Want to know how to accurately establish product costs for your business? You’re in the right place.

Fully understanding the whole “inventory costs” thing is huge, and will be important at every single stage of your business.

This is because if you want an accurate understanding of how you are performing as a business, you need an accurate picture of the costs you have tied into inventory, as well as knowing how to calculate an accurate cost of goods sold (COGS).

Understanding the costs of your inventory units is best done by building a product cost catalog (PCC). This is done for you automatically if you are using an inventory tool but if you are trying to set up an inventory tool or aren’t ready for that yet, you’re not off the hook. An accurate product cost list, or a product cost catalog, for existing products will be the most critical input of the process, along with current quantities. This is something your business cannot do without when you are trying to get an accurate financial picture.

Setting up a PCC does not have to be hard, but it can be if you don’t know where to start. Think of it as determining what costs you want associated with each SKU, both for calculating COGS and for calculating the value of your ending inventory.

Typical Questions about Determining Product Costs

You may say, “But my prices change.”

Right, they do! A tool will update these costs each time you purchase and receive new inventory but doing it manually will require you to continually determine whether these costs are still reasonable.

You may ask, “Which costs should I be including in the unit costs?”

Congratulations, you are now starting to ask the right kinds of questions and understand why this can be so complex. It is not just about knowing how much your products cost you to buy. There are other factors that play an important role, such as shipping costs, manufacturing costs, even packaging costs, and then keeping it current as time goes by. This might seem like an impossible task, but it doesn’t have to be.

In this blog post, we’ll explore how you can create a product cost catalog that is both accurate and effective for your business.

We’ll cover:

