Estimated reading time: 11 mins

Being a small ecommerce business is tough! Founders must wear a lot of different hats as they get the business started! As a business increases in revenue and becomes increasingly complex, there are a LOT of demands, but time is limited. At this stage, it is too early to bring on a full-time, in-house accounting team, but it’s still good to involve outsourced ecommerce accounting professionals.

Here are 5 reasons to outsource the accounting for your ecommerce business:

- Benefit #1: You’ll save time and money.

- Benefit #2: You’ll gain financial discipline.

- Benefit #3: You’ll gain valuable insight into your business.

- Benefit #4: You’ll be able to make strategic decisions.

- Benefit #5: You’ll be ready to attract investors.

Common Complexities for eCommerce Businesses

We talk to a LOT of ecommerce business owners, and we hear the following concerns all the time:

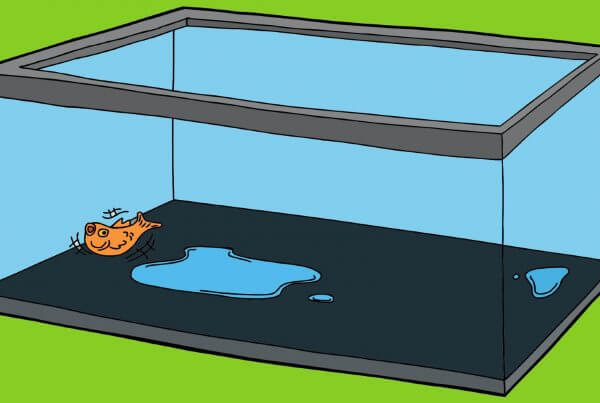

- I don’t know how much inventory I have or what it’s worth.

- I’m not sure what our cost of goods sold (COGS) is or how to find out.

- I don’t know if I’m doing my sales tax properly, and I need help!

- I think I’m selling profitably but I’m not sure, and I don’t have systems in place to find out.

- I sell on more than one channel, but I’m not sure how to see which one is most profitable.

- I’m struggling with timing issues with my sales channel transactions.

- I’m frustrated with complex reports and reconciliations.

- I’m looking for streamlined solutions to handle payment processors.

- Product returns are messing up my revenues and inventory management.

- I don’t know how to handle complex inventory issues, like stocking tracking and replenishment and I keep overselling.

- I’m overwhelmed by the high volume of transactions. It makes keeping accurate records difficult.

Do these sound familiar?

Now we know that very few business owners start a business for the sheer pleasure of doing accounting, and yet as Brittany Brown, LedgerGurus’ founder and CEO is fond of saying:

“Accounting is the language of business.”

So, if you don’t “speak accounting,” you’re missing out on valuable information you NEED to make important decisions in your business.

The beautiful thing is that problems like these can be solved by outsourcing the accounting for your ecommerce business. Let experts focus on your numbers so you can focus on growing your business.

Now let’s talk about some of the benefits of doing this.

Benefit #1 of Outsourced eCommerce Accounting: Saves Time and Money

Congratulations! Your business is growing after months or years of hard work developing a product and website.

So why are you still doing your own accounting?

No, I’m not talking about tax preparation – most business owners/executives know better.

I’m talking about the bookkeeping, invoicing, bill pay, payroll, and other accounting tasks that you’ve been doing yourself. Time is a very precious commodity. Every hour spent doing those things is an hour not selling, marketing, building a product, or delivering a service.

Let Go to Gain Visibility

If you’ve been doing your own accounting, you may feel like you’ll lose visibility by outsourcing. In reality, accounting professionals can go deeper into your finances than you probably have time for AND they can give you BETTER visibility than you had before.

Your Time is Better Spent Elsewhere

You may be great with many of the tasks of accounting, but you’re probably a better engineer, marketer, salesperson, or operator. Proper accounting takes time away from those activities, and you know it.

The critical accounting functions for any business include:

- Payroll

- Invoicing

- Collecting receivables

- Bill pay

- Annual tax preparation

Other necessary accounting activities are:

- Bookkeeping

- Reconciling account statements

- Managing expenses

- Generating / reviewing financials

Many business leaders who are doing their own accounting aren’t doing all or any of this second set of activities. And yet, these are necessary to have the financial insights you need to make informed decisions and keep your business moving smoothly.

Benefit #2 of Outsourced eCommerce Accounting: Get Financial Discipline

When ecommerce businesses start to grow, they tend to grow quickly and require lots of financial discipline to keep things manageable. With business growth though, the demands of sales, customer satisfaction, and product momentum are critical and can easily create financial chaos.

Unfortunately, your accounting and finances can get away from you if you are still doing your own accounting, and it can be near impossible to achieve the discipline you need to move your business forward. Here are some areas where discipline will move your business forward:

Financial Reviews

Financial discipline starts with regular (on a weekly or at least monthly basis) financial reviews. The big three financial reports are the:

- Profit & loss statement (also called an income statement)

- Balance sheet

- Cash flow statement

From these statements, business owners can see where they are making and spending money, how much they have and how the money is flowing.

Keeping track of the high-level information in these reports helps business owners make good business decisions and measure their impacts.

