Trying to figure out ecommerce sales tax on your own? That’s a full-time job you didn’t sign up for.

With every state playing by its own rules, and channels like Shopify or Amazon only handling part of the puzzle, it’s no wonder sellers feel confused, frustrated, or just plain behind.

That’s where we come in.

That’s where we come in.

This isn’t just another blog post. It’s your go-to resource hub to help you finally understand how sales tax works for ecommerce, what steps you need to take, and how to avoid common (and costly) mistakes.

We’ve packed this page with guides, videos, and downloads to help you:

- Know when and where you owe sales tax

- Register and set up your channels the right way

- File without stress

- Avoid (or survive) an audit

- Fix things if you’re already behind

And if you don’t want to deal with any of it? You don’t have to. At LedgerGurus, we specialize in ecommerce sales tax. We can manage the whole process for you accurately, efficiently, and with way less stress.

Use this guide to learn what’s required and what’s possible. Then decide if it’s time to hand it off to a team who knows the drill.

Let’s break it down.

Key Takeaways

- Sales tax isn’t optional, and every state plays by its own rules.

- Understanding nexus, taxability, and exemptions is the first step.

- Mistakes happen, but they’re fixable.

- You don’t have to do it alone.

Table of Contents

- Understanding ecommerce sales tax (and what you need to know BEFORE you take action)

- Getting and stay compliant the smart way

- Sales tax pitfalls (and how to avoid them)

- When to get help (and who to trust)

What to Know About Ecommerce Sales Tax BEFORE You Take Action

What to Know About Ecommerce Sales Tax BEFORE You Take Action

Before you start registering for sales tax or setting up your platforms, it’s important to understand how ecommerce sales tax actually works. The rules vary from state to state, but once you get the basics, everything else gets easier.

This section walks you through the core concepts behind sales tax, so you can feel confident about what you’re dealing with (and what to do next).

What is Nexus?

Sales tax nexus is what determines where you’re responsible to collect and remit tax. You can create nexus in two main ways:

- Physical nexus: You have a presence in the state, like employees, a warehouse, or inventory stored with Amazon FBA.

- Economic nexus: You cross a certain threshold of sales or transactions in that state (often $100,000 or 200 orders in a year).

Even if you’re running your business from one state, you can create nexus in many others through your ecommerce activity. Marketplaces like Amazon or Walmart can create obligations for you, too.

Read: Complete Guide to Sales Tax Nexus for eCommerce Sellers – A clear explanation of how nexus works, along with examples, state thresholds, and what to watch for as you grow.

What is Taxable?

Not everything you sell is taxable. And even if your product is taxable in one state, it might not be in another. Sales tax rules depend on three factors:

- Where the buyer is located

- Who the buyer is (business vs. consumer, exempt organization, etc.)

- What the product or service is (tangible, digital, exempt, etc.)

Sellers often assume they should be collecting tax everywhere but that’s not always true, and over-collecting can land you in hot water, too.

Read: The Where, Who, and What of Sales Taxability for Online Sellers – An overview of how your products, your customers, and their locations impact your sales tax obligations.

What About Exemption Certificates?

Some buyers don’t have to pay sales tax, but you need the paperwork to prove it. These documents are called exemption certificates, and they’re required in most states to avoid charging tax when a buyer is legally exempt.

Common examples:

- Resale certificates for wholesale buyers

- Nonprofit and government entity exemptions

If you don’t collect and store these properly, you could be liable for the tax later.

Read: Understanding the Basics of Sales Tax Exemptions – A simple explanation of how exemption certificates work and how to stay compliant.

Watch: Sales Tax Exemption Certificate Tips – How to properly collect and fill out exemption forms like SST and MTC.

What If You Use Dropshipping?

Dropshipping adds another layer of complexity. You might be selling to a customer in one state, using a supplier in another, and never touching the inventory yourself. That creates a sales tax mess if you don’t know how the rules work.

The big questions:

- Who collects the tax – your business or the supplier?

- Do you need a resale certificate?

- Where do you owe tax in a 3-party transaction?

Read: Sales Tax for Dropshippers in the US: Who Pays and How to Save – How sales tax works in multi-state dropshipping scenarios.

Watch: How to Get a Resale Certificate for Dropshipping – A clear explanation of how to get and use resale certificates when working with dropshippers.

Want the Full Picture of Sales Tax? Start Here.

If you want a bird’s-eye view of everything sales tax touches in your ecommerce business, this is where to start. Our 10 Steps to Ensure Sales Tax Doesn’t Burn Down Your Ecommerce Business guide walks you through:

- Where and when to register

- What to collect and where

- How to stay compliant as you grow

- The full list of every state’s economic nexus thresholds

This guide is like a checklist and a cheat sheet rolled into one… perfect for busy sellers who want clarity.