- Why establishing and tracking product costs is so important

- What is a product cost catalog

- How to Establish Product Costs for a Retail Business

- How to determine buy costs vs. landed costs

- How to Establish Product Costs for a Light Manufacturing Business

- How to Establish Product Costs For a Manufacturing Business

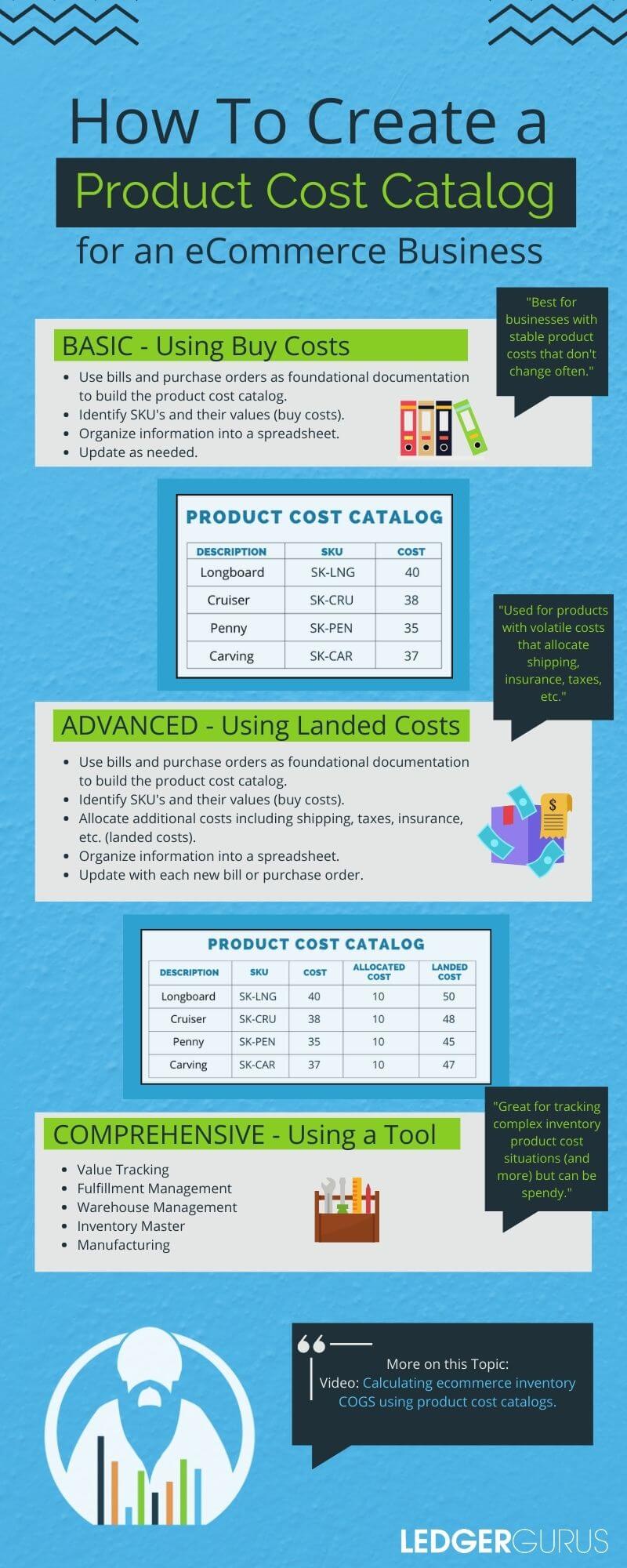

For a quick overview, see the following infographic. For more details, read on.

Video link in: Calculating eCommerce Inventory COGS Using Product Cost Catalogs

Let’s get into it.

