In the complex world of online sales, merchants often find themselves grappling with the overwhelming task of managing sales tax. Calculating the correct amount to collect and ensuring timely remittance can be a major headache. At LedgerGurus, we understand the struggles that ecommerce sellers face when it comes to sales tax.

That’s why we’ve conducted an extensive comparison of some of the top sales tax software solutions available today. Join us as we explore how these tools can alleviate the challenges and bring clarity to your sales tax obligations.

This blog covers:

- What makes sales tax so complicated for ecommerce sellers

- Sales tax engine vs sales tax filing tool – What’s the difference?

- How to choose what sales tax software you need

- Sales tax software comparison wrap-up

Let’s get into it.

Key Takeaways

- Sales Tax Complexity in the U.S.

- Staying Compliant is Challenging

- Sales Tax Software is Essential

- Difference Between Engine and Filing Tool

- Choosing the Right Tool

- The “Big Kahunas” of Sales Tax Software

What Makes Sales Tax So Complicated for eCommerce Sellers

- Every state has different sales tax regulations.

- Each state’s regulations are subject to change at any time.

- Many states require a breakdown by county, city, and/or special jurisdiction.

It can be difficult to manually manage sales tax as a small business because every state has the freedom to regulate sales tax differently. Individual states determine their own:

- Tax rate

- Filing frequency

- Eligible merchandise

- Taxable services and products

Each facet of sales tax calculations and collections is also subject to change at the state’s discretion, meaning you can be in compliance one month, but find that you’re not in the following month. If you’re not seeking out the information to stay informed, you could miss out on new exemptions, whether temporary or permanent.

For an example of temporary exemptions, read about sales tax holidays.

Sales Tax Engine vs Sales Tax Filing Tool – What’s the Difference?

To navigate the labyrinthine world of sales tax, ecommerce sellers require effective tools that can automate calculations, streamline reporting, and ensure accurate remittance. These tools come in the form of sales tax software solutions, offering two key components:

- Tax calculation engine

- Filing tool

These are two different things.

What is a Sales Tax Engine?

Sales tax engines serve as the backbone of accurate tax calculations, simplifying the checkout process. They leverage up-to-date databases to determine the correct sales tax rate for each order, so you, as the seller, do not have to do it manually.

For example, there are often special jurisdiction taxes that small businesses need to be aware of when selling online. Sales tax returns may require narrowing down what is owed based on these specific jurisdictions, meaning you have to track your sales to the exact purchase address.

This creates a tremendous number of variables that have to be researched, understood, and accounted for! A sales tax engine handles all these variables to help you manage everything accurately at checkout and avoid complications.

Marketplaces like Amazon already have built-in sales tax engines, while platforms like Shopify may provide in-house (though not free) engines or recommend external sales tax tools.

For merchants selling on custom websites, there isn’t always the option to build in a sales tax engine. That’s when you need to purchase a software subscription with custom connections for your website to access the data it needs to accurately calculate sales tax in real-time.

What is a Sales Tax Filing Tool?

In contrast, a sales tax filing tool simplifies the reporting and remittance process. It pulls sales data from sales channels and generates reports that comply with each state’s specifications.

Sales tax filing tools also have deadlines built into their programming, so you never miss an important filing date again. You’ll be alerted in advance of the filing deadline, so you can ensure your data is in order before it’s due.

Filing tools, on the other hand, simplify the reporting and remittance process. They pull sales data from various channels, generate reports, and ensure that sellers meet filing deadlines. By automating these tasks, filing tools save time and reduce the risk of missing important dates.

How to Choose What Sales Tax Software You Need

To determine what you need to help with ecommerce sales tax, LedgerGurus suggests asking the following question:

- Do you need a software that calculates tax OR a software that files tax returns?

Addressing these two separate issues helps you decide which tool is best for your business.

The 3 Big Kahunas: Avalara, TaxJar and Sovos

“Kahuna” in Hawaiian means “a wise man, or shaman.” In the world of sales tax software there are three Big Kahunas: Avalara, TaxJar and Sovos.

It’s important to do your homework when doing a sales tax software comparison. You might have heard a lot about each of these sales tax programs. Each one might be right depending on who is asking.

The question is, which one is the wisest option for your company?

Avalara

Avalara is the biggest player here; they’ve been around a long time. So, they’ve got a lot of great information on product taxability and different rates in different states and jurisdictions. In fact, only Avalara supports international filings, including Canada and US territory islands.

Avalara connects with pretty much all other platforms. In fact, some platforms, when you sign up with them, will automatically connect you to Avalara. You can continue to use Avalara this way until you hit a certain threshold of sales volume. Once you’re selling at greater volumes, you must sign up with Avalara and start paying them to use their sales tax engine. They will then charge you on a per-transaction basis. This is because every time you sell a product, you are using their sales tax engine to calculate the amount of sales tax you need to collect.