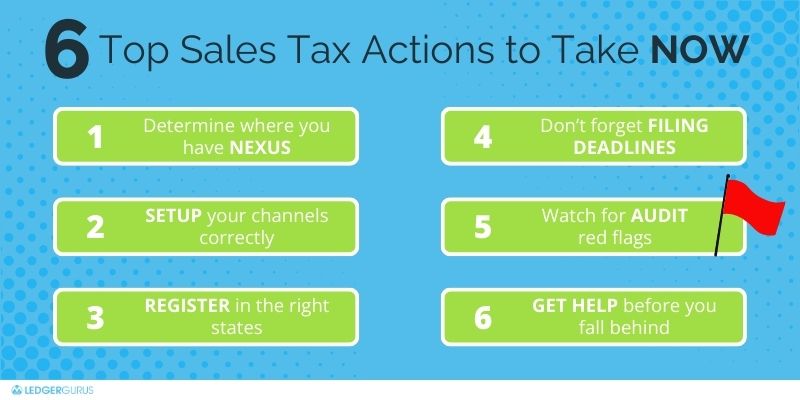

How to Get Sales Tax Compliant

Understanding sales tax is one thing. Actually doing something about it? That’s where most ecommerce sellers get stuck.

The good news is that you don’t have to figure this out on your own. At LedgerGurus, we help ecommerce businesses get compliant, stay compliant, and offload the mess of multistate sales tax for good.

In this section, we’ll walk you through what needs to happen:

- Register for a sales tax permit

- Set up your channels to collect

- Collect the right amount

- Remit to the state

If you’re ready to dive in, we’ve got resources to guide you. And if you’d rather skip the stress and hand it off to pros who do this every day, we’re here for that too.

How to Register for Sales Tax (the Smart Way)

Once you know where you have nexus, the next step is registering to collect sales tax in those states.

But here’s the catch: every state has its own process, forms, portals, and quirks.

We’ve seen sellers delay registration because it feels too overwhelming, and others rush into it and end up with accounts they didn’t actually need.

The best path? Know where you’re required to register and do it right the first time.

Read: How to Register for a Sales Tax Permit in the US – What You Should Know – This guide breaks down the entire registration process: what information you need, how long it takes, and common mistakes to avoid.

Watch: How to Register for Sales Tax in Massachusetts – See what the registration process looks like in a real state portal, so you know exactly what to expect.

How to Setup Your Sales Channels to Collect Tax

Once you’re registered, you need to make sure your platforms are set up to collect tax correctly. This includes:

- Choosing the right product tax codes

- Activating collection in each nexus state

- Making sure you’re collecting tax on shipping where required

Read: Shopify Sales Tax Setup | Where & How to Collect – Detailed guide on configuring Shopify to collect the right sales tax in the right places.

Collect the Right Amount (Without Guessing)

Sales tax rates change often, and they can vary by:

- State

- City

- County

- Special district

Trying to keep track manually is nearly impossible, which is why most sellers either use a tax engine or get help from experts.

Read: Sales Tax Software Comparison: Which is the Right One for Your Online Store? – We compare top tools like Avalara, TaxJar, and Taxify, so you can pick the best fit for your store.

How to File Your Returns

Once you’re registered and collecting sales tax, you’re required to file returns – on time, in the correct format, and with accurate numbers. Sounds simple, but here’s the catch: what your sales platforms report isn’t always what the states want to see.

That’s why understanding your sales tax reports is just as important as knowing how to file.

Returns typically ask for:

- Total sales

- Taxable vs. non-taxable sales

- Tax collected by jurisdiction

- Deductions or exempt sales

If you misreport, or guess, your way through this, you’re more likely to trigger a notice or audit.

Read: How to File Sales Tax Online: An Ecommerce Guide – This guide walks you through how to file accurately, avoid penalties, and keep your business in good standing.

Read: Shopify Sales Tax Report: How to Find & Understand It – Shows you where to find key sales tax data in your Shopify reports and how to use it when filing returns.

Read: How to Find and Understand Your Amazon Sales Tax Report – Understand how Amazon handles tax, and how to pull the right numbers when it’s time to file.

Watch: 2 Ways to Solve Duplicate Transactions on Amazon Sales Tax Report – The challenge with Amazon is that it often duplicates transactions on sales tax reports. This video will show you how to solve that problem.

