American Express business credit cards are widely used for many reasons. The big challenge with American Express is the lack of many features the technology-first credit cards provide. Tradeshift Go is an appreciated solution that brings modern features like virtual cards and detailed spend management to American Express business credit cards.

In this article, we’ll cover:

Let’s get into it.

Key Takeaways

- American Express Offers Powerful Rewards for Business Owners

- Tradeshift Go Adds Key Features to Amex Business Cards

- Benefits of Virtual Credit Cards

- Card Request & Approval System

- Spending Insights & Reporting

- Double Support

- No Additional Fees

Why American Express Dominates

Business owners love credit card rewards programs. These rewards range from cash back to travel benefits, or points that can be used for a variety of benefits. In most cases, these rewards come tax free and can represent a significant financial perk. American Express has some particularly popular credit card programs depending on an owner’s business and rewards preference.

For example, many ecommerce sellers like the American Express Business Gold Card with the accompanying Membership Rewards Points program that provides 4 times the points per dollar up to $150,000 per year on certain business categories, including online advertising purchases on Google and Facebook. Those points add up in a hurry for ecommerce sellers and can be redeemed for gift cards, shopping, and travel.

The challenge of some of the feature-rich and technology-first credit cards is that their rewards programs don’t match those of American Express and business owners will choose rewards over features most of the time.

Tradeshift Go

Tradeshift Go is a software solution that layers on top of American Express business credit cards with some key features:

- Virtual credit cards

- Card request and approval

- Spending insights

- Additional support

- No additional fees

Let’s explore each of these features.

Virtual Credit Cards

Virtual credit cards provide spending and fraud protection particularly for online purchases. In the case of Tradeshift Go, virtual credit card numbers are generated on top of one or more American Express business credit card accounts with specific limits. There are a number of use cases for virtual credit cards including:

- Subscriptions

- Recurring Vendors

- One Time Spend

- Projects

Subscriptions

Businesses run on subscriptions, especially software subscriptions. The challenge with subscriptions is vendor breaches and increased charges. These challenges are mitigated by using a unique virtual credit card number with a distinct limit for each subscription.

When a vendor has their credit card databases breached, customers find themselves having to get a new credit card and update every subscription where that card is used. This can take hours to track down and update every subscription where a specific credit card is being used. With a distinct virtual credit card per subscription, one only needs to regenerate a new card for that specific vendor and update it (or move away from the hacked vendor altogether). No need to update the numerous other subscriptions being paid by an array of virtual credit cards under one or more American Express business credit card accounts.

I wish I had this feature over a decade ago when I was running a small enterprise software company. Much of our business software was running on my American Express. I swear I had some vendor getting their database breached every 6-9 months, resulting in a breach notification letter. That necessitated getting a new credit card, followed by hours of updating all my vendors. It was painful!

Distinct spending limits can be an added benefit if you want to control for overages. Vendor price changes don’t automatically get charged. Picking the right limit can be tricky and you should balance potential spending growth during the life of the virtual credit card with the maximum you want to risk them charging you.

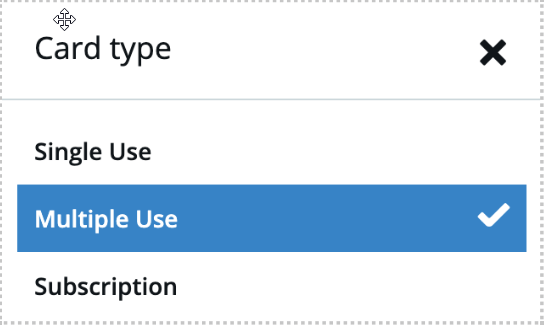

The beauty of Tradeshift Go subscription cards is they can have limits that are set daily, weekly, monthly, quarterly, or annually.

Recurring Vendors

Another scenario for using virtual credit cards is recurring vendor purchases. This could be hardware from Dell or office supplies from Amazon. In these situations, cards can be a budgeting control.

If you want to set an annual budget for a vendor, you can use Tradeshift Go to create a virtual credit card with a limit using a subscription card type set to an annual basis for multiple years. Or you can create a virtual card set to a multiple use card type during a single year. Either approach will create a limit on how much is spent with that vendor.

One-Time Spend

Have you ever had that big one-time purchase for your business? Don’t expose the high-limit American Express. Generate a single-use virtual credit card, purchase, and be done with Tradeshift Go.

Projects

Team members will often need to spend money on a project, such as a marketing campaign or internal meeting. Rather than handing over that high limit American Express, you can use Tradeshift Go to generate a multiple use card with a limit and specific expiration date. Then just let them do the rest.

