Now-a-days, there are hundreds of apps and solutions that offer direct integrations with QuickBooks Online (QBO). This large ecosystem of tools (see the image below) is one of the most compelling reasons to choose QBO as your accounting platform (click here to read about when you should be using QBO vs QuickBooks Desktop). However, integrations can be not only a wonderful resource, but also a big pain in the behind.

On one hand, integrating other apps with QBO can save you time and provide valuable information in one central location. On the other hand, integrations can have the unexpected result of pulling in a large amount of data that creates a huge mess and leaves you with a puzzle to unravel. Integrations may end up increasing the amount of work and headache that you don’t have time for right now – or ever. Therefore, the decision of whether to directly integrate another tool with QBO should be a well-informed decision.

The Purpose of QuickBooks Online – A Paradigm Shift

As you are making the decision whether to integrate an app with QBO, we want to encourage you to consider a paradigm shift about QBO’s purpose. With all the apps available at your disposal, your accounting system should no longer be the place where you track every order, all shipping information, and every movement of inventory. Consider that you have other tools better prepared to track these specifics. Your accounting system should be the hub where the total picture comes together. QBO’s job is to show you how your company is performing as a whole, and to show financial performance.

We have a rule at LedgerGurus: if the information is available in detailed form outside of QBO, there should be a very compelling reason before duplicating that detail in QBO. If you can see detailed information in another system (like detailed orders in Shopify), asking an integration to bring over all that same detail invites discrepancies, which must then be evaluated and investigated. You now have mountains of detail to sort through to figure out why it’s not matching between systems. At the end of the day, no real value is created by having detailed information in QBO. You can run better reports in Shopify and quickly summarize Shopify activity into QBO. You can then evaluate the way Shopify activity is impacting the overall performance of your business.

When to use integrations with QuickBooks Online

With these understandings, don’t get “integration-happy” and click the sync or integrate button with every app that you download. Slow down! Use the technology. Become familiar with it and learn what data and information is available. (If don’t have time for this, we are familiar with most ecommerce apps and have the answers for you! Contact us here). Then, consider whether an integration would actually make sense AND save you time and hassle.

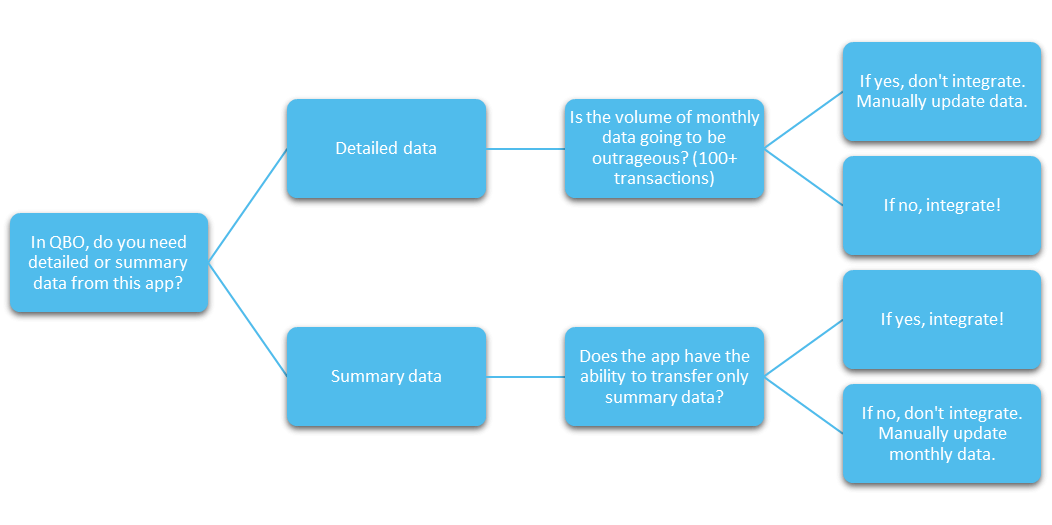

We recommend using the following decision tree during this consideration.

