When you’re running an ecommerce store, it is super important to know exactly what you have in stock, how much it’s worth, and how quickly it sells. This is the essence of inventory accounting.

Good inventory accounting helps you:

- Make smart decisions about buying, pricing, and selling your products

- Spot trends & avoid stockouts

- Spot discrepancies

- Manage cash flow better

Plus, it keeps you in the loop with what’s making you money and what’s just taking up space.

In short, understanding inventory accounting can be the secret sauce to taking your ecommerce business from good to great.

In this article, we’ll cover:

- Key concepts and terms of inventory accounting

- Inventory accounting systems and how they function

- Inventory accounting methods and how to choose the right one for your business

- Inventory costing methods and selecting the best fit for your business

- Best practices for inventory accounting

- How to get help with your inventory accounting

Let’s get into it.

Key Takeaways

- Essential Inventory Terms

- Inventory Accounting Systems

- Accounting Methods

- Costing Methods

- Best Practices

Key Inventory Accounting Concepts and Terms

Without understanding terms like COGS, inventory turnover, and shrinkage, you can easily make costly mistakes.

Inventory terms aren’t just jargon; they are tools to help you track your stock, manage your finances, boost profitability, and make informed decisions.

The essential terms every ecommerce business owner should know are:

- Beginning inventory

- Ending inventory

- Inventory turnover

- Cost of goods sold (COGS)

- Inventory shrinkage

- Inventory write-off

Beginning Inventory

Beginning inventory is the value of the stock you have on hand at the START of an accounting period. It’s your baseline for tracking inventory changes over time.

It is a critical part of calculating your cost of goods sold (COGS), which directly affects your gross profit and overall profitability.

Essentially, beginning inventory sets the stage for understanding how well your inventory is performing and helps you plan for future purchasing, sales, and growth strategies.

Ending Inventory

Ending inventory is the value of the stock you have on hand at the END of an accounting period. It represents the goods that remain unsold.

Knowing your ending inventory helps you determine your inventory turnover rate and ensure that your financial statements reflect the true value of your assets.

Inventory Turnover

Inventory turnover is a measure of how often your inventory is sold and replaced over a specific period.

A high turnover rate indicates strong sales and efficient inventory use, while a low rate might signal overstocking or weak sales.

Understanding this metric helps you meet customer demand without tying up too much capital in unsold goods.

Cost of Goods Sold (COGS)

This is a BIG one!

Cost of Goods Sold (COGS) is the total cost of producing or purchasing the goods that your business sells during a specific period.

This includes the direct expenses that are tied to the production of goods, such as:

- Materials

- Labor

- Manufacturing overhead

COGS also includes the landed costs associated with the product’s journey from your supplier to your warehouse, including:

- Shipping Costs

- Customs and Duties

- Taxes

- Insurance

- Handling Fees

- Storage Fees

COGS directly impacts your gross profit and overall profitability.

By accurately calculating COGS, you can determine how much it costs you to produce and/or obtain your products and set appropriate pricing to ensure profitability.

Inventory Shrinkage

Inventory shrinkage refers to the difference between the recorded inventory on your books and the actual physical inventory you have on hand.

This loss of inventory is due to theft, damage, misplacement, or clerical errors.

High levels of shrinkage can indicate underlying problems in your operations, such as:

- Security issues

- Inefficiencies in inventory management

- Internal controls problems

By identifying and addressing shrinkage, you can minimize losses, improve accuracy in your financial records, and ensure a more efficient and cost-effective inventory management process.

Inventory Write-Off

An inventory write-off is the formal recognition in your accounting records that a portion of your inventory has lost its value and can no longer be sold.

This can happen due to various reasons, such as damage, obsolescence, theft, or deterioration.

Applying a write-off appropriately ensures your financial statements accurately reflect the true value of your assets.

