Our CEO Brittany spoke at the Utah Crowdfunding summit. She spent part of her presentation talking about the Inventory cycle and managing cash flow. In other words, the process of turning inventory into cash for your company.

(For more information on managing cash flow in the inventory cycle visit our CEO Brittany’s full presentation.) She stressed that “managing this cycle is one of the most important things ecommerce business can do to survive.”

In this article, we’ll cover:

- Understanding your inventory cycle

- Why is cash flow important for businesses?

- How is managing cash flow impacted by your inventory cycle?

- Outsourcing locations directly impact lag-time

- Carefully watch your days-in-inventory and inventory turnover

- What does this mean for your business?

Let’s get into it.

Key Takeaways

- Understanding Your Inventory Cycle Is Crucial

- Inventory Cycle Directly Impacts Cash Flow

- Inventory Cycle Steps Vary by Business

- Outsourcing Location Affects Lag Time

- Track Inventory Metrics to Avoid Cash Traps

- Poor Inventory Management Can Lead to Bankruptcy

- Plan Ahead to Avoid Cash Crises

Understanding Your Inventory Cycle

On that note, what does your Inventory cycle look like? Understanding your company’s inventory cycle is important to it’s well being. Just like trying to understand your significant other. Not forgetting an anniversary is important to your well-being. You’ve seen it before, whether in real life or on a TV show. (Hopefully just on TV). Usually it’s the man who is portrayed as being forgetful. And it’s the woman who makes it clear she is not pleased he forgot their special day. Subsequently, you see him trying to pull out all the stops to make it up to her.

It would have been a lot easier if he had just gotten it right from the start. He probably wishes he had written it down. Or that he had paid closer attention to her hints. Similarly, it takes paying attention to understand your companies inventory cycle. It is much better to plan accordingly than to find yourself in a tight spot. As being without cash can put you in quite a pickle.

For more information on tracking and managing your inventory, click here.

Why is cash flow important for businesses?

Having a healthy cash flow is pivotal to growing a product-based business. If customers and/or sales channels are late with their payments, then sellers can’t pay their suppliers, shippers, employees, etc. Without payment those companies and people won’t be working for you very long. Companies should always make positive operating cash flow a priority. It’s important to have more cash coming in then going out. This creates the foundation necessary to grow your business.

How is managing cash flow impacted by your inventory cycle?

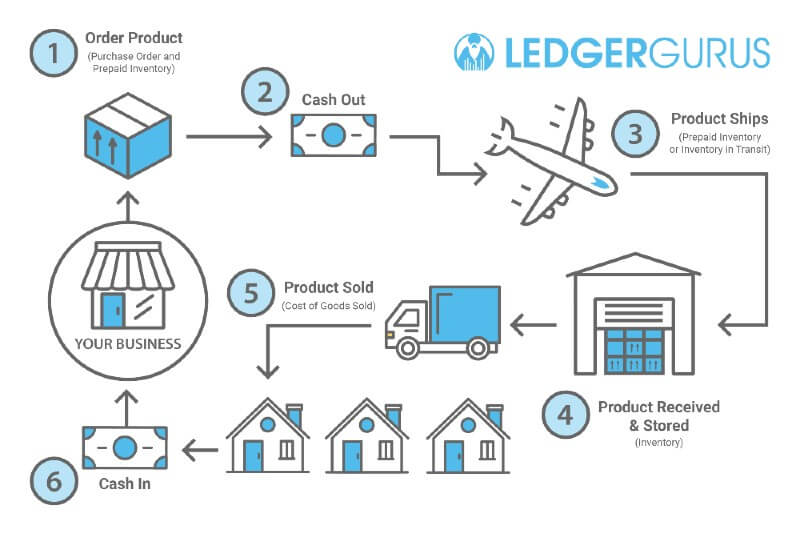

A typical inventory cycle starts with ordering your product. Cash goes out when you pay for it. (For information on how to account for inventory, click here). Then you sell that product and cash comes back in.

During the cycle you have a few other steps to consider. Some of these steps include the shipping of the product to you, receiving the product, and storing the product. During that time in the cycle you do not have cash coming in for the product. It is common to outsource a lot of these steps. Therefore, every inventory cycle is not the same for every business. These differences affect how much cash companies have on hand.

During the cycle you have a few other steps to consider. Some of these steps include the shipping of the product to you, receiving the product, and storing the product. During that time in the cycle you do not have cash coming in for the product. It is common to outsource a lot of these steps. Therefore, every inventory cycle is not the same for every business. These differences affect how much cash companies have on hand.

Outsourcing locations directly impact lag-time

As mentioned, the longest lag is in the time between “cash out” and “cash in”. This lag is also dependent on where you outsource manufacturing. If you outsource manufacturing to a local company then it will not take as long for cash to come in. If you outsource to another country like China then it can take much longer. Additionally, outsourcing to other countries can increase products being put on back order.

Another thing to consider is manufacturing in-house. This may create more hassle. However, you will have more control over your production and therefore your inventory cycle. You can better manage that lag-time in between cash going out and cash coming in. Most of the time lost is in the purchasing of the products/materials.

Additionally, you also must consider seasonality and how companies often have to stock up for increased sales. This occurs at different times depending on the company. It’s important to be prepared and have enough stock for Black Friday, Christmas, memorial day sales, etc. You need to buy for those times way in advance. Especially if you are ordering overseas. You may find yourself in a cash crisis. The cash cycle REALLY extends under those circumstances with a large amount of cash being paid upfront. Understanding this aspect of your cash cycle can help you to plan ahead. It can also help you line up favorable financing instead of being caught unaware.

Carefully watch your days-in-inventory and inventory turnover

It’s important to be mindful and track your days-in-inventory and Inventory turnover. Companies lose sight of how long inventory remains in the warehouse. If it becomes obsolete then they can’t sell it. Then they have all of their cash tied up in this inventory. There are many financial management studies, journals, and research that show a direct relationship between cash flow problems and how they predict bankruptcy. Click here for an article about this from the Financial Management Association International.

Inventory turnover:

COGS/Average Inventory

Inventory turnover is a formula that shows a company if it has too much inventory compared to it’s sales level.

High inventory turnover is good. It means a company is selling goods quickly and there is demand for their products. Low inventory turnover means a company is not selling goods quickly and there isn’t enough demand for their products. Make sure you have the correct COGS when using this ratio! For more information on correctly determining COGS, click here. This formula is a good way to measure the time lapse between cash in and cash out for your inventory cycle.

Days-in-inventory:

365/Inventory Turnover

Days-in-inventory helps you see how quickly you are converting your inventory into sales. In other words, It measures the number of days of the year your cash is tied up in inventory. A slower turnaround can mean you have a lot of cash tied up in inventory for a long period of your cycle.

What does this mean for your business?

In conclusion, it’s important to be aware of your companies inventory cycle. Be able to measure how long it takes to go from cash going out to cash coming in. Correctly managing cash flow ensures cash isn’t tied up in inventory for excessive amounts of time. Determine if you have sufficient reserves to tie your over during lag-times. Once aware of your inventory cycle, improve your cash management if desired. (Such as moving manufacturing closer to your business, or taking it in-house). Either way, understanding your businesses cash cycle will save you a big fat headache. The same headache that comes with forgetting your partner’s birthday. And standing spit-spat in the middle of bankruptcy court. Start planning now and save yourself the trouble of wishing you had later!