Ecommerce sales tax is a BEAST. A beast with a mean growl, sharp claws, and putrid breath…yeah, it’s scary.

Facing the beast of ecommerce sales tax is so challenging that many small- to medium-sized businesses run or hide (we don’t blame you). But avoiding sales tax can threaten business survival and success.

One of the most difficult aspects of ecommerce sales tax to understand is sales tax nexus. But once you get it, you are well on your way to subduing the “beast.” You’re definitely in the right place.

We’ll cover:

- What sales tax nexus is

- The main kinds of nexus affecting ecommerce sellers

- How to determine where you have nexus

- How sales tax responsibility varies by sales channel

- Risks of delaying compliance

- Resources to help you handle your sales tax responsibilities

Let’s get into it.

Key Takeaways

- Understand where you have sales tax nexus: Nexus determines where you must collect and remit sales tax. You may trigger nexus by having a physical presence (like employees or inventory in a state) or by reaching a certain level of economic activity (sales volume or transactions).

- Sales channels affect your responsibility: If you sell on Amazon (or other marketplaces), they’ll handle sales tax for you as a marketplace facilitator. But on Shopify and other non-marketplace platforms, you’re responsible for collecting and reporting sales tax once you meet state thresholds.

- Avoid delays in compliance: Delaying sales tax registration can lead to audits and fines. You can use resources like LedgerGurus’ consultations or sales tax services to simplify compliance and ensure you’re on the right track.

What is Sales Tax Nexus?

Like most things tax related, this term seems complicated at first glance but is actually fairly straightforward. In short, ‘Nexus’ is a term used to describe when a business has a strong enough connection with a given state or local government to be obligated to collect and file sales tax in that state.

It’s a simple enough concept. However, the devil is in the details.

Main Types of Sales Tax Nexus Affecting Ecommerce Sellers

Previous to the South Dakota v. Wayfair ruling (June 2018), states could only tax ecommerce businesses based on old nexus laws (and a few less common laws).

It used to be that the only basis used to determine whether a business had tax obligations in a state was if it had a physical presence there.

Now there are other factors to consider:

- Physical presence

- Economic nexus

- Click-through nexus

- Affiliate nexus

The first two (physical presence and economic nexus) are the main ones that ecommerce sellers have to deal with. The other two (click-through and affiliate) are really only applicable in certain circumstances. Read below for descriptions of each type.

Physical Presence

Physical presence can be in the form of locations, employees, warehouses, etc. An easy way to think of it is PEOPLE & PROPERTY. If you have people (employees, contractors, traveling salespeople, etc.) or property (warehouses, buildings, inventory, etc.) in a state, you have physical presence there.

Good questions to ask yourself are:

People

- Where is my company located?

- Where are my employees?

- Where are my salespeople?

Property

- Do I have any company-owned equipment or vehicles?

- Where are my offices and warehouses?

- Where is my inventory?

Please note that whether you store your inventory in your own warehouse or in a 3PL, if you own that inventory it is creating physical nexus for you.

For example: If your business is located in Georgia, you have a physical presence there. You need to register and start collecting sales tax.

If your business is located in Georgia and your inventory is in a warehouse in Tennessee, you have a physical presence in Tennessee, as well. That means you’ll need to register for sales tax permits in BOTH Georgia and Tennessee, and start collecting and remitting sales tax on your sales into those states.

Economic Nexus

The South Dakota v. Wayfair ruling made it so states can also tax businesses based on “economic activity”. Economic activity refers to the amount of gross sales annually and/or the number of transactions that a business has within a state.

When you reach a certain threshold of sales and/or transactions within a state, your business is said to have economic nexus. You are then required to collect and remit sales tax to that state.

Note: Some states have either sales OR # of transactions thresholds, while others require BOTH to pass the threshold. Also, while many states are set at 200 transactions OR $100,000 in revenue, this does change by state.

For example, Arizona only has a gross sales threshold. If you sell over $100,000 into Arizona, you’ve passed the economic threshold for that state. You need to register for a permit and start collecting sales tax.

Connecticut has a BOTH threshold. That means that you’ll have to sell over $100,000 AND have over 200 transactions before you cross the threshold.

NOTE: You are NOT responsible for sales tax BEFORE you pass the threshold. So, don’t make the common mistake of setting up your sales channels to collect in every state as soon as you start. Besides, it is ILLEGAL to collect sales tax if you don’t have a sales tax permit.

For a complete list of economic thresholds by state, download our 10 Steps to Ensure Sales Tax Doesn’t Burn Down Your eCommerce Business guide. Besides the 10 steps, there is a chart in the appendix with all the thresholds.