Key Takeaways

- Accurate Product Costs Are Essential for COGS

- Product Costs Drive Pricing Decisions

- Solid Pricing = Strong Business Performance

- Use a Product Cost Catalog

- Understand Different Costing Methods

- Regularly Update Product Costs

Why Establishing and Tracking Product Costs is So Important

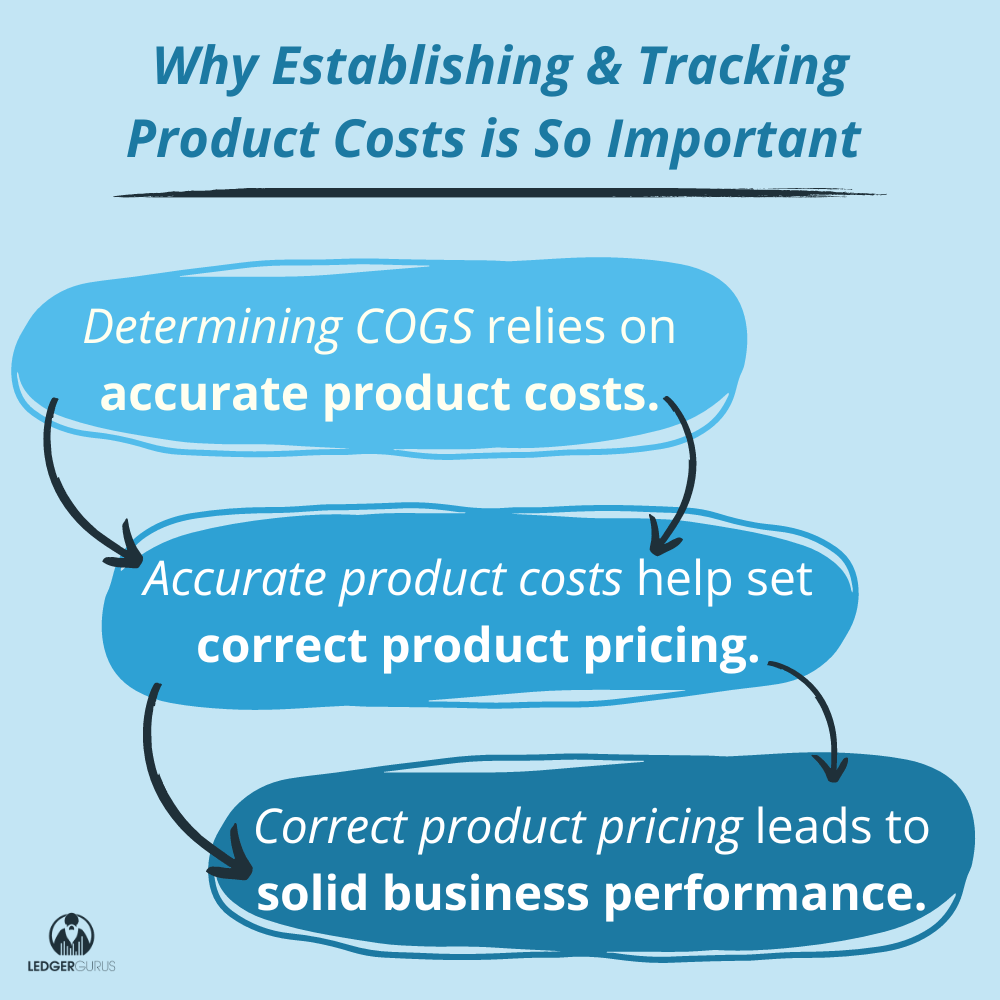

First, determining COGS, a key number of ecommerce businesses and the largest expense for most businesses, relies on accurate product costs.

COGS is the direct cost of producing (or purchasing) the products sold by a business. A business’s profit margin reflects the total amount of revenue left over after all expenses, including COGS, are paid.

Second, establishing accurate product costs helps set product pricing.

One of the most important decisions a business owner will make is how much to charge for their product or service. Pricing a product below cost will result in negative profit margins. This means you are spending more than you are making, which is not sustainable.

Third, correctly pricing products leads to solid business performance.

It’s not a 1:1 correlation, but as we said before: “If you want an accurate understanding of how you are performing as a business, you need an accurate picture of the costs you have tied into inventory, as well as knowing how to calculate an accurate COGS.” This accurate understanding of your business’s performance will help you understand your true financial picture, which leads to solid business performance.

Now that we recognize why establishing and tracking product cost is so important, how do we do it? One method is creating and keeping a product cost catalog.

What is a Product Cost Catalog?

Simply put, a product cost catalog is a list of all your products by SKU (learn how to name your SKUs) and established costs. This can be done easily in a spreadsheet, which allows for possible calculations and filtering.

Now let’s discuss how to establish product cost for the catalog. To show this we will look at 3 kinds of businesses along the supply chain.

- First, we will look at a retail business that purchases a finished good for resale.

- Second, we will look at a light manufacturing business that produces a finished good by outsourcing the assembly of the product.

- Finally, we’ll finish with a manufacturing business that manufactures the finished good.

How to Establish Product Costs for a Retail Business

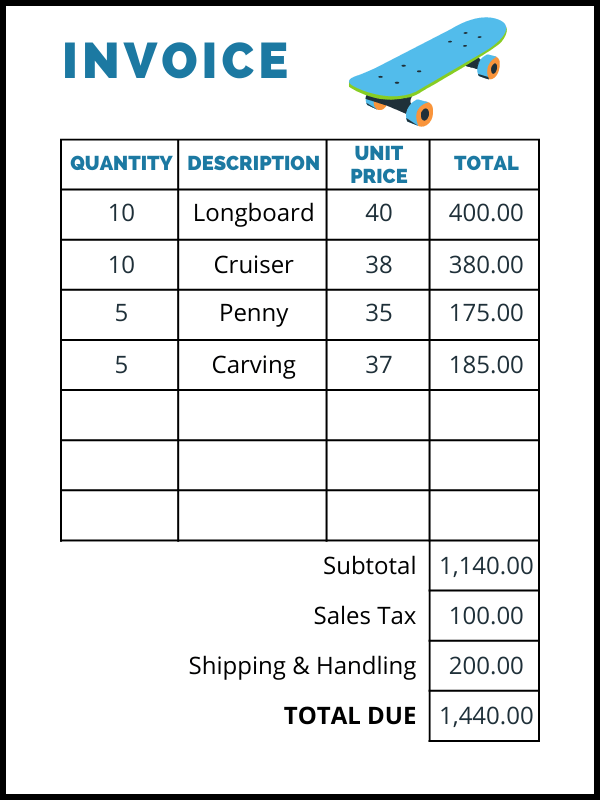

Let’s start with a simple business, Skate City, that purchases skateboards from a manufacturer and resells them. When they purchase the skateboards, they receive an itemized invoice like this.

