Estimated reading time: 12 1/2 minutes

Ecommerce funding is in a difficult place now. With almost no venture capital, high interest rates, and limited traditional lenders, ecommerce businesses must navigate some tough choices in securing funding amidst the unique costs and challenges they face.

But all is not lost. Capital is still available, though investors are being very selective.

In this article, we’ll discuss what is available for ecommerce funding, the implications of different lenders, and what it takes to get funded.

We’ll cover:

- Available ecommerce funding options

- The importance of having a solid financial foundation

- How to prepare to get funding

- How to prepare your financial statements

- How to make your business more attractive to investors

Available Funding Options for Ecommerce Businesses

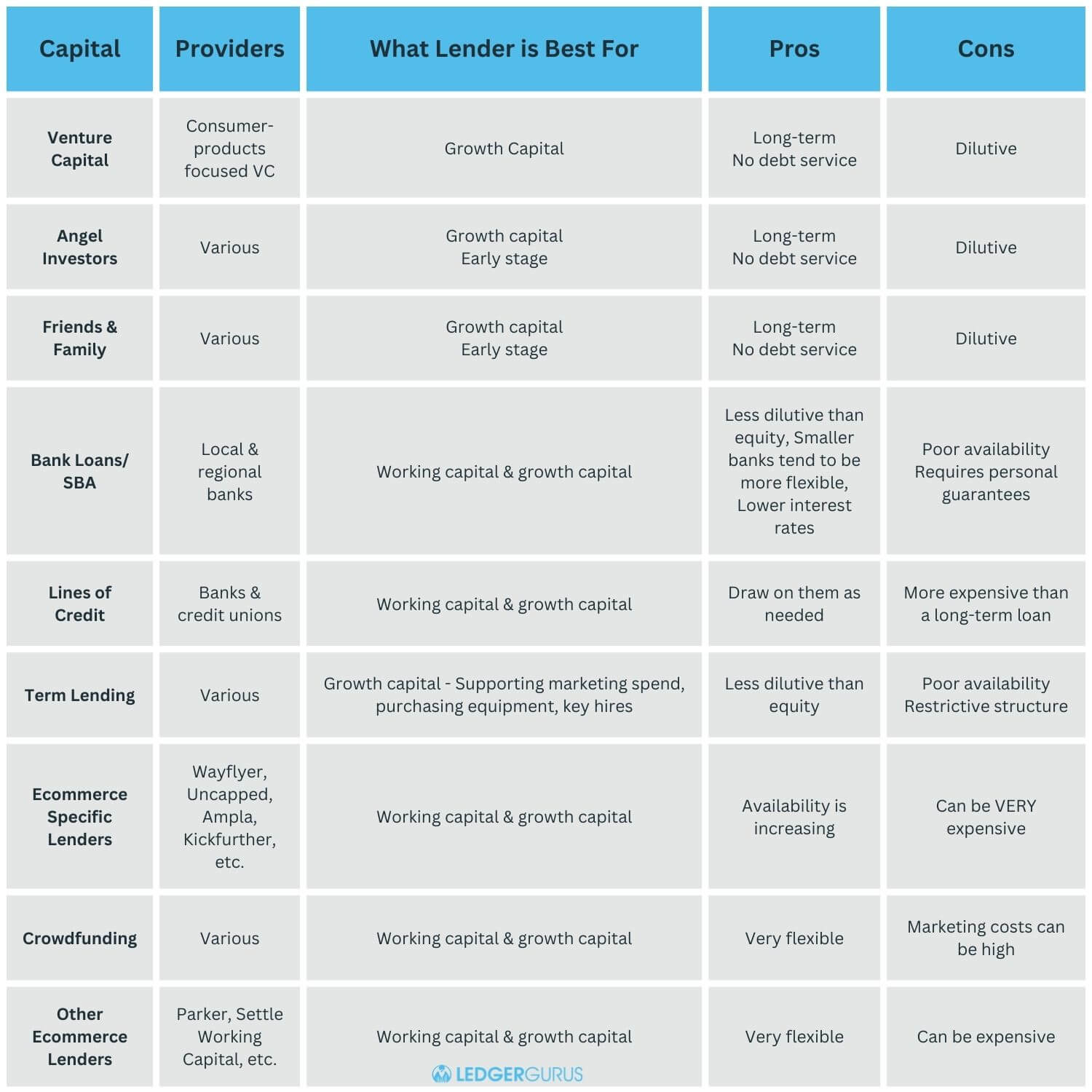

Business funding encompasses a variety of solutions tailored for ecommerce businesses, offering flexibility and personalized options to support growth.