Click-Through Nexus

A seller meets sales threshold in a state from the activities of an in-state referral agent. The seller must be making commission payments for any sales that come about because of the website or marketing of the referral agent.

Affiliate Nexus

A remote retailer can have affiliate nexus when he/she holds substantial interest in, or is owned by, an in-state retailer that sells the same or similar line of products under the same or similar name.

Criteria to Determine Where You Have Sales Tax Nexus

To determine whether you have sales tax nexus with a specific state, you need to answer the following questions:

- Do I have any physical locations/operations within the state?

- Do I make enough sales to surpass the state’s sales tax threshold?

If you answered yes to either of these questions, you’ll probably have to register and file a return. Your ecommerce platform of choice will usually provide information about your number of transactions, how much money they’re generating, and where they’re taking place.

Here are some resources for how to read your reports to get this information:

- Shopify Sales Tax Report: How to Find & Understand It

- How to Find and Understand Your Amazon Sales Tax Report

Your appetite for risk comes into play here – if you’re only liable for $10 in Texas, is it really worth going through the process and cost of filing? That’s up to you.

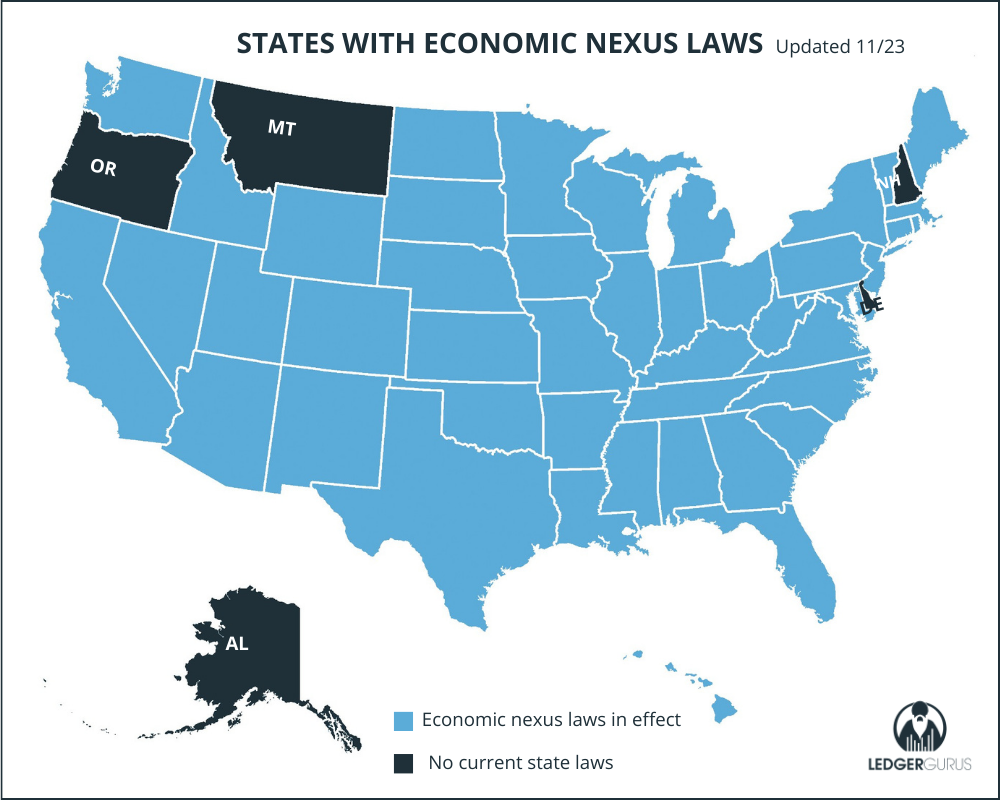

Economic Nexus Thresholds by State

Each state sets their own laws on economic nexus thresholds. For example, South Dakota expects sales tax to be collected by your business when you have annual sales in their state of more than $100K OR more than 200 annual transactions. California expects you to collect when you pass $500K in annual sales, but doesn’t specific how many transactions.

Another “fun” fact is that sales tax laws change fairly often.

It used to be that not all states that have state sales tax laws also had economic nexus laws. That is no longer the case. All states with state sales tax laws also have economic nexus laws. So the question becomes, does your business have significant sales volumes in any of these states? If so, refer to our free sales tax guide for thresholds and other important info in those states.

This is a great starting point for navigating the world of ecommerce sales tax and especially economic nexus.