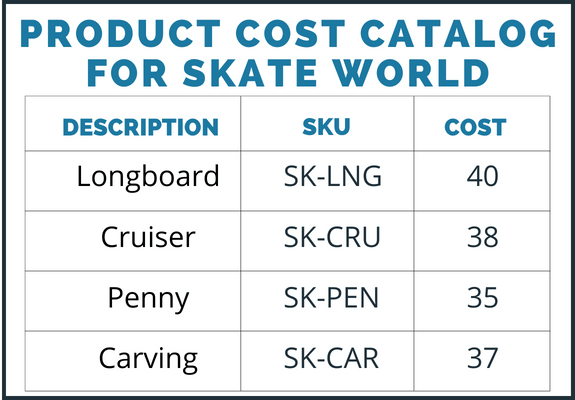

How to Determine Buy Costs

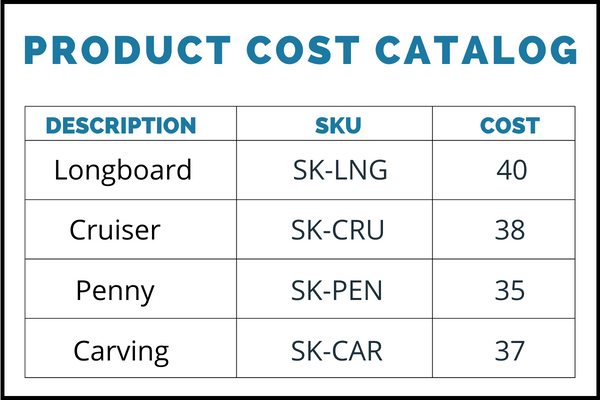

A basic product cost equals the unit price, or buy cost, listed on an invoice or purchase order. A product cost catalog in its simplest form, assuming costs remain fairly stable, lists the product’s description, SKU and buy cost (the unit price of the product from the invoice).

Using the sample invoice, a product cost catalog for Skate City would look like the following:

As Skate City continues to purchase products for resale, they should monitor the unit price on the invoice and adjust the cost in the catalog, as needed, using the cost to help set pricing and calculate COGS.

At this point you might be thinking, “Wait, wouldn’t you want to consider the total cost on the invoice and not just the unit cost. I mean, doesn’t that reflect the true cost of products purchased for resale?” And you are right!

This is known as using landed cost instead of buy cost. In other words, a buy cost is what you paid for the product, whereas landed costs include what you paid for the product AND the cost of getting the product to you.

How to Determine Landed Costs

Landed costs include all the costs to get product to you, and include things such as:

