Estimated reading time: 9 mins

Running a bustling ecommerce business is thrilling, but can also be a bit confusing at times. Your virtual shelves are stocked with products, waiting to be shipped to customers across the country. But, as orders pour in and your products fly out the door, you may be wondering:

- “How much does it really cost me to stock these best-selling remote controlled rubber ducks?”

- “Is that top-selling gadget really as profitable as I think it is?”

This is where understanding how to calculate cost of goods sold (COGS) comes in. Much like assembling the perfect product listing, calculating COGS requires blending the right elements – inventory, purchases, and sales —to arrive at the right figure.

In this article, we will discuss:

- What is COGS? What’s included and what isn’t?

- Why it is important to understand COGS in ecommerce

- The COGS formula

- 4 Practical ways to figure out COGS

- Cash vs accrual accounting, and how it relates to COGS

- How to get help calculating your COGS

What is Cost of Goods Sold, or COGS?

Cost of goods sold, or COGS, is a key number for ecommerce and includes all the direct costs required to produce or acquire the products you sell.

This sounds really straightforward, but it can be confusing, so let’s talk about what IS and IS NOT included in this all-important number.

What is Included in Cost of Goods Sold?

For an ecommerce business, COGS includes:

- The amount you pay to manufacture or buy the product. This includes raw materials, machinery and equipment (if applicable), labor for design, testing, and manufacturing, as well as packaging, labels, or printing for the products themselves.

- Freight and tariffs. Make sure to include these, especially if you’re importing your products.

- Shipping costs to get it TO your warehouse or 3PL for fulfillment

In short, COGS is all your costs getting the product TO the warehouse.

What is NOT Included in Cost of Goods Sold?

Cost of goods sold is often confused with other things, like operating expenses and cost of sales. So, knowing what is NOT included in COGS is just as important as knowing what is.

Operating expenses, like overhead costs, and payroll, are not included.

Neither is your cost of sales, which are all your costs to get your product from your warehouse to your customer. These include:

- Marketing and advertising costs

- Labor costs of picking, packing, and shipping after your product has sold

- Packaging and shipping costs to your customers

If you’re not sure about the difference between COGS and Cost of Sales, you can learn more here.

Why It is Important to Understand Cost of Goods Sold in Ecommerce

Understanding the true cost of your products is critical for the success of your business for several reasons:

- COGS directly impacts your profitability.

Understanding COGS allows you to calculate your gross profit margin, which helps you see how efficiently your business is running.

- COGS informs pricing strategies.

Knowing your COGS allows you to set appropriate product prices that cover costs and protect profit margins.

- COGS enables effective inventory management.

Accurately calculating COGS helps you manage your inventory costs, avoiding overpricing or underpricing your products.

- COGS enables better cash flow management.

A clear understanding of COGS helps you manage your cash flow better, ensuring your business can cover its costs.

- COGS informs better decision-making.

Knowing your COGS lets you identify cost-saving opportunities, negotiate better deals with your suppliers, and streamline how you produce or buy your products.

- COGS enables accurate financial reporting.

Getting your COGS right means your financial reports are accurate, which is super important for tax compliance and showing your investors how your business is really doing.

So, how do you make sure you’re getting it right?

How to Calculate Cost of Goods Sold: the COGS Formula

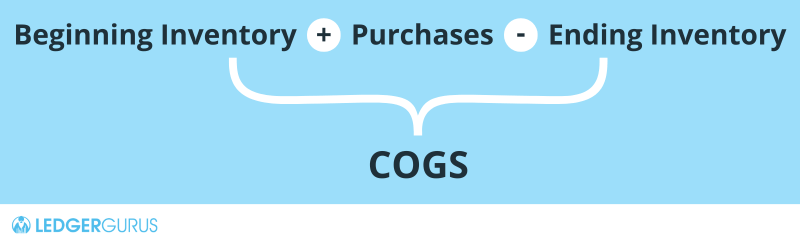

The formula for cost of goods sold is:

To use this formula, you need to know a few key numbers.

Know Your Inventory Quantities

For the time period you’re determining your COGS for, ask yourself:

- How much inventory did you start with? This is your Beginning Inventory.

- How much inventory did you buy during this period? These are your Purchases.

- How much inventory did you end up with? This is your Ending Inventory.

If you use inventory software, it can give you these numbers, but it’s also important to do a physical count (called a stocktake) of all your inventory on a regular basis to make sure that what you have and what you THINK you have matches up.

