1. Bookkeeping errors

This is a given. Owners attempting DIY accounting will make bookkeeping errors. Frankly, seasoned professionals will make errors too. Sometimes these errors don’t really matter. Other times, these errors can look like fraud during an audit. Errors will also give you poor financial data, leading to bad business decisions, because they are based on wrong financial numbers.

Want to learn from the gurus? We’ve created a course on bookkeeping basics.

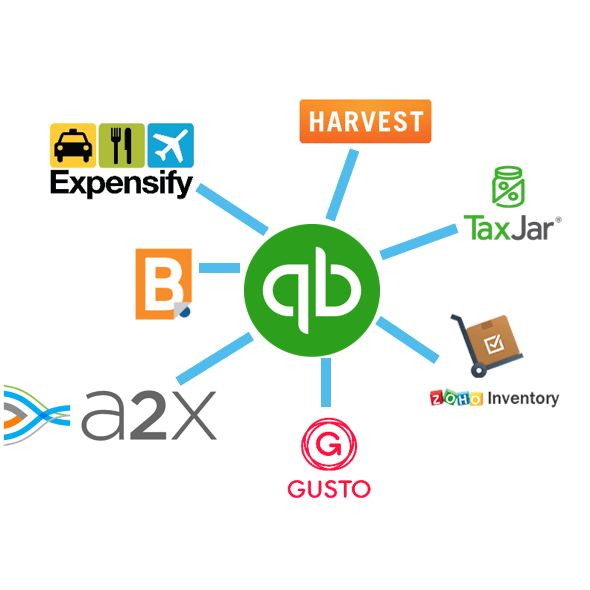

2. Relying too heavily on accounting software

Business owners are trying to automate and streamline as many processes as possible. Accounting software can allow for automation. These software products often advertise themselves as DIY accounting software, but beware! Sometimes accounting software isn’t perfect, or it doesn’t do everything that you need it to. In addition, integrating accounting software with other apps can create BIG problems and hours of fixing complicated issues. (Click here, to read about when to integrate QuickBooks Online with other apps.)

In the end, you need a close eye on everything your accounting software is doing, either your eye or someone else’s. The more experienced this eye is in accounting (specifically accounting in your industry), the better. They can save you hours of time by setting up your accounting technology ecosystem in the correct way and constantly double checking everything that is happening.

For more on how to implement accounting software correctly and other related issues in this blog, please refer to Toptal’s article here.

3. Poor bill management

Oh, the bane of every business owner’s existence. Staying on top of bills is no easy task. As bill management becomes complicated for a business, a couple of things tend to happen:

- Business owners forget to pay bills – this will cost the business unnecessary fees.

- Business owners expose their business to embezzlement – business owners take shortcuts in the bill management process. Shortcuts may include signing blank checks, giving one person the ability to approve and send checks, and other risky behavior. We’ve seen too many small businesses be embezzled by an employee. Mind you, this employee is usually very well trusted by the business owner!

Click here to read about how to protect your business with quality bill management processes.

4. Missing deadlines

When a business owner is attempting DIY accounting, the chances of missing deadlines increase dramatically, and we don’t blame them! Business owners are busy with important to-dos and tasks. This often leads to missing accounting deadlines, such as remitting sales tax, paying bills, filing taxes, and more. And missing deadlines equals unnecessary costs.

5. Spending unnecessary time on DIY accounting

With DIY accounting, you will most likely be spending more time than an accounting expert would. Mistakes may lead to hours of fixing problems. Or the learning curve for a new area of accounting may take up A LOT of time.

Therefore, you should be asking yourself some questions. How much is your time worth? What other things could you be doing in your business to decrease costs or increase revenue? Are you prone to the mistakes mentioned in this article? Is DIY accounting really worth it? What options do you have available to meet your accounting needs and allow you to spend your own time where it’s most valuable?

If you’re ready to start outsourcing your ecommerce accounting, let us know. Our ecommerce accounting experts can take care of it for you, freeing you up to do the important work on running and growing your business.