Card Request and Approval

Business credit cards get abused. This can range from passing around the owner’s business credit card or creating an employee-specific card off the company American Express credit card account. Unless they are traveling, virtual credit cards are perfectly suitable and Tradeshift Go layers in a request and approval process.

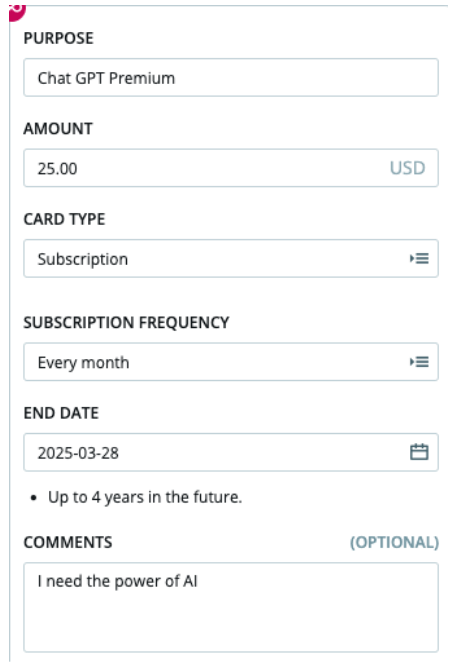

Tradeshift Go enables businesses to set up departments with approvers and team members. We’re big believers in having a system with checks and balances for company financial purposes. With a spend request, a team member must specify the purpose, the amount, the card type, and an end date, with optional comments.

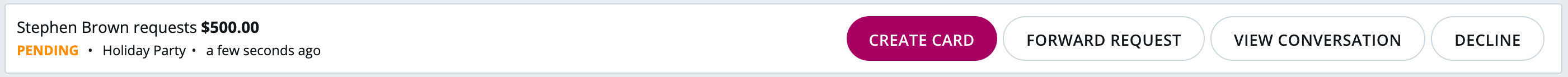

Approvers will receive and email notification to approve a request and can create the card, forward the request, have a conversation, or decline the request.

Spending Insights

Spending Insights

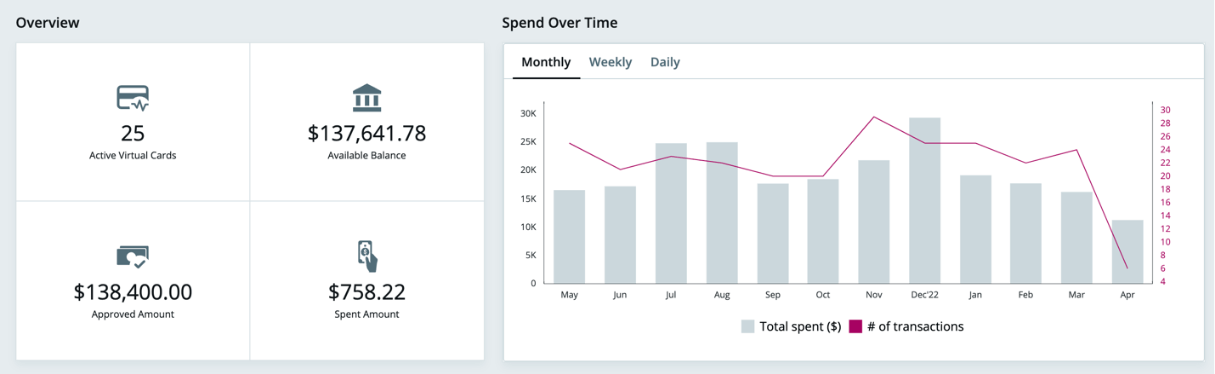

Tradeshift Go provides spending insights to better see how your American Express spend is being used. There is a team dashboard that shows an overview of the virtual cards in use, with approved spending amounts and actual spend. You can see spend over time, who has cards and how much, and a history of approval requests.

There are also settlement reports that show transaction histories with amounts, vendor, and user.

Additional Support

You also get Tradeshift’s support on top of the American Express support, so double the support you would normally have with credit card spending.

No Additional Fees

One of the best parts of Tradeshift Go is there are no additional fees to use it. If you own an American Express business credit card, you are eligible. Their partnership with American Express enables them to offer these features at no cost.

Get Started with Tradeshift Go

Tradeshift Go’s modern features, additional support, and no cost make this a no-brainer for any business with American Express business credit cards. Getting set up is quick and then you’re off and running.

We’ve been using Tradeshift Go at LedgerGurus for some time now and it works as described. We recommend it! Learn more about Tradeshift Go here.