This will also help to prevent overselling, as well.

Value of Inventory

You need to know not only how much inventory you have or how much you bought, but also its VALUE. There are different inventory valuation methods to determine this.

For a deeper explanation about what kind of businesses each of these methods works best for, as well as the pros and cons for each, read 3 Inventory Costing Methods.

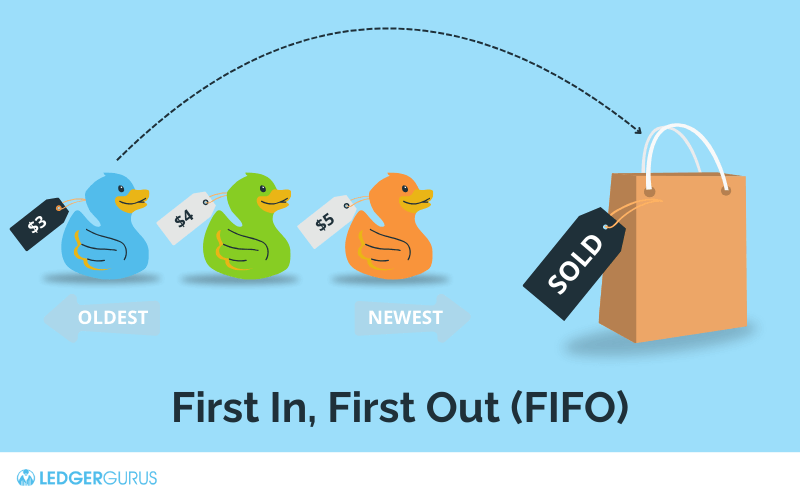

FIFO (First-In, First-Out)

This method assumes that the first thing you bought is also the first thing you sell.

FIFO is generally regarded to be the most accurate costing method since businesses generally want to sell their oldest items first. It can be a bit tricky to manage, though, without an inventory management system.

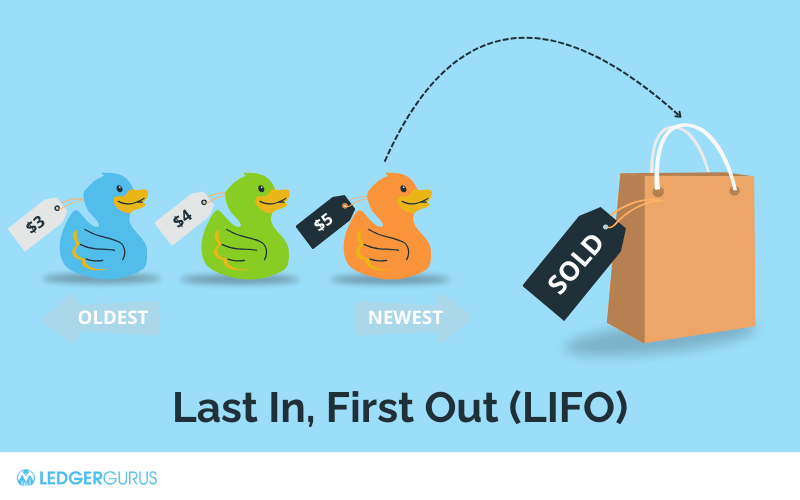

LIFO (Last-In, Last-Out)

This method assumes that the last thing you bought is the first thing you sell.

LIFO can be a great way to make sure you’re addressing higher costs during periods of inflation, but, unless you’re selling 100% of your inventory before buying more, the first items will never show up as sold.

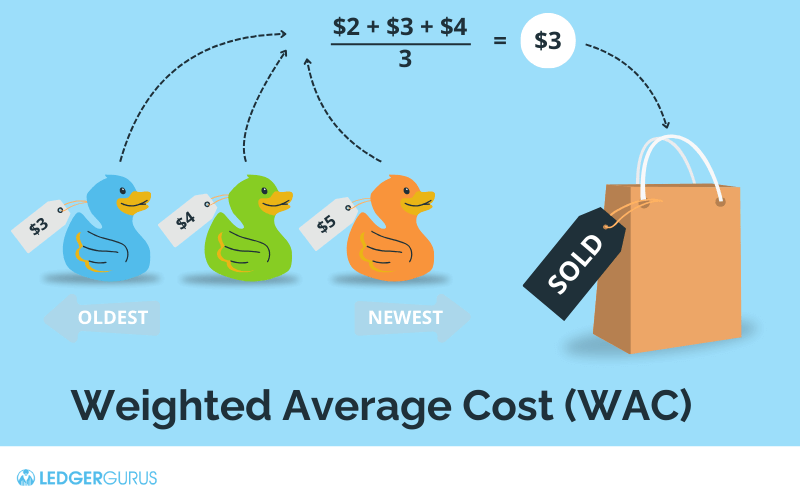

WAC (Weighted Average Cost Method)

This method combines all the costs and averages them by the number of items in stock.

