Inventory costing methods are vital for any business to monitor inventory and correctly capture its appropriate costs for related sales. The value of a company’s inventory and associated cost of goods sold (COGS) directly impacts its reported income and general financial health.

So, why do so many businesses neglect inventory and fail to establish a method for valuing one of their biggest assets & expenses? Inventory management can be intimidating, and is made more so due to the multiple approaches you can take. But the concept is basic, so let’s walk through it.

In this article, we’ll discuss the 3 most common inventory costing methods:

- Average cost

- FIFO

- LIFO

More importantly, we will explain how each inventory costing method can impact your business and why you would choose one over the other.

What are Inventory Costing Methods?

First, let’s backtrack a little and discuss inventory systems.

An inventory system is the system you use to track your inventory as it moves through the supply chain.

There are two systems:

- Perpetual Inventory System

- Periodic Inventory System

With a Perpetual Inventory System, inventory and cost of goods sold accounts are updated with each sale, or perpetually.

With the Periodic Inventory System, inventory and cost of goods sold accounts are updated periodically.

For New Businesses

Small businesses using straightforward accounting procedures may choose to utilize the periodic inventory method because of the simplicity it can provide. It doesn’t require a high level of operational maturity and can still provide accurate financials with less work. But it is also less timely.

For More Mature Businesses

However, as a business grows, they may choose to switch to the perpetual method. This is for two reasons:

- The balance in an inventory account is current at any point in time.

- It provides better visibility for a large volume of inventory transactions.

Those using a perpetual inventory system will assign a value to their inventory with each sale.

Those using a periodic inventory system will do so periodically (maybe once a month or once a year).

We will refer to this process both as inventory valuation and inventory costing. It’s the same thing, just different words. In essence, you are putting a dollar amount on your inventory. This is how you determine the value of your inventory and the associated cost of goods sold.

How Inventory Management Tools Affect Costing Methods

In the process of choosing an inventory system (or tool), you must also consider the costing method you will want to use. Some inventory tools only give you one option and others give you several to choose from.

All inventory tools will do this for you automatically once you’ve implemented one, but you will have to understand this if you are still doing this process manually in spreadsheets. (Reach out to us if you would like to talk about implementing an inventory management system and avoid death by spreadsheets.)

Three Inventory Costing Methods

Now, let’s look at each inventory method, the pros and cons of each, and discuss how it can impact your business.

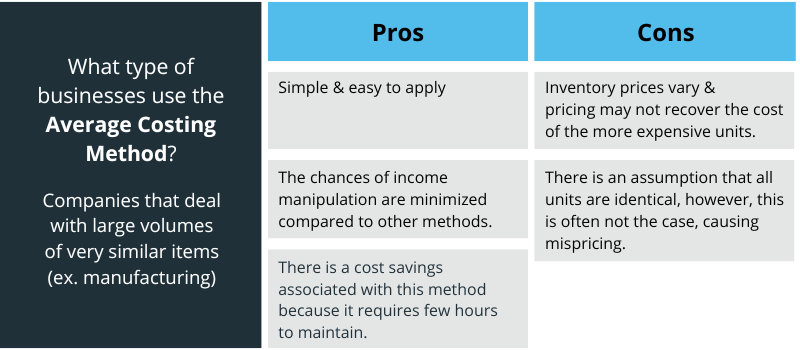

Average Cost

Average cost is one of the most popular costing methods. It’s simple – you divide the total cost of purchased items by the number of items in stock.

Let’s look at an example.

Say you own a custom shirt printing business. You make two purchases of blank shirts. The first purchase is for 200 shirts that cost $12 a shirt. The second purchase is for 100 shirts that cost $15 a shirt. You now have a total of 300 shirts that you invested a total of $3900 in.

At the end of the week, you sold 75 shirts.

So, how do you value your leftover inventory? You assign the average cost of $13 per shirt to each of these buckets – 75 shirts sold and 225 left over in inventory.