Regularly reviewing and writing off unsellable inventory helps you:

- Maintain a realistic picture of your business’s financial health

- Avoid overstated asset values

- Make better-informed decisions about purchasing and inventory management

Additionally, inventory write-offs can have tax benefits by reducing taxable income.

Breaking Down Inventory Accounting into Manageable Pieces

We have yet to meet a business owner who jumped into their business excited by the prospect of accounting for their inventory.

If you did, hats off to you!

Typically you are forced into it by the need to answer three questions:

- How do you track and update your inventory levels?

- When should you recognize and record revenue and expenses?

- How do you assign costs to your inventory items?

To answer these questions, we will explain the following, with pros and cons of each:

- Accounting systems

- Accounting methods

- Costing methods

These can seem very similar, so here’s a way to visualize it:

Two Inventory Accounting Systems & How They Work

When it comes to tracking inventory, there are two main systems to choose from:

- Periodic inventory system

- Perpetual inventory system

The Periodic Inventory System

The periodic inventory system involves counting inventory at specific intervals, such as monthly, quarterly, or annually.

During these counts, businesses physically tally up their stock to determine the quantity on hand.

This system is simpler and often cheaper to implement, making it a good fit for smaller businesses with less complex inventory needs.

However, because it only provides inventory data at discrete points in time, it can lead to less accurate tracking and potential discrepancies between counts.

The Perpetual Inventory System

On the other hand, the perpetual inventory system continuously updates inventory records in real-time as sales and purchases occur.

This system uses technology, like barcode scanners and inventory management software, to automatically adjust inventory levels.

The perpetual system provides a more accurate and up-to-date picture of inventory, allowing businesses to make more informed decisions about reordering and managing stock.

While it can be more expensive and complex to set up, the benefits of real-time inventory tracking often outweigh the costs, especially for larger businesses with extensive and varied inventories.

By maintaining precise inventory data, businesses can reduce the risk of stockouts, improve customer satisfaction, and enhance overall operational efficiency.

The perpetual method is really only possible if you’re using inventory management software, such as Finale or Cin7.

To learn how an IMS gets you real-time sales insights, watch our video:

Best Practices for Choosing the Right System

When choosing an inventory accounting system, ask yourself: “How do I want to track and update my inventory levels?“

Here are some best practices to help you make the right choice:

- Assess your business size and complexity: Smaller businesses might find the simpler, cheaper periodic system sufficient. Larger or more complex businesses usually benefit from the real-time tracking of a perpetual system.

- Evaluate your budget: Consider both initial setup costs and ongoing expenses. While the perpetual system can be pricier initially, companies that use it often save money in the long run with better inventory control and reduced losses.

- Consider your inventory turnover: High-turnover businesses usually need the real-time accuracy of a perpetual system to keep up with the rapid pace. Low-turnover businesses might do fine with periodic counts, as their inventory levels don’t change as often.

- Technology integration: Make sure the inventory system integrates well with your current technology stack, such as your accounting software, point-of-sale system, and ecommerce platform to save time and reduce errors.

- Future growth plans: If you plan to expand or scale up operations, investing in a perpetual system might be a better long-term investment.

By carefully considering these factors, you can select the inventory system that best fits your business, helping you manage your stock more effectively and support your business goals.

If you are considering an inventory management system (IMS), take a look at How to Tell If You’re a Good Fit for an Inventory Management Solution.

Accounting and Costing Methods for Ecommerce Inventory

Just as you choose your inventory accounting system based on what your business needs, you should do the same with your accounting and costing methods.

Accounting methods determine how you record and report your financial transactions, while costing methods influence how you value your inventory and calculate your Cost of Goods Sold (COGS).

Different methods can significantly impact your financial statements, tax obligations, and overall business strategy.

In this section, we’ll explore the two primary accounting methods:

- Cash basis

- Accrual basis

Along with three common inventory costing methods:

- FIFO (First-In, First-Out)

- LIFO (Last-In, First-Out)

- Weighted average

Inventory Accounting Methods: Cash Basis vs. Accrual Basis

The two primary accounting methods used to record and report financial transactions are cash basis and accrual.