Pros of AvaTax (Avalara’s Sales Tax Engine)

- Sales tax engine: 10/10 rating from LedgerGurus for calculation ability

- Geolocating software to get the correct rate for each address

- Frequent updates for sales tax calculations

- Integration with many other platforms (700+ connections) and customizes developments for additional platforms

Pros of Avalara’s Sales Tax Filing Tool

- Mobile app

- More time to file (11th of each month)

- Easy to make adjustments

- Automatic filings

Cons of Avalara

- Caters to Fortune500 companies; may have extras small businesses don’t need

- Higher cost to purchase software to use as a sales tax engine

- Long setup process

- Their customer support isn’t great

NOTE: Avalara pulls sales tax funds as one large payment vs multiple, smaller payments to individual states.

Even if Avalara isn’t a fit for you, it is still a great resource. They have been around the longest and have a lot of good educational material, including their blog. Check out the blog here.

TaxJar

TaxJar is probably the most standard option. If you are a simple ecommerce business selling on only a few channels, then TaxJar might be perfect for you. You can’t have anything crazy going on though. If everything is straightforward, then it’s a more cost-effective way to track and file your taxes. Unlike Avalara, TaxJar can cater to ecommerce businesses as well as solve their sales tax problems. They also have some great information on their blog.

Pros of TaxJar

- Inexpensive monthly subscription costs for sales tax engine

- Data can be manually uploaded

- Tracks FBA inventory for physical nexus

- Flexible and smooth integration

Cons of TaxJar

- Additional costs for custom integration

- Strict filing deadline (5th of each month)

- Rigid auto-enrollment process

- Only remits what it has calculated, regardless of what you actually collected

- No internal or local home-ruled jurisdiction filings

- Less customer support available

NOTE: TaxJar will only file information based on the sales tax that it calculates vs what you collect. Therefore, if you are doing your own calculations and estimate your own sales tax, you won’t be able to remit what you collected; you’ll remit what the program calculates. This can create discrepancies, and you may have to make up the difference out of pocket.

TaxJar is good for uncomplicated cases as mentioned before. If you have tax-exempt products, then it’s probably not for you. It is more of a pre-set system.

It also doesn’t allow for backfiling. For example, if you haven’t been filing for the last year and want to catch up; you can’t go back and pay all those penalties and interest. With TaxJar, you can only go forward.

TaxJar also doesn’t support local jurisdiction sales tax filing. For example, Colorado is a home rule state, so you might need to file separately for Colorado and the city of Denver. TaxJar won’t support the Denver filing. However, Sovos does.

Sovos

Sovos is good at keeping their offerings up-to-date which helps them stay competitive and relevant. They have similar offerings as TaxJar and Avalara, (tax rate information, PDF filings, and payment confirmations to name a few). However, they usually offer things first and are somewhat of a leader in terms of ecommerce sales tax software.

Pros of Sovos

- Great sales tax engine database

- Easy to make adjustments

- Can work as a sales tax engine for your custom website

- Affordable sales tax filing tool

- More time to file (12th of the month)

- Same filing fee for backfilling

- Lots of data transparency

- Ability to file what you collected instead of what Sovos automatically calculates

Cons of Sovos

- Doesn’t have as many connections as TaxJar or Avalara

- A bit more expensive than TaxJar

Unlike TaxJar, Taxify allows for more flexibility. It is the perfect solution for companies that have a little more complexity, such as those that sell on many different channels. Or even those that have business-to-business sales that are exempt from tax. You can edit the information based on orders and edit the actual sales tax returns before they get filed. So, if there are discrepancies you can manually go in and fix those. Taxify allows for backfiling as well.