The average cost is $13, and after selling 75 shirts, the account balances will reflect the following:

Cost of Goods Sold: 75 T-shirts x $13 Average Costs = $975

Remaining Inventory: 225 T-shirts x $13 Average Cost = $2,925

One other major consideration of this costing method is that it can become significantly skewed over time if prices are rising or falling.

For example, if you’ve been in business for 10 years and the cost of your products has gone up, maybe even doubled or tripled in those 10 years, your current costs may be artificially inflated or deflated by the impact of inputs factoring into an average with costs that are far outliers from your current reality.

It may be wise to do adjustments periodically (every couple years or so) to all average costs to bring them closer to an average that more accurately reflects recent costs.

The Need for FIFO or LIFO Costing Methods

When we are using FIFO or LIFO, we have to consider that small products bought in bulk are rarely individually assigned the costs they were originally purchased at. The exception to this would be large items like cars or appliances or very expensive pieces of jewelry. But in general they are all dumped into one bin and pulled out when sold.

How do we know whether this particular shirt was bought at $12 or $15? We don’t. That’s where FIFO or LIFO come in. We place products in pricing tiers when they are bought and then make a general assumption on the order that those pricing tiers will pulled off the shelf and sold.

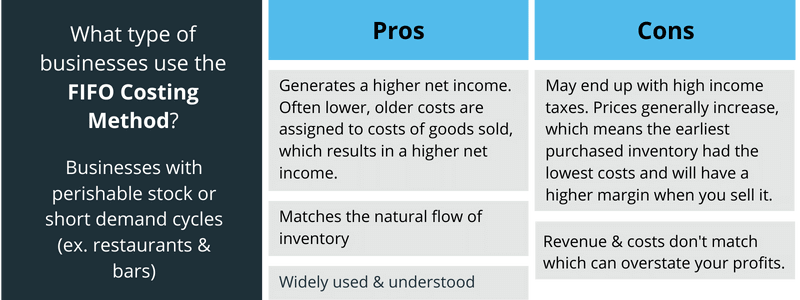

FIFO (First-In, First-Out)

Businesses that use FIFO record the oldest inventory items to be sold first. First In First Out. When inventory is sold, the oldest cost of an item in inventory will be recovered and then reported on the income statement as part of the cost of goods sold. We track how many items were bought at the oldest price tier and then use them all up before moving onto the next price tier.

I REALLY hope you are using an inventory tool if you are trying to use FIFO or LIFO because this can get seriously HAIRY!!

Let’s return our example.

What is the FIFO cost of our shirts? $12, because the first 75 shirts we bought cost $12, so they are the first ones considered sold. First In First Out.

And the cost of goods sold?

COGS = 75 x $12 = $900

Those 75 shirts were taken from the oldest pricing tier (also called a tranche) of shirts. But there are still 125 left at that $12 price point because we bought a total of 200 in that first tranche. We also still have all 100 shirts of the second tranche at $15 per shirt, so our ending inventory balance is $3,000.

FIFO is normally considered the costing method crowd favorite because it is considered to create the most accurate picture. Most businesses do want to get rid of their oldest items first and usually consider this approach to be the costing method with the fewest issues to correct for in the long run.

However, it does create the lowest COGS numbers when prices are rising, which can result in the highest taxable income. See the end of this blog for more information on that.