Cash Basis Accounting

Cash basis accounting records revenue and expenses only when cash is received or paid.

This method is simple and easy to use, making it popular for small businesses.

It provides a clear picture of cash flow, but doesn’t always reflect the true financial position of a business, since it ignores receivables and payables until cash changes hands.

Accrual Basis Accounting

Accrual basis accounting, on the other hand, records revenue and expenses when they are earned or incurred, regardless of when the cash is received or paid.

It offers a more accurate and comprehensive view of a business’s financial health by matching income with related expenses, helping in understanding profitability.

Although it’s more complex and requires more sophisticated bookkeeping, it is generally preferred by larger businesses and those complying to Generally Accepted Accounting Principles (GAAP).

If you’d like more detail about these methods, including what they look like on your books, read Cash vs. Accrual Accounting for Inventory: Which is Best for eCommerce?

Best Practices for Choosing the Right Accounting Method

When choosing an accounting method, ask yourself: “When should I recognize and record revenue and expenses?”

The key difference is timing: when do you record revenue or expenses? For inventory, do you record its cost when you buy it or when you sell it?

You might not need to fully commit to one method over the other. Many businesses transition between them as they grow. For more details and examples of how this works, read Should I Use Cash or Accrual Accounting for My Business?

Costing Methods for Ecommerce Inventory: FIFO, LIFO, and Weighted Average

We’ve now discussed how to answer these questions:

- How do you track and update inventory levels?

- When should you recognize and record revenue and expenses?

Let’s tackle the last question:

- How do you assign costs to your inventory items?

This is where the three main costing methods come into play:

- FIFO (First-In, First-Out)

- LIFO (Last-In, First-Out)

- Weighted Average

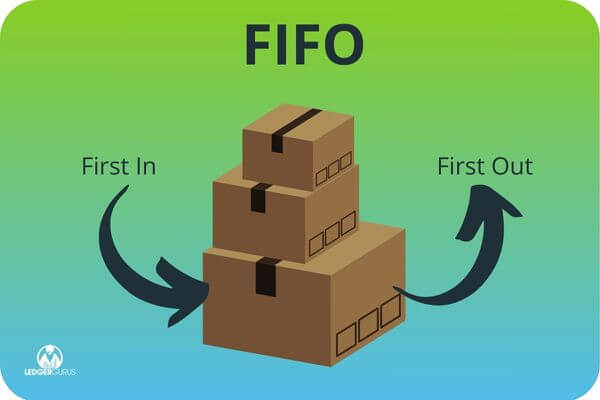

FIFO (First-In, First-Out)

Businesses using the FIFO method record the oldest inventory items as sold first.

This means the cost of the oldest items is used to calculate COGS, which is then reported on the income statement.

This means that you track and use up items bought at the oldest price before moving on to the next price tier, ensuring older inventory costs are recovered first.

FIFO often aligns with the actual physical flow of inventory, simplifying tracking and management.

It typically results in lower COGS when prices rise, leading to higher profits and more attractive financial statements, also higher tax liabilities.

However, during inflation, FIFO may not reflect the most current costs of inventory, potentially distorting profitability.

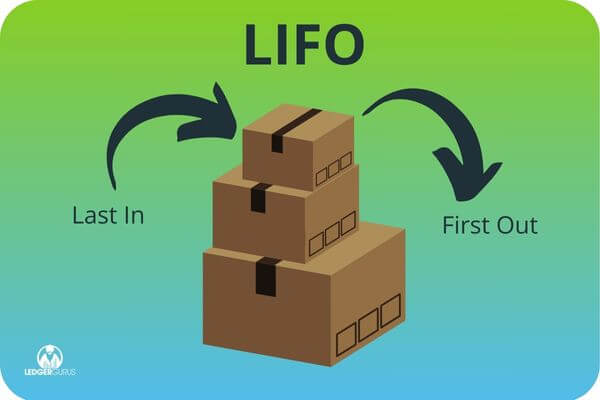

LIFO (Last-In, First-Out)

LIFO is the opposite of FIFO, using the most recent prices for COGS.