Let’s walk through the following options for ecommerce funding, with some details around each.

- Venture capital

- Angel investors

- Friends & family

- Bank loans

- SBA loans

- Lines of credit

- Term lending

- Ecommerce specific lenders

- Crowdfunding

- Other ecommerce lenders

Venture Capital

Venture capitalists are the sophisticated investors that provide funds for equity (ownership) in a business. They are mostly associated with technology companies.

It used to be that billions of dollars were being invested into consumer products ($5 billion in 2021), but in 2023, it was under $150 million (see VCs No Longer Do DTC).

Take this one off the table: you probably aren’t going to raise money via venture capital.

Angel Investors

Angel investors are rich people who, like venture capitalists, provide funding for equity (ownership) in a business. With equity ownership comes oversight and control over your ecommerce business.

Their backgrounds can be wide as there are a lot of ways to get rich. Some of the better ones for ecommerce funding are those who have experience in the space.

Sometimes they will provide guidance with the money, sometimes they don’t. And sometimes you may wish they would provide guidance and at other times wish they wouldn’t.

Angel investors often follow the lead of venture investors. They tend to work in groups and syndicate (invest together) in deals.

You are also limited in the amount of funds you can get from angel investment with roughly $500,000 being the upper limit.

Friends and Family

Do you have a rich uncle?

Friends and family have always been and will always be an option. The amount you can raise is dependent on the wealth of those individuals. Usually, you take their money for equity, but creative loans can be an option.

A couple of cautions on this one:

- Friends and family often have no insights in your business – they are investing in you.

- If you can’t pay them back, there are long-term relationship consequences.

Beware! Thanksgiving dinners can get gnarly when you can’t return investment or loan money.

Bank Loans

Let’s go to a different end of ecommerce funding: business loans, often referred to as bank loans.

Traditional bank loans come in different flavors: secured and unsecured.

Secured loans are typically made against a physical asset like a building, a truck, or equipment. Banks don’t love consumer product companies because often the only asset is inventory, and they don’t usually value or know how to liquidate your products if the loan fails.

Unsecured loans are done without something to loan against. These types of loans have higher interest rates and lower limits, due to the risk for the bank.

If you go through a bank, they’ll ask for some kind of personal guarantee when you individually commit to paying back the loan. They may ask you to stake your home against the loan. Many business owners don’t want to personally guarantee a loan.

Here’s something to consider, if you don’t have enough confidence to personally guarantee the loan, you may not want to be taking it. That’s a sign that maybe you’re not ready to use that money effectively.

It helps to have history with a bank where they see a flow of cash through your accounts with them. Smaller banks tend to be more flexible, but all banks are increasingly risk adverse in 2024.

While this requirement for a personal guarantee can make bank loans more restrictive than other kinds of funding, banks generally offer lower interest rates, making them a potentially cheaper, though more difficult to obtain, source of capital.

SBA Loans

The U.S. Small Business Administration (SBA) offers several types of loans for small businesses. These loans are not directly issued by the SBA, but rather through banks, credit unions, and specialized institutions.

The SBA guarantees a portion of these loans, which reduces the risk for lenders and makes it more feasible for them to offer favorable terms.

Of the different SBA loans, the most popular is 7(a) which offers up to $5 million. These funds can be used for a variety of purposes, including:

- Working capital

- Expansion

- Equipment purchases

SBA loans often come with more favorable terms than those available from traditional lenders, including:

- Lower down payments

- Flexible overhead requirements

- No collateral needed for some loans

- Tend to offer competitive interest rates

Depending on what the loan is used for, repayment terms can range from 5 to 25 years, making monthly payments more manageable.

Applying for an SBA loan can be more complex and time-consuming than other types of loans. The process includes submitting detailed information about your business and financial history, a business plan, financial statements, and descriptions of collateral.

Note that SBA notes also require personal guarantees.

Lines of Credit

Most ecommerce funding is needed for inventory purchases, and lines of credit can be the best tool. They are typically more expensive than a long-term loan, but you draw upon them when you need them.

Banks and credit unions will often provide secured and unsecured lines of credit. Many of the same terms apply as a long-term loan.

