Estimated reading time: 8 minutes

You really need good inventory management!

Accurate inventory management is essential for ecommerce businesses. When selling products is your entire revenue stream, inventory is usually your largest asset on the books and the cost of it is your biggest expense.

So, when it comes to receiving funding, qualifying for a loan, or selling your business, accurate inventory management systems and accounting is crucial. Investors, lenders, and buyers will want to see accurate, valuable inventory data over periods of time.

In addition, providing financials that don’t show a history of reasonable inventory numbers cause others to question your maturity as an organization.

Correcting past inventory numbers during critical times of transition can be expensive and time-consuming. A lot of calculations and steps go into getting your inventory accounting correct. Now is the time to make the necessary changes in inventory management and accounting, so there are fewer bumps down the road.

Your Road Map for Inventory Management

Accurate inventory accounting and accurate inventory management go hand-in-hand.

That is why when LedgerGurus helps businesses get a handle on their inventory accounting, most of the work involves fine-tuning their inventory management.

At a high level, inventory management is about tracking both the quantity and value of your inventory. Getting a handle on these two pieces can be very daunting, depending on the stage and situation of your business. So, don’t expect your inventory management to be a well-oiled machine overnight.

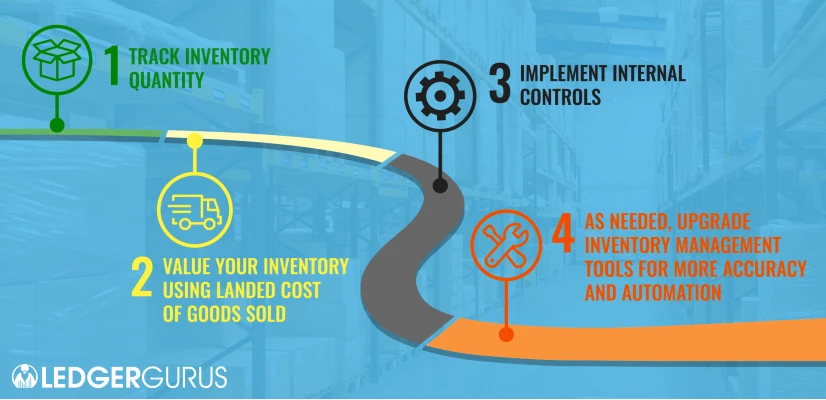

Instead, we suggest our road map for getting your business to a place of good inventory management:

- Track inventory quantity accurately

- Value your inventory using “landed” cost of goods sold

- Implement internal controls

- As needed, upgrade your inventory management tools for more accuracy and automation

Where do you see your business currently on this path?

Whether you’re on step 1, 4, or somewhere in between, you need to make sure you’re hitting each step on the road map. It is important to understand and accomplish each one.

Getting to step four should be your goal, and will no doubt improve business performance.

Step 1 – Track Inventory Quantity

I’m guessing you are already doing some sort of inventory quantity tracking, as this is a natural step for ecommerce businesses. Knowing your quantities will prevent selling unavailable products and help you make informed managerial decisions.

Many ecommerce sales channels already have inventory tracking built into the platform. If you are only moving product through one channel, tracking will be straightforward.

But in most cases, you will start selling on multiple channels or have movement of inventory outside of your channel (giveaways, giving product to influencers, disposing of defective product, etc.).

This is when things start getting tricky.

Inventory Data You Need

How do you know you have all the inventory data you need?

Here’s what you should know about your inventory:

- SKUs – Stock Keeping Units

- UPCs – Universal Product Codes

- QOH – Quantities on hand (onsite or in a facility)

- Product storage location – Where the product is on the shelf

- Supplier information – Contact information, lead times, order minimums, etc.

- Product costs – What’s the wholesale cost for products from various suppliers?

- Retail pricing – How are you currently pricing products for sale, and what promotions are coming up?

For more information: Read how to create SKU numbers and how to determine product costs.

As the complexity of your inventory increases, using an inventory “master” will be important. An inventory “master” is your one source of truth for inventory management. All your channels should look to this master for updating available quantities.

Options for a master source include a spreadsheet like this one at a very basic level, to a 3PL (third-party logistics) software that syncs with all your channels, or inventory management software (IMS) that updates & keeps track of it all for you.

You will need to use more robust tools as you experience increases in selling channels, inventory quantity, number of SKU’s, movement of inventory, etc.

Other things to consider when tracking inventory quantities:

- Will you store it onsite?

- Are you using a fulfillment center?

- How do your inventory processes tie into your dropship suppliers?

- What’s currently on order?

- What’s on hand?

- What’s available for sale?

- If you’re selling product bundles, is the availability limited by some of the components?

Internal vs external product storage will change how you control your inventory, so be sure that whatever process you’re using gives you the insights and accessibility you need to collect accurate data.

Step 2 – Value Your Inventory Using “Landed” Cost of Goods Sold Method

Calculating the correct cost for each SKU can be quite intense and more complicated than you think.