When inventory is sold, the cost of the newest items is used to calculate COGS.

This recovers the latest costs first, leaving older prices in ending inventory.

LIFO often results in higher Cost of Goods Sold (COGS) during rising prices, lowering taxable income and tax liabilities.

It matches current costs with revenues, reflecting profit margins more accurately.

However, LIFO can leave inventory values on the balance sheet, and is not permitted under International Financial Reporting Standards (IFRS), limiting it’s use for international companies.

Weighted Average

Weighted average costing averages the cost of all inventory items for COGS.

This method sums the total cost of all items and divides it by the number of items to get an average cost per unit, which is then used for COGS. The weighted average method calculates the average cost of all items in inventory and assigns this average cost to each unit sold.

This straightforward approach smooths out price fluctuations simplifying accounting and reducing the impact of price volatility.

However, it may not reflect the most current market prices, leading to less precise financial insights, and may be less accurate during significant price changes compared to FIFO or LIFO methods.

Best Practices for Choosing the Right Costing Method

When choosing a costing method, ask yourself: “How do you allocate the cost of your inventory?”

- FIFO: Ideal for businesses where inventory turnover matches the actual flow of goods, resulting in higher profits and inventory values when prices rise, but also higher tax liabilities.

- LIFO: Beneficial for industries with rising costs, such as manufacturing, as it matches current costs with revenues and lowers taxable income. However, it isn’t allowed under IFRS, limiting global use.

- Weighted average: Suits businesses with significant price fluctuations or large volumes of similar items. It averages all inventory costs for stable cost management but might not reflect current prices.

To choose the best costing method, here are 3 best practices:

- Assess your business size, industry practices, and financial goals.

- Consider how each method aligns with your operations, the complexity of implementing it, and tax implications.

- Regularly review your inventory practices to ensure they meet your needs as your business grows or market conditions change.

For more details, read 3 Inventory Costing Methods | Pros, Cons, and How to Choose One for Your eCommerce Business.

Inventory Accounting Best Practices

Best practices for inventory accounting are important for accurate financial records, optimized stock levels, and smooth operations.

Key practices to consider:

- Regular audits and reconciliations: Conduct periodic physical counts of your inventory to match accounting records to identify discrepancies like theft or damage.

- Use inventory management software: When you’re ready, invest in reliable inventory management software to automate tracking, streamline processes, and reduce errors. These tools provide real-time data on stock levels for informed decisions.

- Use appropriate costing methods: Select the right method (FIFO, LIFO, or weighted average) based on your business model and financial goals.

- Monitor inventory turnover ratios: Track how quickly your stock sells. High turnover indicates strong sales, while low turnover may signal overstocking.

- Train your team: Ensure employees understand inventory processes and the importance of accurate data entry through regular training.

- Regularly review and update processes: Adapt to changes in your business and market for ongoing success and growth.

How to Get Help with Your Inventory Accounting

In summary, mastering inventory accounting is essential for the success and growth of your ecommerce business.

By understanding key concepts like beginning and ending inventory, cost of goods sold (COGS), and inventory turnover, along with using appropriate accounting and costing methods, helps you optimize stock levels, improve profitability, and maintain accurate financial records.

Implementing best practices such as regular audits, using inventory management software, and training your team ensures efficient and effective inventory management.

However, the complexities of inventory accounting can be challenging as your business grows.

A skilled ecommerce accountant can help you avoid costly mistakes, streamline your operations, and make informed financial decisions.

If you’re ready to take your ecommerce business to the next level, consider exploring our services.

Our expert team provides tailored accounting solutions to meet your needs. Visit our services page to learn more about how we can support your success.