FDIC protection.

- Payments checking account – All credit card payments, electronic payments, and checks should come from this account. Fund what is needed for a month, and nothing more.

- Payroll checking account – Connect the payroll system to this, and fund it for a month of payroll at most.

- Income tax savings account – Using Profit First, calculate the tax that will need to be paid out, and hold it here until annual or quarterly payments are needed.

- Profit savings account – Profit First is smart in that profits should be allocated here. Draw from this account to the owner’s compensation account on a regular basis.

That’s 8 accounts: 3 savings and 5 checking.

Make sure to look at bank fee and minimum balance structures as many larger banks like to take out fees when there aren’t minimum balances.

Could you get away with more or less? Yes – it all depends on your approach.

When you go to switch business bank accounts, make sure you’re thinking of everything involved. Click here to read 10 Steps for Switching Business Bank Accounts.

How to Manage Cash Across Accounts

With multiple accounts, there is some math and movement of money. The math isn’t complex, and a good accountant or bookkeeper can help with the allocation of funds.

Next, you need to come up with a money movement strategy.

Here at LedgerGurus, we sweep income weekly and reallocate to other accounts monthly.

Plan on moving money at least monthly and not more than weekly. It doesn’t take long if you have a formula. Get the formula right, and even consider a buffer on payments as it’s easy to have unexpected payments from time to time.

In terms of movement of funds, there are two approaches:

- Same bank: Within a bank, movement is usually easy. Most banks have easy, and often instant, methods of moving funds from accounts within the bank under a single business owner.

- Bank to bank: There are low to no cost ways to move funds from bank to bank. These tools take minutes to use once setup, and the timing can be same day to a few days, depending on the approach that is used. Wires are fast and expensive, and ACH takes a few days and is cheap.

How LedgerGurus Can Help

How many bank accounts should business have?

You should have some ideas for your business now. There is no one right answer, but only one is definitely a wrong answer.

There is some work up front, but once set up, it’s not that hard to maintain going forward. A good accountant or bookkeeper can make this much easier. Once done, funds are better allocated, protected, and usable.

LedgerGurus follows the Profit First methodology in how we run our business finances, and we can help you do it for yours.

We also specialize in ecommerce accounting. We’re happy to focus on your numbers while you do what you do best – grow your business.