- Shipping

- Customs

- Taxes

- Insurance

- Packing

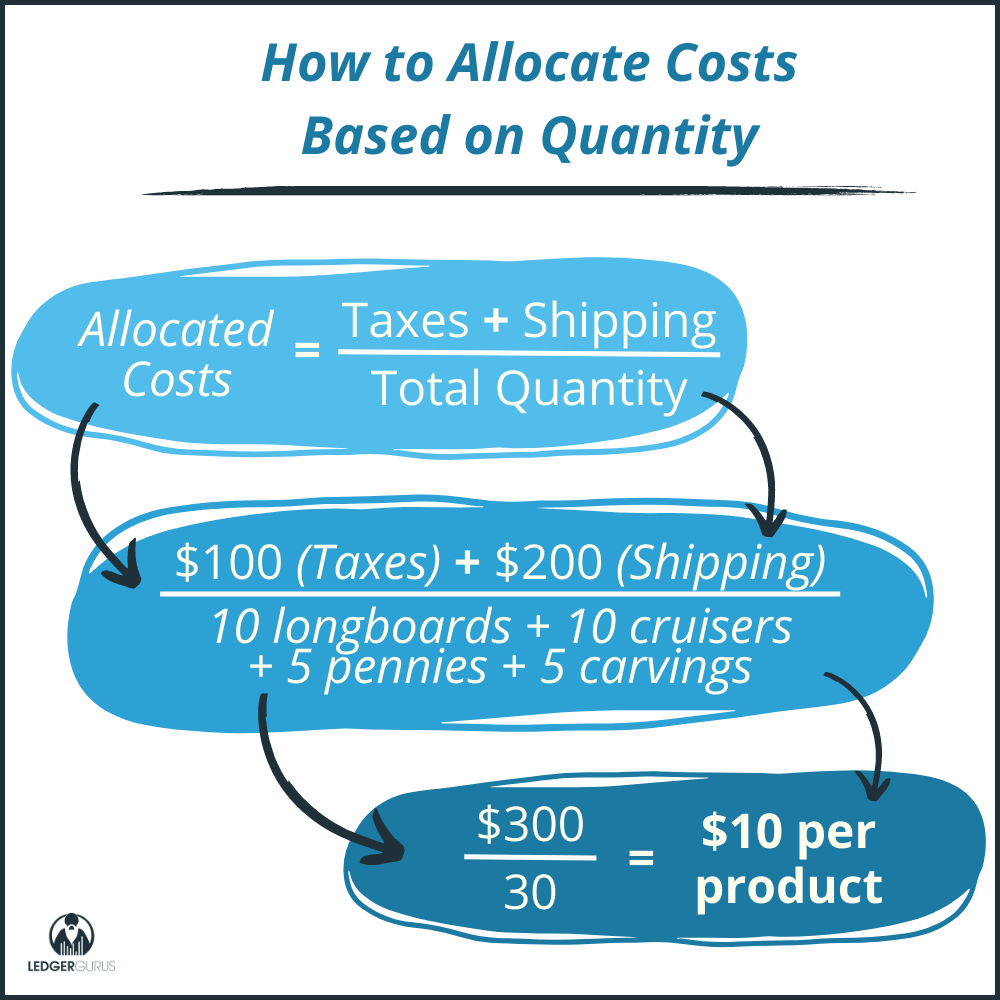

Looking at the total due on our previous invoice, it includes $100 in taxes and $200 in shipping. Both are costs of getting the products to Skate City. We can now take those costs and allocate them across the cost of the products purchased. We then add that to the unit price to get to the landed cost.

You can allocate landed costs based on many options. You can allocate based on:

- Quantity

- Weight

- Size

- or Dollar amount, to name a few

In this example we will allocate based on quantity.

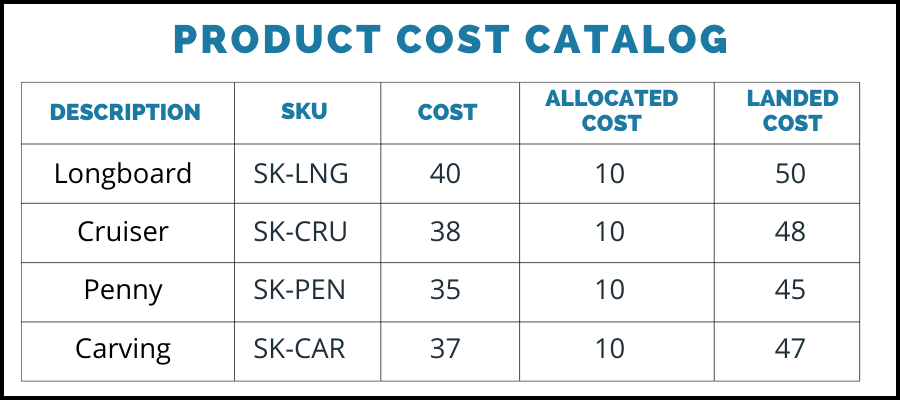

Add the allocated cost to the buy cost (unit price) of each product for the landed cost.