Read: Sales Tax Journal Entry – How to properly account for sales tax in your books and avoid mixing tax collected with revenue. That’s a serious no-no!

Sales Tax Pitfalls (and How to Avoid Them)

Most ecommerce sellers don’t plan to ignore sales tax. They’re just busy running businesses, managing inventory, launching products.

But sales tax doesn’t wait. When compliance slips through the cracks, states take notice.

This section covers the common traps we see sellers fall into, and what to do if you’re already in one. From surprise audit letters to falling behind on registrations, we’ll help you spot the red flags early and fix what needs fixing.

States Are Getting Aggressive. Don’t Wait to Act!

The grace period for ecommerce sales tax compliance is long gone. States are proactively hunting down non-compliant sellers.

Even small sellers have been caught off guard by enforcement notices and unexpected penalties.

Read: States Are Cracking Down on Online Sales Tax Enforcement – Real-world examples of how states are finding online sellers and what to expect if you’re not prepared.

Read: 9 Sales Tax Compliance Challenges Facing Sellers – From inconsistent platform settings to recordkeeping nightmares, this blog highlights the traps even seasoned sellers fall into, and how to avoid them.

Download: End-of-Year Sales Tax Checklist – Make sure nothing slips through the cracks. This checklist helps you clean up your compliance before states come knocking. It also highlights the most current sales tax issues affecting ecommerce sellers.

Sales Tax Audits: What Triggers Them?

States are ramping up enforcement and using new technology to find gaps in compliance. Some of the most common audit triggers include:

- A sudden increase in reported sales

- Missing or inconsistent filings

- Registering but never filing

- Claims of exempt sales without documentation

- Marketplace activity that isn’t clearly separated

Even sellers who think they’re compliant can get flagged. But the good news? Most audits are survivable, if you’re prepared.

Read: Sales Tax Audits Guide 2025 – A clear breakdown of what states are looking for, how sellers get flagged, and how to get ahead of issues before they escalate.

Watch: The Secret to Surviving a Sales Tax Audit – Practical tips from our team on what to do (and not do) when that dreaded audit letter arrives.

Pre-Audit Questionnaires: The Warning Shot

Before launching a full audit, many states now send a business activity questionnaire. It’s a pre-audit tool used to gather information and see if you’re worth digging deeper into.

Ignore it, and you risk escalating the process. Respond carelessly, and you might give them reason to look further. This really is a time to respond promptly and thoroughly.

Read: What Sales Tax Pre-Audit Questionnaires Mean for Your Ecommerce Business – Explains what these letters mean, what states are really asking, and how to respond carefully.

Watch: Navigating Pre-Audit Questionnaires – A quick, clear video walk-through of what to do when a questionnaire shows up in your inbox.

Behind on Sales Tax? Fix It with a VDA

If you’ve been selling into a state without registering or collecting sales tax, don’t panic. There’s a way to come clean without getting hit with years of penalties or backdated interest.

It’s called a Voluntary Disclosure Agreement (VDA), and when used correctly, it can wipe out much of your historical liability and let you start fresh.

Read: A Guide to Voluntary Disclosure Agreements – Everything you need to know about how VDAs work, which states offer them, and when to use one.

Watch: How to Use a VDA to Wipe Out Sales Tax Liabilities – A seller-friendly explanation of how to use a VDA strategically and what the process looks like.

When to Get Help (and Who to Trust)

You didn’t start your ecommerce business to become a part-time tax expert, but sales tax sure tries to make you one.

The reality? DIY sales tax doesn’t scale.

It might work when you’re just getting started. But what about when:

- You’re registered in 12 states?

- Tax rules change?

- A pre-audit letter shows up in the mail?

That’s when “I’ve got this” turns into “Why didn’t I hand this off months ago?” At a certain point, sales tax becomes a business liability, and staying compliant requires more than a quick Google search.

Many sellers turn to automation tools, and those can be great if your business is straightforward and your setup is flawless. But when you’re managing complexity across states and channels, even the best tools have limits.

Sometimes the best solution is a mix: 💡 Let the tools handle the math, and let experts like us make sure it’s accurate, compliant, and audit-ready.

How LedgerGurus Helps

We’re not just accountants. We’re ecommerce specialists. Sales tax is one of our core services, and we’ve helped hundreds of sellers get and stay compliant without the stress.

What we can do for you:

- Navigate Shopify , Amazon, and marketplace facilitator rules

- Set up your channels to collect tax correctly

- Manage registrations, filings, audits, and VDAs

- Clean up messes (without judgment)

- Keep your business compliant as you scale

Ready to stop Googling and start scaling? Learn about our ecommerce sales tax services.