Decision Tree: When to use app Integrations with QuickBooks Online

Do you need detailed data or summary data in QuickBooks Online?

When deciding on app integrations with QuickBooks Online, the first question to ask yourself is if you need the detailed data in QBO or whether summary information would meet your needs. Is the detailed data valuable to have in QBO, or is it simply additional information? Are you losing anything critical by not transferring over detailed data?

Let me walk you through two scenarios to show you the difference here:

Detail is NOT needed. Summary is adequate:

An inventory management application (like Dear systems, SOS Inventory, SkuVault, or Locate) is going to be integrating with your sales channels. These systems will track the value of every individual SKU and recognize an associated cost of goods sold with each sale. It does a great job of tracking this important level of detailed data. If you needed to see exactly what the cost for an order was, you could easily look that up in your inventory app. Asking that app to integrate with QBO at a detailed level means you have inventory data in two places. Hopefully the integration brings clean data into QBO. But you will need to constantly validate data between the two systems and fix discrepancies.

The same app will also allow you to simply run a report showing summary COGS for the month. This would be more summary-level data. When looking at you company’s overall performance, you are really looking at the total COGS against all other revenue and expenses. In this scenario, there is no additional value created by bringing the detail into QBO. Nothing is lost in the summary data, and a huge potential mess can be avoided by not integrating.

Detail IS needed. Summary is inadequate:

On the other hand, let’s look at an app (like Bill.com, Veem, or Plooto) handling accounts payable or accounts receivable functions. Although those applications do a great job of handling many parts of that process, open bills and open invoices at the end of a reporting period represent accrual adjustments. Adjustments would need to be manually updated in your financials. This would require more work at month-end than if you had just set up a good integration from the beginning. Furthermore, in QBO, the payments made and received for those items are often being reconciled against bank and credit card transactions moving through QBO. This will also make your job in QBO easier.

In this case, if the integration can be counted on to bring in good details and information, the integration SHOULD be used. However, even in this case, if the number of bills or invoices being processed is large and the outside app does an adequate job of tracking the status of open items, this data should be summarized at month-end in QBO as well.

When integrations can help with summary data

If you need only summary data in QBO, find out if the app can transfer only summary data. Some apps can (integrate away!). And some apps can’t (DO NOT integrate, if you don’t need detailed data).

Our favorite example of an app that transfers summary data is A2X. A2X integrates all your sales channel transactions on Amazon with QBO. Instead of transferring over each transaction, the integration lumps all transactions on Amazon into the accurate accounts on QBO. In addition, the app then ties the Amazon activity out to the deposits actually hitting your bank account in QBO. This is a perfect integration app that will save you time and provide you with valuable information on QuickBooks Online!

There are also some inventory apps that allow you to choose if you want it to just bring in a journal entry for summary data. (An example of this is Cin7). These apps are usually good options for integration. Some sales tax tools create sales tax liability information in summary form. This is helpful too. For each app in which you need only summary data in QBO, you will want to investigate whether an integration is possible for summary-level data.

A last consideration

When considering QBO integrations, you may be trying to solve a problem that trumps all the other considerations we discussed. An example of this is a job costing tool a construction company may use. They may be tracking all their job-related costs in QBO, but they also need that information available to project managers. Because they don’t want project managers to have full QBO access, they will need another program with the job-related cost information.

In this case, an integration between QBO and a job costing project management app is very helpful, because detailed data is needed in two places. Without integrating, there would be a need for a large amount of double-entries into two systems. Although an integration may create the issues already discussed, in the end, the benefits outweigh the hassle.

Final Thoughts

This blog will certainly help you navigate the important decision of when to use app integrations with QuickBooks Online. When used correctly, this ecosystem of technology can significantly increase the accuracy of and decrease the pain of bookkeeping. Then, we can accomplish our goal of helping you build your business with better numbers. Best of luck in growing your successful business!