If you’re selling into New York, you’d better play by their rules because they don’t mess around.

Long before most states were even thinking about taxing online sales, New York had laws on the books. They just didn’t have the legal teeth to enforce them until the Supreme Court’s Wayfair decision changed the game.

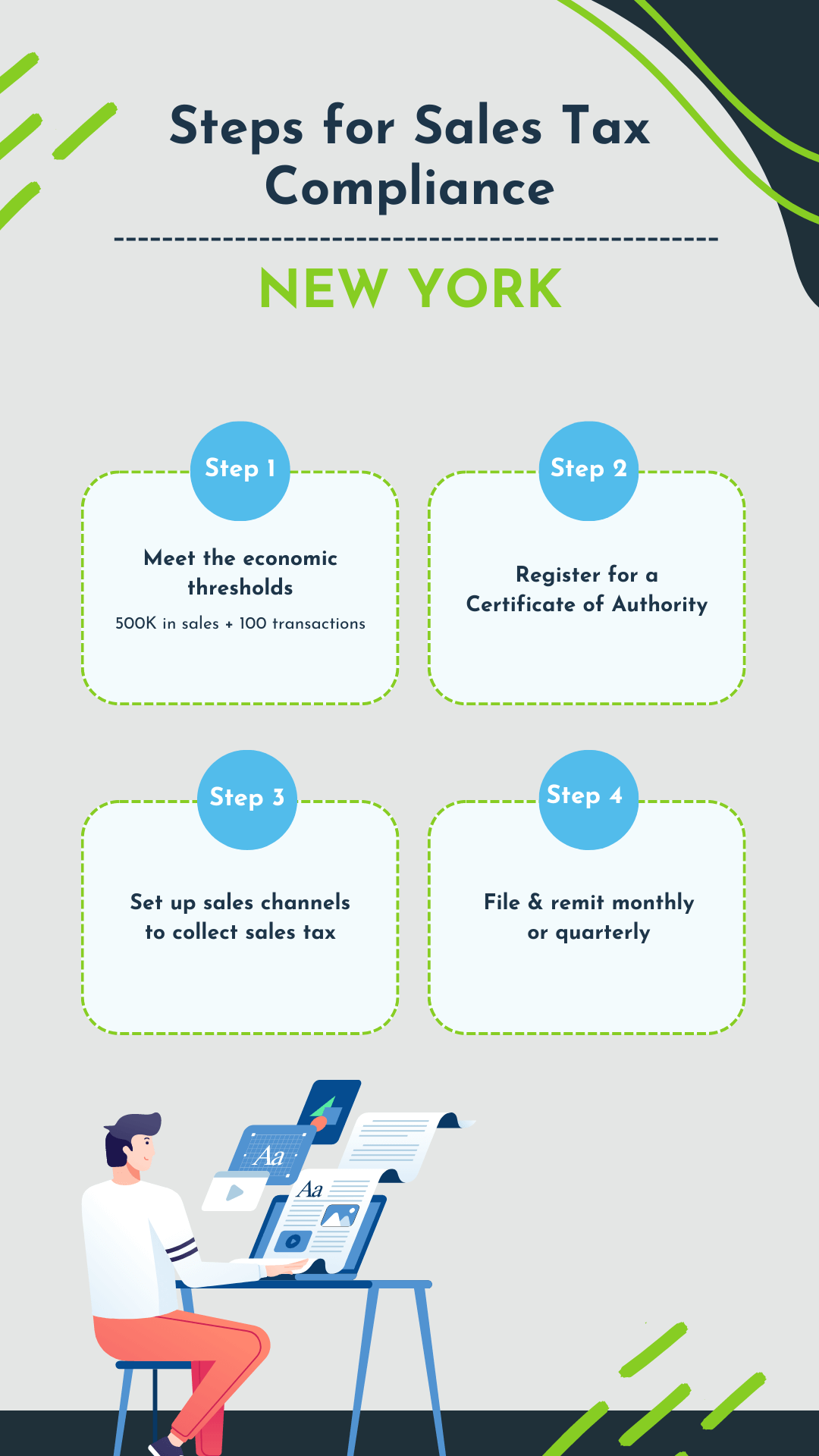

Now, New York is fully empowered and fully committed to making sure out-of-state sellers collect and remit sales tax. If your ecommerce business is crossing into New York territory (even without a physical presence), there are very specific steps you need to follow – from calculating thresholds to registering, collecting, and filing.

In this blog, I’ll walk you through what counts, what’s exempt, and how to stay compliant, so you can avoid costly penalties and stay focused on running your business.

We’ll cover:

- When to collect sales tax in New York

- How to get a sales tax permit in New York

- How to collect online sales tax

- How to get help with your sales tax

Let’s get started.

Key Takeaways

Key Takeaways

- New York requires out-of-state sellers to collect sales tax once they hit $500K in sales and 100 transactions in the previous four quarters.

- You must register for a New York Certificate of Authority before collecting any sales tax. Collecting early is illegal.

- New York’s sales tax quarters are unique (March-May, June-Aug, etc.), and different forms are used depending on your filing frequency.

- Marketplace sales (like Amazon or eBay) are handled by the platform, but your own website sales are your responsibility.