This is a very common method of valuing inventory because it is so easy to manage, but it can become skewed over time if the prices are rising and falling significantly.

If you’d rather watch a video explaining these methods in more detail, watch Understanding FIFO, LIFO, and Average Cost Methods for Inventory.

4 Practical Ways to Figure Out Your Cost of Goods Sold

As you can see, understanding the true cost of your products is critical for the success of your business and getting a clear picture of your financial health and profitability.

Many business owners feel overwhelmed, though, when it comes to calculating their cost of goods sold, but you can easily calculate it in just a few simple steps.

Here are 4 practical methods for determining COGS, based on the needs of your business.

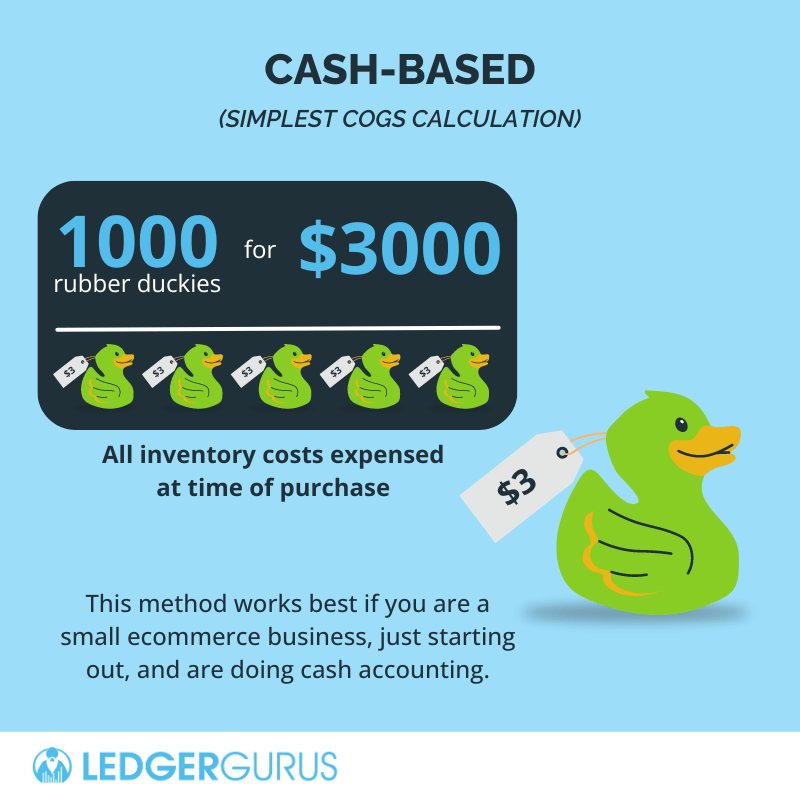

Cash-Based Method

This is typically the simplest way to calculate your cost of goods sold.

With this approach, all inventory-related purchases are expensed at the time you buy them, so they immediately flow to the profit and loss statement.

This means that if you purchase 1000 remote controlled rubber duckies for $3000 in January, you will see the expense in your books for the month of January. You now have what you need to get you through the next three months.

Because this method is simple and straightforward, it works best for small ecommerce businesses who are using cash-based accounting and just starting out.