Important Note: This guide is for informational purposes. Laws continue to change, and laws other than economic nexus may also require you to pay sales tax, including old nexus laws, click-through nexus laws, and affiliate nexus laws. Always contact the state if any questions remain.

How Sales Tax Responsibility Changes on Different Sales Channels

The state(s) you’re engaging with aren’t the only factor to think about – your ecommerce platform of choice is also important.

Sites like Amazon or eBay are what’s known as “marketplace facilitators” – they make sales, transactions, and often fulfillment possible. Many states have marketplace facilitator laws that ‘force’ these companies to collect sales tax on behalf of their sellers.

We explore the basics of this below:

Amazon (and Other Marketplaces)

If you sell exclusively on Amazon, you usually won’t have to worry about collecting sales tax yourself. The company now does this on behalf of their sellers in every state with a fulfillment center.

For more guidance on what you need to do about sales tax as an Amazon seller, watch 2023 UPDATE – Do Amazon Sellers Need to Worry About Sales Tax?

Shopify

If you’re wondering how to determine sales tax nexus for Shopify stores, the process is much like that described above. You’ll need to know how many transactions you’re making and/ or how much revenue these transactions generate – the specifics, again, come down to each state.

If you’re using Shopify’s fulfillment network, you may be liable for sales tax in the following states (At the time of this writing, Shopify has physical fulfillment warehouses in these locations):

- California

- Georgia

- Nevada

- New Jersey

- Ohio

- Pennsylvania

- Texas

If you know you’re liable for sales tax in a given state, follow these steps:

- Login to your account

- Click settings > tax

- Click tax regions > United States > manage > collect sales tax

- Go back to taxes – tax calculations and click charge tax on shipping rates

-

- This can be overridden for states where shipping isn’t taxable (settings > taxes > tax regions > shipping override

We have more detailed instructions, along with screenshots, in this blog – Shopify Sales Tax Setup | Where and How to Collect.

Non-Marketplace Sales

If you’re not selling on a common ecommerce platform, your situation may be a little trickier to navigate. You’ll need to keep good records of the following:

- How many sales you’re making

- How much money these sales have made

- Where these sales are generated

- Any physical locations you have in the United States

Once you’ve reached a state’s threshold, it’s your responsibility to start collecting sales tax on future sales and file returns where applicable.

Risks of Delaying Compliance

It may seem like a good idea to save money and time by putting off sales tax filings, but it is NOT smart to do this.

States are becoming increasingly aggressive towards online sellers and sales tax audits are becoming more common.

They are also starting to send out pre-audit questionnaires, to both registered and unregistered businesses, to see who is not being compliant.

For more information and to learn how to protect your business, read Sales Tax Audits Guide: What’s Triggering Them and What Sellers Need to Know.

If you’ve got a significant sales tax exposure, you may want to consider a Voluntary Disclosure Agreement (VDA) to reduce your liability and prevent an audit.

Resources Available to Help You Comply with Sales Tax Nexus Laws

Our 10 Steps to Ensure Sales Tax Doesn’t Burn Down Your eCommerce Business is a super valuable and free resource. It is intended to help you understand all the steps necessary for sales tax compliance. And, as an added bonus, there’s a chart at the end with all the economic nexus thresholds by state, as well as links for more information.

Another resource we have to help you better understand the complexities of sales tax and how to manage them is our free masterclass: The Uncomplicated Truth about Sales Tax.

Still scratching your head about how sales tax applies to your specific situation? We’re happy to help.

You can schedule a sales tax consultation with our sales tax experts. They are happy to answer your questions.

Final Thoughts – Learn More With LedgerGurus

Sales tax is complicated, and continues to become more so as states pass new laws and regulations.

If you’re ready to hand this whole thing over to someone else so you don’t have to deal with this headache every month, consider the sales tax experts at LedgerGurus.

We have a whole team that specializes in US sales tax. We do this stuff every day! We’d be happy to give you the peace of mind that comes from knowing you’re sales tax compliant without having to be the one doing the work.

Contact us today so we can take this off your plate.

FAQs

If I’m drop shipping, do I have nexus where my supplier is?

No. The drop shipper owns the product, not you, so you don’t have physical presence in that state.

Am I responsible for sales tax as soon as I start selling into a state?

No. If you don’t have physical presence in a state, you don’t need to worry about any sales tax until AFTER you pass the economic nexus threshold.

Should I go ahead and start collecting in every state right from the start?

NO!!!!! You are not responsible for sales tax until after you have nexus in a state. Also, it is ILLEGAL to collect sales tax if you don’t have a permit.