The standard method of valuing inventory is using the cost of your inventory as its value (the price at which you purchased your inventory).

Note: The only time you shouldn’t value your inventory this way is if the market value of your product is less than your cost for that product (hopefully this is not the case!).

So in order to value for all your inventory, you will need to calculate a cost for each SKU in your business.

Most businesses start with the “buy” cost. Although not ideal, this is better than having no cost at all. Here is the “buy” cost of goods sold formula for a SKU:

Buy Cost = Total purchase price of SKU / Quantity purchased

This method doesn’t include other costs you paid to get your product to the warehouse. Other costs may include shipping fees, customs & duties fees, insurance fees, etc.

Including these fees will give you a more accurate cost of goods sold number and is known as “landed” cost:

Landed Cost = Buy cost + Shipping fees + Customs & duties fees + Other misc. fees

For more information: This video will walk you through exactly how to do this process.

This landed cost calculation will be used as your COGS when each SKU is sold.

You will find the Inventory & COGS template mentioned in the video above here.

Step 3 – Implement Internal Controls

If you are tracking inventory quantity and can confidently provide a cost for each product you sell, you are getting closer to good inventory management.

But don’t stop! You’ll be surprised to find that inventory numbers on your books may be way off from actual inventory numbers, and you want to prevent huge inventory and COGS adjustments.

You will need to develop systems and processes to

- Reconcile your inventory

- Identify reasons for gaps

- Decrease gaps

This is where you can get creative in developing solutions that are unique to your business.

Reconcile Your Inventory

Reconciling your inventory with a manual count sounds terrible, but it is needed.

This is the only way to true up your inventory correctly and find problems with inventory controls.

You will want to think about how often you would like to complete a manual count reconciliation and what it will look like. How can you simplify the process and make it less daunting?

One of our clients divides their warehouse into fourths to make everything easier. Reconciling a fourth of the warehouse each month seems a lot more doable than the whole thing all at once.

3PLs also provide manual counts as part of their services.

Before manual counts, you will want to implement processes to reconcile what has been ordered, purchased, and received. Ask yourself the following questions:

- Does my purchase order match the numbers on my bill/invoice?

- Did I receive the amount of inventory I ordered and purchased?

- How can I implement a process to make sure I’m cross-checking these documents?

Cross-checking orders, purchases, and received inventory can prevent problems when you complete a manual count reconciliation later. Setting up a streamlined process for receiving inventory is probably one of the key elements to successfully managing your products.

With inventory being the most important asset of a product business, these types of internal inventory controls are important to take seriously.

Identify Reasons for Gaps

You will find that even when you have developed good processes for reconciling your inventory, your manual inventory counts will still differ from your ending inventory number on the books.

Our goal is to decrease this gap as much as possible with more internal controls.

To find the reason behind gaps, here are the questions to consider:

- Did we reconcile our received product with ordered product?

- Are we tracking refunds?

- Did we account for products we gave away?

- Are we accounting for defection?

- Is theft a possibility?

Answering these questions should give you a better idea of where gaps are occurring. Then you can work on solutions to decrease these gaps.

Decrease Gaps

Once you have uncovered where you have gaps, you can work on improving your processes and finding solutions for specific gaps.

For example, if you weren’t tracking refunds, you will need to make sure you incorporate refund tracking into your processes.

If you suspect theft, you may want to have a talk with employees, screen employees in a better way, or invest in better security. The key is to ensure that your solutions are ingrained into your systems and processes.

Step 4 – Upgrade Your Inventory Management Tools for More Accuracy and Automation

As your business grows, inventory accounting will likely become more complex. You will want to refine your internal controls over time and use tools that will assist you in the automation and accuracy of your inventory management. Tools we recommend really depend on your situation.

For more information: Read 5 tips to choose the right inventory management tool for your business.

Pros of Investing in Inventory Management Software (IMS)

Automate some of your inventory management tasks with an IMS that literally takes the work off your hands. As you scale your business, you may find yourself stretched too thin to do hands-on inventory tracking tasks. Some of the benefits of inventory management systems (IMS) include:

- Real-time analytics

- Barcoding capabilities

- Sales & order tracking

- Order management

For more information: Read about 10 more benefits of an IMS here.

LedgerGurus Can Help You Reach Your Inventory Management Destination

Following this road map is a journey for most companies. But this journey and the end destination of good inventory management can be a huge piece of success for your inventory-based company for the following reasons:

- High customer satisfaction because of high fulfillment rates

- Receiving loans and/or funding with accurate inventory accounting

- Having accurate COGS and profit margin numbers that will help you make better decisions (ad spend, order quantities, hiring, etc.)

- Accurate tax filings to prevent audit issues

Reach out to us for help or with any questions. We’re happy to help. Improve business performance through specialized and in-depth accounting solutions is what we enjoy. This is our expertise. Best of luck on your journey to greater business success.