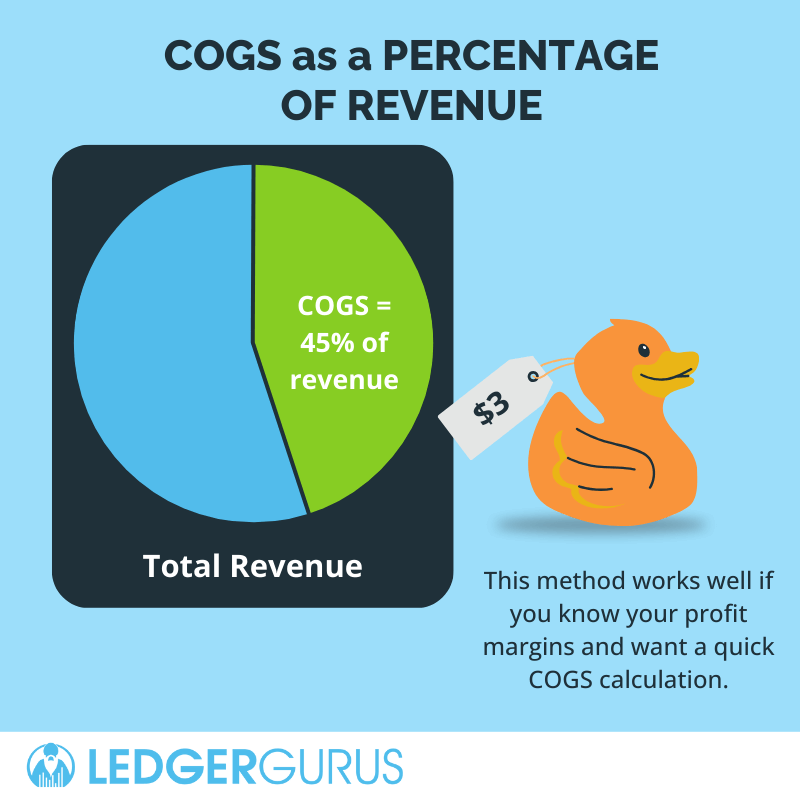

Percentage of Revenue Method

With this method, you calculate COGS as a percentage of total revenue, based on your historical data.

Here’s a quick example. If you sell remote controlled rubber ducks and you know that historically your business spends 45% of revenue on the total landed product costs, then you would take 45% of your revenue and code it as COGS for that specific time period.

This approach is ideal if you have a solid understanding of your profit margins and you’re looking for a quick way to calculate COGS, without having to worry about a lot of individual product costs.

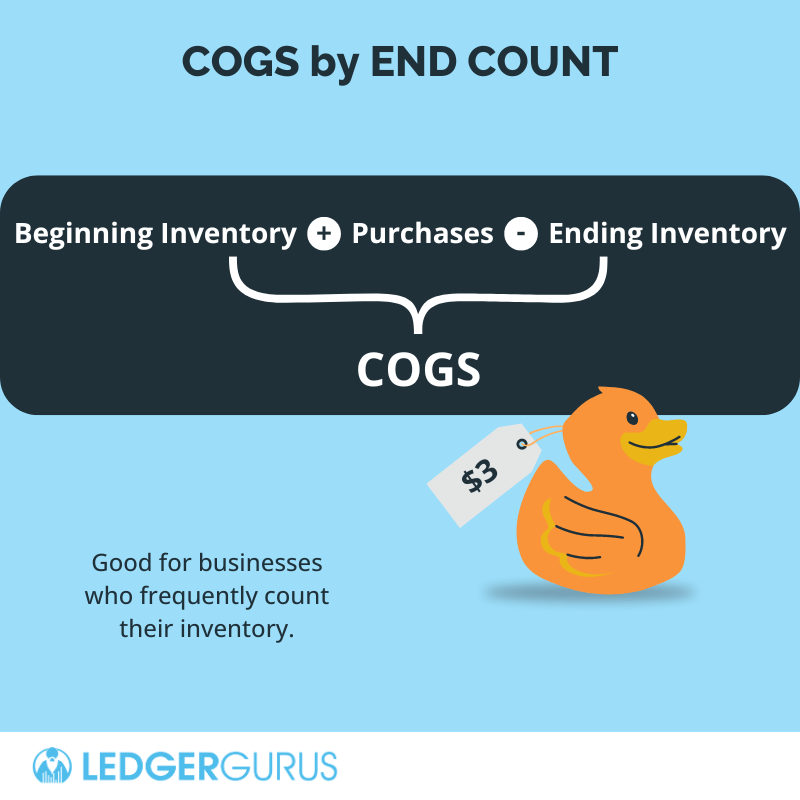

End Count Method

The end count method is ideal for ecommerce businesses who frequently count their inventory because you can then use those inventory counts to calculate your COGS.

Here’s how it works: you calculate COGS by subtracting your ending inventory from your beginning inventory, while also taking into account any inventory purchases made during the time period.