- Longboard landed cost = $40 + 10 = $50

- Cruiser landed costs = $38 + 10 = $48

- Penny landed cost = $35 + 10 = $45

- Caring landed cost = $37 + 10 = $47

Update the product cost catalog to include the allocated and landed costs.

A Quick Recap

A product cost catalog is a list of products a business sells and their established costs.

We can establish product costs using the unit cost listed on the invoices or purchase orders used to acquire the products. This is known as the buy cost and is a basic way to establish the cost of a product.

Or, we can include the additional costs of acquiring the products, like taxes and shipping, to determine product costs. This is known as landed costs and is more accurate than the buy cost. (This is a basic example of landed costs. There can be a lot more to landed costs and something we will cover in future blogs in more depth.)

Let’s take it up a notch and look at establishing costs for a light manufacturing company, like the company Skate City purchased their skateboards from – Skate World.

How to Establish Product Costs for a Light Manufacturing Business

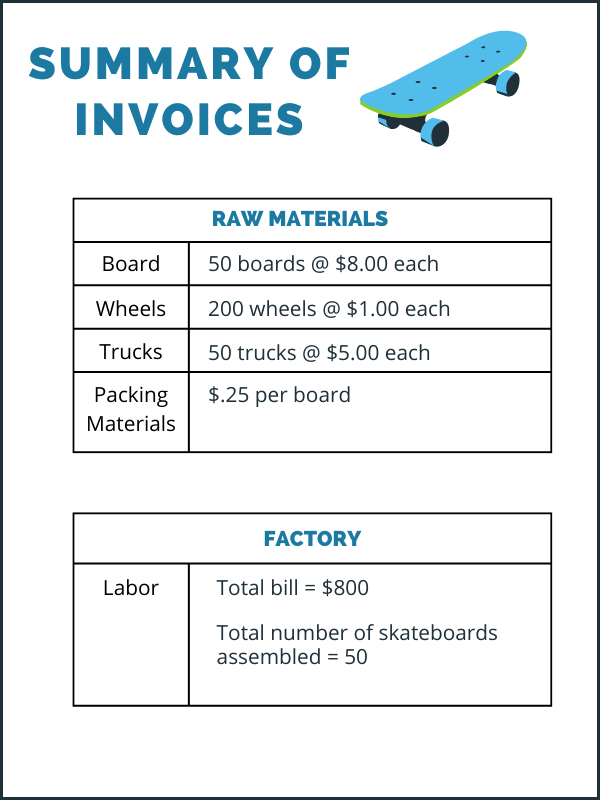

Skate World is a light manufacturing business that purchases the components needed to make a skateboard. The components, known as raw materials, make up a skateboard. They include the board, wheels, and trucks (comprised of several parts: the baseplate, kingpin, hanger, bushings, and axles). The raw materials are sent to a factory that assembles the skateboard and sent back to Skate World with an invoice for labor.

To determine a product cost, Skate World will need to consider the cost of raw materials and the cost charged by the factory to assemble the skateboard. Using invoices or purchase orders they can determine the cost of both.

Below is a summary of what would be included on the invoice. It includes the raw materials for a long board and the labor needed to assemble all the longboards.

How to Calculate Product Costs

Let’s calculate the product cost, starting with the raw materials. A longboard is made up of one board, four wheels, one truck and packing material.

Raw material cost for one longboard = 8.00 + 4.00 + 5.00 + 0.25 = $17.25

Now for the labor. We know the total amount for assembling 50 boards, so we can divide the total by 50 for the cost per longboard.

Labor cost for one longboard = 800/50 = $16

So, what is the total product cost for one longboard? We need to add the raw material cost and the labor cost to get the total cost.

Total product cost for one longboard = 17.25 + 16 = $33.25

After completing the process for each board, we would add the product cost to the product cost catalog as it shows below.