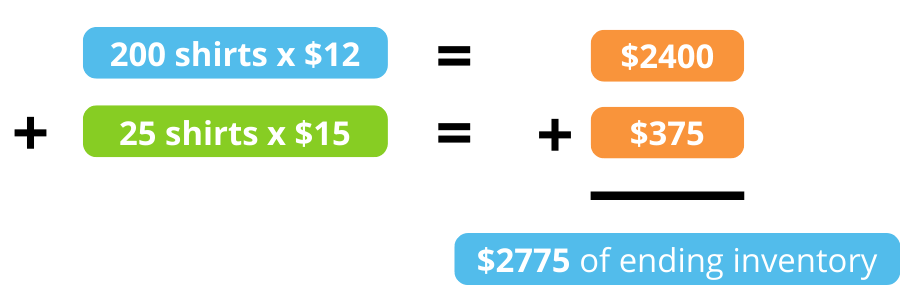

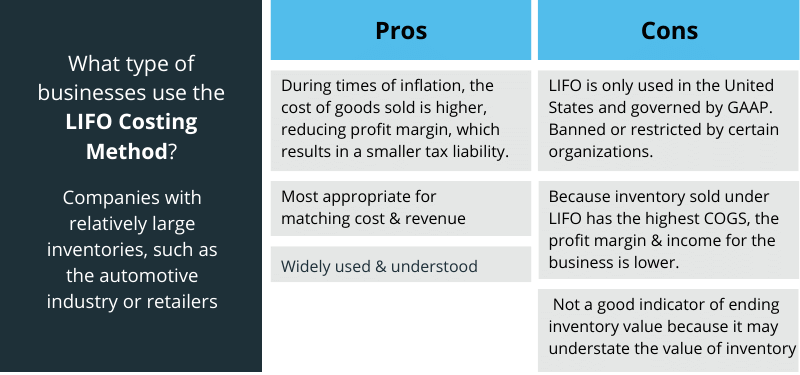

LIFO (Last-In, First-Out)

LIFO is opposite of FIFO and reports the most current prices as being cost of goods sold. Last In First Out.

So, when inventory is sold, the newest cost of an item in inventory will be recovered and reported on the income statement as part of the cost of goods sold. And the oldest prices will be what’s remaining in ending inventory.

Back to our shirt example.

What is the LIFO cost of our T-shirts? $15, because they were the last items bought, so they are the first items sold. Now let’s calculate COGS and remaining inventory.

COGS: 75 T-shirts x $15 LIFO Cost = $1,125

Those 75 shirts were taken from our newest tranche of shirts. But there are still 25 left at the $15 price point because we bought 100 in that tranche. We also still have all 200 shirts of the older tranche at $12 per shirt, so our ending inventory balance is $2,775.

This method’s biggest issue is that it leaves a grossly understated ending inventory balance that only gets more egregious as time goes on. Basically, unless you are turning over 100% of your inventory before buying more, the first items bought never actually show as sold. Over time, as prices rise, these ending inventory balances become less and less representative of the actual value of that inventory.

What if I want to change my inventory method? Can I do that?

Although it is best to use the same costing system consistently so your financial statements can be equitably compared from period to period (think apples to apples), you can change inventory costing methods if needed, although you may need to properly disclose if following GAAP. Changes should be made at the end of an accounting period and cannot be changed each accounting period.

The IRS does require a business to commit to the first year it files its tax return before changing methods, and urges companies to maintain consistency throughout the years.

So, what impact does an inventory method have on my business?

Now that you understand the three most common inventory costing methods, let’s return to this idea of how an inventory method can impact your business.

How much was the COGS value in each of the methods for our T-shirt example?

COGS Value:

- Average cost = $975

- FIFO = $900

- LIFO = $1,125

As you can see, the inventory method a company uses affects its cost of goods sold, which impacts profitability. If you use the FIFO method, you’ll report a lower COGS, which increases your gross profit and net income. A higher net income means higher profit margins.

The balance sheet is also affected by the inventory method a company uses. Looking back at our example, what was the value of the remaining inventory for each of the different methods?

Remaining Inventory:

- Average Cost = $2,925

- FIFO = $3,000

- LIFO = $2,775

Those that use FIFO report higher inventory in their current assets, resulting in a higher current ratio and a better financial position.

As you can see the value of a company’s inventory does directly impact their reported income and general financial health.

Next Steps

I’ll say it again, knowing how to manage inventory is a vital activity for companies. But it can be intimidating, especially as businesses grow and processes become more complex.

We have a lot of videos on Inventory, as well as blogs. But sometimes it’s too complex and you need a little help. That’s where we come in. LedgerGurus has a team that specializes in the management of inventory. With our help, you are sure to see an improvement in the profitability and general financial health of your business.