The formula fits the classic method mentioned above:

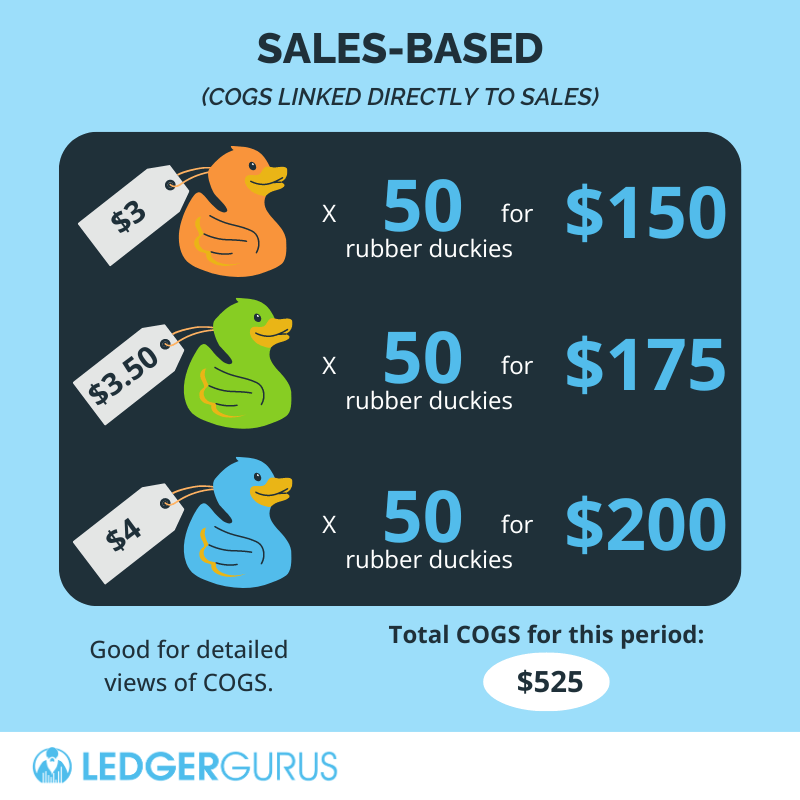

Sales-Based Method

With this method, your COGS is directly linked to your sales. You take your unit costs and multiply that by the number of sales you’ve had, giving you your COGS for the given period.

For example, imagine you sell three different styles of remote-controlled rubber duckies. You know that your COGS for the orange ones is $3, the green ones are $3.50, and the blue ones are $4. For the month of January, you sold 50 of each style.

Your calculations would look like this.

This approach gives you a detailed view of your COGS in relation to your sales. It’s ideal for sellers who are wanting a per SKU breakdown of costs.

But don’t be fooled, this can also be one of the most difficult ways to calculate Cost of Goods Sold because it requires a per SKU unit cost for accuracy.

How to Decide Which COGS Calculation Method is Best for My Business

As you can see there are several options for calculating your cost of goods sold. The one you choose will depend on the needs of your business and the resources you have at your disposal.

One thing to note -> whichever method you choose, stick with it. It’s not a good idea to switch between methods during the same year.

If you find that the current method you’re using isn’t working, no problem. Simply make the switch at the start of the new year or plan to redo all the COGS entries that were already made during the current year.

Cash vs Accrual Accounting and COGS

One thing that’s really important to think about, as well, is which overall accounting method you’re using because it will impact how you’re tracking expenses and calculating COGS. Unless you’re really new in business, we recommend switching to accrual accounting as soon as you can. This will give you a more accurate picture of your numbers than cash-based will.

For more information on cash vs accrual and how each impacts a business’s profitability, read Cash vs Accrual Accounting: Which Method is Best for Ecommerce.

To understand how businesses move from cash to accrual accounting, read Should I Use Cash or Accrual Accounting for My Business?

How to Get Help Calculating Your COGS

Knowing how to calculate your cost of goods sold correctly can help you better understand your profitability, your pricing, your cash flow, your reporting, etc. Getting it wrong messes up all those things.

We can help you get it right.

We’ve got a template for inventory and COGS accounting to help you track and record your cost of goods sold properly. It can guide you through:

- Quantity reconciliation (beginning inventory and ending inventory numbers)

- Doing an inventory valuation

- Putting together a product cost catalog to make bringing together all your costs easier

- A simple COGS computation template

You can get your free template here.

If your business is complicated and you need some help with your ecommerce accounting and getting an accurate COGS number each month, we can help. We are ecommerce specialized accountants, and ecommerce inventory and COGS accounting is one of our specialties.

Click here to learn more about our inventory and COGS accounting services.