Expense Management

With a growing business comes more employees and more role specialization. It is no longer feasible to have one or a few people in charge of all expenses. Sales, marketing, and other staff members need the ability to support their activities with appropriate expenses. Unfortunately, excessive spending can occur without proper expense management policies, processes, and solutions.

Budgeting

Budgeting and budget management are the hallmark of financial discipline. Spending on intuition only gets a business so far before the bank account is empty. Budgeting enables a business to spend like Goldilocks: not too much, not too little, but just right. By spending judiciously, you can turn spending into smart investments and not ignorant expenses.

Benefit #3 of Outsourced eCommerce Accounting: Gain Business Insight

To gain business insight, you must have the accounting essentials covered. They are the foundation for getting the right information you need to make good business decisions. If these first two steps are done right, generating good reports and other information is easy. If done wrong, all the financial reporting in the world is useless, or at best misleading.

Build Your Business with Better Numbers from Gaining Business Insight

With good financial processes and execution, you’re ready to gain business insight. What insights might you gather? Start by asking some basic questions like:

- What is our current cash balance, and is it sufficient to cover upcoming expenses?

- How much do we owe to suppliers and vendors (accounts payable)?

- Are we consistently profitable, or do we have periods of losses?

- Do I have enough inventory to keep me going until my next shipment arrives?

From this point, you can make informed decisions to optimize or increase your business. Once you start getting answers to good questions, you’ll find more will arise. Such questions might include:

- What are our profit margins on individual products or product categories?

- Are we optimizing payment processing options to minimize transaction fees?

- Is our shipping process efficient and cost-effective?

- What is our current financial position, and how does it compare to our projections and goals?

Benefit #4 of Outsourced eCommerce Accounting: Be Strategic

Everyone in business wants to be strategic, but how can accounting be strategic? Here are some ways:

Financial Analysis

As previously stated, financial reviews are the a starting point for understanding your business and making good decisions.

Making strategic decisions involves real analysis of your financial statements and the underlying information they represent.

Here are some questions to consider:

- Who are your most profitable customers?

- What product or service sales are growing or declining the most?

- Are your COGS growing or declining in proportion to your income?

- Are expenses increasing faster than income?

These are just examples of questions whose answers are contained in your financial reports (or the underlying transactions that they summarize). With good bookkeeping and proper analysis, you can get that information quickly. Are you able to easily get these answers for your business?

At this point, we highly recommend the Diagnostic Toolkit for eCommerce Sellers from Common Thread Collective. It is a DIY audit with 10 ecommerce KPIs that will help you gauge how well your ecommerce company is doing and what you need to change. For more information, as well as a link to a special offer, Unlock the Secrets of eCommerce KPIs: Discover the Power of the Diagnostic Toolkit.

Forecasting

As you become more sophisticated, you can begin forecasting your financials. Forecasting is built on the foundation of good accounting practices (payroll, bill pay, invoicing, etc.), financial fundamentals (bookkeeping, expense management, etc.), and financial analysis. It also incorporates good managerial practices of sales pipeline management with related costs and expenses.

Forecasting will help you create accurate budgets and plan your business wisely. Great businesses use forecasting to hire and spend wisely, plan for cash shortfalls or increases, and grow profitably (or with a controlled loss).

Cash Management

Cash is king! If you don’t know that already, you will soon. Cash management is built on many other accounting activities. Good bookkeeping, financial reviews and analysis are the tools for understanding your cash position. Solid accounting operations including invoicing, bill pay, payroll, and expense management are the primary levers for managing cash flow. Forecasting and budgeting are tools that give you an understanding of how expected future activity will affect cash balances. To do cash management right is to truly be strategic with your accounting.

Benefit #5 of Outsourced eCommerce Accounting: Attract Investors

Growing technology businesses and raising capital go hand in hand. Unfortunately, landing that great round of funding and crappy books do not. Your friends, family, and even that angel investor may have been willing to go off your pitch and spreadsheets alone, but as you ask for more money, the diligence will go up.

Improper Accounting = Low or No Funding

Ask yourself these questions about your own books (if you don’t, the investors will):

- How long is your cash cycle?

- What’s the average first year value of a customer?

- What’s the average lifetime value of a customer?

- Are you properly recognizing revenue?

These questions can be easy to answer if your books have been properly managed and maintained. If not, getting good answers can take days or weeks.

Investor Ready vs. Functional Financials

If your business if growing successfully, you have functional financials. They may not be efficient or effective, but you’re doing enough to keep the doors open. When investors come knocking, functional financials are not enough – they want audited financials. How do you know if your financials are audit ready? Here are a couple of good questions to ask yourself:

- Has revenue been booked and recognized properly?

- Are you capturing all expenses?

- Have owners and investors equity been properly represented?

Are You Ready to Outsource Your Accounting to the Experts?

So, as you can see, there are lots of benefits to outsourced ecommerce accounting.

If you’d like to see what this looks like for one of our customers, watch this video:

LedgerGurus is an ecommerce-specialized accounting firm with accountants and bookkeepers familiar with the peculiarities for ecommerce and accounting needs. Get in touch with us and we’ll help you see how we can take the load of accounting off your plate and give you clear insights. Let us focus on your numbers while you focus on growing your business.