There are also some unique lenders like American Express with their Business Line of Credit which currently tops out at $250,000 and is more expensive than traditional lenders.

Term Lending

These are specialized lenders and investor groups that provide loans, not equity investments. Often, they are unique to a particular geography or subset of consumer products.

These investors are more sophisticated and will want to understand your business and see that you can repay the loan. Good financials and financial operations are a must!

Typically, these loans are between 12-36 months, even as long as 48 months.

They can bridge funding gaps, but are less prevalent and can still be more expensive than a bank or credit union.

Ecommerce Specific Lenders

There are many ecommerce specific lenders, but BEWARE!

These revenue-based funding loans can appear very attractive, but can also be VERY expensive.

Online businesses, in particular, should be cautious as ecommerce-specific lenders tailor their services with credit card offers and fees that might seem appealing but can be costly in the long run, especially when comparing annual fees, APR, rewards, and various credit card features targeting online businesses.

Often, they will lend against revenue with fixed fees that appear affordable on the surface, but the real annual percentage rate (APR) can be astronomical.

These loans are often easy to obtain as they look at your sales and determine a loan amount accordingly. The real costs are obscured.

Take note, if the loan is easy to obtain, it’s usually expensive.

Before you go down the path of these type of loans, read this article by Bill D’Alessandro. The section on Fixed Fee Loans: How They REALLY Work unveils the dark secrets of these loans.

Be sure to check out his APR calculator, as well, to see how fixed fee loans translate to APRs.

Here are some options for ecommerce-specific lenders*:*

These loans are aggressively marketed. You probably shouldn’t take them unless it really makes sense financially, as many of these loans will bury a seller with interest payments.

Crowdfunding

Crowdfunding is also a viable option, however, it should only be one part of a comprehensive strategy to fund your business.

It can be beneficial for cash flow as you receive funds before creating product, but don’t underestimate the costs of marketing to achieve your goal.

Other Ecommerce Lenders

There are also some unique lenders for ecommerce funding to consider.

Parker provides rolling payback on their business credit card with increasing fees for the length of the payback period.

Settle Working Capital is a fixed fee loan, but with better terms than a lot of the alternatives.

A Solid Foundation is Key for Ecommerce Funding

There’s been a big shift in investment strategies in the past few years.

Investors used to put a big emphasis on boosting top-line revenue growth. They were all about pouring money into companies to scale up fast, no matter the cost. This often led to high customer acquisition costs and big marketing spends.

But the focus has really changed now.

It’s not just about growing fast anymore; it’s about being smart with your money. Profit margins and overall profitability are becoming key.

This more disciplined approach to capital focuses more on solid business fundamentals and sustainable profit growth than just explosive top-line growth.

To ensure your company is solid, investors will take a deep dive into your company’s finances to ensure everything checks out before putting their money on the line.

They will pore over financial statements, check out cash flow details, and analyze debt to see if there are any red flags. It’s all about confirming that the numbers add up and the business is on solid financial ground.

Why eCommerce Companies Must Prepare Properly

For ecommerce companies, this scrutiny is especially important because you deal with complex cash flows from online sales, inventory costs, and marketing expenses.

Investors really zoom in on how you:

- Handle money

- Manage supply chain costs

- Stay profitable amid fierce online competition

If you can show that your business is financially sound and poised for growth, you are much more likely to attract the funding you need.

How to Prepare for Ecommerce Funding

To prepare to get funding, you need to:

- Know what makes your product/brand unique

- Understand the key metrics that matter in online retail

- Maybe even team up with accountants who know the ecommerce ropes

Differentiate Your Product AND Brand

Know what makes your product unique and the value that it brings to the marketplace. Build your product and your brand around it.

Ask yourself:

- What is it that makes my product stand out in the market?

- How is it unique from other similar products?

But it doesn’t stop there.

Know Your Key Financial Metrics

To get funding, you need to know the key financial metrics and data points that investors look for in consumer product businesses.

These key metrics are:

- Product margins

- Customer acquisition costs

- Repeat purchase rates

Understanding and analyzing financial ratios is also crucial in evaluating a company’s financial health and performance.

These ratios, derived from financial statements, are compared over time and against industry standards to provide a comprehensive view of a company’s operational efficiency.

These are critical because investors are looking for businesses that can show consistent revenue through recurring customer activity.

Other Financial Indicators

It’s also important to make sure other financial indicators are in order, particularly how the company’s management handles capital allocation and overhead costs.