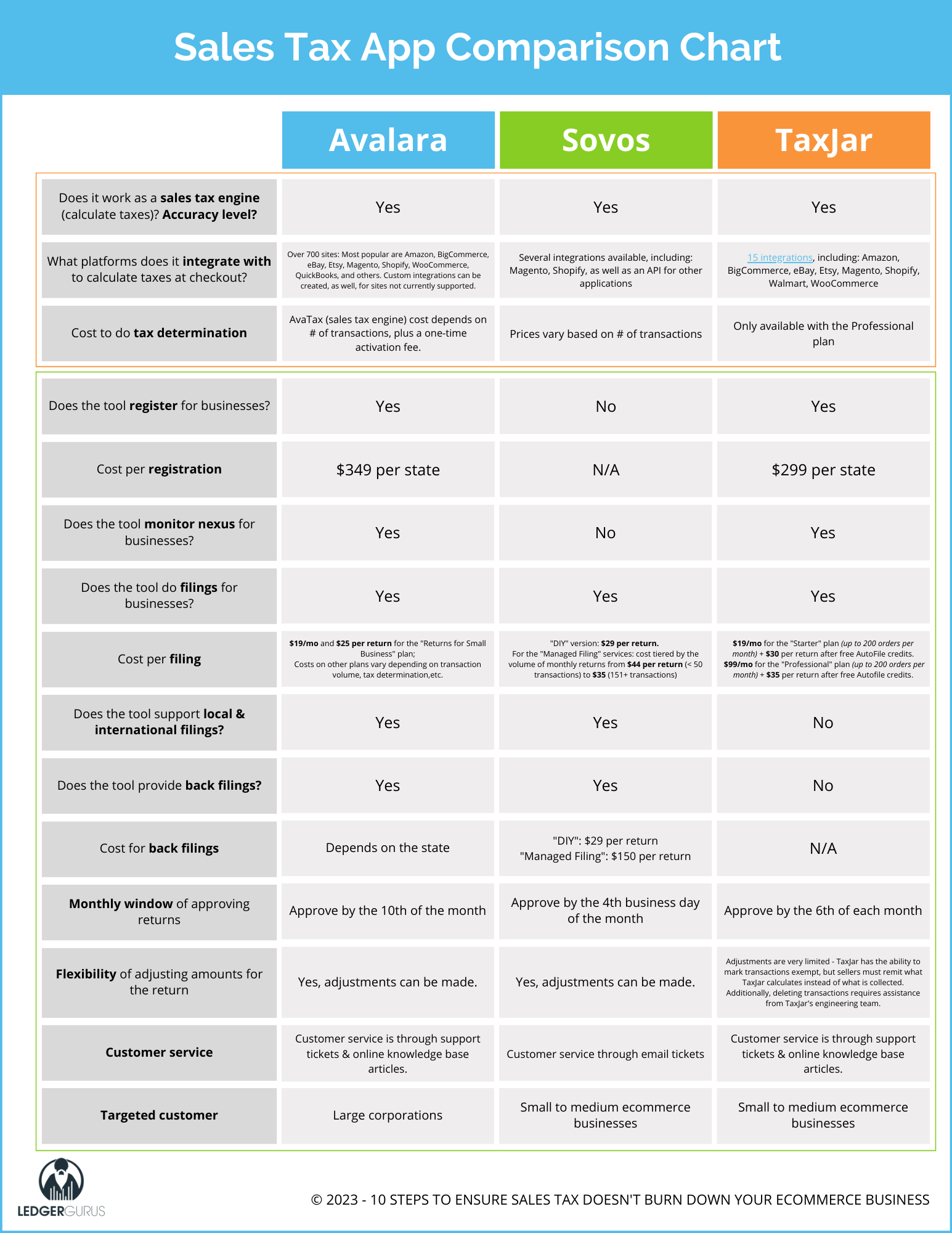

To compare these 3 tools in an “apples to apples” chart, see below.

Sales Tax Software Comparison Wrap-Up

Sales Tax Software Comparison Wrap-Up

The most important thing when making this decision is knowing your company’s needs.

If you sell on a lot of channels, have tax exempt products, require backfiling, or want more flexibility, then it might be good to consider Sovos.

If you only sell on a few channels, are just starting off, and don’t have any of those extras to worry about, then the most cost-effective choice is TaxJar.

Avalara may not be the best choice for smaller ecommerce companies, but it does have high-quality performance and a very robust system, making it a good choice for larger companies.

If your sales channel doesn’t already have a built-in sales tax engine, LedgerGurus highly recommends choosing a tool that has one. This makes the calculations easier, improves the customer’s experience by making the checkout process smooth and hassle-free, and relieves you from having to do everything by hand.

If your sales channel already takes care of the engine and all you need is the filing tool, it’s still worth the money, time, and effort to set it up since it can calculate what is owed to each state, fill out the returns, and handle the filing process for you. Win-win!

Please note that using a sales tax engine and/or filing tool does not remove responsibility for sales tax compliance from the seller completely. If you’d rather not have to deal with the frustration of sales tax yourself, be sure to check out our services page. We’ve got several services designed for different-sized companies. There’s sure to be one that’s a good fit for you.

More Sales Tax Related Content

- California Online Sales Tax Explained

- Illinois Sales tax Explained | Rates, Forms, Registration, and More

- New York Online Sales Tax Guide for Ecommerce Businesses

- How to Find and Understand Your Amazon Sales Tax Report

- Shopify Sales Tax Report | How to Find & Understand It

- Sales Tax Outsourcing | Options & Things to Consider