Does Your Ecommerce Business Need to Collect and Remit Online Sales Tax in New York?

If you are an ecommerce business without a physical presence in the state of New York, you need to start collecting and remitting sales tax when your sales and delivery of tangible personal property in New York meet the following economic thresholds:

- $500K in gross receipts in the prior four sales tax quarters AND

- More than 100 sales transactions in the prior four sales tax quarters

If you meet both criteria, you are legally required to pay sales tax on all sales during the applicable periods that you meet these criteria.

“Gross receipts” means your amount of sales in New York, regardless of whether your sales are taxable or exempt. It also means the amount of sales before applying discounts or promotional codes.

Finally, remember to consider sales on all sales channels, including your own website and third-party marketplaces, such as Amazon. That means you will need to add your total sales on all your channels to determine when you pass the economic nexus thresholds.

The sales tax quarters you should be assessing are the following (but remember to only consider the prior four for the period you are looking at):

New York Sales Tax Quarters

- Q1: March 1 – May 31

- Q2: June 1 – August 31

- Q3: September 1 – November 30

- Q4: December 1 – February 28/29

Note: New York’s quarterly schedule is different from all other states.

You can read New York’s sales tax notice regarding economic nexus for remote sellers.

(Worried about economic thresholds in other states? Click here for each state’s economic nexus laws.)

Sales Tax Vendor Registration in New York

If you are still reading, you’ve probably determined that you may need to start collecting and remitting sales tax for your online sales in New York. We see many people rush to their online sales channels and update the settings to collect sales tax in New York.

Stop!

Collecting sales tax from customers before registering is actually illegal.

The first step you need to take is registering for a New York State sales tax permit online (called a “Certificate of Authority” in New York). This registration is necessary to start legally charging sales tax.

You can start the process here.

New York assigns you a filing frequency based on the amount of taxable sales (not gross receipts as described above), or the amount of tax due. This will be monthly, quarterly, or annually depending on your business.

Once your filed sales exceed $500K, you will be automatically switched to monthly filings.

Generally, the due date for filing is on the 20th of the month following the reporting period, unless weekends or holidays push that date back.

Be aware that monthly and quarterly filings use different forms.

You will need to file monthly returns on ST-809 for the first two months, and then ST-810 for the third month.

Quarterly filers will only need to file the ST-810.

Collecting Online Sales Tax in New York

Once you have registered for a sales tax permit in New York, you must start collecting sales tax from customers. Businesses must comply with sales and use tax regulations.

Sales tax applies to retail sales of tangible personal property, prepared foods, and many services, among other things. For more information, click here.

New York State Sales Tax Rates

NY sales tax rates vary depending on the city and county where your sale is delivered. The tax rate will range from 4% – 8.875%.

On Shopify and other non-marketplace sales channels, you can update the settings to collect sales tax in New York. (Marketplaces like Amazon, Etsy, eBay, and Walmart will automatically collect sales tax because of marketplace facilitator laws.)

These sales channels are pretty accurate in applying the correct tax rate, depending on the location of where your product is delivered.

If you are using a sales tax application such as TaxJar or Avalara that is connecting to your sales channel, you can also update the settings through those apps. (Click here for a comparison of sales tax software solutions).

Taxability of Products

A few items are tax exempt in New York. Although you will need to consider the sales of these products when assessing the economic thresholds mentioned at the beginning of this article, you may not need to collect and remit sales tax on these products.

The tax-exempt products that we see affect ecommerce businesses the most are:

- Groceries and food items, including dietary and health supplements (learn more)

- Certain clothing and footwear with a price tag of less than $110 per item (learn more).

Make sure to file a Schedule H if you sell clothing. (By the way, any clothing that costs more than $110 IS taxable.)

For any products that are tax exempt, update your sales channels so you don’t collect sales tax on these products. If you have any questions as to whether your product is taxable, you can view New York’s Quick Reference Guide for Taxable and Exempt Property and Services.

Third-Party Marketplace Sales

If you are selling on a marketplace, such as Amazon, you do NOT need to collect and remit sales tax for the sales on that marketplace. New York requires marketplaces to collect and remit sales tax for its sellers if the marketplace meets the thresholds mentioned at the beginning of this article (Amazon obviously meets these thresholds).

Don’t collect sales tax for any marketplace that is collecting and remitting sales tax for its sellers.

Filing Sales Tax in New York

After registering and collecting sales tax, you will need to file and pay those collected funds. You can file online at the New York Department of Taxation and Finance.

Whether or not you are using a sales tax tool such as TaxJar or Avalara, you will want to double check the calculation of how much sales tax you owe.

Also be aware that New York has incentives for filing on time. You can actually receive a discount of 5%, up to $200 per quarter, for filing on time!

A penalty of $50 plus interest exists for late filings.

How to Get Help with Your NY Sales Tax

By following the guidelines for NY state sales tax in this blog, you will be well on your way to avoiding the heavy New York gavel!

We have created a 10 Steps of Sales Tax guide detailing all the steps you need to take to become sales tax compliant.

If you need help in handling your sales tax, reach out to us with questions or needs. We have an entire team of sales tax professionals who do this everyday, and can take this off your hands, so you can focus on what you do best – growing your business!