And what needs to happen next? Skate World will review the invoices and make necessary adjustments to the product cost.

Let’s change the scenario a bit from light manufacturing to straight up manufacturing. We will present a very basic example but know it can get complicated and something to cover, in depth, for future blogs.

How to Establish Product Costs For a Manufacturing Business

Skate Galaxy is a manufacturing business that purchases the components needed to make a skateboard, then puts it together as a finished good. Manufacturing businesses can determine a product cost by calculating how much it costs to turn raw materials into their finished product and how much it costs to manufacture each item. Manufacturing costs include any direct labor or manufacturing overhead.

Let’s look at the process of producing a longboard at Skate Galaxy. For simplicity, we will say each type of board is produced in its own factory.

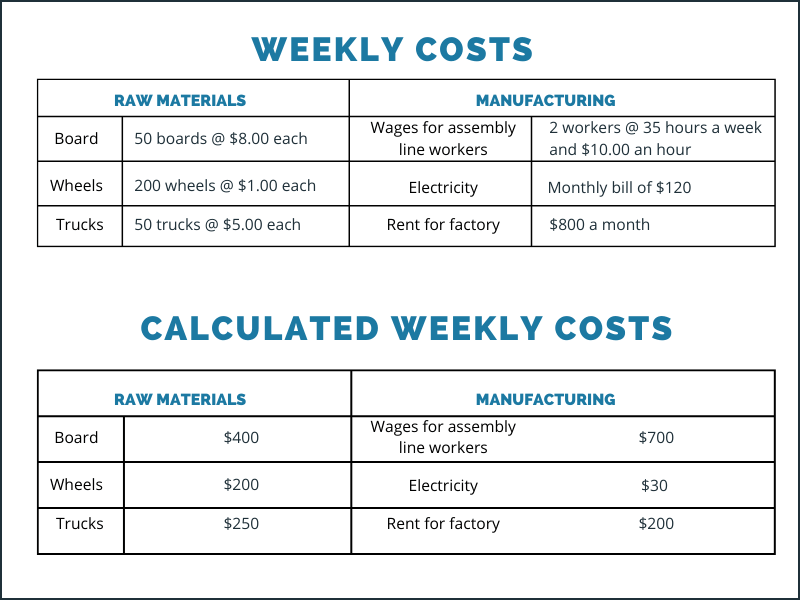

To start the process, Skate Galaxy must purchase the raw materials that make up a skateboard including the board, the wheels, and the trucks. Next, they use an assembly line of workers to assemble the skateboards.

Now, let’s breakdown the weekly costs by the cost of raw materials and the cost of manufacturing the board. Let’s say they can produce 50 boards a week.

With the calculated cost, we can now determine the product cost of one skateboard by dividing the total cost by the number of skateboards produced.

Product Cost per Unit = (Total Product Cost) / (Number of Units Produced) = $1,780/50 = $35.60

We can follow the same process for each type of skateboard produced and add the product cost to the product cost catalog, making necessary adjustments monthly.

How LedgerGurus Can Help You With Your Product Costs

And there you have it. Establishing product costs for a product cost catalog for a retail business, light manufacturing business and a manufacturing company.

So, let’s circle back to why establishing and tracking product costs is so important. Remember establishing a product cost can help set prices and calculate accurate COGS. Skate City, Skate World and Skate Galaxy can use their product costs to set a sustainable price for their products and determine an accurate cost of goods sold that will contribute to a healthy gross profit margin.

Use Our Inventory & COGS Template to Create Your Product Cost Catalog

This does not have to be a complicated process. We’ve already created an Inventory & COGS template that you can use to create your Product Cost Catalog.

We’ve also created a video showing you how to use the Product Cost Catalog part of the template.

If you are approaching $2M in annual revenue, it’s likely that inventory is becoming a serious issue for your business. If you’d like some help with it or your ecommerce accounting, LedgerGurus is happy to help. We have an entire team of people who work with inventory issues. Let us help you bring calm to the inventory crazies.