One thing investors LIKE TO SEE is that owners and the company’s management understand capital allocation and what capital is required to support sales growth and purchasing inventory.

One thing they DO NOT LIKE TO SEE is when overhead costs are not kept in check by the company’s management.

Too often brands have too much payroll, too much warehouse\office space, and too much operating expenses. Lenders will see through that quickly and are less likely to provide funding when you are a sloppy spender.

How Gross Margins Affect Investors’ Decisions

It’s vital to properly define and understand your gross profit margin

It should be calculated like this:

Net sales minus landed product costs. Then divide by net sales to get a percentage.

A common mistake a lot of companies make is mixing in merchant account fees or fulfillment costs. From an investor’s perspective, gross margins really come from purely landed product costs.

Don’t muddy the waters by adding other costs that don’t belong here.

Investors like to see gross margins of 40% or higher. If your business operates at lower gross margins, though, you can still be attractive if you manage your overhead well.

Ideally, brands should be aiming for gross margins of 60% or higher gives businesses better leeway to cover other operational costs and still maintain profitability.

Preparing Your Financial Statements for Ecommerce Funding

“If you want a good price on your capital, you need to have clean financial statements.” Stephen Brown, LedgerGurus

Clean financial statements not only boosts a business’s credibility but also makes it more attractive to investors by showing that it’s managed wisely and ready for the big leagues.

Investors rely on these detailed financial statements to understand the financial performance of your business and the driving factors behind the numbers.

Accounting Best Practices

So, what do clean financial statements look like?

- They need to be accrual-based. eCommerce accounting becomes a total mess if it’s cash-based because of revenue timing.

- Good inventory and COGS accounting. This means that you’re properly applying inventory purchases to your balance sheet and then applying it as cost of goods sold as products are sold.

- Maintain consistent procedures. Investors want to see a history of consistency with your financials.

- Forecasting based on historical financials. Forecasting needs to be logically tied back to what the financials say.

- Reasonable owner discretionary expenses (a.k.a. add backs). Investors don’t care about your tax strategy. They care about the profitability of the business. Be transparent and reasonable.

This is a great place to get professional help from ecommerce specialized accountants, like LedgerGurus. We can help you make sure that your financials are clean and telling an accurate story of your business.

This will make it easier to get the funding you need.

How to Make Your Business More Attractive to Investors

A question you may be asking yourself now is “How can I improve my financial health and make my business more attractive to investors?”

Well, it all comes down to ecommerce accounting practices and knowing how to interpret what your financial statements are telling you.

How to Make Sure Your Accounting is Being Done Right

Whether you’re doing your accounting yourself or you want to make sure that all the bases are being covered when someone else is doing it, here’s an essential ecommerce bookkeeping checklist.

This guide will show you what to do (or what needs to be done) weekly, monthly, quarterly, and annually to keep your books clean, up to date and reliable.

How to Get Value from Your Financial Statements

Accounting is the language of business.

Since this is true, you need to know how to read your financial statements and then interpret them to make good decisions.

We’ve created an entire video series on how to read your financial statements (also linked below). We’ve gone into great detail on the various parts, what they mean, and ways to optimize them.

Knowing how to read your financial statement is an important skill that EVERY business owner should have, regardless of who is doing your accounting.

Good financial statements enable good decisions, so be sure you understand what yours are telling you.

How to Get Help

If you’d rather not do all this yourself, we can help.

LedgerGurus is an ecommerce-specialized accounting firm. We can clean up your books, do your bookkeeping and accounting, and help you get insights into your finances that you need to make good business decisions.

Click here to learn more about our ecommerce accounting services.

Let us focus on your numbers, so you can focus on what you do best…running a GREAT company!

Financial Statement Video Series

Financial Statement Video Series

- Quick Guide to Gross v Net Revenue for eCommerce Sellers

- COGS Explained for eCommerce Sellers

- The Difference between Cost of Sales & Cost of Goods Sold (COGS) in eCommerce

- Inventory Landed Costs Explained | What’s Included and How to Calculate It

- Ecommerce COGS vs. Expenses Explained: Key Differences

- Net Operating Income vs Net Income: Understanding eCommerce Profitability

- Other Income & Expenses Explained: Income Statement (Profit and Loss) for eCommerce Sellers

- Understanding EBITDA: A Guide for eCommerce Sellers

- eCommerce Profitability Explained: From Gross Sales to Net Income